In today’s fast-evolving financial landscape, insurance advisory services are more valuable than ever. As individuals and businesses seek guidance on managing risks and safeguarding assets, the insurance advisory industry has experienced significant growth and demand. Starting an insurance advisory business can be both profitable and impactful, providing a unique opportunity to help clients make informed decisions on a wide range of policies—whether life, health, property, or business insurance. As consumers become increasingly aware of the need for tailored advice in complex insurance products, advisors who can offer personalized, expert guidance are poised to thrive.

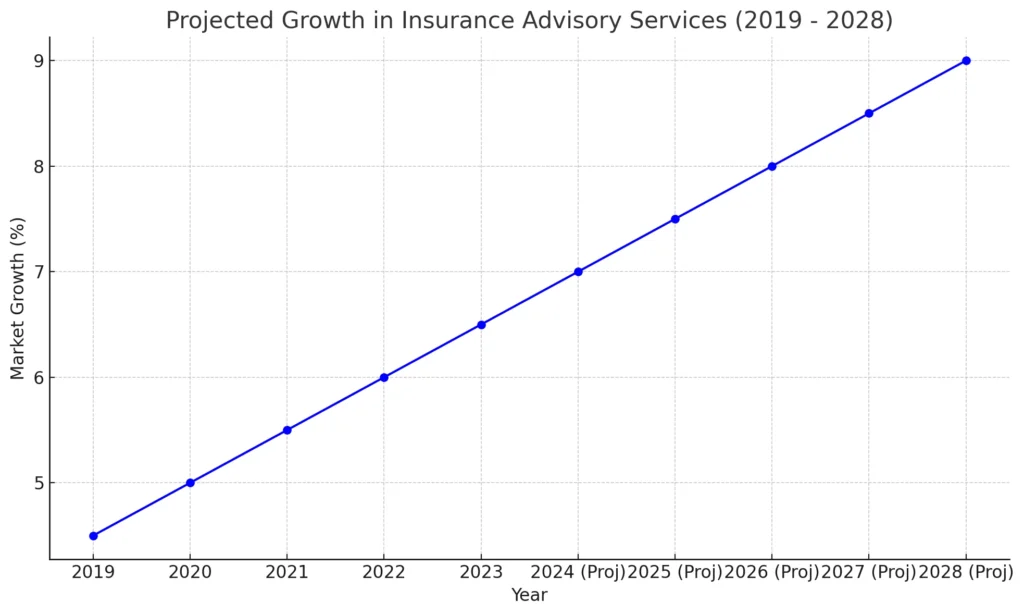

The insurance industry’s growth is driven by rising consumer demand for financial security, coupled with a global focus on risk management and financial wellness. Entrepreneurs entering this field can benefit from substantial market potential, with the global insurance advisory sector expected to grow steadily over the next few years. In this blog, we’ll uncover ten innovative ideas for insurance advisory business startups that cater to diverse client needs and align with the latest industry trends.

| احصائيات | قيمة | وصف |

|---|---|---|

| حجم السوق العالمية (2023) | $54 billion | Estimated market value of the insurance advisory industry globally. |

| Projected CAGR (2024–2028) | 6.5% | Expected compound annual growth rate, indicating steady demand and market expansion. |

| محركات النمو الرئيسية | Financial awareness, digitalization | Factors fueling the industry’s growth, including increased consumer financial knowledge and tech adoption. |

| Demand for Personalized Advice | 72% of consumers prefer tailored plans | Consumer trend showing a strong preference for customized advisory services over standard policies. |

| Emerging Markets Growth | 8% CAGR in developing regions | Faster growth in emerging markets, showing opportunities for new advisors to expand reach. |

Why Choose an Insurance Advisory Business?

Starting an insurance advisory business offers more than just financial rewards—it provides a chance to make a real impact on people’s lives by helping them secure their futures. In today’s uncertain world, individuals and businesses alike are increasingly aware of the need for comprehensive risk management. This growing awareness translates into a steady demand for knowledgeable advisors who can offer tailored insurance solutions. Whether it’s advising families on health and life insurance or guiding companies on liability and asset protection, an insurance advisory business taps into a market driven by a need for expert guidance.

Beyond the demand, the industry has proven resilient, even thriving during times of economic stress. Insurance is an essential part of financial planning, and consumers increasingly value professional advice when choosing among the vast range of policies available. From digital insurance platforms to automated risk assessments, innovations in technology are reshaping the insurance advisory field, allowing new advisors to leverage data analytics, AI-driven tools, and online platforms to enhance client relationships and streamline operations.

Entering this sector also brings the benefit of flexible scalability. Whether starting small with a niche focus—such as advising young families or small business owners—or building a comprehensive advisory service, the insurance industry offers room for growth and adaptation as your business evolves.

The industry has proven resilient, with high إمكانات السوق even in fluctuating economic conditions.

Current Trends and Future Opportunities in Insurance Advisory

The insurance advisory industry is being transformed by new technologies and changing consumer expectations, opening up exciting possibilities for future business. Today’s clients want more than just traditional advice—they seek digital solutions, customized policies, and advisors who can make complex insurance options easy to understand. As a result, digital innovation, personalized services, and a focus on education are shaping the industry’s top trends and future opportunities.

One of the biggest trends in insurance advisory is the rise of digital insurance platforms. More advisors are now using digital tools and platforms to streamline processes, allowing clients to view options, receive quotes, and even sign policies online. For new businesses, this shift toward digital services reduces operational costs and provides clients with a convenient and transparent experience.

بالإضافة إلى ذلك، تحليلات البيانات has become a cornerstone in personalized insurance advisory. With access to data-driven insights, advisors can offer tailored solutions based on clients’ financial behaviors and specific needs. This not only improves customer satisfaction but also helps advisors better understand risk factors and create more secure policies.

نتطلع إلى الأمام، الذكاء الاصطناعي والتعلم الآلي are expected to further impact the industry by enhancing risk assessment and predicting client needs more accurately. AI-powered chatbots, for instance, can assist in answering common client questions, while machine learning algorithms help advisors refine client portfolios with precision.

These advancements, combined with the ongoing demand for insurance advisors who can provide trustworthy and transparent guidance, signal a bright future for those entering this field.

One of the biggest trends in insurance advisory is the rise of المنصات الرقمية, which streamline processes and enhance client accessibility.

| الاتجاه/التكنولوجيا | وصف | التأثير على الصناعة |

|---|---|---|

| Digital Insurance Platforms | Online platforms for quotes, policy selection, and sign-ups. | Increases convenience for clients, reduces operational costs, and enhances transparency. |

| تحليلات البيانات | Use of data to tailor insurance solutions to clients’ needs. | Enables personalized policies, boosts client satisfaction, and improves risk assessment accuracy. |

| الذكاء الاصطناعي | AI-powered tools like chatbots and predictive analytics. | Assists with customer inquiries, improves client portfolio management, and streamlines workflows. |

| التعلم الآلي | Algorithms that predict client needs and refine advisory approaches. | Enhances advisor efficiency, supports targeted insurance options, and improves policy recommendations. |

| Client Education Tools | Interactive content and tools that explain complex insurance options in simple terms. | Builds trust, educates clients, and increases engagement by making insurance choices easier to understand. |

Top 10 Ideas for an Insurance Advisory Business Startup

Starting an insurance advisory business opens doors to several specialized services tailored to the unique needs of different clients. Here are ten impactful ideas to consider, each with its distinct focus, requirements, and target market. Whether you’re looking to assist families, businesses, or niche markets, these ideas offer promising avenues for launching a successful insurance advisory business.

| فكرة عمل | تكلفة بدء التشغيل | السوق المستهدف | تقديرات إمكانية الربح |

|---|---|---|---|

| Health Insurance Advisory | معتدل | Families, individuals, small businesses | عالي |

| Life Insurance and Wealth Protection | منخفض إلى متوسط | Young professionals, families, high-net-worth individuals | عالي |

| Commercial Insurance Consultant | معتدلة إلى عالية | الشركات الصغيرة والمتوسطة الحجم | عالي |

| Automobile Insurance Advisor | قليل | Individual vehicle owners, fleet owners | معتدل |

| Cybersecurity Insurance Specialist | معتدل | Companies with sensitive data | عالي |

| Property and Home Insurance Advisor | منخفض إلى متوسط | Homeowners, landlords, renters | عالي |

| Employee Benefits and Group Insurance | عالي | Mid to large-sized companies | عالية جداً |

| Insurance Advisor for Senior Care Plans | معتدل | Seniors and their families | معتدل |

| Travel Insurance Specialist | قليل | Frequent travelers, tour operators, travel agencies | معتدل |

| Environmental and Climate Insurance | معتدلة إلى عالية | Agriculture, real estate, renewable energy businesses | عالي |

1. Health Insurance Advisory

- لماذا: Rising healthcare costs drive demand for personalized health insurance guidance.

- متطلبات بدء التشغيل: Knowledge of healthcare policies and a strong understanding of benefits and premiums.

- السوق المستهدف: Families, individuals, and small businesses.

- التكاليف التقديرية: Moderate, with possible investments in client education materials.

2. Life Insurance and Wealth Protection Advisor

- لماذا: Increased awareness about financial security makes life insurance advice crucial.

- متطلبات بدء التشغيل: Certification in life insurance, along with financial planning knowledge.

- السوق المستهدف: Young professionals, families, and high-net-worth individuals.

- التكاليف التقديرية: Low to moderate, depending on technology use.

3. Commercial Insurance Consultant

- لماذا: Businesses require protection against liabilities, making advisory services valuable.

- متطلبات بدء التشغيل: Expertise in business insurance policies and risk management.

- السوق المستهدف: Small to medium-sized businesses.

- التكاليف التقديرية: Moderate to high due to licensing and compliance.

4. Automobile Insurance Advisor

- لماذا: With vehicle ownership rising, auto insurance advisory is in steady demand.

- متطلبات بدء التشغيل: Familiarity with vehicle insurance policies and claims processes.

- السوق المستهدف: Individual vehicle owners and fleet owners.

- التكاليف التقديرية: Low, with minimal operational expenses.

5. Cybersecurity Insurance Specialist

- لماذا: Digital threats increase demand for cybersecurity insurance for businesses.

- متطلبات بدء التشغيل: Knowledge of cybersecurity risks and digital asset insurance.

- السوق المستهدف: Companies with sensitive data or digital assets.

- التكاليف التقديرية: Moderate due to technology and policy-specific training.

6. Property and Home Insurance Advisor

- لماذا: Homeowners seek personalized guidance for protecting valuable assets.

- متطلبات بدء التشغيل: Understanding of property insurance policies and valuation skills.

- السوق المستهدف: Homeowners, landlords, and renters.

- التكاليف التقديرية: Low to moderate, depending on marketing efforts.

7. Employee Benefits and Group Insurance Consultant

- لماذا: Companies need experts to manage employee insurance and benefit plans.

- متطلبات بدء التشغيل: Knowledge in group insurance policies and employee benefits.

- السوق المستهدف: Mid to large-sized companies.

- التكاليف التقديرية: High, with requirements for regulatory compliance.

8. Insurance Advisor for Senior Care Plans

- لماذا: Aging populations need advisors for long-term care and senior-focused insurance.

- متطلبات بدء التشغيل: Familiarity with Medicare, senior care, and long-term policies.

- السوق المستهدف: Seniors and their families.

- التكاليف التقديرية: Moderate, with a focus on outreach and client education.

9. Travel Insurance Specialist

- لماذا: Increasing travel and tourism spur demand for travel-related insurance advice.

- متطلبات بدء التشغيل: Knowledge of travel insurance, from health to loss coverage.

- السوق المستهدف: Frequent travelers, tour operators, and travel agencies.

- التكاليف التقديرية: Low, with investments in marketing and client engagement.

10. Environmental and Climate Insurance Consultant

- لماذا: Climate change awareness drives demand for policies covering environmental risks.

- متطلبات بدء التشغيل: Expertise in environmental risks and related policies.

- السوق المستهدف: Agriculture, real estate, and renewable energy businesses.

- التكاليف التقديرية: Moderate to high due to specialized policy knowledg

أمثلة من العالم الحقيقي

To build trust and gain insights, it’s valuable to look at real-world examples of successful insurance advisory businesses. These case studies showcase how innovative approaches, specialized niches, and customer-focused services can drive success in this industry. By learning from these examples, new advisors can find inspiration and understand what it takes to stand out in a competitive field.

Example 1: Health First Insurance Advisors

- ركز: Health and life insurance

- الاستراتيجية: Health First has grown its client base by focusing on preventive care and wellness programs, providing clients with both insurance options and ongoing health resources. Through digital health tools and personalized policy consultations, they’ve built a reputation as a trusted partner for health-conscious clients.

- حصيلة: With a client satisfaction rate above 90%, Health First has successfully grown to serve thousands across the region, attributing much of its growth to its health-centered approach.

Example 2: CyberSecure Insurance Solutions

- ركز: Cybersecurity insurance for businesses

- الاستراتيجية: This business identified an increasing need for cybersecurity insurance as more companies faced data breaches and cyber threats. They specialize in working with tech companies and financial institutions, offering risk assessments, custom policy recommendations, and education on best cybersecurity practices.

- حصيلة: In just three years, CyberSecure Insurance Solutions became a leading provider in cybersecurity insurance, with substantial client loyalty and high referral rates, especially in data-sensitive industries.

Example 3: TravelWise Insurance Advisory

- ركز: Travel insurance for frequent travelers and businesses

- الاستراتيجية: TravelWise built a niche by partnering with travel agencies, focusing on frequent travelers and corporate clients who need comprehensive coverage. They offer easy online policy selection, quick claims processing, and added benefits like medical evacuation insurance.

- حصيلة: By specializing in a travel-focused market, TravelWise saw rapid growth and high customer retention, particularly among businesses with frequent travel needs.

These examples underscore the power of specialization and customer-centric strategies in creating a successful insurance advisory business. By focusing on specific needs and providing expert guidance, advisors can build lasting client relationships and a strong brand reputation.

Mistakes to Avoid When Starting an Insurance Advisory Business

Starting an insurance advisory business can be rewarding, but it’s essential to avoid common pitfalls that can hinder long-term success. Knowing these mistakes upfront helps new advisors build a strong foundation and maintain credibility with clients. Here are the top mistakes to watch out for and how to avoid them.

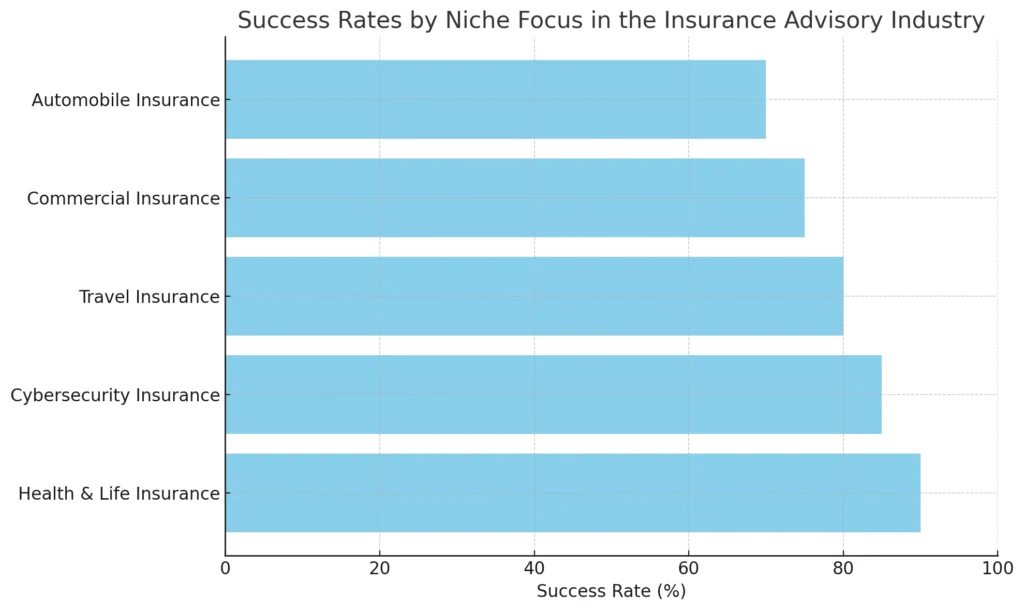

1. Lack of Specialized Knowledge

- The Mistake: Attempting to cover every type of insurance without in-depth knowledge in any one area.

- حل: Specialize in a niche that matches your strengths or has high demand, like health or cybersecurity insurance. Building expertise in a focused area helps you stand out as a reliable advisor.

2. Neglecting Regulatory Compliance

- The Mistake: Overlooking industry regulations can lead to fines, reputational damage, or even legal trouble.

- حل: Stay up-to-date with regulatory requirements in your area and for your niche. Consider consulting a compliance expert when setting up your business to ensure all bases are covered.

3. Ineffective Client Communication

- The Mistake: Failing to communicate policy details clearly, which can lead to misunderstandings and dissatisfied clients.

- حل: Prioritize clear, transparent communication. Provide clients with easy-to-understand explanations of policies, terms, and any fine print. Effective communication builds trust and reduces confusion.

4. Overlooking Digital Presence

- The Mistake: Many new advisors underestimate the value of a strong online presence, missing out on potential clients.

- حل: Invest in a professional website and leverage social media. A digital presence not only broadens your reach but also offers clients convenient access to your services and information.

5. Underestimating the Importance of Client Retention

- The Mistake: Focusing solely on acquiring new clients and overlooking existing relationships can result in high client turnover.

- حل: Cultivate long-term relationships through regular follow-ups, loyalty programs, and value-added services. Retaining clients is often more cost-effective than constantly seeking new ones.

Learning from these common mistakes can be invaluable in establishing a trusted and successful insurance advisory business. With attention to detail, a focus on client relationships, and a commitment to industry standards, new advisors can confidently avoid these pitfalls.

| خطأ شائع | وصف | إجراء وقائي |

|---|---|---|

| Lack of Specialized Knowledge | Attempting to cover too many insurance types without expertise | Focus on a niche area to build credibility and deliver better service. |

| Neglecting Regulatory Compliance | Overlooking regulations, leading to legal and financial issues | Stay updated on regulations, and consult a compliance expert if needed. |

| Ineffective Client Communication | Poor communication causing client dissatisfaction | Prioritize clear explanations of policies, terms, and fine print. |

| Overlooking Digital Presence | Missing out on potential clients by not having an online presence | Develop a professional website and use social media to enhance visibility. |

| Underestimating Importance of Client Retention | Focusing only on new clients, resulting in high turnover | Build long-term relationships through follow-ups and loyalty programs. |

لماذا تثق في حلول Miracuves لمشروعك القادم؟

Choosing the right partner for your business development is crucial to ensure efficiency, innovation, and success. Miracuves Solutions stands out as a trusted ally for businesses looking to break into the insurance advisory industry. With a dedicated team of experts, we offer ready-made, cost-effective solutions that empower entrepreneurs to enter the market quickly and effectively.

Our approach is built on a commitment to excellence and a deep understanding of client needs. At Miracuves Solutions, we recognize that time and budget constraints are common challenges for startups, and we are here to bridge that gap. By leveraging our solutions, entrepreneurs save up to 90% of typical costs and complete projects in significantly reduced timelines. Whether you need assistance with app development, streamlined workflows, or compliance tools, our ready-made solutions are designed to accelerate your growth without compromising on quality.

In addition to cost savings and speed, حلول ميراكويفز brings technical expertise and an in-depth knowledge of industry standards. We have a proven track record of delivering high-quality solutions that help businesses establish credibility, build client trust, and navigate regulatory requirements. When you choose Miracuves Solutions, you’re investing in a partnership committed to your success, with support every step of the way.

خاتمة

Starting an insurance advisory business is both a valuable and rewarding endeavor, with numerous opportunities to help clients secure their financial futures. By focusing on a niche, leveraging current trends like digital platforms and data analytics, and building long-term relationships with clients, new advisors can find success in this competitive industry.

Each business idea presented here offers a unique path, from health insurance to cybersecurity consulting, allowing aspiring advisors to choose an area that aligns with their interests and expertise. Avoiding common mistakes, such as neglecting compliance or underestimating the importance of digital presence, can significantly boost the chances of long-term growth and client trust.

Remember, with the right strategies, tools, and a commitment to delivering genuine value, building a successful insurance advisory business is entirely achievable. Whether you’re in the early planning stages or ready to launch, the insights provided in this guide equip you with the knowledge to start strong and make informed decisions as you go.

الأسئلة الشائعة

What qualifications do I need to start an insurance advisory business?

Most insurance advisory roles require certifications specific to your region, such as a state insurance license. Specializations like health or cybersecurity insurance may also need additional training or certifications.

How much should I budget for starting an insurance advisory business?

The budget varies depending on your niche. Initial costs may range from $5,000 to $20,000, covering licensing, digital tools, and marketing, with higher costs for regulated fields like commercial or cybersecurity insurance.

How do I choose a niche within insurance advisory?

Consider your expertise, interests, and market demand. Popular niches include health, life, and cybersecurity insurance. Researching trends and local demand can help identify a profitable focus.

Is an online presence important for my insurance advisory business?

Yes, a strong online presence is essential. It helps clients find you, builds credibility, and allows for efficient client interactions, especially with today’s digital-focused consumer base.

What are some common challenges new advisors face?

Common challenges include client retention, navigating regulatory compliance, and establishing trust with new clients. Focusing on clear communication and maintaining updated knowledge of regulations can help address these issues.