In recent years, investment apps have revolutionized the way people manage their finances, breaking down barriers and making investing more accessible than ever before. Acorns, a leader in this space, is well-known for its innovative round-up investing feature, where users can automatically invest spare change from everyday purchases. This simple yet powerful concept has helped millions of users take small steps toward building wealth, without the need for active portfolio management.

In this blog, we’ll take you on a deep dive into the development of an investment app like Acorns. We’ll explore the various types of investment apps, the key features that contribute to their success, and the steps to bring your own investment platform to life. From understanding the costs involved to choosing the right development partner, this guide will equip you with everything you need to embark on the journey of creating a game-changing financial app.

What is Acorns?

Acorns is a popular micro-investing platform that aims to make investing simple and accessible for everyday users. Launched in 2012, Acorns introduced the concept of “round-up investing,” where users can automatically invest spare change from their daily purchases. By linking debit or credit cards to the app, every transaction is rounded up to the nearest dollar, and the difference is invested in a diversified portfolio. This innovation removes the complexity of traditional investing and helps users grow their wealth effortlessly over time.

Acorns doesn’t stop at round-up investing. It offers a variety of account types tailored to different financial goals. Users can choose from Acorns Invest for basic taxable accounts, Acorns Later for retirement savings through IRAs, or even Acorns Early, designed for custodial accounts for minors. Additionally, the app offers educational tools to improve financial literacy and features like “Found Money,” where users can earn cashback from partnered brands, making it a holistic financial management tool.

Key Milestones in Acorns’ Journey:

| Ano | Milestone |

|---|---|

| 2012 | Acorns is founded by Walter Cruttenden, Jeff Cruttenden, and Mark Dru. |

| 2014 | Acorns launches its mobile app for iOS and Android. |

| 2015 | Raises $30 million in a funding round led by PayPal and Rakuten. |

| 2016 | Surpasses 1 million investment accounts; introduces the “Found Money” program. |

| 2017 | Launches “Acorns Later,” a retirement account option; partners with CNBC for content. |

| 2018 | Reaches 3 million investment accounts; launches “Acorns Spend,” a checking account. |

| 2020 | Raises $105 million in Series E funding; valuation reaches $860 million. |

| 2021 | Acorns goes public via a merger and begins trading on NASDAQ under the ticker “OAKS.” |

| 2023 | Continues to grow its user base and financial education offerings. |

Acorns Account Types:

| Account Type | Descrição |

|---|---|

| Acorns Invest | Basic taxable investment account |

| Acorns Later | Retirement account (Traditional or Roth IRA) |

| Acorns Spend | Checking account with a debit card |

| Acorns Family | Investment accounts for children |

| Acorns Early | Custodial investment account for minors |

Acorns Pricing Tiers:

| Tier | Monthly Fee | Características |

|---|---|---|

| Acorns Lite | $1 | Basic investing features |

| Acorns Personal | $3 | All Lite features + retirement account (Acorns Later) |

| Acorns Family | $5 | Personal features + investment accounts for children |

Types of Investment Apps

Investment apps come in various forms, each catering to specific investment needs and financial goals. Understanding the different types of apps is crucial if you’re looking to develop a platform like Acorns. Below are the main types of investment apps available in the market:

1. Stock Trading Apps

Stock trading apps, like Robinhood or E*TRADE, allow users to buy and sell stocks, ETFs, and other securities in real-time. These apps typically provide market data, research tools, and different types of orders, enabling users to make informed trading decisions. They cater to individuals who prefer an active, hands-on approach to investing.

2. Robo-Advisors

Robo-advisors are digital platforms that offer automated portfolio management using algorithms. After collecting information about a user’s risk tolerance and financial goals, the software generates and manages a diversified portfolio. Apps like Betterment and Wealthfront fall into this category, providing users with a low-maintenance, passive investing experience.

3. Cryptocurrency Exchanges

With the rise of digital currencies, cryptocurrency exchanges such as Coinbase and Binance have become popular. These apps facilitate the buying, selling, and trading of cryptocurrencies like Bitcoin, Ethereum, and more. They offer features like market tracking, portfolio monitoring, and advanced trading tools.

4. Mutual Fund and ETF Platforms

Platforms like Vanguard and Fidelity offer users the ability to invest in mutual funds and exchange-traded funds (ETFs). These apps provide research tools, access to a wide range of funds, and often include the option to consult with financial advisors. They are suitable for long-term investors seeking diversified, professionally managed portfolios.

5. Peer-to-Peer Lending Apps

Peer-to-peer lending apps, like LendingClub and Prosper, connect borrowers with individual lenders. Investors can earn interest by lending money directly to borrowers, while the apps handle loan filtering, risk assessment, and transaction management. This type of app opens new investment avenues by offering personal loans as an alternative to traditional bank lending.

6. Real Estate Investment Apps

Real estate investment apps, such as Fundrise, enable users to invest in properties or real estate investment trusts (REITs). They may offer crowdfunding opportunities, giving users access to real estate projects that would otherwise require substantial capital. These platforms provide tools for analyzing property investments and typically have lower entry points compared to direct real estate purchases.

7. Retirement Savings Apps

These apps focus on helping users build and manage retirement savings, often through tax-advantaged accounts like IRAs. Examples include apps like Acorns Later and Stash, which help users set up automated contributions and use retirement calculators to plan for the future. They provide a convenient way for users to focus on long-term, goal-based investing.

8. Micro-Investing Apps

Micro-investing apps like Acorns allow users to invest small amounts of money, often by rounding up everyday purchases and investing the spare change. These apps make investing accessible to those with minimal capital, gradually building wealth with tiny, automated contributions.

Each type of investment app serves a distinct purpose and user base, but they all contribute to making investing more accessible. When planning to develop an investment app like Acorns, it’s essential to understand these categories to determine which features will best serve your target audience.

Leia também:- Build a Multi-Asset Trading App Like WeBull: A Complete Guide

Key Features to Include in an Investment App Like Acorns

To build a successful investment app like Acorns, you need to incorporate specific features that provide users with a seamless, user-friendly experience. These features are crucial for helping users manage their investments, track performance, and grow their wealth effortlessly. Below are the key features to include in both the user panel and the admin panel of your app.

User Panel Features

These features are designed to make the app intuitive and useful for end-users, helping them invest, track progress, and achieve financial goals.

1. Account Dashboard

The user dashboard provides an overview of the user’s investment accounts, showing essential details such as account balances, portfolio performance, and the current value of investments. It acts as the central hub for managing finances.

2. Portfolio Summary

This feature breaks down the user’s investments by asset class (e.g., stocks, bonds, ETFs) and provides insights into asset allocation. It helps users understand how their funds are distributed across different investment options.

3. Transaction History

The transaction history shows all past investment activities, including purchases, sales, dividend payments, and deposits. This allows users to track how their money has been allocated over time.

4. Performance Tracking

Users can monitor the growth of their portfolio over time with performance tracking tools. Graphs and charts help visualize returns and compare them to market benchmarks, providing a clear picture of the user’s financial progress.

5. Round-Up Investing

One of Acorns’ standout features is round-up investing, where users can link their bank accounts, and every purchase they make is rounded up to the nearest dollar. The spare change is then invested automatically, allowing users to save and invest effortlessly.

6. Goal Setting

Users can set and track financial goals such as saving for a vacation, building an emergency fund, or planning for retirement. This feature keeps users motivated and helps them stay on track with personalized investment recommendations.

7. Recurring Investments

With this feature, users can set up automatic, recurring investments, such as weekly or monthly contributions. This encourages disciplined saving habits and allows users to build their portfolios gradually over time.

8. Educational Resources

To improve financial literacy, the app should offer educational resources such as articles, videos, and interactive tutorials. Acorns provides similar features, helping users learn more about investing and personal finance.

9. Notifications & Alerts

The app should include customizable notifications for users to receive updates about portfolio changes, market events, or reminders for upcoming investments. This keeps users informed and engaged.

10. Customer Support

A customer support feature, whether through live chat, email, or a detailed FAQ section, ensures users can easily resolve issues or get answers to their questions.

Recursos do painel de administração

The admin panel is designed to help platform administrators manage the app efficiently, ensuring smooth operations and compliance with financial regulations.

1. User Management

Administrators can manage user accounts, including registration, profile updates, account deactivation, and user verification. This feature is essential for maintaining an active, verified user base.

2. Investment Product Management

Admins can add or update investment products, configure portfolio options, and set parameters such as minimum investment amounts. This flexibility allows administrators to offer a variety of investment options tailored to different user profiles.

3. Transaction Monitoring

Admins can track all user transactions, including deposits, withdrawals, and trades, ensuring transparency and compliance with regulatory requirements. This feature is critical for detecting any suspicious or fraudulent activity.

4. Risk & Compliance Management

Admin tools should include the ability to set risk management parameters, monitor user activities for regulatory compliance, and enforce limits or restrictions on risky investment behaviors. This ensures the app operates within legal boundaries.

5. Reporting & Analytics

Analytics tools provide admins with insights into user behavior, portfolio performance, and app usage. Reports can be generated to assess the app’s financial health and make data-driven decisions for future updates.

6. Fee & Revenue Management

Admins can manage the fee structure for various services, including subscription fees or transaction charges. They can also track the platform’s revenue generation and monitor commissions earned from user activities.

7. Customer Support & Communication

Admins can manage user support tickets, view and respond to inquiries, and track ongoing support issues. They can also communicate with users through notifications, email, or in-app messaging.

8. Content Management

For apps offering educational resources, the admin panel should allow content management, enabling administrators to add, update, or remove articles, tutorials, and FAQs. Keeping content relevant and up to date enhances the user experience.

9. Marketing & Promotions

Admins can create and manage marketing campaigns, track referral programs, and analyze the effectiveness of promotional efforts. This feature helps drive user acquisition and retention through targeted marketing.

10. System Settings & Configuration

Admins can configure app settings, manage security protocols, and update branding elements. This allows flexibility in maintaining and customizing the app’s operational environment.

Leia também:- How to Build a Cryptocurrency App like Gemini from Scratch

How Much Does It Cost to Develop an Investment App Like Acorns?

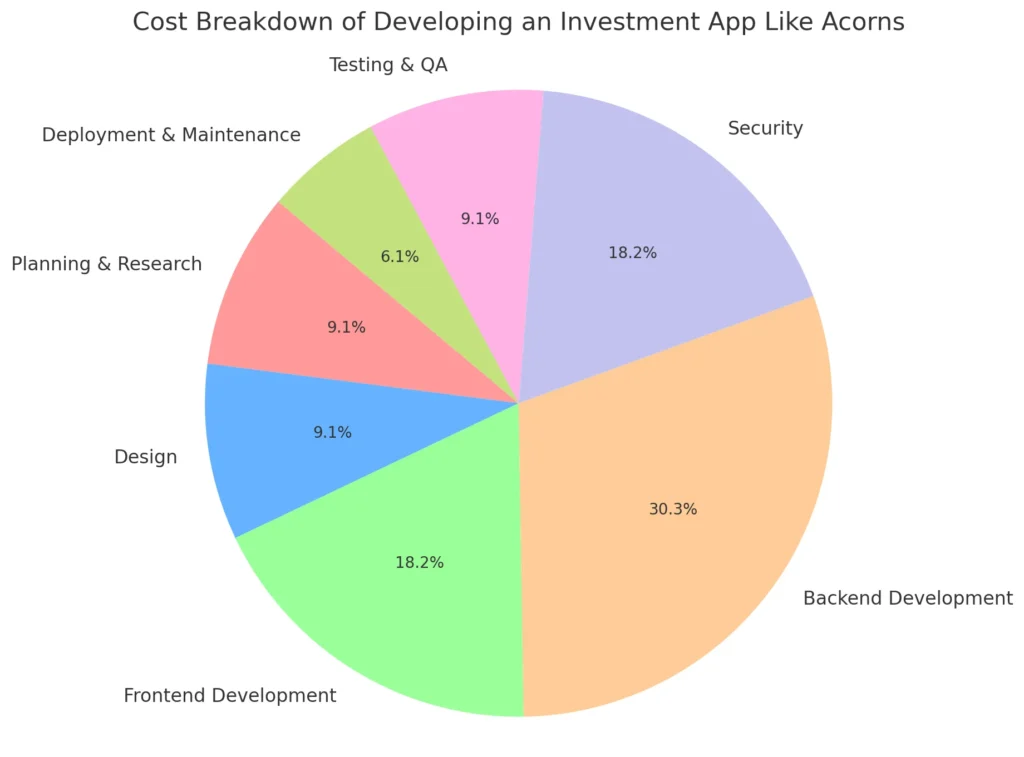

Developing an investment app like Acorns involves several stages, each with its own set of costs. The total cost will depend on factors such as the complexity of the features, the platforms you choose (iOS, Android, or both), the backend infrastructure, and security requirements. Here’s a breakdown of the key components and their associated costs.

Factors Influencing Cost

1. Planning and Research

Before diving into development, thorough market research, competitor analysis, and defining the scope of the app are necessary. This stage helps to identify user needs, assess market opportunities, and establish the app’s value proposition.

- Custo estimado: $5,000 – $20,000

2. Design

User interface (UI) and user experience (UX) design are critical to the success of an investment app. A simple and intuitive design will attract and retain users, while a poor design could result in high churn rates.

- Custo estimado: $5,000 – $20,000 (depending on complexity and custom graphics)

3. Development

The development cost is often the largest portion of the budget. This stage involves building the app’s core features and functionalities. The cost will vary based on the platform (iOS, Android, or both) and whether you choose a native or hybrid approach.

- Custo estimado: $15,000 – $75,000 for front-end and back-end development

4. Backend Development

A robust backend infrastructure is essential for managing user data, processing transactions, and ensuring secure integration with financial institutions. The complexity of backend development, including database management and cloud services, will significantly impact costs.

- Custo estimado: $25,000 – $75,000

5. Security

Given the sensitivity of financial data, implementing high-level security measures is crucial. This includes data encryption, secure authentication protocols, and ensuring the app complies with industry standards like GDPR.

- Custo estimado: $10,000 – $45,000 for strong encryption, multi-factor authentication, and security audits

6. Testes e Garantia de Qualidade (QA)

Testing ensures that the app functions as expected, is user-friendly, and is free of bugs. Rigorous quality assurance, including functionality testing, security testing, and performance testing, is vital for a seamless user experience.

- Custo estimado: $10,000 – $20,000

7. Deployment and Maintenance

Deploying the app to app stores (Google Play and Apple App Store) and ongoing maintenance, including updates, bug fixes, and user support, are essential for long-term success.

- Custo estimado: $5,000 – $15,000 for initial deployment; ongoing maintenance can cost 20-25% of the development cost annually

Global Cost Estimate

The total cost to develop an investment app like Acorns generally ranges between $7000 and $25500+, depending on the complexity of the app and the features included. For a basic app with minimal features, costs will be on the lower end, while advanced apps with robust features, complex integrations, and high-security requirements will push costs higher.

Miracuves Pricing

No Miracuves, we offer premium development services at a highly competitive rate. Our pricing for developing an investment app like Acorns is half the global market cost, making us the go-to solution for businesses looking to build cost-effective, high-quality investment apps.

- Miracuves Price Estimate: Starting from $3500 for a fully functional investment app, which is significantly lower than the global average. We deliver the same high-quality app development services, ensuring you save on costs without compromising on quality.

Leia também:- Launch a Cryptocurrency App Like Kraken: Everything You Need to Know

Steps to Develop an Investment App Like Acorns

Building an investment app like Acorns requires careful planning, a solid understanding of your target market, and a strategic approach to development. Below are the essential steps involved in developing an app that mirrors Acorns’ success while meeting your unique business goals.

Etapa 1: Pesquisa de mercado e planejamento

Before development begins, it’s essential to conduct thorough market research. This includes identifying your target audience, analyzing competitors, and determining the core features that will set your app apart. Understanding user needs, especially in financial literacy and investing habits, will guide the development of a user-friendly product.

- Objective: Define your target market and unique value proposition (UVP).

- Resultado: A clear roadmap of features and strategies tailored to your audience.

Step 2: Feature Integration

The key to an app like Acorns lies in its core features. The main feature—round-up investing—automatically invests spare change from everyday purchases. Beyond that, automated investing, portfolio management, and financial goal setting are crucial to ensure that users can grow their wealth effortlessly.

- Essential Features:

- Round-up investing

- Automated investing

- Goal tracking

- Portfolio management

Step 3: Offering Portfolio Options

Providing users with customizable portfolios based on their risk tolerance is critical. Acorns offers pre-built portfolios comprising a diversified mix of assets like ETFs. Your app should offer similar options, with the potential to introduce premium features that allow users to select individual stocks or tailor their investments further.

- Key Deliverables: Diversified portfolios, risk management tools, and customization options for advanced users.

Step 4: Implementing Banking Features

Consider integrating a banking solution, such as checking accounts or debit cards, to provide a seamless experience between spending and investing. A feature like Acorns’ “Real-Time Round-Ups” can enhance user engagement by instantly transferring spare change into investments.

- Integration Needs: Banking API, debit card functionality, and mobile deposit options.

Step 5: Facilitating Retirement Planning

Offering retirement savings options like IRAs can add significant value to your app. By allowing users to set up retirement accounts (Traditional, Roth, or SEP IRAs), you encourage long-term financial planning, making your app an all-in-one platform for financial management.

- Feature Examples: IRAs with tax advantages, retirement calculators, and personalized savings advice.

Step 6: Investing for Kids

Offering custodial accounts for minors, like Acorns Early, enables parents to invest on behalf of their children. These accounts not only encourage long-term savings but also help users plan for their children’s education or future financial needs.

- Benefícios: Tax advantages, long-term savings growth, and a unique selling point for families.

Step 7: Creating Reward Programs

Partnering with brands to offer bonus investments, similar to Acorns’ “Found Money” feature, can boost engagement and offer users added value. When users make purchases through partnered brands, they receive cashback or bonus investments, encouraging them to stay engaged with the app.

- Considerações: Establish partnerships with relevant brands and businesses.

Step 8: Promoting Financial Literacy

A significant part of Acorns’ success is its emphasis on financial education. Your app should provide users with educational resources like articles, tutorials, and videos on investing basics, personal finance management, and retirement planning. This not only helps users make informed decisions but also builds trust.

- Características: Financial literacy tools, interactive quizzes, and expert Q&A sessions.

Step 9: Development Process

After planning and designing the app, the development process begins. This involves choosing the right technology stack (like React Native for frontend development and Node.js for backend), integrating APIs, and setting up a secure and scalable backend system. The development team should focus on creating a seamless user experience and ensuring high security for financial transactions.

- Key Tasks: Frontend and backend development, API integration, and security protocols.

Step 10: Marketing and Growth

Once the app is ready, an effective marketing strategy is crucial for user acquisition. Use social media, influencer partnerships, and targeted ads to create buzz around your app’s launch. Additionally, incentivize users with referral programs to encourage organic growth.

- Growth Strategies: Social media campaigns, influencer collaborations, and referral rewards.

Tech Stack for Developing an Investment App

Choosing the right technology stack is critical when developing an investment app like Acorns. The tech stack influences the app’s performance, scalability, security, and overall user experience. Below are the essential technologies and frameworks that should be considered for both frontend and backend development.

1. Frontend Development

The frontend is the user-facing part of the app, and it must be intuitive, fast, and responsive across all devices. Cross-platform development frameworks are a popular choice for building apps that work seamlessly on both iOS and Android platforms.

- Reagir Nativo: A widely used framework that allows developers to build cross-platform apps using JavaScript. It offers a native-like experience, reducing development time and costs while maintaining high performance.

- Flutter: An open-source framework by Google, Flutter provides a flexible UI toolkit for creating natively compiled applications for mobile, web, and desktop from a single codebase.

Both options offer excellent performance and flexibility for building investment apps with engaging user interfaces and smooth user experiences.

2. Backend Development

The backend handles all of the app’s business logic, user authentication, transaction management, and interaction with external systems like financial institutions. It’s important to choose a robust backend architecture to ensure security and scalability.

- Node.js: A popular, scalable server-side platform that allows for real-time data handling, essential for financial apps. It is fast, efficient, and widely used for applications that handle high user traffic and frequent updates.

- Python (Django/Flask): Known for its simplicity and speed, Python is often used for backend development in financial apps. Django and Flask are two popular Python web frameworks that support secure and scalable applications.

3. Database

The database is responsible for securely storing user data, transactions, and investment portfolios. For a financial app like Acorns, the database must handle large volumes of data with high accuracy and reliability.

- PostgreSQL: An open-source relational database that is highly reliable and offers ACID compliance, which is crucial for handling financial data. It supports complex queries and large datasets, making it ideal for financial applications.

- MySQL: Another robust relational database option, MySQL offers excellent performance and flexibility, suitable for handling structured data like user profiles, transactions, and account details.

4. Cloud Services

Cloud platforms provide the infrastructure for hosting your app, ensuring it can scale as your user base grows. Cloud services also offer tools for real-time data management, secure backups, and application monitoring.

- Serviços Web da Amazon (AWS): AWS is one of the most popular cloud service providers, offering a range of tools for application hosting, storage, security, and monitoring. AWS Lambda, for example, allows for serverless computing, enhancing app scalability.

- Plataforma de nuvem do Google (GCP): Google Cloud offers scalable cloud computing solutions with features like Firebase, which is great for real-time database management and user authentication. GCP is also known for its powerful machine learning and data analytics tools.

5. Security

Security is the top priority when developing a financial app. To protect user data and financial information, advanced security measures should be integrated at every stage of development.

- HTTPS: Ensures secure communication between the app and the server by encrypting data in transit.

- AES-256 Encryption: This encryption standard is used to secure user data and transactions stored in the database.

- Autenticação de dois fatores (2FA): 2FA adds an extra layer of security by requiring users to provide two pieces of evidence (password and a verification code) to access their accounts.

- Penetration Testing: Regular security assessments to identify vulnerabilities and protect against potential cyberattacks.

6. Payment Gateway Integration

To handle financial transactions, you need to integrate a secure and reliable payment gateway. This allows users to deposit and withdraw funds, make transactions, and manage their investments.

- Listra: Stripe is widely used for integrating secure payment processing into apps. It supports multiple currencies and payment methods, making it ideal for global financial apps.

- PayPal: Another trusted payment gateway, PayPal, offers seamless payment processing with extensive global reach.

7. Analytics and Monitoring Tools

Analytics and monitoring are critical for understanding user behavior, tracking app performance, and identifying issues before they escalate.

- Análise do Google: Provides insights into user behavior, engagement, and retention, helping you optimize the app based on user interactions.

- Sentinela: A powerful tool for monitoring and fixing errors in real time, ensuring your app runs smoothly and without interruptions.

- New Relic: Offers detailed performance monitoring, helping developers track app health, server performance, and user interactions.

8. Microservices Architecture

A microservices architecture allows for modular development, where different parts of the app (user authentication, transaction processing, portfolio management) are built as independent services. This makes the app more flexible, scalable, and easier to maintain.

- Benefits of Microservices: Easier updates, enhanced fault isolation, and the ability to scale different components independently, depending on user demand.

Leia também:- How to Create a Robinhood like Stock Trading App in 2024

Why Choose Miracuves for Your Next Project?

When developing a financial app like Acorns, you need a trusted and experienced partner who can deliver high-quality results while keeping costs competitive. Miracuves stands out as a top choice for businesses looking to build cutting-edge investment platforms. Here’s why you should choose Miracuves for your next project:

1. Expertise in FinTech Solutions

Miracuves specializes in developing financial technology (FinTech) applications, with a deep understanding of the nuances and requirements of building secure, scalable, and user-friendly investment apps. Our team has successfully built numerous financial platforms, making us experts in crafting apps that balance innovation with regulatory compliance.

2. Cost-Effective Development

One of the most significant advantages of working with Miracuves is our cost-effectiveness. We offer development services at half the global market price, ensuring that you get the best value for your investment. While the global cost to build an app like Acorns can range from $70,000 to $255,000+, Miracuves can deliver the same high-quality service starting at $35,000.

3. Customizable and Scalable Solutions

Whether you’re a startup or a large financial institution, our solutions are designed to grow with your business. We offer customizable features that align with your business model and provide scalable solutions that can handle a growing user base and evolving needs. From basic micro-investing tools to complex financial products, we tailor our approach to fit your vision.

4. Security and Compliance

In the FinTech industry, security is paramount. At Miracuves, we prioritize the safety of your users’ financial data. We implement industry-leading security measures, such as data encryption, two-factor authentication (2FA), and regular security audits. Additionally, we ensure that your app complies with relevant regulations, including GDPR, PCI-DSS, and other global financial standards.

5. Dedicated Support

Our team is committed to providing ongoing support throughout the development process and beyond. From initial consultation to post-launch maintenance, we work closely with you to ensure your app runs smoothly and continues to meet your users’ needs. Whether it’s bug fixes, feature updates, or scaling support, we’re always there to assist you.

6. Client-Centric Approach

At Miracuves, your project’s success is our top priority. We adopt a client-centric approach, which means we take the time to understand your business goals and work collaboratively to achieve them. Throughout the project, we provide regular updates, feedback loops, and transparent communication to ensure that your vision is realized on time and within budget.

7. Rapid Time-to-Market

We understand that timing is crucial in the competitive world of financial apps. Our streamlined development process ensures that your app is delivered within the agreed timeline, without compromising on quality. Our agile methodology allows for flexibility and quick adaptation to changes, helping you stay ahead in the fast-evolving market.

Considerações finais

Developing an investment app like Acorns can open up new avenues in the rapidly evolving FinTech landscape. As financial services continue to shift towards mobile-first solutions, offering users an accessible, user-friendly platform to manage their investments is a surefire way to gain traction in the market. By incorporating key features such as round-up investing, portfolio management, and financial education, your app can not only help users grow their wealth but also improve financial literacy.

In this blog, we’ve covered the different types of investment apps, the essential features to include, and the steps to develop your app, as well as the cost considerations and the tech stack required for smooth development. We’ve also highlighted how Miracuves can be your ideal development partner, offering a blend of expertise, cost-effectiveness, and scalable solutions tailored to your needs.

Ready to Build Your Investment App?

If you’re looking to create an investment app that rivals Acorns, Miracuves is here to help. Our team of experts specializes in FinTech app development and can guide you through every step of the process—from initial planning and design to development, security, and post-launch support. And with our competitive pricing, we make it easier than ever to turn your vision into a reality.

Get in touch with us today to start your journey in building a powerful and scalable investment platform!

Perguntas frequentes

1. What Features Should an Investment App Like Acorns Have?

An investment app like Acorns should include essential features such as round-up investing, automated recurring investments, portfolio management, goal-setting tools, performance tracking, and educational resources. Additionally, robust security measures like two-factor authentication and encryption are crucial to protect user data.

2. How Much Does It Cost to Develop an Investment App Like Acorns?

The cost of developing an investment app like Acorns depends on several factors, including the platform (iOS, Android, or both), the complexity of the features, and security requirements. Globally, it can range between $7000 and $25500. However, at Miracuves, we offer the same high-quality development services at half the global cost, starting from $3500.

3. How Do Investment Apps Like Acorns Make Money?

Investment apps like Acorns typically generate revenue through subscription fees, management fees, transaction fees, and partnerships with brands. Acorns, for instance, charges users a monthly fee based on the pricing tier (Lite, Personal, or Family) and also earns through its “Found Money” program, where brands pay a commission when users shop through Acorns.

4. Is It Necessary to Have a Banking License for an Investment App?

It depends on the services offered. If your app directly handles financial transactions, loans, or other banking services, a banking license may be required. However, some apps partner with licensed financial institutions to offer these services without needing their own license. Consulting with legal and compliance experts during development is crucial to ensure regulatory adherence.

5. How Can Users Trust the Security of Their Investments?

To build trust with users, investment apps must implement strong security measures such as encryption (e.g., AES-256), two-factor authentication (2FA), and regular security audits. Ensuring compliance with industry regulations like GDPR and PCI-DSS further assures users that their personal and financial data are safe.