The world of retail investing is evolving rapidly, with platforms like WeBull leading the charge by offering multi-asset trading apps that empower users to trade stocks, ETFs, options, and more—often with zero commissions. In a time when people want full control of their financial decisions, apps like WeBull have become indispensable tools for novice and experienced investors alike. These platforms make investing accessible, mobile, and engaging, offering advanced charting tools, social trading features, and instant access to real-time data.

Aufbau eines multi-asset trading app like WeBull presents a valuable opportunity to tap into this growing market. With more individuals embracing self-directed trading and diversified portfolios, there is increasing demand for platforms that combine ease of use with professional-grade tools. The market landscape also shows that the demand for accessible and mobile-first investing platforms will only rise, driven by a new generation of tech-savvy users who expect seamless and flexible financial solutions.

In this guide, we will walk through the key steps and essential features required to create a robust, multi-asset trading app. From design and development to marketing and compliance, every stage will help you build a platform that competes with industry leaders like WeBull. Whether you aim to create an innovative app for seasoned traders or offer a learning experience for beginners, developing a multi-asset trading app now positions you at the forefront of a booming fintech market.

What the App Is and What It Does

A multi-asset trading app like WeBull serves as a one-stop platform where users can trade stocks, ETFs, options, and more from the convenience of their smartphones. These apps are designed to empower individual investors by offering access to real-time market data, commission-free trading, Und advanced analytical tools, which were once only available to institutional investors.

The core objective of a WeBull-style app is to make investing easy and accessible for everyone—whether users are placing small trades or managing diverse portfolios. With WeBull, users can execute trades instantly, analyze market trends with customizable charts, and manage assets across different markets, all within a sleek, mobile-friendly interface. Additionally, features like margin trading and paper trading (simulated trading for beginners) provide flexibility and a risk-free learning environment.

These apps aim to be user-centric and mobile-first, ensuring users can track their investments, set alerts, and trade on the go. Multi-asset platforms attract users by integrating several financial products—such as stocks, crypto, and ETFs—within a single app, allowing them to diversify portfolios without needing multiple tools.

WeBull-style apps also go beyond just trading by offering educational resources, including tutorials, articles, and webinars, helping users improve their financial knowledge. These resources are especially valuable for novice traders, providing them with the confidence to invest and grow their portfolios. With such features, a multi-asset trading app fosters financial literacy while delivering a user-friendly, high-performing platform for retail investors.

Why Build This App?

Entwicklung einer multi-asset trading app like WeBull presents a unique opportunity to capitalize on several growing trends in the fintech and retail investing sectors. The demand for accessible and commission-free trading platforms has surged, with more people embracing self-directed investing to manage their finances independently. Users today are looking for all-in-one financial tools that let them trade across multiple asset classes, including stocks, ETFs, and cryptocurrencies, without switching between different platforms.

Democratization of Investing:

The rise of retail investors—fueled by trends like fractional shares and zero commissions—has disrupted traditional brokerage models. An app like WeBull caters to this trend by providing users with full access to financial markets without high fees or barriers, empowering everyday investors to build wealth.

Diverse Asset Options:

Modern investors value platforms that offer more than just stock trading. A multi-asset app allows users to diversify their portfolios with crypto, options, and ETFs, helping them minimize risks and maximize potential returns. Offering multiple investment products also expands user engagement by catering to different trading strategies and preferences.

Future-Proof Market Demand:

The fintech sector continues to grow, with analysts forecasting a steady increase in demand for retail trading platforms. Millennials and Gen Z are becoming more interested in investing as part of their financial planning, driving the need for mobile-first tools that match their lifestyle.

By building a platform like WeBull, businesses can meet the evolving needs of retail investors while tapping into a profitable market that rewards user-focused innovation. The app will not only provide trading tools but also create a learning environment that nurtures confident investors, fostering long-term user engagement and trust.

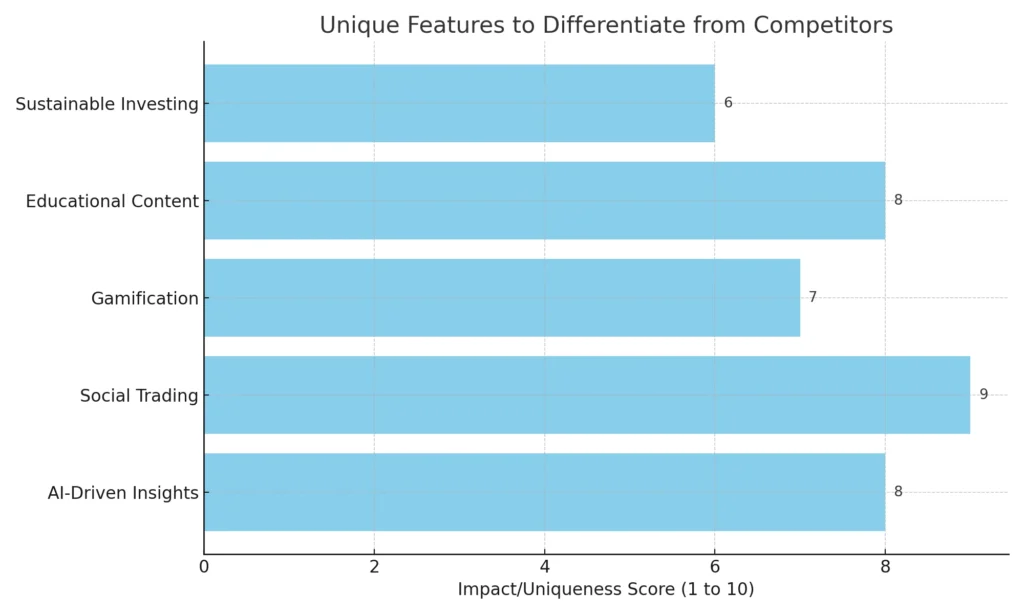

What Can I Do to Differentiate It?

To stand out in the crowded world of trading platforms, your multi-asset trading app needs to offer more than just basic functionalities. Here are some innovative features and strategies that can help your app rise above competitors like WeBull:

1. AI-Driven Personalized Insights

- Implementieren AI-powered algorithms to provide personalized trading insights, such as custom alerts or market trends relevant to user portfolios.

- This feature not only enhances decision-making but also builds engagement by tailoring content to individual users.

2. Social Trading and Communities

- Introduce social trading features where users can follow top traders, share investment strategies, or discuss market trends in real-time chat rooms.

- This promotes community interaction and helps beginners learn from experienced investors, improving user retention.

3. Gamified Investment Experience

- Angebot rewards for completing milestones, such as making the first trade or achieving specific profit goals.

- Users can collect points or badges, encouraging continuous engagement and making the investment journey more interactive.

4. Educational Content for All Levels

- Provide high-quality tutorials, webinars, and beginner guides within the app, along with simulated paper trading environments.

- Educational content attracts new investors and builds trust, making your app a reliable source for learning as well as trading.

5. Sustainable Investing Options

- Differentiate with ESG (Environmental, Social, and Governance) investment options. Highlight funds and companies that align with socially responsible investing trends, appealing to the values of modern investors.

Market Size, Growth, and Business Model

Der global market for fintech apps, including multi-asset trading platforms like WeBull, is expanding at an impressive pace. With the rise of mobile trading and commission-free investing, the demand for accessible, user-friendly platforms continues to grow. Investors—especially millennials and Gen Z—are increasingly seeking financial apps that allow them to manage diverse assets in real-time without complicated processes or high fees.

Market Growth Overview

- Der fintech market is projected to reach $305 billion by 2025, driven by rapid adoption of digital financial services.

- Retail trading apps have experienced a significant surge in user growth since 2020, as more people participate in self-directed investing.

- Platforms that offer multi-asset trading options, such as WeBull, appeal to a broader audience by enabling users to invest in stocks, ETFs, crypto, and options through a single app.

Business Model Strategies

Creating a sustainable business model is essential to ensure the long-term success of your platform. WeBull demonstrates how multiple income streams can offset the costs of offering commission-free services. Below are some core business models that work effectively for multi-asset trading platforms:

- Payment for Order Flow:

- Earn revenue by routing trades to market makers, who pay for processing transactions. This allows the platform to offer commission-free trades.

- Abonnementgebühren:

- Provide access to premium features—such as advanced market data and in-depth analysis—through monthly or yearly subscriptions.

- Margin Lending:

- Angebot margin accounts where users can borrow funds to trade with leverage. The interest earned on these loans contributes to the platform’s income.

- In-App Ads and Promotions:

- Monetize app space by displaying relevant financial ads or partner promotions, creating an additional revenue stream.

| Geschäftsmodell | Beschreibung | Umsatzpotenzial | Impact on User Engagement |

|---|---|---|---|

| Payment for Order Flow | Earns revenue by routing trades to market makers who pay for order processing. | High – Offsets commission-free model | Minimal impact, users experience fast trades. |

| Abonnementgebühren | Offers premium features (like advanced data) through paid plans. | Moderate – Recurring revenue stream | High – Engages serious traders seeking deeper insights. |

| Margin Lending | Provides loans to users for leveraged trading, generating interest income. | High – Margin interest boosts profits | Medium – Attracts experienced traders. |

| In-App Ads & Promotions | Displays targeted ads or partner offers within the app. | Low to Moderate – Depends on partnerships | Medium – If non-intrusive, users accept ads. |

Features of the App

A multi-asset trading app like WeBull must provide essential and advanced features to attract and retain users. To meet the expectations of modern investors, the platform should offer a smooth user experience, powerful tools, and easy access to various financial instruments. Below is a breakdown of the key features your app needs to succeed:

User-Side Features:

- Real-Time Data and Market News: Provide users with up-to-the-minute stock prices, ETF values, and crypto updates to keep them informed.

- Advanced Charting Tools: Include interactive charts with multiple indicators to help users analyze market trends.

- Alerts and Notifications: Allow users to set alerts for price movements and market changes, ensuring they never miss an opportunity.

- Fractional Trading: Enable users to buy partial shares, making high-priced stocks more accessible to smaller investors.

- Paper Trading Mode: Offer a simulated trading environment where users can practice without risking real money.

Admin-Side Features:

- Tools zur Benutzerverwaltung: Help administrators onboard, verify, and manage user accounts securely.

- Transaktionsüberwachung: Track trades and account activity in real-time to ensure smooth operations and compliance.

- Analyse-Dashboard: Provide insights into app usage, trade volume, and market behavior for better decision-making.

Unique Add-ons for Differentiation:

- Crypto Trading Integration: Allow users to trade cryptocurrencies alongside traditional assets, meeting growing demand.

- In-App Education Hub: Offer tutorials, webinars, and articles to guide beginners and enhance user engagement.

Technical Requirements

Building a multi-asset trading app like WeBull requires selecting the right technology stack to ensure reliability, speed, and scalability. The backend, frontend, APIs, and cloud infrastructure must work seamlessly to handle real-time trading operations and user interactions without downtime.

Backend and Database Technologies

- Backend: Verwenden Node.js oder Django for building the server-side operations, ensuring efficient data processing and faster responses.

- Datenbank: Implementieren PostgreSQL oder MongoDB for storing user data, transaction history, and portfolio details securely.

Frontend-Technologien

- Frameworks: Wählen Native reagieren oder Flattern to provide a smooth cross-platform experience on Android and iOS devices.

- UI Libraries: Leverage popular libraries for user interfaces to enhance usability and responsiveness.

APIs and Integrations

- Market Data API: Integrate with Alpha Vantage oder Yahoo Finance to deliver real-time market updates and historical data.

- Payment Gateway API: Verwenden Streifen oder Plaid to enable seamless funding of user accounts and secure payments.

- Authentication: Implementieren OAuth 2.0 for user login and secure access.

Cloud Hosting and Security Infrastructure

- Cloud Platform: Deploy the backend on AWS oder Google Cloud to scale the infrastructure according to user growth and traffic.

- CDN (Content Delivery Network): Verwenden Cloudflare to ensure fast loading times for all regions.

- Security Protocols: Protect user data with SSL-Verschlüsselung Und Zwei-Faktor-Authentifizierung (2FA) to ensure compliance with financial regulations.

Integrieren payment gateways like Plaid (Plaid) to ensure seamless account funding and secure transactions. This feature simplifies the onboarding process for new users, allowing them to quickly link their bank accounts and start trading. Additionally, using Plaid enhances trust with users by providing encrypted data exchange and compliant payment solutions.

| Komponente | Technology/Service | Zweck |

|---|---|---|

| Backend Framework | Node.js, Django | Handles server-side operations and data processing efficiently. |

| Datenbank | PostgreSQL, MongoDB | Stores user data, transaction history, and portfolio information securely. |

| Frontend Framework | React Native, Flutter | Ensures a smooth cross-platform experience on both Android and iOS. |

| Market Data API | Alpha Vantage, Yahoo Finance | Provides real-time and historical market data for trading. |

| Payment Gateway API | Stripe, Plaid | Enables seamless transactions and secure account funding. |

| Authentication Protocol | OAuth 2.0 | Ensures secure login and access management for users. |

| Cloud-Hosting | AWS, Google Cloud | Scales infrastructure to handle user growth and traffic spikes. |

| CDN (Content Delivery Network) | Cloudflare | Improves loading speeds and ensures global app performance. |

| Sicherheitsmaßnahmen | SSL Encryption, 2FA | Protects user data and ensures regulatory compliance. |

Design and User Interface (UI/UX)

Der design and user interface (UI/UX) of a multi-asset trading app like WeBull plays a critical role in user satisfaction and retention. Since trading requires real-time decisions and precise navigation, the app must offer an intuitive, well-structured interface to ensure that users can execute trades and manage portfolios seamlessly.

Key Design Elements

- Minimalist Layout: A clean design ensures that users can easily find important tools like market data, portfolios, and trading options without clutter.

- Customizable Dashboards: Give users the option to personalize their trading screens with preferred widgets such as stock watchlists, market news, or alerts.

- Dark Mode and Themes: Provide light and dark mode options for improved user experience and accessibility, especially during extended use.

User Experience (UX) Principles

- Fast Navigation: Ensure users can switch between different asset classes (like stocks, ETFs, or crypto) with minimal taps.

- Interactive Charts: Enable users to zoom, add indicators, or switch between timeframes to analyze trends efficiently.

- Onboarding Tutorial: Offer a brief, interactive tutorial during the first login to help new users navigate the platform quickly.

Testing and Prototypes

- Verwenden wireframes Und prototypes to validate the app’s user flow during the early stages of development.

- Benehmen usability testing with real users to identify pain points and make improvements before launch.

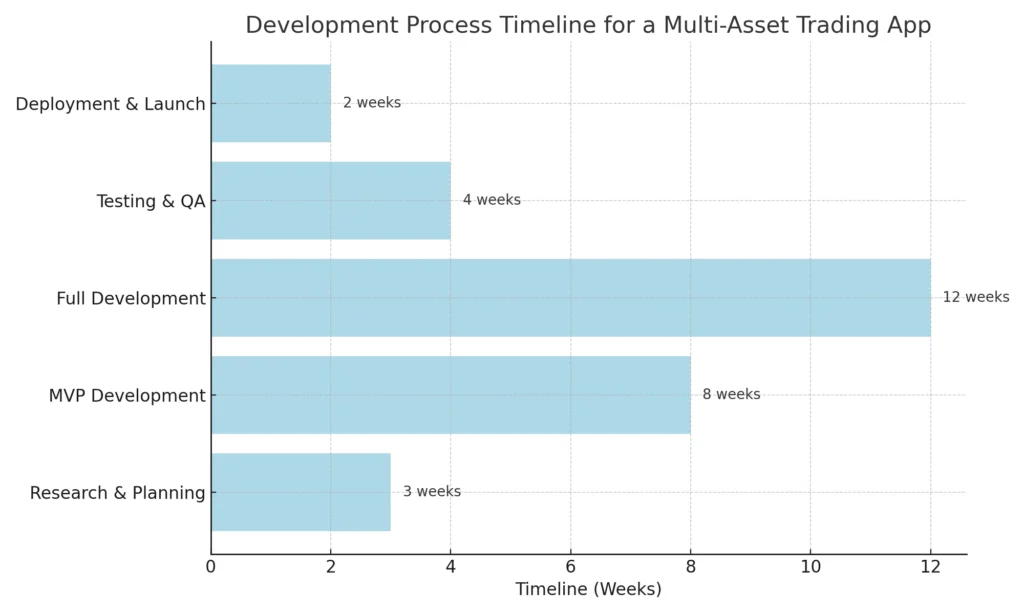

Development Process

Building a multi-asset trading app like WeBull requires a clear roadmap to ensure smooth execution and timely delivery. Each phase plays a crucial role, from brainstorming the app’s features to deploying a functional product that meets market standards. Below is a breakdown of the step-by-step development process:

Step 1: Research and Planning

- Identify the core features users expect, such as real-time trading, alerts, and advanced charting tools.

- Benehmen Marktforschung to understand competitors and user preferences, ensuring the app aligns with industry trends.

- Define a development timeline and budget to stay on track.

Step 2: Building the MVP (Minimum Viable Product)

- Focus on developing an MVP with essential features—like market data display, order placement, and basic user profiles.

- Launch the MVP to gather early feedback from beta users and refine the app.

Step 3: Full-Scale Development and Integration

- Expand the MVP with additional features such as multi-asset support, payment integrations, and social trading elements.

- Ensure the app is optimized for both Android and iOS platforms using cross-platform frameworks like Native reagieren oder Flattern.

Step 4: Testing and Quality Assurance

- Conduct rigorous QA testing to identify and resolve bugs, ensuring a smooth user experience.

- Perform load testing to guarantee the app can handle high traffic without performance issues.

Step 5: Deployment and Launch

- Deploy the app to Google Play Store and Apple App Store, ensuring compliance with all publishing requirements.

- Monitor post-launch feedback and roll out updates and fixes as needed.

Cost Estimation and Timeframe

Developing a multi-asset trading app like WeBull involves several key cost factors across different stages, including design, development, testing, and deployment. The total budget and timeline will depend on the complexity of the app’s features, the size of the development team, and the location of the developers. Below is a breakdown of the key elements affecting the costs and timeframe:

Cost Breakdown by Development Phase

- Design and Prototyping:

- Geschätzte Kosten: $5,000 to $10,000

- Zeitrahmen: 2 to 4 weeks

- Involves creating wireframes, user flows, and UI/UX prototypes.

- MVP Development:

- Geschätzte Kosten: $20,000 to $40,000

- Zeitrahmen: 8 to 12 weeks

- Focuses on building core features like account creation, trading functionality, and market data integration.

- Full-Scale Development and Integration:

- Geschätzte Kosten: $40,000 to $80,000

- Zeitrahmen: 12 to 16 weeks

- Includes advanced features, such as multi-asset support, alerts, and premium tools.

- Testing and Quality Assurance:

- Geschätzte Kosten: $5.000 bis $15.000

- Zeitrahmen: 3 to 4 weeks

- Covers bug fixes, load testing, and usability improvements.

- Deployment and Post-Launch Maintenance:

- Geschätzte Kosten: $5,000 to $10,000 annually

- Zeitrahmen: 1 to 2 weeks for launch + ongoing maintenance

- Involves deployment to app stores and rolling out regular updates.

| Development Phase | Geschätzte Kosten | Zeitraum | Beschreibung |

|---|---|---|---|

| Design und Prototyping | $5,000 – $10,000 | 2 – 4 weeks | Creation of wireframes, user flows, and UI/UX prototypes. |

| MVP Development | $20,000 – $40,000 | 8 – 12 weeks | Core features like user accounts, trading functions, and market data integration. |

| Full-Scale Development | $40,000 – $80,000 | 12 – 16 weeks | Advanced features including multi-asset support, notifications, and premium tools. |

| Prüfung und Qualitätssicherung | $5,000 – $15,000 | 3 – 4 weeks | Bug fixes, usability improvements, and load testing. |

| Deployment & Post-Launch Maintenance | $5,000 – $10,000 annually | 1 – 2 weeks + Ongoing | Launch on app stores and continuous updates for optimal performance. |

Monetarisierungsstrategien

Creating a sustainable business model for a multi-asset trading app like WeBull requires diversifying revenue streams. Offering commission-free trading is attractive to users, but the platform must generate income through other smart, non-intrusive monetization strategies. Below are some effective ways to ensure your app remains profitable:

1. Payment for Order Flow (PFOF)

- Partner von market makers who pay for trade orders routed through your platform.

- This strategy allows you to maintain commission-free trading while generating consistent revenue.

2. Subscription Plans for Premium Features

- Angebot advanced analytics, real-time alerts, and deeper market insights as part of paid subscription plans.

- Subscriptions create a recurring revenue stream and appeal to serious traders looking for enhanced tools.

3. Margin Lending and Interest Income

- Provide users with the option to trade on margin accounts, generating interest on borrowed funds.

- This feature attracts experienced investors and provides a steady stream of interest income.

4. In-App Ads and Partner Promotions

- Display relevant financial ads or exclusive partner promotions within the app.

- Carefully placed ads provide passive income without compromising the user experience.

5. Referral Programs and Loyalty Rewards

- Implement referral incentives where users earn free stocks or rewards for bringing in new users.

- This boosts user acquisition and promotes loyalty through continued engagement.

Launching and Marketing the App

A successful launch sets the foundation for your app’s long-term success. To create buzz and attract early users, it’s important to combine strategic marketing efforts with a seamless launch experience. Below is a step-by-step approach to launching and promoting your multi-asset trading app.

Pre-Launch Preparation

- Beta Testing: Conduct beta testing to identify bugs and gather user feedback. This ensures the app performs smoothly at launch.

- Onboard Early Adopters: Engage with influencers or financial bloggers to promote your app to their audience. Offer early access incentives like free trades or premium trials to attract initial users.

- Build Hype: Verwenden social media marketing and email campaigns to create anticipation. Sharing sneak peeks of the app’s features builds excitement.

Launch Strategy

- App Store Optimization (ASO): Ensure your app is optimized for visibility in the Google Play Store and Apple App Store. Use keywords related to trading and investments for higher rankings.

- Press Release: Announce your launch through a press release to gain media coverage and drive more downloads.

- Empfehlungsprogramme: Offer referral bonuses, such as free stocks or rewards for users who invite their friends.

Post-Launch Marketing

- Continuous User Engagement: Schicken Push-Benachrichtigungen about new features, market trends, and exclusive offers to keep users engaged.

- Werbung in sozialen Medien: Run targeted ads on platforms like Instagram, Facebook, and LinkedIn to attract traders actively looking for investment tools.

- Collect Reviews and Feedback: Encourage early users to leave positive reviews, which enhance your app’s reputation and improve its visibility in app stores.

Legal and Regulatory Considerations

Building a multi-asset trading app like WeBull requires strict compliance with financial laws and regulations to protect both the platform and its users. Operating in the financial space means following rules that ensure fair trading practices, data security, and user transparency.

1. Securities and Trading Regulations

- Ensure your app complies with relevant financial authorities such as the SEC (Securities and Exchange Commission) in the U.S.

- Obtain the necessary licenses to facilitate stock, ETF, and options trading legally.

2. KYC (Know Your Customer) and AML (Anti-Money Laundering)

- Implementieren KYC protocols to verify users’ identities before they begin trading. This prevents fraud and ensures your platform meets regulatory standards.

- Follow AML policies to detect and report suspicious transactions, maintaining platform integrity.

3. Data Privacy and Security Compliance

- Comply with data protection laws like DSGVO Und CCPA to safeguard user information.

- Ensure all sensitive data is encrypted and stored securely to prevent breaches and build user trust.

4. Payment and Tax Compliance

- Integrieren payment gateways that comply with PCI DSS (Payment Card Industry Data Security Standards) to ensure secure transactions.

- Track and report taxable activities on the platform, ensuring compliance with regional tax regulations.

5. User Agreement and Transparency

- Provide clear and accessible terms and conditions outlining the app’s services, fees, and risks involved in trading.

- Ensure that users receive real-time alerts on trading risks to maintain transparency.

Ensure your app complies with financial authorities like the SEC (SEC) to facilitate stock, ETF, and options trading legally. Meeting these requirements builds trust with users and ensures that your platform operates smoothly while avoiding regulatory risks. Additionally, implementing KYC and AML protocols will help prevent fraud and align your app with regulatory expectations.

Lesen Sie auch: - Launch a Cryptocurrency App Like Kraken: Everything You Need to Know

Future Growth and Scalability

A multi-asset trading app like WeBull must be designed with scalability in mind to support future growth. As your user base expands and trading volumes increase, your app needs to handle the pressure while remaining reliable and efficient. Planning for future growth ensures the platform remains competitive and continues to evolve with user expectations.

1. Scalable Cloud Infrastructure

- Deploy your backend on AWS or Google Cloud to easily scale resources based on demand.

- Verwenden Microservices-Architektur to divide the app into independent modules, making scaling faster and more manageable.

2. Continuous Feature Updates

- Regularly introduce new asset classes like cryptocurrencies, commodities, or international stocks to keep users engaged.

- Roll out AI-powered tools and portfolio management features to stay ahead of market trends.

3. Expanding into New Markets

- Explore opportunities to expand into Internationale Märkte, considering regional preferences and regulations.

- Introduce multi-currency and multi-language support to attract a global audience.

4. Data-Driven Insights for Growth

- Verwenden Analysetools to monitor user behavior, trading patterns, and feature usage.

- Predict trends with machine learning algorithms to improve trading recommendations and platform efficiency.

5. Strategic Partnerships for Growth

- Collaborate with financial institutions and educational platforms to enhance user offerings.

- Partner von investment firms or fintech startups to bring innovative features and products to your users.

Lesen Sie auch: - How to Build App like E*Trade from Scratch – Complete Guide

Warum sollten Sie bei Ihrem nächsten Projekt auf die Lösungen von Miracuves vertrauen?

Bei der Entwicklung eines multi-asset trading app like WeBull, partnering with the right company is essential. Miracuves-Lösungen offers a unique blend of expertise, speed, and cost-efficiency, making it the perfect choice for your fintech project.

1. Proven Expertise in Fintech Development

- Miracuves Solutions has a track record of delivering high-quality financial apps with advanced features like real-time data, secure payments, and seamless multi-asset trading.

- Our team understands the specific challenges of the fintech industry and offers solutions that align with regulatory requirements and market trends.

2. Fast and Cost-Efficient Development

- With a development process that is 30-mal schneller than industry standards, Miracuves Solutions ensures your app reaches the market quickly.

- Wir bieten up to 90% savings compared to traditional development firms, without compromising on quality or performance.

3. Comprehensive End-to-End Support

- From the initial concept and design to deployment and maintenance, we provide full-cycle development services.

- Our dedicated support team ensures your app stays updated and optimized post-launch, with quick responses to any technical needs.

4. Focus on Security and Scalability

- At Miracuves Solutions, we prioritize Sicherheit by integrating encryption, two-factor authentication, and compliance with global regulations.

- Unser scalable infrastructure guarantees that your app can handle growth, adapting effortlessly to increasing user demand.

Lesen Sie auch: - How to Create a Robinhood like Stock Trading App in 2024

Abschluss

Aufbau eines multi-asset trading app like WeBull offers a remarkable opportunity to tap into the booming fintech industry. With more users embracing self-directed investments and commission-free trading, your platform can become a trusted hub for retail investors. By focusing on user-friendly design, scalable infrastructure, and secure trading functionalities, you can meet the needs of both beginners and experienced traders.

From developing an MVP to rolling out advanced features and planning for future growth, each phase plays a crucial role in ensuring your app’s success. With smart monetization strategies in place—such as subscription plans and margin lending—you can create a sustainable business model while keeping the platform free of unnecessary fees.

Choosing the right partner is also essential. Miracuves-Lösungen offers expertise, fast delivery, and reliable post-launch support, helping you bring your vision to life efficiently. With the right tools and strategies, your multi-asset trading app will not only attract users but also create lasting value in an evolving financial landscape.

FAQs

How much does it cost to build a multi-asset trading app like WeBull?

Building a trading app can cost between $50.000 bis $100.000, depending on the features, integrations, and complexity required. Partnering with cost-efficient firms like Miracuves-Lösungen can significantly reduce these costs.

How long does it take to develop a multi-asset trading app?

The development process typically takes 4 bis 6 Monate, including research, MVP creation, full development, testing, and deployment. With optimized workflows, this timeline can be shortened.

What are the essential features for an app like WeBull?

Zu den Hauptmerkmalen gehören real-time market data, advanced charting tools, multi-asset support (stocks, ETFs, crypto), alerts, and paper trading modes. These elements ensure the platform attracts a wide range of investors.

Can I include cryptocurrency trading along with stocks and ETFs?

Yes, adding crypto trading functionality enhances your app’s appeal and aligns with modern investment trends, offering users more ways to diversify their portfolios.

How do apps like WeBull make money if trades are commission-free?

These platforms generate revenue through payment for order flow, subscription fees, margin lending, and partner promotions. This allows them to offer free trades while maintaining profitability.