From a developer-friendly payment API built to simplify online transactions to becoming the backbone of global digital commerce, Stripe has transformed how businesses accept and manage payments. In 2025, Stripe processes hundreds of billions of dollars annually and supports millions of businesses across SaaS, marketplaces, fintech startups, and global ecommerce platforms. What began as a simple solution for developers is now a critical infrastructure layer of the modern internet economy.

For entrepreneurs and startup founders, this journey is more than a success story. It is a proven business model. Global digital payments are projected to exceed $14 trillion in transaction value in 2025, driven by subscription economies, cross-border commerce, and embedded finance. At the same time, many businesses face challenges with Stripe itself, such as regional availability limits, compliance complexity, higher transaction fees, and restricted customization. These gaps have created strong demand for Stripe-style payment platforms tailored for specific regions, industries, and use cases.

This is where Stripe Clone Development becomes strategically important. A modern Stripe Clone Script is not just about accepting card payments. It is a complete fintech ecosystem that enables subscriptions, automated invoicing, marketplace payouts, multi-currency transactions, fraud prevention, and API-first integrations. When built correctly, it becomes a high-margin, scalable business rather than a single-feature product.

Miracuves Clone Solutions help founders convert this complex payment infrastructure into a launch-ready platform with predictable timelines and enterprise-grade scalability. By leveraging proven architectures and fintech-ready frameworks, entrepreneurs can move faster, reduce technical risk, and focus on market expansion instead of infrastructure hurdles.

What Makes a Great Stripe Clone Script in 2025

A great Stripe clone in 2025 is defined by how well it balances developer experience, financial security, and business scalability. Entrepreneurs are no longer impressed by platforms that simply process payments. They expect infrastructure that can grow from a few hundred transactions to millions without breaking performance, compliance, or user trust.

At its core, a Stripe-style clone must be API-first and modular. Founders want the flexibility to plug payments into SaaS products, marketplaces, mobile apps, and enterprise systems without rewriting core logic. Performance also plays a critical role. In modern fintech platforms, an average API response time under 300ms is no longer optional, and 99.9% uptime is the baseline expectation to avoid revenue loss and trust erosion.

Security and compliance are equally non-negotiable. A great clone embeds PCI-DSS readiness, tokenized payments, automated fraud detection, and region-specific compliance flows directly into the architecture. In 2025, successful payment platforms also differentiate themselves through intelligent automation, such as AI-driven risk scoring, smart retries for failed payments, and real-time transaction insights for merchants.

Core Characteristics of a High-Quality Stripe Clone

• High-performance payment APIs with low latency and horizontal scalability

• Multi-currency and cross-border support optimized for regional expansion

• Subscription and recurring billing engines with smart dunning workflows

• Marketplace-ready payout systems with split payments and escrow logic

• Enterprise-grade security layers including encryption, tokenization, and fraud monitoring

• Developer-friendly documentation and SDKs for faster adoption

Advanced Technology Expectations in 2025

Modern Stripe clones go beyond traditional payment rails. Many successful platforms now integrate AI-based fraud prevention, blockchain-backed transaction verification for audit trails, and cross-platform SDKs that work seamlessly across web, iOS, Android, and backend systems. These capabilities are no longer “nice to have”; they are what separate scalable fintech products from short-lived tools.

Comparison of Modern Stripe Clone Approaches

| Capability Area | Basic Payment Clone | Modern Stripe-Style Clone | Miracuves Stripe Clone |

|---|---|---|---|

| API Performance | Moderate latency | Optimized APIs | <300ms response time |

| Uptime Guarantee | Best effort | 99.5% | 99.9% production-ready |

| Subscription Billing | Limited | Advanced | Smart recurring + dunning |

| Fraud Prevention | Rule-based | AI-assisted | AI-driven risk scoring |

| Scalability | Vertical only | Partial horizontal | Fully cloud-scalable |

| Compliance Readiness | Manual | Semi-automated | Compliance-first architecture |

Why This Matters for Founders

In 2025, investors and enterprise clients evaluate fintech startups based on reliability, extensibility, and regulatory readiness. A poorly built clone may work for early demos but will fail under real transaction volume. Miracuves approaches Stripe Clone Development with production use in mind, ensuring every module is designed for real-world scale, not just MVP validation.

Essential Features Every Stripe Clone Must Have

Building a Stripe clone in 2025 means designing a multi-layered fintech platform, not a single payment feature. The most successful payment platforms are those that deliver a smooth experience for end users, deep operational control for businesses, and intelligent automation for scale. Each layer must work together without friction, even as transaction volumes grow exponentially.

For founders, this feature architecture determines whether the product remains an MVP or evolves into a long-term fintech business. Miracuves structures its Stripe Clone Development around three core functional layers, each optimized for performance, security, and growth.

User-Side Features: Experience, Trust, and Retention

On the user and merchant side, simplicity drives adoption. Businesses want payments to work invisibly while still offering powerful controls in the background. A strong Stripe-style clone delivers seamless checkout, fast settlements, and transparent reporting without overwhelming users.

Key user-side capabilities include secure card and wallet payments, multi-currency checkout, saved payment methods, real-time transaction notifications, and subscription management dashboards. In 2025, AI-based payment optimization such as smart retries and automatic payment routing significantly improves success rates and customer retention.

Admin Panel Features: Control, Analytics, and Automation

The admin layer is the command center of a payment platform. This is where fintech businesses monitor transaction health, manage compliance, and automate operations at scale. A great Stripe clone offers real-time dashboards, customizable reports, dispute management tools, and automated compliance workflows.

Advanced admin systems now include AI-powered fraud analytics, automated KYC/AML checks, configurable fee structures, and region-wise tax handling. These tools reduce manual workload while improving accuracy and regulatory confidence.

Service Provider and Platform Layer: Scale and Intelligence

For marketplace and platform-based use cases, the service provider layer enables seller onboarding, split payments, escrow handling, and automated payouts. Real-time balance tracking, earnings dashboards, and payout scheduling are essential for maintaining transparency and trust.

In 2025, leading platforms add AI-driven recommendations for payout timing, risk alerts for unusual activity, and predictive analytics to help merchants optimize revenue flow.

Advanced 2025-Ready Features

• AI-based fraud detection and risk scoring

• AR-assisted onboarding for faster merchant verification

• Blockchain-backed transaction logs for audit and transparency

• Dynamic currency conversion and routing

• Embedded finance APIs for lending, invoicing, and tax automation

Technical Architecture Requirements

A production-grade Stripe clone must be cloud-native and built for horizontal scaling. This includes microservices architecture, load balancing, encrypted data storage, role-based access control, and integration with third-party services such as banks, identity providers, and tax engines. Handling high transaction loads while maintaining sub-300ms response times is critical for global expansion.

Feature Tier Comparison

| Feature Set | Basic | Professional | Enterprise |

|---|---|---|---|

| Payment Methods | Cards only | Cards + wallets | Cards, wallets, bank transfers |

| Subscription Billing | Limited | Advanced | AI-optimized billing |

| Fraud Protection | Rule-based | AI-assisted | Predictive risk models |

| Marketplace Payouts | Not included | Partial | Full escrow and splits |

| Scalability | Limited | Moderate | Global-scale ready |

| Compliance Automation | Manual | Semi-automated | Fully automated |

How Miracuves Implements These Features

Miracuves Clone Solutions are built using modular fintech frameworks that allow founders to start lean and scale intelligently. Each feature tier is designed to upgrade seamlessly without rewriting the core system. This ensures faster launches, lower long-term costs, and a platform that evolves alongside business growth.

Read More : What is Stripe and How Does It Work?

Cost Factors & Pricing Breakdown

Stripe-Like Payment Gateway Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Payment Gateway MVP | Merchant onboarding, API-based payment processing, card payments, transaction logs, basic security, and a simple admin panel. | $70,000 |

| 2. Mid-Level Payment Processing Platform | Web dashboards, multi-currency support, recurring payments, webhook system, refund handling, notifications, and analytics dashboards. | $180,000 |

| 3. Advanced Stripe-Level Platform | Payment APIs & SDKs, subscription billing, marketplace payouts, fraud detection, compliance automation, reporting, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a developer-first, API-driven payment gateway platform similar to Stripe.

Miracuves Pricing for a Stripe-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete payment gateway foundation with merchant onboarding, secure payment processing APIs, transaction management, subscription-ready billing logic, webhook infrastructure, fraud-prevention hooks, and a powerful admin backend — built for fintech scalability and long-term control.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard integration, and deployment assistance — allowing you to launch a fully branded Stripe-style payment platform under your own ownership.

Launch Your Stripe-Style Payment Gateway Platform — Contact Us Today

Delivery Timeline for a Stripe-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Number of payment methods & regions

- Subscription, payout, or marketplace logic

- Compliance & security requirements

- API & webhook complexity

- Branding & UI/UX customization

- Reporting and admin controls

Tech Stack

Built using a JS-based architecture, ideal for API-first fintech platforms that require secure payment processing, high availability, scalable microservices, and real-time transaction handling.

Customization & White-Label Option

Building a Stripe-style payment processing and financial infrastructure platform isn’t just about accepting online payments — it’s about creating a developer-friendly, API-driven fintech ecosystem that powers transactions for startups, SaaS platforms, marketplaces, and enterprises. A platform inspired by Stripe must focus on reliability, security, scalability, and seamless integration while supporting global payments and complex billing models.

Miracuves delivers a fully white-label Stripe-style solution that allows deep customization across payment flows, APIs, dashboards, compliance layers, and backend financial infrastructure. Whether you are targeting online businesses, SaaS products, marketplaces, or subscription-based platforms, the system can be tailored to your fintech and business requirements.

Why Customization Matters

Modern payment platforms serve diverse use cases — one-time payments, subscriptions, marketplaces, and global payouts. Customization ensures your platform adapts to different business models, regulatory environments, and developer needs while maintaining performance and security at scale.

What You Can Customize

Complete UI/UX Personalization

Customize merchant dashboards, admin panels, reporting views, onboarding flows, typography, color schemes, and interface layouts to align with your brand identity.

Payment & API Workflows

Configure payment intents, checkout flows, webhooks, tokenization logic, refunds, disputes, retries, and transaction lifecycle management.

Subscription & Billing Logic

Set up recurring billing, usage-based pricing, metered billing, invoicing, proration rules, coupons, and lifecycle automation for SaaS businesses.

Marketplace & Payout Systems

Enable split payments, escrow-style flows, multi-party payouts, seller onboarding, balance management, and scheduled settlements.

Global Payments & Currency Handling

Multi-currency support, FX logic, regional payment rules, localization, and cross-border transaction handling.

Security & Compliance Controls

KYC/KYB workflows, AML checks, fraud detection rules, risk scoring, transaction limits, audit logs, and regulatory reporting.

Developer & Integration Tools

API keys, SDKs, sandbox environments, webhook testing, documentation portals, and version-controlled integrations.

Backend & Third-Party Integrations

Integrate payment methods, banking APIs, accounting tools, analytics platforms, CRM systems, and customer support software.

Monetization & Revenue Models

Transaction fees, subscription plans, premium APIs, value-added financial services, and enterprise pricing tiers.

How Miracuves Handles Customization

Miracuves follows a structured customization approach built for high-scale fintech infrastructure platforms.

- Requirement Understanding

Analysis of your target use cases, developer ecosystem, and compliance needs. - Planning & Breakdowns

Customization tasks are organized into modular, API-driven components. - Design & Development

UI/UX enhancements, payment logic, and backend fintech workflows are implemented according to your roadmap. - Testing & Quality Assurance

Security testing, transaction accuracy checks, performance validation, and compliance reviews. - Deployment

Your fully white-labeled payment infrastructure platform goes live with complete branding and operational configuration.

Real Examples from the Miracuves Portfolio

Miracuves has powered 600+ successful fintech and marketplace deployments, including:

- Payment gateways for SaaS and ecommerce platforms

- Subscription billing and invoicing systems

- Marketplace payment and payout solutions

- White-label fintech APIs for startups and enterprises

These real-world deployments demonstrate how customization transforms a Stripe-style platform into a scalable, developer-first, and enterprise-ready payment infrastructure.

Launch Strategy and Market Entry for a Stripe Clone

Launching a payment platform is as much a go-to-market challenge as it is a technical one. In 2025, founders who succeed with Stripe-style platforms treat launch as a phased rollout, carefully balancing compliance, reliability, and early traction. A strong launch strategy reduces regulatory risk while accelerating user adoption and revenue generation.

Pre-Launch Checklist

Before processing the first live transaction, founders must ensure operational readiness across technical, legal, and business layers. This preparation directly impacts approval speed, partner trust, and early customer confidence.

Key pre-launch steps include security testing, performance stress testing, compliance validation, merchant onboarding flows, app store and dashboard readiness, and marketing asset preparation. Establishing monitoring and alerting systems from day one prevents costly downtime and reputational damage.

Regional Market Entry Strategies

Payment behavior varies significantly by region, making localization critical.

Asia-Pacific markets favor wallet integrations, local bank transfers, and price-sensitive fee structures.

MENA regions require strong compliance alignment and trust-first onboarding experiences.

Europe emphasizes regulatory clarity, data protection, and subscription transparency.

United States focuses on scalability, enterprise reliability, and developer-friendly APIs.

Founders who tailor features and messaging to each region gain faster traction than those deploying one-size-fits-all solutions.

User Acquisition Frameworks That Work in 2025

Successful fintech platforms rely on distribution strategies that compound over time. Influencer-led B2B education, referral incentives for merchants, API partnerships with SaaS platforms, and content-driven onboarding funnels consistently outperform traditional advertising. Retention improves when platforms offer clear analytics, predictable pricing, and proactive support.

Monetization Models Proven in 2025

Stripe-style platforms generate revenue through transaction fees, subscription plans, premium feature access, cross-border conversion margins, and value-added services such as fraud protection or analytics. Combining multiple revenue streams creates stability and increases lifetime value.

Miracuves End-to-End Launch Support

Miracuves supports founders beyond development. From server setup and security configuration to compliance readiness and early growth planning, Miracuves provides a 90-day post-launch roadmap focused on stability, adoption, and revenue validation. This holistic support helps entrepreneurs move confidently from launch to scale without operational blind spots.

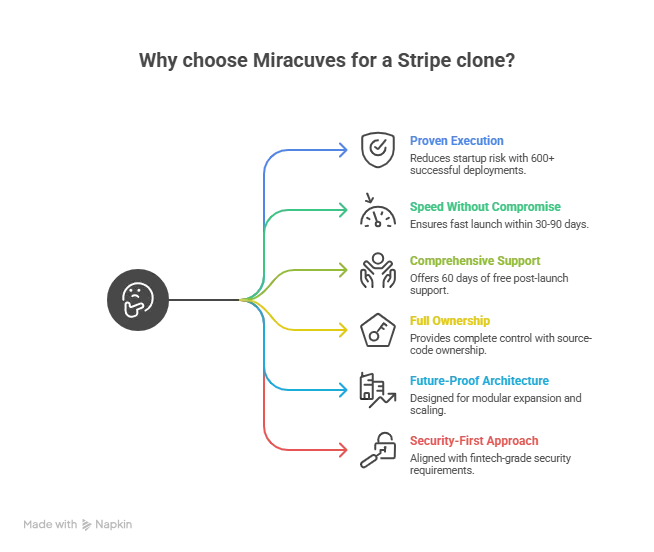

Why Choose Miracuves for Your Stripe Clone

A Stripe-style payment platform looks straightforward on the surface, but founders quickly discover the real challenge is not building a checkout screen. The challenge is building trustworthy financial infrastructure that can handle real money, real disputes, real compliance checks, and real scaling pressure. This is where the right technology partner changes everything. Miracuves is built for entrepreneurs who want to launch fast without sacrificing security, performance, or long-term control.

Proven Execution That Reduces Startup Risk

When you build payments infrastructure, mistakes are expensive. A small flaw in security, reconciliation, or payout logic can cost revenue, partnerships, and reputation. Miracuves brings execution confidence through 600+ successful deployments across fintech, ecommerce, and high-traffic digital platforms. This experience means founders are not betting on experimental code. They are building on frameworks designed for production realities like payment failures, fraud patterns, and scaling spikes.

Built for Speed Without Cutting Corners

Founders lose opportunities when development drags on. Miracuves follows a streamlined delivery model that helps entrepreneurs move from idea to launch-ready product within a predictable 30–90 days timeline depending on scope. That speed allows you to validate demand, onboard early merchants, and start monetizing while slower competitors are still planning.

What Founders Get With Miracuves Clone Solutions

600+ successful deployments that prove real-world reliability

30–90 days delivery timeline based on customization scope

60 days free post-launch support to stabilize and optimize after release

Full source-code ownership for total control and future upgrades

Future-proof architecture designed for modular expansion and scaling

Security-first build approach aligned with fintech-grade requirements

Short Success Stories and Transformations

A SaaS founder targeting subscription billing launched a Stripe-style recurring payment platform with a focused MVP, then expanded into premium analytics and automated dunning, improving payment recovery and retention within the first quarter.

A marketplace entrepreneur launched a payout and split-payment system tailored to local banking rails, reducing settlement time and improving merchant trust, which directly increased onboarding conversions.

A regional fintech startup replaced manual invoice collection with automated payment links and reporting dashboards, enabling predictable cash flow and faster business scaling.

Final Thought

Stripe succeeded because it did not just process payments it simplified a complex financial workflow into something businesses could trust and scale. That same business logic is the opportunity for founders in 2025. When you understand how a Stripe-style platform earns trust through reliability, earns revenue through transaction volume, and earns retention through developer-friendly experiences, you stop thinking like a feature builder and start thinking like a fintech founder.

A well-executed Stripe clone is not about copying a brand it is about building a payment infrastructure that fits a specific market better than global platforms can. That might mean localized payment methods, region-first compliance, niche pricing, or industry-focused billing for SaaS, marketplaces, education, healthcare, or logistics. The winners are the entrepreneurs who launch with a clear niche, ship fast, and keep improving based on real transaction data not assumptions.

Miracuves helps you do exactly that by turning Stripe Clone Development into a structured, scalable launch path. With production-ready architecture, full source-code ownership, and a predictable 30–90 days delivery timeline based on scope, you can move faster, reduce risk, and build a platform designed to grow into a real fintech business. If your goal is to launch smarter, scale stronger, and dominate a niche where payments are the backbone, the right clone foundation can be your unfair advantage.

Ready to launch your Stripe cloneGet a free consultation and detailed project roadmap from Miracuves trusted by 200+ entrepreneurs worldwide

FAQs

How quickly can Miracuves deploy my Stripe clone

Miracuves can deliver a launch-ready Stripe-style payment platform within 30–90 days, depending on customization scope, compliance requirements, and feature depth.

What is included in the Miracuves Stripe clone package

The package includes core payment APIs, merchant dashboards, admin controls, security layers, subscription billing modules, documentation, and deployment support.

Will I get full source-code ownership

Yes. Every Miracuves Stripe clone comes with 100 percent source-code ownership, giving you full control over customization, scaling, and future upgrades.

How does Miracuves ensure scalability for high transaction volumes

Miracuves uses cloud-native, modular architecture with load balancing, horizontal scaling, and performance optimization to support growth without system rewrites.

Does Miracuves help with compliance and regulatory readiness

Yes. The platform is built with compliance-first architecture, supporting PCI-aligned security practices, KYC and AML workflows, and region-specific configurations.

Is post-launch maintenance included

Miracuves provides 60 days of free post-launch support to stabilize performance, resolve issues, and optimize real-world transaction flows.

Can I integrate custom or local payment gateways

Absolutely. Miracuves Stripe clones are designed for flexible integration with local banks, wallets, and third-party payment providers based on your target market.

How are future upgrades and updates handled

The modular system allows features to be added or upgraded without disrupting live operations, ensuring smooth evolution as your business scales.

How does white-labeling work in a Stripe clone

White-labeling allows you to launch under your own brand with custom domains, UI design, pricing rules, and merchant communication, without any Miracuves branding.

What kind of ongoing support can I expect after launch

Beyond the initial support window, Miracuves offers flexible long-term maintenance and growth support plans focused on security updates, feature expansion, and performance optimization.

Related Articles

- Best Neobank Clone Scripts in 2025: Features & Pricing Compared

- Best Binance Clone Scripts in 2025: Features & Pricing Compared

- Best Wise Clone Scripts in 2025: Features & Pricing Compared

- Best Revolut Clone Scripts in 2025: Features & Pricing Compared

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best PayPal Clone Scripts 2025 Launch a Secure Global Digital Payment Platform