Best Crypto Exchanges and Apps Top Cryptocurrency Exchanges

The world of cryptocurrencies has rapidly expanded over the years, and with it, the need for reliable platforms to buy, sell, and trade digital assets has become paramount. Lets get into in-depth exploration of the best crypto exchanges and apps, covering various aspects such as how cryptocurrency exchanges work, choosing the best crypto exchange, types of cryptocurrencies and exchanges, buying and selling on exchanges, security and regulation in crypto exchanges, and the role of cryptocurrency apps in facilitating digital asset transactions.

What is a Cryptocurrency Exchange?

A cryptocurrency exchange is a digital platform that facilitates the buying, selling, and trading of various cryptocurrencies. These platforms act as intermediaries, matching buyers and sellers to execute transactions. In essence, a crypto exchange is a marketplace specifically designed for trading digital currencies, offering users the ability to exchange one type of cryptocurrency for another or convert digital assets into fiat currencies.

How do cryptocurrency exchanges work?

Cryptocurrency exchanges work by utilizing order books, which list the buy and sell orders for a particular digital currency. When a buyer’s bid matches a seller’s ask, the exchange facilitates the transaction, ensuring the proper transfer and record-keeping of the involved cryptocurrencies.

What are the different types of cryptocurrency exchanges?

There are various types of cryptocurrency exchanges, including centralized exchanges, decentralized exchanges, and peer-to-peer platforms. Centralized exchanges are operated by a single entity and often offer advanced trading features. Decentralized exchanges, on the other hand, are designed to operate without a central authority, providing users with more control over their assets. Peer-to-peer exchanges connect buyers and sellers directly, allowing them to negotiate the terms of their transactions.

Are decentralized exchanges better than centralized exchanges?

The choice between decentralized and centralized exchanges depends on individual preferences and requirements. Decentralized exchanges offer enhanced privacy and security due to their distributed nature, whereas centralized exchanges often provide a more user-friendly interface and additional features such as margin trading and increased liquidity.

Choosing the Best Crypto Exchange

When selecting the best crypto exchange for your needs, it’s essential to consider several factors to ensure a seamless and secure trading experience. Factors to consider include the reputation and security measures of the exchange, trading fees, available trading pairs and liquidity, and the range of supported cryptocurrencies.

What are the factors to consider when choosing a crypto exchange?

Users should consider the reputation, security, and regulatory compliance of the crypto exchange, as well as the available trading pairs, trading fees, and overall user experience. Additionally, factors like deposit and withdrawal options, customer support, and the exchange’s geographical availability can play a significant role in the decision-making process.

How to ensure the security of a crypto exchange?

Security measures such as two-factor authentication, cold storage for funds, and regular security audits are crucial for safeguarding users’ funds on a crypto exchange. Additionally, choosing exchanges regulated by reputable authorities can add an extra layer of protection.

Which crypto exchanges offer the best trading volume and liquidity?

Exchanges like Binance, Coinbase, and FTX are known for offering high trading volumes and liquidity, allowing users to execute trades efficiently and at competitive prices.

Types of Cryptocurrencies and Exchanges

With the proliferation of cryptocurrencies, various digital assets have emerged as popular choices for trading and investment. Bitcoin, Ethereum, and Ripple are among the most widely traded cryptocurrencies on exchanges, offering diverse opportunities for investors.

What are the most popular cryptocurrencies on exchanges?

The most popular cryptocurrencies on exchanges include Bitcoin, Ethereum, Ripple, Litecoin, and many others. These digital assets are commonly traded against fiat currencies and serve as foundational elements in the crypto trading space.

How do crypto wallets work with exchanges?

Crypto wallets play a crucial role in managing digital assets on exchanges. Users can deposit their cryptocurrencies from their wallets to the exchange for trading purposes and subsequently withdraw their funds back to their wallets for safekeeping.

What are the risks associated with peer-to-peer exchanges?

Peer-to-peer exchanges carry risks related to the direct interaction between users, including the potential for fraudulent activities and disputes. Users should exercise caution and thoroughly vet their trading counterparts before engaging in transactions on peer-to-peer platforms.

Buying and Selling on Exchanges

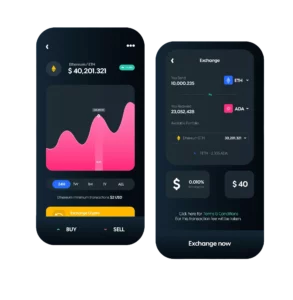

The process of buying and selling cryptocurrencies on exchanges involves various steps, including account creation, depositing funds, executing trades, and withdrawing funds. Different payment methods and trading pairs are offered by exchanges to accommodate diverse user preferences.

How to buy and sell cryptocurrencies on exchanges?

To buy cryptocurrencies on an exchange, users typically create an account, deposit funds, select the desired trading pair, and execute the purchase order. Conversely, selling cryptocurrencies involves initiating a sell order for the chosen digital asset at a preferred price point.

What payment methods do exchanges offer for buying and selling?

Exchanges offer a range of payment methods, including bank transfers, credit/debit card payments, and in some cases, payment through digital wallets or other cryptocurrencies. These options provide users with flexibility in funding their exchange accounts and acquiring digital assets.

What are the differences between a cryptocurrency exchange and a traditional stock exchange?

While both types of exchanges facilitate the trading of assets, cryptocurrency exchanges deal exclusively with digital assets, whereas traditional stock exchanges handle securities and financial instruments related to traditional companies and industries.

Security and Regulation in Crypto Exchanges

Security and regulation are pivotal aspects of crypto exchanges, ensuring the protection of users’ funds and the overall integrity of the digital asset trading ecosystem. Reputable exchanges implement stringent security measures and adhere to regulatory standards to foster trust and confidence among their user base.

What security measures do reputable exchanges implement to safeguard users’ funds?

Reputable exchanges employ advanced security protocols such as two-factor authentication, cold wallet storage, encryption techniques, and regular security audits to protect users’ funds from potential security breaches and unauthorized access.

How are crypto exchanges regulated, and why is it important?

Crypto exchanges are subject to regulatory oversight by relevant authorities in different jurisdictions. Regulations are essential to safeguard users, prevent fraudulent activities, and ensure compliance with anti-money laundering (AML) and know your customer (KYC) standards, thereby promoting the legitimacy and transparency of the crypto trading environment.

What should users do in the event of a hack or security breach on an exchange?

In the unfortunate event of a hack or security breach on an exchange, users should immediately report the incident to the exchange’s support team, cease any further transactions, and follow the prescribed security protocols, such as changing passwords and enabling additional security measures, to mitigate potential risks and protect their accounts.

The Role of Cryptocurrency Apps

Cryptocurrency apps have gained prominence as convenient tools for users to access and manage their digital assets on the go. These applications offer features for buying, selling, and storing cryptocurrencies, catering to the diverse needs of the crypto community.

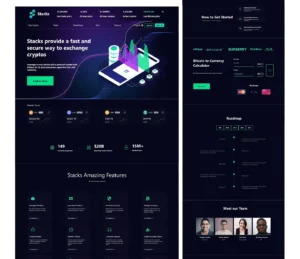

What are the best cryptocurrency apps of February 2024?

In February 2024, some of the best cryptocurrency apps include Coinbase, Binance, Kraken, and Gemini, offering intuitive interfaces, secure storage solutions, and seamless trading experiences for users.

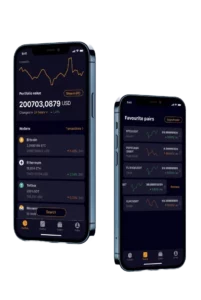

How do crypto apps facilitate buying and selling cryptocurrencies?

Crypto apps streamline the process of buying and selling cryptocurrencies by providing user-friendly interfaces for initiating transactions, accessing market data, and managing digital asset portfolios, all from the convenience of mobile devices.

Are there specific apps that cater to different types of digital currencies?

Indeed, certain cryptocurrency apps specialize in supporting specific types of digital currencies, catering to niche market segments and offering tailored solutions for managing and trading distinct digital assets. These centralized and decentralized exchanges allow for crypto transactions.

Cryptocurrency trading has witnessed exponential growth over the years, with many exchanges emerging to cater to the diverse needs of crypto investors. These exchanges, whether centralized or decentralized, act as a platform for individuals to buy or sell digital assets.

While centralized exchanges are operated by a central authority, decentralized exchanges operate without a central intermediary, offering a more secure and transparent trading environment.

Brokers play a vital role in cryptocurrency trading, offering brokerage services to facilitate transactions between buyers and sellers. Many exchanges also allow users to trade directly with each other, bypassing the need for a broker. However, regardless of the trading options available, transaction fees are typically involved, including maker fees and taker fees.

These fees vary depending on the exchange and the type of transaction, but they help cover the costs associated with facilitating trades and maintaining the exchange platform. Overall, the presence of brokers and exchanges make it easy for crypto investors to participate in the market and capitalize on the opportunities presented by the rapidly evolving cryptocurrency landscape.

Frequently Asked Question:

1. What are the 10 best crypto exchanges for someone looking to buy cryptocurrencies?

The cryptocurrency market boasts numerous exchanges offering various digital assets. From decentralized cryptocurrency exchanges to leading platforms like Coinbase Pro, investors have a plethora of options. These exchanges, known for their low fees and diverse offerings, make it easy to buy and sell digital currencies.

2. How do cryptocurrency exchanges make money, and what fees do they charge?

Cryptocurrency exchanges generate revenue through various means, including maker and taker fees charged on trades. These fees are often based on the volume of trading and help cover operational costs. While some exchanges offer low fees, others may have higher charges, so it’s essential to research before trading.

3. What are the different types of crypto exchanges available in the market?

Cryptocurrency exchanges come in various forms, including centralized and decentralized platforms. Centralized exchanges are operated by a company or organization, offering trading and investing opportunities. On the other hand, decentralized exchanges allow trading without the need for intermediaries, providing greater security and transparency.

4. Which cryptocurrency exchanges are the largest and most popular in the crypto space?

Some of the leading crypto exchanges, such as Coinbase Pro and Binance, dominate the cryptocurrency market. These platforms offer a wide range of digital assets and trading options, including futures trading. With their user-friendly interfaces and robust security measures, they attract a significant user base globally.

5. How do cryptocurrency exchanges differ from brokerage platforms regulated by the Securities and Exchange Commission (SEC)?

Cryptocurrency exchanges operate in the cryptocurrency market, facilitating the trading of cryptocurrencies among users. In contrast, brokerage platforms regulated by the SEC deal with securities trading. While both involve trading and investing, they operate in different financial realms.

6. What factors should one consider when choosing a cryptocurrency exchange?

When selecting a cryptocurrency exchange, factors such as security measures, trading fees, available cryptocurrencies, and user interface should be considered. Additionally, it’s crucial to choose exchanges based on your trading preferences and requirements to ensure a seamless and rewarding experience in the cryptocurrency space.