Starting a scooter rental business has become an attractive opportunity for entrepreneurs, fueled by the growing demand for convenient, eco-friendly urban transportation. With cities embracing sustainable mobility options, electric scooters are increasingly favored for short-distance travel. From urban commuters seeking quick, last-mile connectivity to tourists exploring new destinations, the scooter rental business caters to a broad audience. However, like any business venture, entering this space requires a well-thought-out plan, particularly when it comes to understanding the costs involved.

One of the primary steps in launching a successful Electric Bike Rental Business Startups is getting a clear picture of the startup costs. These costs vary based on factors such as fleet size, city regulations, and the technology infrastructure required. Unlike traditional businesses, a scooter rental operation involves unique expenses, including fleet acquisition, maintenance, licensing, and the establishment of a charging network. Additionally, building a reliable and user-friendly mobile app to manage rentals and track scooters is essential, adding to the initial investment.

This guide breaks down all the critical financial aspects of starting a scooter rental business, covering everything from initial investment to ongoing operational expenses. By understanding each cost component, you’ll be better equipped to create a robust business plan and estimate the revenue potential of your venture. We’ll explore topics like fleet acquisition, maintenance expenses, and operational costs, as well as less obvious factors such as licensing fees and insurance requirements. Each of these elements plays a crucial role in determining the financial feasibility of your scooter rental business.

Through this comprehensive cost analysis, you’ll gain valuable insights into what it takes to start and sustain a scooter rental operation. This will include practical budgeting tips, strategies for financial planning, and ways to optimize costs without compromising service quality. Whether you’re considering a small fleet to test the market or aiming for a large-scale operation, understanding these financial foundations is vital to achieve profitability and long-term success.

The goal of this guide is not only to outline the expenses but to provide a clear pathway for new entrepreneurs in this space. With the right planning and knowledge, you can minimize risks, make informed decisions, and position your scooter rental business for growth in the competitive market. This journey begins with knowing the exact costs and what they mean for your bottom line—let’s dive into each aspect to help you build a financially sound foundation for your scooter rental business.

Market Analysis for Scooter Rentals

To build a successful scooter rental business, it’s essential to understand the market landscape. Conducting a market analysis helps you gauge the demand for scooter rentals in different areas, identify key target audiences, and gain insights into competitors’ strengths and weaknesses. This foundational step not only guides your business strategy but also informs financial planning and expected revenue.

Industry Overview

The scooter rental industry has seen substantial growth in recent years, driven by the rise of micro-mobility solutions in urban areas. As cities around the world strive to reduce traffic congestion and carbon emissions, electric scooters offer a sustainable alternative for short-distance travel. According to recent industry reports, the global scooter-sharing market is expected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. Cities like Paris, San Francisco, and New York have become hotspots for scooter rentals, demonstrating the widespread adoption and potential for growth in this sector.

This trend is further fueled by the younger, tech-savvy generation, who prefer app-based, on-demand mobility solutions over traditional car ownership. For entrepreneurs, this translates into a lucrative opportunity to tap into an expanding market, provided they understand local regulations and consumer preferences.

Target Audience

Understanding your target audience is crucial for tailoring your services and marketing efforts. The primary users of scooter rentals include:

- Urban Commuters: Individuals who use scooters for short-distance commuting, particularly for last-mile connectivity from transit stations to workplaces.

- Tourists: Visitors looking for convenient and fun ways to explore a city without the hassles of parking and traffic.

- Students and Young Adults: This demographic is often drawn to eco-friendly, affordable transportation options, especially in university towns and densely populated areas.

By identifying these audience segments, you can better position your scooter rental business to meet specific needs. For instance, providing multi-hour or daily rental packages might appeal to tourists, while offering discounted rates for students could attract younger users.

According to recent reports, the global scooter-sharing market is expected to grow significantly in the coming years.

Competitor Analysis

A comprehensive market analysis also includes studying your competitors. Major players in the scooter rental industry, like Bird, Lime, and Spin, have already established strong brand identities and expansive fleets. Analyzing their pricing models, app features, fleet maintenance practices, and customer engagement strategies can provide valuable insights. This analysis enables you to differentiate your offering, whether by adding unique features, focusing on under-served locations, or offering competitive pricing.

Local Competitors: In addition to global brands, many cities have smaller, local scooter rental businesses that target specific neighborhoods or niche markets. While these companies may not have the same brand recognition as industry leaders, they often cater well to local preferences and regulations. Studying these local competitors can give you ideas for establishing a niche or capitalizing on unmet demand in specific areas.

Regulatory Considerations

Finally, the regulatory environment plays a critical role in determining the viability of a scooter rental business in any given market. Cities have diverse regulations regarding scooter rentals, covering aspects like speed limits, parking restrictions, fleet sizes, and usage zones. Some cities also require scooter rental companies to pay licensing fees and follow specific operational guidelines, which can impact startup and operational costs.

Understanding and adhering to these regulations is crucial for avoiding fines and ensuring smooth operations. It’s advisable to consult with local transportation authorities or legal experts to stay compliant and factor these regulatory costs into your business plan.

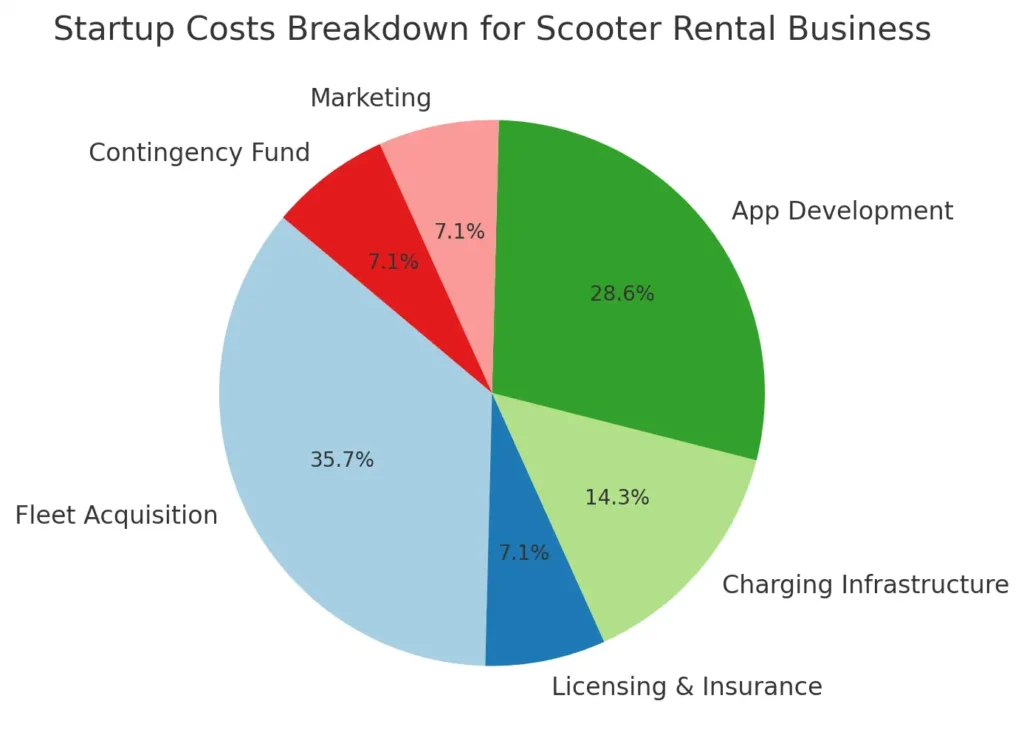

Key Factors Contributing to Startup Costs

Starting a scooter rental business involves several key expenses that determine the financial viability of the venture. These startup costs encompass fleet acquisition, licensing and insurance fees, charging infrastructure, and more. A clear understanding of each cost factor is essential for creating a robust financial plan and ensuring smooth business operations from the outset.

| Expense Category | Description | Estimated Cost |

|---|---|---|

| Fleet Acquisition | Cost of purchasing scooters for the fleet | $15,000 – $50,000 |

| Licensing and Insurance | Fees for obtaining licenses and fleet insurance | $3,000 – $7,000 |

| Charging Infrastructure | Installation of charging stations or battery swaps | $8,000 – $15,000 |

| Mobile App Development | Development of a custom app for rentals | $10,000 – $50,000 |

| Marketing and Branding | Initial promotional and branding costs | $3,000 – $5,000 |

| Contingency Fund | Set aside for unexpected expenses | $5,000 |

| Total Estimated Startup Cost | $44,000 – $132,000 |

Fleet Acquisition

One of the most significant initial expenses in a scooter rental business is fleet acquisition. The cost of electric scooters varies widely based on the model, features, and quality. Basic electric scooters may start around $300 per unit, while high-end models with longer battery life, better durability, and enhanced safety features can range from $500 to $1,000 each. For a small fleet of 50 scooters, this translates to an investment of $15,000 to $50,000.

When choosing scooters, it’s essential to consider factors like battery life, weight capacity, and durability. Opting for high-quality scooters may increase your initial investment but will likely reduce long-term maintenance expenses and enhance user satisfaction. Additionally, some suppliers offer discounts for bulk purchases, which can help lower the overall acquisition cost.

Licensing Fees and Insurance Requirements

Licensing and insurance are crucial components of your startup costs. Many cities require scooter rental businesses to obtain specific licenses to operate legally. These licensing fees vary depending on the city and can range from a few hundred to several thousand dollars per year. Failure to comply with local licensing regulations can lead to penalties and business interruptions.

Insurance requirements are another significant cost. Insurance policies protect your fleet and business from potential liabilities, including accidents, theft, and property damage. Basic insurance coverage typically costs between $50 and $100 per scooter annually, depending on the policy and location. For a fleet of 50 scooters, this could mean an insurance expense of $2,500 to $5,000 annually. Comprehensive insurance might be more expensive, but it provides broader coverage and peace of mind, especially in high-risk areas.

It’s essential to understand the types of insurance required to protect both your fleet and your users.

Charging Infrastructure

A reliable charging infrastructure is essential for keeping your fleet operational. There are two primary options for charging scooters: setting up dedicated charging stations or using a battery swap system.

- Charging Stations: Establishing charging stations at strategic locations can cost anywhere from $1,000 to $5,000 per station, depending on the setup. These stations require access to electricity and a safe area where scooters can be parked and charged. While charging stations have higher upfront costs, they allow for efficient charging and reduce the need for manual battery swapping.

- Battery Swap System: In contrast, a battery swap system involves removing depleted batteries from scooters and replacing them with fully charged ones. This option requires investment in spare batteries and a charging facility for recharging depleted batteries. Although more labor-intensive, battery swapping is often preferred in busy areas with high scooter usage, as it minimizes downtime.

Technology and Software

Another critical aspect of startup costs is the technology infrastructure for managing scooter rentals. A user-friendly mobile app and backend software are essential for tracking scooter availability, processing payments, and providing customer support. Developing a custom mobile app can cost anywhere from $10,000 to $50,000, depending on the features, design, and complexity.

Many scooter rental businesses also invest in fleet management software that allows real-time tracking, usage monitoring, and maintenance scheduling. This software ensures that scooters are always available and helps optimize fleet performance, improving the overall user experience. For startups, choosing a reliable software provider or working with a developer familiar with the scooter rental industry can make a substantial difference in long-term costs and efficiency.

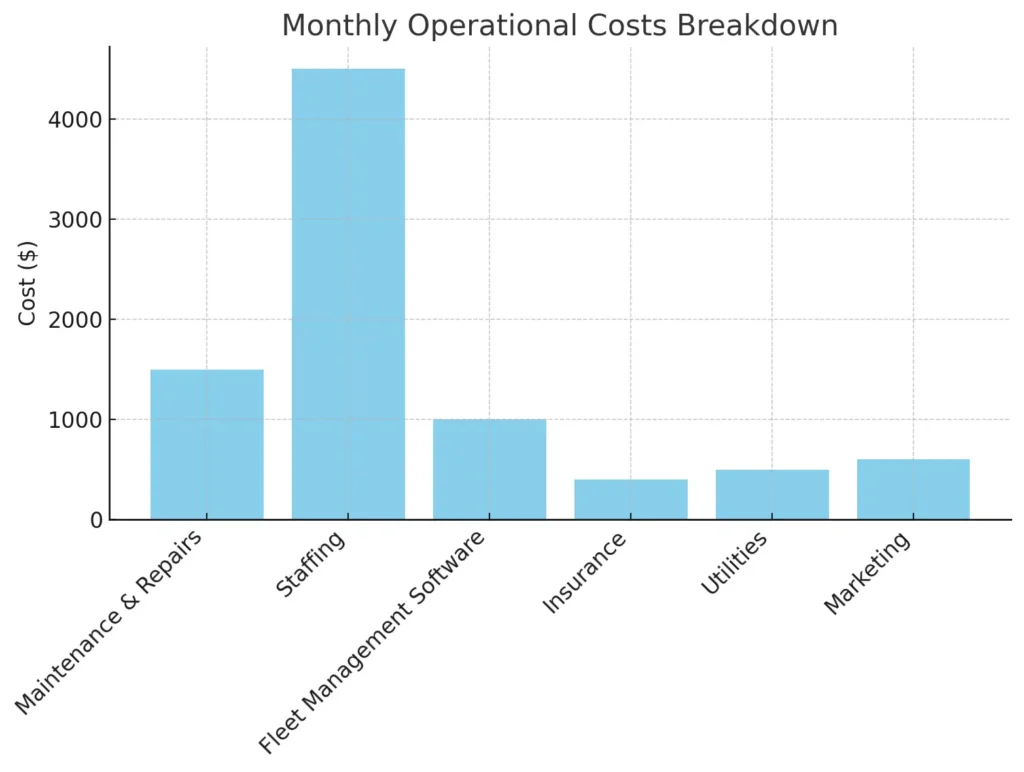

Operational Costs: Running a Scooter Rental Business

Once the initial setup is complete, running a scooter rental business involves ongoing operational costs. These expenses are crucial to maintaining fleet performance, ensuring customer satisfaction, and keeping the business compliant with regulatory requirements. Properly estimating and planning for these costs is essential for sustainable operations and long-term profitability.

| Expense Category | Description | Estimated Monthly Cost |

|---|---|---|

| Maintenance and Repairs | Regular maintenance for scooters | $750 – $1,500 |

| Staffing | Salaries for fleet management and support | $3,000 – $5,000 |

| Fleet Management Software | Monthly fee for tracking and monitoring | $500 – $1,500 |

| Insurance | Ongoing insurance premium | $400 – $600 |

| Utilities (Charging) | Electricity costs for charging the fleet | $500 |

| Marketing | Monthly marketing and promotional costs | $500 – $1,000 |

| Total Monthly Cost | $5,650 – $10,100 |

Maintenance Expenses

Regular maintenance is necessary to keep your scooters in optimal working condition and ensure user safety. Maintenance includes tasks like battery checks, tire replacements, brake adjustments, and cleaning. Depending on the frequency of usage and the quality of your scooters, maintenance costs can vary. On average, expect to spend between $15 to $30 per scooter monthly on basic upkeep, translating to $750 to $1,500 per month for a fleet of 50 scooters.

Wear and tear are inevitable, especially in high-traffic urban areas where scooters may experience rough handling. Scheduling routine maintenance can help prevent costly repairs and extend the lifespan of your scooters. Investing in durable, high-quality models initially can also reduce long-term maintenance costs. Some businesses opt to employ in-house technicians, while others contract maintenance to third-party services—each with its own cost implications.

Staffing and Operational Expenses

Running a scooter rental business requires a team to manage daily operations, especially as the fleet grows. Key roles include fleet managers, customer service representatives, and maintenance technicians. Staffing costs will vary based on location, labor market conditions, and the scale of your operations.

- Fleet Management: Fleet managers oversee the deployment, collection, and distribution of scooters across operational areas. They ensure that scooters are available in high-demand zones and are promptly retrieved and charged when needed.

- Customer Service: A customer support team is essential for handling inquiries, resolving app issues, and assisting users with any challenges they may encounter. Customer satisfaction directly impacts user retention and brand reputation.

- Technicians: Hiring in-house or contracted technicians to conduct maintenance, repairs, and battery swaps is also necessary for smooth operations.

For a small-scale operation, staffing costs might start around $3,000 to $5,000 per month, while larger fleets in metropolitan areas could require a higher budget for staffing. Automation and software solutions can help reduce labor costs by streamlining fleet management and customer service tasks.

App Development and Software Costs

In today’s digital era, a mobile app is indispensable for scooter rental businesses. A robust app allows users to locate scooters, unlock them, make payments, and receive notifications. Building a custom mobile app can cost between $10,000 and $50,000, depending on its complexity and features. However, there are third-party solutions available, which offer pre-built apps specifically designed for scooter rentals at lower costs.

Aside from the app itself, scooter rental businesses also need fleet management software to monitor scooter locations, usage data, battery levels, and maintenance needs in real time. This software is typically cloud-based and can be integrated with the mobile app for seamless operations. Monthly fees for fleet management software range from $500 to $1,500, depending on the provider and functionality.

Automation tools and analytics features in these systems allow businesses to optimize fleet distribution, enhance user experience, and reduce downtime. Investing in high-quality software is essential, as it can streamline operations, enhance user satisfaction, and provide valuable insights into operational efficiency.

Scooter Rental Business Cost Calculator

\

Need help with your rental app launch?

Get our step-by-step guide on developing a successful

platform for properties, vehicles, or equipment rentals.

Insurance and Liability Coverage

Given the risks involved in public scooter rentals, insurance and liability coverage are non-negotiable operational costs. Liability insurance protects the business in case of accidents or injuries involving users. The cost of insurance depends on factors like fleet size, location, and local accident rates. Typically, businesses can expect to pay $50 to $100 per scooter annually for basic coverage, although this may increase for comprehensive plans.

Additionally, liability coverage helps protect the business from lawsuits and financial claims, which can be substantial if accidents occur. Some insurers offer packages tailored for scooter rental businesses, which provide comprehensive coverage for both the fleet and users. It’s advisable to consult with an insurance broker to find a policy that meets your specific needs.

Revenue Potential and Profitability Analysis

A thorough understanding of revenue potential is essential for assessing the long-term profitability of a scooter rental business. By examining different pricing models, revenue streams, and market demand, you can estimate potential earnings and determine the financial viability of your venture. This section provides an overview of how scooter rental businesses generate income and the factors that influence profitability.

Pricing Models

The pricing model you choose has a direct impact on your revenue. Most scooter rental businesses use a pay-per-minute or pay-per-mile pricing model, where users are charged based on their usage time or distance traveled. Here are some common pricing structures:

- Per-Minute Pricing: This model charges users a fixed rate per minute, typically between $0.15 and $0.30. Additionally, there may be an unlock fee (often around $1.00) that users pay to start a ride. This structure appeals to users who only need short, quick trips, like getting from a transit station to their destination.

- Per-Mile Pricing: Some businesses prefer to charge based on distance covered rather than time, especially in tourist-heavy areas. In this model, users pay a fixed rate per mile, which may range from $0.50 to $1.00 per mile.

- Flat Hourly or Daily Rates: Offering hourly or daily rates can attract tourists and other users who need scooters for an extended period. Daily rates typically range from $20 to $30, depending on the market.

Selecting the right pricing model depends on your target market. In urban areas with high commuter traffic, per-minute or per-mile pricing is ideal, as it encourages short, frequent trips. For tourist-heavy locations, offering longer-term rental options can boost revenue and attract users who want the flexibility to explore at their own pace.

| Scenario | Average Rides per Day | Revenue per Ride | Estimated Monthly Revenue |

|---|---|---|---|

| Low Demand | 100 | $6 | $18,000 |

| Medium Demand | 150 | $6 | $27,000 |

| High Demand | 200 | $6 | $36,000 |

Revenue Streams

In addition to direct ride charges, there are several secondary revenue streams that can enhance the profitability of your scooter rental business:

- In-App Advertisements: Partnering with local businesses to display ads in your app can provide an additional revenue source. For instance, nearby restaurants, coffee shops, or tourist attractions may pay to advertise to users renting scooters in their vicinity.

- Subscription Plans: Some companies offer subscription plans where users pay a monthly fee in exchange for discounted or unlimited rides. This model encourages frequent use and provides a steady income stream.

- Event Sponsorships: Businesses can partner with events or festivals to provide exclusive scooter rental services. Sponsoring events increases brand visibility and can attract new users, leading to higher revenue.

By diversifying revenue streams, you reduce reliance on ride fees alone, creating a more resilient business model that can withstand seasonal or market fluctuations.

Market Demand and Seasonal Trends

Market demand for scooter rentals can fluctuate based on location and season. In densely populated urban areas, demand is generally steady, with peak usage during weekdays and commuting hours. Conversely, tourist-heavy areas may experience seasonal spikes, especially during holiday seasons or summer months.

Understanding these patterns is essential for optimizing revenue. During high-demand periods, businesses can consider surge pricing, increasing rates slightly to maximize revenue without discouraging users. Conversely, in low-demand seasons, promotions or discounts can encourage usage and maintain steady income.

Some cities also impose restrictions on scooter operations during winter months or adverse weather conditions, which can temporarily impact revenue. Planning for seasonal trends by adjusting fleet distribution and marketing strategies can help mitigate revenue losses during off-peak periods.

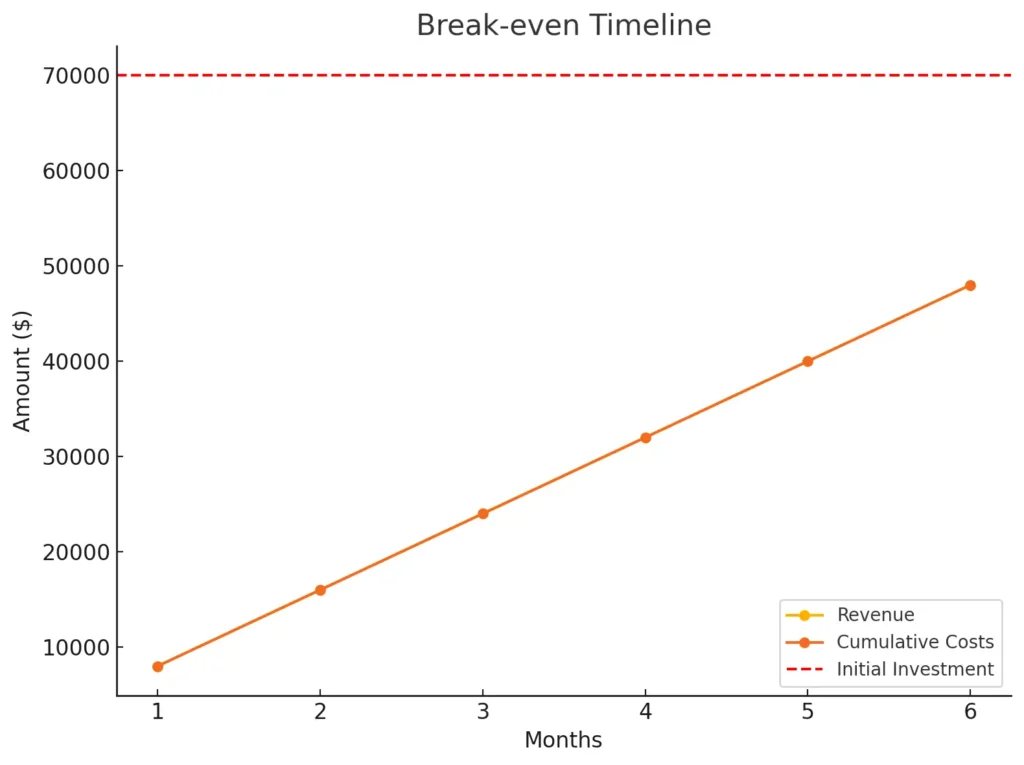

Profitability Timeline and Break-Even Analysis

Achieving profitability in a scooter rental business depends on effective cost management and revenue generation. Most scooter rental businesses aim to reach their break-even point within the first year, but this timeline varies based on initial investment and operational efficiency.

A simple break-even analysis considers the startup and operational costs against expected monthly revenue. For instance, if your initial investment (fleet, licensing, insurance, app development) is $100,000 and monthly operational costs are $10,000, you would need to generate at least $10,000 in monthly revenue to break even on operational costs. After covering initial startup costs, additional revenue contributes to profit.

Achieving profitability requires balancing the scale of operations with demand. A large fleet in a high-demand area can generate substantial income, but costs rise accordingly. Startups should begin with a manageable fleet size and expand based on demand, allowing them to control costs and improve the profitability timeline.

Financial Planning and Cost Breakdown

Effective financial planning and a clear understanding of cost breakdowns are essential for building a sustainable scooter rental business. This section provides a guide to budgeting, exploring various funding options, and conducting a break-even analysis to help entrepreneurs navigate the financial aspects of launching and maintaining a profitable venture.

| Factor | Amount |

|---|---|

| Total Initial Investment | $70,000 |

| Monthly Operational Costs | $8,000 |

| Monthly Revenue (estimated) | $28,000 |

| Monthly Profit | $20,000 |

| Break-even Timeline | 3.5 months |

Budgeting Tips for Startups

Starting a scooter rental business requires careful budgeting to ensure all necessary expenses are covered without overspending. Here are some key budgeting tips:

- Prioritize Essential Costs: Begin by identifying and allocating funds for essential costs like fleet acquisition, licensing, insurance, and technology. It’s crucial to ensure these foundational aspects are covered, as they form the backbone of the business.

- Plan for Contingencies: Set aside a portion of the budget for unexpected expenses, such as repairs, insurance adjustments, or regulatory changes. A contingency fund helps manage unforeseen costs and keeps operations running smoothly.

- Control Initial Overheads: Start with a manageable fleet size and limited staffing to control initial overheads. As demand grows, you can scale your fleet and team, allowing for gradual expansion based on revenue.

By following a structured budgeting approach, you can ensure your business remains financially viable, particularly during the initial months when revenue may be unpredictable.

Funding Options

Securing adequate funding is a critical step for launching a scooter rental business. Here are some common funding options available to startups in this industry:

- Personal Savings and Bootstrapping: Using personal savings to fund the business allows full control over operations without the obligations of debt or equity. However, this approach may limit the initial investment size.

- Small Business Loans: Banking Solution Development and financial institutions offer small business loans with competitive interest rates. These loans can provide the capital needed for fleet acquisition, licensing, and operational expenses. It’s essential to have a solid business plan to increase the chances of loan approval.

- Angel Investors and Venture Capital: For startups with significant growth potential, angel investors or venture capital firms can offer substantial funding. In exchange, these investors often request equity in the business. This funding method is ideal for entrepreneurs who plan to scale rapidly and are open to sharing ownership.

- Grants and Government Programs: Some local governments provide grants or funding programs for businesses focused on eco-friendly initiatives. Electric scooter rental businesses often qualify due to their contribution to sustainable transportation. Research available grants in your area and consider applying to reduce startup costs.

Choosing the right funding method depends on your financial situation, growth goals, and willingness to share ownership or take on debt.

Break-Even Point Analysis

A break-even analysis helps determine the timeframe required to recover the initial investment and begin generating profit. This analysis compares total startup costs with projected monthly revenue and expenses, allowing you to estimate when your business will reach profitability.

To calculate the break-even point:

- Calculate Total Startup Costs: Sum up initial investments, including fleet acquisition, licensing, insurance, technology, and infrastructure. Let’s assume a hypothetical startup cost of $100,000.

- Estimate Monthly Operational Costs: Add up ongoing expenses, such as maintenance, staffing, insurance, and software. Suppose monthly operational costs are approximately $10,000.

- Project Monthly Revenue: Based on the pricing model and market demand, estimate expected monthly revenue. For instance, if you anticipate $15,000 in monthly revenue, you’ll have a monthly profit of $5,000 after covering operational costs.

Using these figures, the break-even point is calculated by dividing the total startup costs by the monthly profit.

In this example:

Break-even Point=Monthly ProfitTotal Startup Costs=5,000100,000=20 months

This means it would take approximately 20 months to break even under the given revenue and expense assumptions. Adjusting fleet size, operational efficiency, or pricing can alter this timeline.

Practical Budgeting Example

Here’s a sample budget breakdown for a small-scale scooter rental business:

- Fleet Acquisition (50 scooters at $500 each): $25,000

- Licensing and Insurance: $5,000

- Charging Infrastructure: $10,000

- Mobile App Development: $20,000

- Initial Marketing and Branding: $5,000

- Contingency Fund: $5,000

- Total Estimated Startup Cost: $70,000

A structured financial plan with a detailed cost breakdown enables you to allocate resources effectively, secure funding, and track profitability over time. By conducting a thorough break-even analysis and planning for growth, you set a solid foundation for achieving financial success.

Practical Tips for Managing Costs in a Scooter Rental Business

Effective cost management is essential for maintaining profitability and ensuring the long-term success of a scooter rental business. By focusing on strategies to minimize expenses without compromising quality or service, you can optimize your operations and enhance overall efficiency. Here are practical tips to help you manage and reduce costs in your scooter rental business.

Fleet Maintenance and Longevity

One of the most significant ongoing expenses in a scooter rental business is fleet maintenance. Keeping scooters in top condition is crucial for user safety, brand reputation, and cost control. Here are some tips to manage maintenance costs effectively:

- Regular Maintenance Checks: Conduct routine checks on essential parts like brakes, tires, and batteries. Regular inspections help detect issues early, preventing costly repairs down the line.

- Invest in Durable Scooters: While high-quality scooters come with a higher upfront cost, they often have better durability and require fewer repairs. Investing in reputable brands known for reliability can lead to long-term savings.

- Preventative Measures: Train staff to perform simple preventative tasks, such as cleaning scooters and inspecting for visible wear and tear. Preventative maintenance is generally cheaper than major repairs.

By adopting a proactive maintenance approach, you can extend the lifespan of your fleet and reduce the need for frequent replacements, thus minimizing overall expenses.

Optimizing Charging Infrastructure

The cost of charging electric scooters can add up, especially with a large fleet. Optimizing your charging infrastructure not only reduces operational expenses but also improves the availability of scooters for users. Here are some strategies to consider:

- Energy-Efficient Charging Stations: Invest in energy-efficient charging stations that consume less power while providing the necessary charge. This reduces electricity costs and minimizes environmental impact.

- Battery Swapping: For businesses in high-demand areas, consider implementing a battery-swapping system instead of charging scooters directly. Swapping allows for quicker turnaround times and reduces the need for multiple charging stations.

- Schedule Charging During Off-Peak Hours: In regions where electricity rates vary by time, charging scooters during off-peak hours can lead to significant savings. This may require adjusting operational workflows, but the cost savings can be substantial.

Efficient charging practices not only reduce electricity expenses but also enhance fleet availability, allowing you to serve more users and generate higher revenue.

Leveraging Technology for Operational Efficiency

Technology plays a crucial role in reducing operational costs by streamlining fleet management, improving customer service, and enhancing decision-making. Here’s how to leverage technology effectively:

- Fleet Management Software: Invest in a reliable fleet management system that provides real-time data on scooter locations, battery levels, and usage patterns. This data allows you to optimize scooter distribution, schedule maintenance, and monitor usage trends.

- Automated Customer Support: Use chatbots or AI-driven customer support tools to handle common inquiries, reducing the need for extensive customer service staffing. Automation enables faster response times and improves user satisfaction without increasing labor costs.

- Data Analytics: Utilize analytics to identify high-demand areas and adjust fleet deployment accordingly. Data-driven decisions help ensure scooters are placed where they’re needed most, maximizing revenue while reducing unnecessary operational costs.

By incorporating technology into daily operations, you can enhance efficiency, improve user experience, and control costs more effectively.

Staff Efficiency and Cost-Effective Labor Practices

Labor costs can be substantial, especially if your business requires a team for tasks like fleet management, maintenance, and customer support. Here are some cost-effective labor practices:

- Cross-Training Staff: Train employees to handle multiple roles, such as customer service, basic maintenance, and fleet distribution. Cross-training maximizes productivity and allows you to operate with a smaller, more flexible team.

- Outsourcing Specialized Tasks: Consider outsourcing specialized tasks like app development or major repairs to third-party providers. Outsourcing allows you to access expert skills without the need for full-time employees, reducing payroll expenses.

- Remote Monitoring Systems: Implement remote tracking systems for fleet management, allowing staff to monitor scooter locations and battery levels from a central hub. This reduces the need for on-site personnel and minimizes labor costs.

Efficient labor practices help maintain operational continuity while keeping staffing costs manageable, contributing to better profitability.

By implementing these cost-management strategies, you can run a scooter rental business more efficiently and sustainably. Proactive fleet maintenance, optimized charging practices, technology integration, and cost-effective labor management are key to controlling expenses and enhancing profitability. These practical tips will help you build a financially resilient scooter rental operation capable of thriving in a competitive market.

Case Study: Cost Breakdown of a Successful Scooter Rental Startup

To illustrate the real-world financial requirements and profitability potential of a scooter rental business, let’s examine a hypothetical case study of a small startup. This example will provide a detailed cost breakdown and a view of the revenue and profitability timeline, helping aspiring entrepreneurs understand what it takes to launch and sustain a scooter rental venture successfully.

Initial Investment Breakdown

In this scenario, our startup is launching in a mid-sized city with a fleet of 50 electric scooters. The initial costs are calculated based on average market prices and industry requirements.

| Expense Category | Cost per Unit | Quantity | Total Cost |

|---|---|---|---|

| Fleet Acquisition (scooters) | $500 | 50 | $25,000 |

| Licensing and Insurance | – | – | $5,000 |

| Charging Stations | $2,000 | 5 | $10,000 |

| Mobile App Development | – | – | $20,000 |

| Marketing and Branding | – | – | $5,000 |

| Contingency Fund | – | – | $5,000 |

| Total Startup Cost | $70,000 |

Explanation:

- Fleet Acquisition: Our startup is investing in 50 electric scooters at an average cost of $500 each. This includes basic models with robust batteries and reliable performance to minimize maintenance needs.

- Licensing and Insurance: Based on city regulations, the business must pay annual licensing fees and insurance premiums to protect the fleet and cover liability. This cost is estimated at $5,000 for a fleet of 50 scooters.

- Charging Stations: The business plans to install five charging stations in high-traffic areas. Each station costs approximately $2,000, leading to a total charging infrastructure cost of $10,000.

- Mobile App Development: A custom mobile app is developed to manage rentals, payments, and scooter tracking, with an estimated cost of $20,000.

- Marketing and Branding: The startup allocates $5,000 to promote the business and create brand visibility through online advertising, social media campaigns, and local partnerships.

- Contingency Fund: A $5,000 contingency fund is set aside for unexpected expenses, such as regulatory changes, repairs, or additional equipment.

The total initial investment for launching this scooter rental business is $70,000.

Monthly Operational Costs

After the initial setup, the business will incur ongoing operational expenses to keep the fleet running smoothly. Here’s a monthly breakdown of these costs:

| Expense Category | Monthly Cost |

|---|---|

| Maintenance and Repairs | $1,000 |

| Staffing (3 employees) | $4,500 |

| Fleet Management Software | $1,000 |

| Insurance | $400 |

| Utilities (Charging) | $500 |

| Marketing | $600 |

| Total Monthly Cost | $8,000 |

Explanation:

- Maintenance and Repairs: Routine maintenance for 50 scooters is estimated at $1,000 per month, covering basic repairs and parts replacement.

- Staffing: The business hires three employees (fleet manager, customer service, and technician), with an average monthly payroll of $4,500.

- Fleet Management Software: This software enables real-time tracking, monitoring, and management of the fleet, costing approximately $1,000 per month.

- Insurance: Ongoing insurance premiums for fleet protection amount to about $400 per month.

- Utilities: Monthly electricity costs for charging scooters are estimated at $500.

- Marketing: An additional $600 is allocated for continued marketing efforts to maintain brand visibility and attract new users.

The total monthly operational cost is $8,000.

Revenue and Profitability Timeline

To estimate revenue, let’s assume the business charges users $1.00 to unlock a scooter and $0.25 per minute of usage. With an average usage of 20 minutes per trip, each trip generates $6.00 in revenue.

If the fleet averages 200 rides per day, monthly revenue would be calculated as follows:

200 rides / day X 30 days x 6.00 = $36000

Break-Even Analysis

With a monthly revenue of $36,000 and monthly operational costs of $8,000, the business has a monthly profit of $28,000. Based on the initial investment of $70,000, the break-even point would be calculated as:

Break-even Point=Total Startup CostsMonthly Profit=70,00028,000≈2.5 months\text{Break-even Point} = \frac{\text{Total Startup Costs}}{\text{Monthly Profit}} = \frac{70,000}{28,000} \approx 2.5 \text{ months}Break-even Point=Monthly ProfitTotal Startup Costs=28,00070,000≈2.5 months

In this scenario, the business would break even in approximately 2.5 months, after which revenue would contribute to profit. This quick break-even timeline demonstrates the potential profitability of a scooter rental business in a well-chosen market.

This case study highlights how initial and operational costs impact the financial outlook of a scooter rental startup. By managing costs effectively and optimizing pricing and fleet utilization, this hypothetical business achieves a sustainable and profitable operation. Real-world factors, like market demand and regulatory compliance, will affect individual outcomes, but this example serves as a guide for aspiring entrepreneurs.

Conclusion

Starting a scooter rental business presents a lucrative opportunity for entrepreneurs, especially with the rising demand for eco-friendly, convenient transportation in urban areas. However, achieving success in this industry requires thorough planning, particularly regarding the costs involved. From fleet acquisition and licensing fees to ongoing maintenance and staffing, each financial aspect plays a crucial role in the viability and profitability of the venture.

Throughout this guide, we’ve explored the key cost factors associated with launching a scooter rental business, including:

- Startup Costs: Initial investments in fleet acquisition, charging infrastructure, mobile app development, and marketing to establish the business.

- Operational Costs: Recurring expenses for maintenance, staff, software, and insurance to keep the business running smoothly.

- Revenue Potential: Different pricing models and revenue streams, including pay-per-minute pricing, subscription plans, and in-app advertising, which can boost profitability.

- Financial Planning and Break-even Analysis: Tips on budgeting, funding options, and a break-even timeline to help entrepreneurs plan for sustained growth.

This comprehensive cost breakdown provides a blueprint for entrepreneurs to develop a robust financial strategy that minimizes risks and maximizes profit potential. By understanding each financial component and optimizing expenses where possible, you can create a stable foundation for long-term success in the scooter rental industry.

Whether you’re just starting out or planning to expand, careful cost management and strategic financial planning are essential. Keep an eye on market trends, regulatory changes, and technological advancements to stay competitive and capitalize on new opportunities. With the right approach, your scooter rental business can thrive in today’s rapidly evolving transportation landscape.

This guide has equipped you with the insights and tools needed to make informed decisions and set your scooter rental business on the path to success. As you move forward, remember that effective planning, adaptability, and a focus on quality service will be key to standing out in this dynamic and growing market.

Launch Your Scooter Rental Business with Miracuves!

Transform your idea into a successful scooter rental business with Miracuves. From fleet management software to custom mobile apps, we provide end-to-end solutions tailored to your needs. Our expertise ensures you reduce startup costs and maximize revenue potential.

Want to see how our rental platform works?

From user-friendly booking systems to secure payments, we’ve got you covered.

FAQs

1. How much does it cost to start a scooter rental business?

Starting a scooter rental business typically requires an initial investment ranging from $50,000 to $100,000, depending on the fleet size, city regulations, and technology requirements. Key expenses include scooter acquisition, licensing fees, insurance, charging infrastructure, and mobile app development. Effective budgeting and cost management can significantly impact the financial viability of the business.

2. What are the primary costs involved in running a scooter rental business?

The main operational costs for a scooter rental business include maintenance and repair expenses, insurance premiums, staff salaries, fleet management software, and utilities for charging stations. On average, monthly operational costs range from $5,000 to $10,000, depending on fleet size and location. Managing these expenses effectively is essential for achieving profitability.

3. Is a scooter rental business profitable?

A scooter rental business can be highly profitable in cities with high demand for short-distance, eco-friendly transportation. With effective cost management and a robust pricing strategy, businesses often achieve break-even within 6-12 months. Profitability depends on factors such as fleet utilization rates, operational efficiency, and market demand. Diversifying revenue streams, such as offering subscription plans or in-app advertising, can also boost profits.

4. What type of insurance is needed for a scooter rental business?

Scooter rental businesses typically require liability insurance to protect against potential accidents and injuries. This coverage may include protection for both the fleet and users. Annual insurance costs depend on factors like fleet size, location, and accident rates but typically range from $50 to $100 per scooter. Comprehensive insurance is advisable to minimize financial risk.

5. How does a scooter rental business make money?

Scooter rental businesses primarily generate revenue through ride fees, usually based on a pay-per-minute or pay-per-mile pricing model. Additional income streams can include subscription plans, in-app advertisements, and event partnerships. Pricing typically includes an unlock fee and a per-minute or per-mile charge, with daily revenue depending on fleet utilization and user demand.

6. What permits and licenses are required to start a scooter rental business?

Licensing requirements for scooter rentals vary by city and state. Most cities require specific permits and regulatory compliance to operate legally, which may include licensing fees, parking regulations, and usage guidelines. It’s essential to research local regulations or consult with a legal expert to ensure compliance and avoid potential fines or operational disruptions.