The year 2025 is witnessing a monumental surge in healthtech innovation, and at the forefront of this revolution are online pharmacy platforms like 1mg and PharmEasy. As healthcare continues its digital transformation—fueled by rising consumer demand for convenience, post-pandemic healthcare access, and increased investment in AI-driven platforms—startup founders are racing to build the next big healthtech solution.

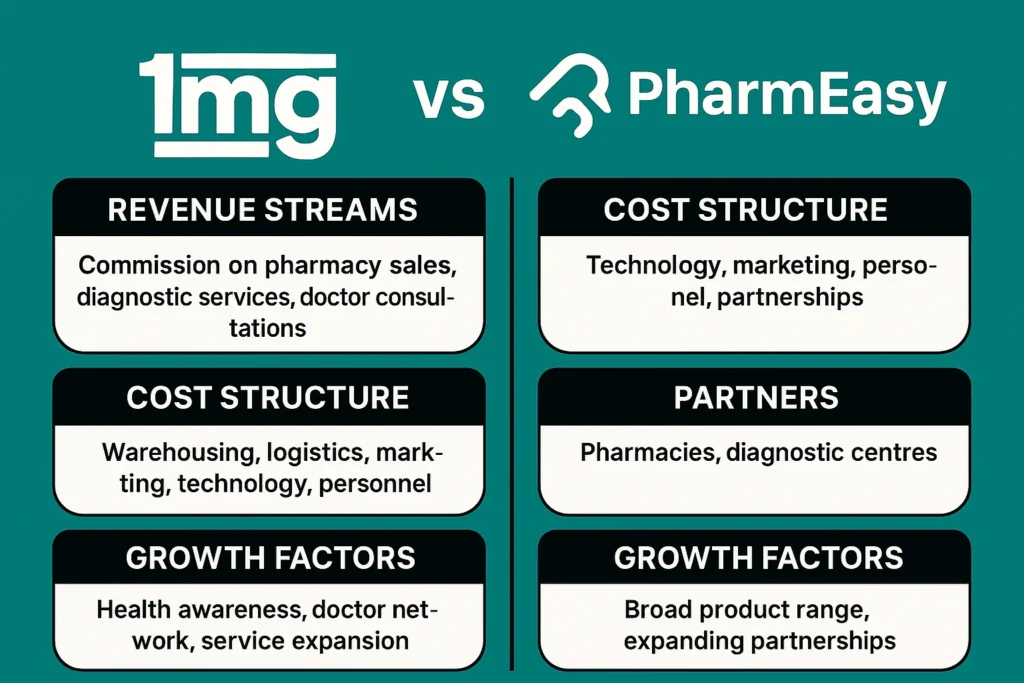

But the real question is: Which business model works best—1mg’s full-stack medical ecosystem or PharmEasy’s aggressive aggregator approach?

Understanding how these healthtech giants generate revenue, manage costs, form strategic partnerships, and scale their platforms is critical for entrepreneurs aiming to launch apps that are not just functional—but profitable and sustainable.

In this comprehensive breakdown, we’ll explore the 1mg vs PharmEasy business models, compare their strategies, and help you decide which framework is best suited for your startup in 2025.

What is 1mg?

1mg, now known as Tata 1mg, started as an online medicine delivery app but has evolved into an integrated digital healthcare platform. It offers:

- E-pharmacy (prescription & OTC drugs)

- Diagnostic tests & lab bookings

- Doctor consultations (telemedicine)

- Health & wellness content

- Supplements and devices

In 2021, the Tata Group acquired a majority stake in 1mg, transforming it into a highly credible and resource-rich brand under the Tata Digital umbrella.

Today, 1mg positions itself as a trust-first, medically backed platform, prioritizing verified doctors, accredited labs, and prescription-based medicine services.

What is PharmEasy?

PharmEasy, founded in 2015, is one of India’s largest and fastest-growing healthtech aggregators. It provides:

- Online pharmacy with prescription validation

- Diagnostics through the acquisition of Thyrocare

- Medical devices and healthcare essentials

- Teleconsultations

- B2B medicine delivery to clinics and pharmacies via Retailio

PharmEasy has scaled rapidly through mergers and acquisitions, including Medlife and Thyrocare, and operates on a multi-vertical healthtech stack. It emphasizes speed, scale, and convenience, catering to a wide consumer base from metros to tier-2 cities.

Business Model of 1mg

Revenue Streams

- Commission on medicines sold

- Diagnostics services (lab partnerships & home collection)

- Doctor consultation fees

- Featured listings and promotions

- Health subscriptions (1mgCare)

- Corporate health plans

Cost Structure

- Warehousing & inventory management

- Cold-chain logistics

- Doctor and lab network operations

- Technology development (mobile app, CRM)

- Customer acquisition (ads, coupons)

Key Partners

- Pharmaceutical companies & manufacturers

- NABL-accredited diagnostic labs

- Verified doctors and specialists

- Insurance providers

- Tata Group subsidiaries (cross-promotions)

Growth Strategy

- Expansion into corporate health programs

- Integration with Tata Digital ecosystem

- Focus on telemedicine credibility

- AI for prescription validation and medicine alternatives

- Reaching tier-3 cities with localized content

Learn More: Business Model of 1mg: How the Platform Earns Revenue

Business Model of PharmEasy

Revenue Streams

- Commissions from partner pharmacies

- Diagnostics revenue (via Thyrocare labs)

- Retailio B2B pharma supply

- Subscription plans & care packs

- Teleconsultation charges

- Ads & marketplace listings

Cost Structure

- Partner onboarding & fulfillment

- Last-mile delivery & logistics

- Technology infrastructure (AI, analytics)

- Customer loyalty & retention programs

- Brand partnerships & celebrity endorsements

Key Partners

- Pharmacies & diagnostic centers

- Healthcare influencers

- Retailio B2B network

- Logistics partners

- Insurance and telehealth networks

Growth Strategy

- Acquisitions to consolidate market share

- Scaling B2B pharma supply via Retailio

- Lab automation and tech-driven diagnostics

- Market penetration in rural India

- AI for demand prediction & dynamic pricing

Comparison Table: 1mg vs PharmEasy Business Model

| Feature | 1mg (Tata 1mg) | PharmEasy |

|---|---|---|

| Parent Company | Tata Digital | API Holdings |

| Revenue Streams | Commissions, diagnostics, consultations | Aggregator fees, diagnostics, B2B supply |

| B2B Presence | Corporate health & insurance | Retailio pharma supply |

| Diagnostics | Partner labs | Owns Thyrocare |

| Market Strategy | Quality-first, doctor-led | Speed & scale-driven |

| Tech Focus | Prescription safety, AI diagnosis | Fulfillment, demand prediction |

| Primary Model | Full-stack healthcare | Healthtech aggregator |

| Monetization Add-ons | Subscriptions, cross-sells | Ads, bundles, B2B commissions |

Pros & Cons of 1mg’s Business Model

Pros

- Backed by Tata trust and funding

- Strong doctor credibility

- High focus on compliance and prescription safety

- Clean UX for health-conscious users

Cons

- Slower growth pace than competitors

- Lower flexibility in pharmacy pricing

- Smaller B2B footprint than PharmEasy

Pros & Cons of PharmEasy’s Business Model

Pros

- Fastest-growing network in India

- Deep B2B and diagnostics integration

- Strong M&A play for vertical ownership

- Tech-led logistics for fast delivery

Cons

- Higher operational burn rate

- Risk of compliance gaps due to aggregator model

- Thinner margins in B2C due to scale discounts

Market Data Snapshot (2025)

| Metric | 1mg (Tata 1mg) | PharmEasy |

|---|---|---|

| Est. 2025 Revenue | $160–190 Million | $320–400 Million |

| Active Users | 6+ million | 10+ million |

| Diagnostics Market | Partner-based | Direct ownership (Thyrocare) |

| App Downloads | 25M+ | 40M+ |

| Funding Raised | ~₹1200 Cr (via Tata) | ~₹5500 Cr+ |

| IPO Status | Not listed (Tata-backed) | Delayed, under planning |

Which Model is Better for Startups in 2025?

The answer depends on your vision and funding stage:

- Want credibility, compliance, and medical depth? → Go for a 1mg-style full-stack platform.

- Want scalability, multi-partner access, and fast rollouts? → Choose a PharmEasy-style aggregator model.

Choose 1mg-Style Business Model If…

- You’re targeting urban, health-conscious users

- Your focus is quality assurance and compliance

- You want to build corporate health partnerships

Launch your app with us: Build Your 1mg Clone

Choose PharmEasy-Style Business Model If…

- You’re entering with VC backing or scaling fast

- You want a wide product offering fast

- You aim to build a B2B plus B2C hybrid

Launch your app with us: Build Your PharmEasy Clone

Conclusion

Both 1mg and PharmEasy are iconic Indian healthtech success stories—but they took very different roads to get there. One relied on trust and integration, the other on speed and scale.

For your startup, the key is knowing whether you want to own the entire healthcare journey or become a powerful marketplace.

At Miracuves, we help founders craft custom healthtech platforms tailored to their strategy—whether it’s 1mg’s medical depth or PharmEasy’s expansive reach.

FAQs

1. What is the difference between 1mg and PharmEasy’s revenue models?

1mg earns via commissions, diagnostics, and subscriptions, while PharmEasy monetizes through aggregator fees, B2B pharma supply, and diagnostics via Thyrocare.

2. Is it easier to replicate 1mg or PharmEasy’s model?

PharmEasy’s model is more scalable but operationally complex. 1mg is slower to scale but easier to manage with a quality-first approach.

3. Which app is better for rural or tier-2 market reach?

PharmEasy’s logistics and partner-based model gives it an edge in wider reach.

4. Can I launch a healthtech app like 1mg or PharmEasy?

Yes! Miracuves offers full-scale 1mg and PharmEasy clone development for healthtech entrepreneurs.

5. Do these models support telemedicine?

Yes, both 1mg and PharmEasy integrate doctor consultations through their apps, with AI-powered features and secure prescription handling.