How Much Does It Cost to Develop a LocalBitcoins App

Create a powerful, customizable streaming solution with Miracuves’ LocalBitcoins Clone, equipped with high-performance features and next-gen technology.

Looking to build a peer-to-peer crypto exchange like LocalBitcoins? Before diving into wallet features or escrow systems, there’s one critical question every crypto founder must answer:

What’s the cost to develop a LocalBitcoins-like app?

A LocalBitcoins-style platform goes far beyond basic trading. It requires secure user onboarding, escrow smart contracts, multi-currency wallet support, and dispute management — all wrapped in a seamless, trust-first user experience.

Whether you’re launching in a single market or aiming for global P2P crypto access, understanding the LocalBitcoins app development cost helps you scope the project realistically, avoid unexpected costs, and allocate your resources effectively.

In this guide, we’ll break down the real cost components, region-based price ranges, hidden fees, and smart cost-optimization strategies — so you can build your crypto exchange with confidence.

Key Factors That Influence Development Cost

There’s no one-size-fits-all answer when it comes to building a LocalBitcoins clone. Your total development cost depends on how feature-rich and secure your platform needs to be — and how you choose to build it.

Here are the major factors that affect the budget:

App Complexity & Features → Escrow smart contracts, multi-currency wallets, in-app chat, KYC/AML integration, and real-time price tracking add significant scope.

Security Architecture → End-to-end encryption, two-factor authentication, fraud detection systems, and secure cold/hot wallet management increase complexity.

Platform Support (Web + Mobile) → Supporting Android, iOS, and web clients simultaneously raises design, development, and QA requirements.

Smart Contract Development → If your P2P platform supports Ethereum or other chains, custom smart contract development is an added cost layer.

Third-Party Integrations → KYC/AML services, blockchain data feeds, SMS/email services, and crypto APIs (like CoinGecko, Chainlink) involve setup + subscription fees.

Customization vs. Clone Script → Clone scripts reduce time and cost but limit flexibility. A custom build gives you full control at a higher upfront cost.

Development Team Region → Hiring offshore (India, Eastern Europe) versus local (U.S./EU) drastically changes hourly rates and total spend.

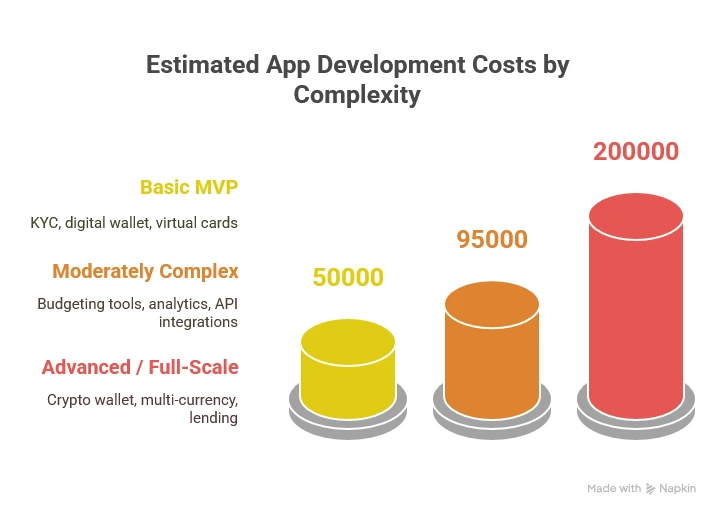

LocalBitcoins App Development Cost by App Complexity

To help visualize what your investment might look like, here’s a cost breakdown based on how advanced your app needs to be.

This includes UI/UX, blockchain integration, backend, QA, and basic post-launch support — but excludes legal and marketing costs.

|

Type

|

Features

|

Estimated Cost (USD)

|

|---|---|---|

|

MVP (Minimum Viable Product)

|

P2P trading, user wallet, escrow system, KYC module, BTC-only support

|

$35,000 – $70,000

|

|

Mid-level App

|

Multi-crypto wallets, real-time charts, in-app chat, order matching

|

$70,000 – $140,000

|

|

Full-Scale Neobank

|

Global fiat support, advanced dispute resolution, affiliate system, admin panel

|

$140,000 – $300,000+

|

Note: These are development-only figures. Legal compliance, audits, exchange licenses, and liquidity management costs should be planned separately.

Miracuves offers modular solutions — so you can scale from MVP to full marketplace without rebuilding from scratch.

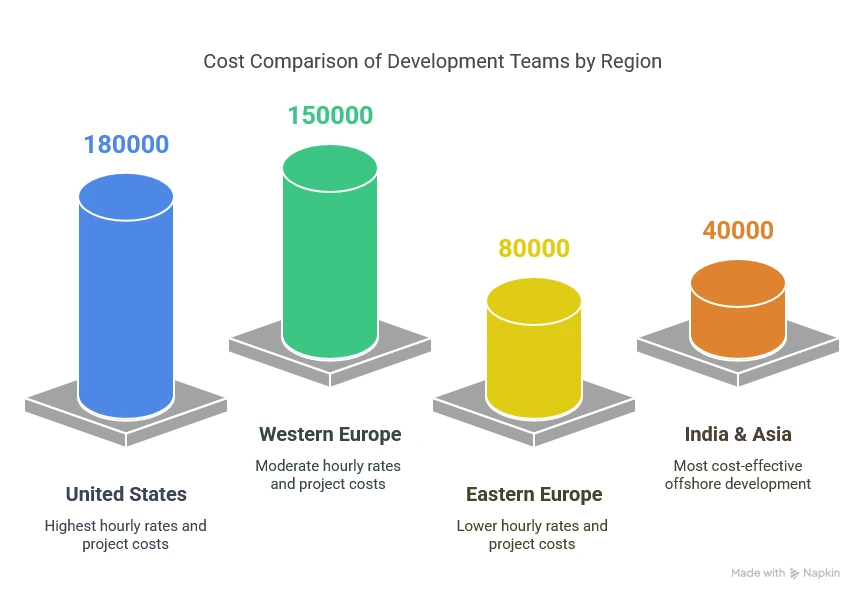

Average Cost Estimates by Region

Where you build matters. Development costs for crypto apps vary widely by geography due to hourly rates and access to blockchain-experienced teams

|

Region

|

Avg Hourly Rate

|

MVP Cost

|

Full App Cost

|

|---|---|---|---|

|

USA/Canada

|

$100 – $180

|

$100K – $140K

|

$250K – $500K

|

|

Western Europe

|

$80 – $130

|

$90K – $130K

|

$200K – $400K

|

|

Eastern Europe

|

$40 – $70

|

$50K – $80K

|

$120K – $250K

|

|

India / Asia

|

$25 – $50

|

$35K – $70K

|

$90K – $200K

|

Offshore development is often ideal for crypto startups — especially when working with blockchain-focused teams that offer security, speed, and cost-efficiency.Offshore development (India, Eastern Europe) provides cost-efficiency without compromising quality when you partner with the right fintech-focused team.

Hidden Costs You Should Plan For

Beyond development, launching a LocalBitcoins-like app involves several critical but often overlooked expenses:

Crypto compliance & legal setup → Depending on jurisdiction, costs vary for licenses, legal documentation, and AML checks

API & third-party service fees → KYC tools, crypto data feeds, SMS gateways, and cloud platforms come with recurring costs

Cloud hosting & scaling → Hosting secure, decentralized services on AWS, Google Cloud, or IPFS scales with usage

Security audits & certifications → Penetration testing, smart contract audits, and data protection readiness are mandatory

Ongoing maintenance → Fixes, chain updates, UI enhancements, and support cost money post-launch

User support & moderation → Dispute handling, chat support, and multilingual response teams need backend tooling

Marketing & liquidity incentives → Launch campaigns, influencer outreach, and user referral rewards should be planned upfront

Factoring these into your early planning helps avoid roadblocks once your platform goes live.

How to Reduce LocalBitcoins App Development Costs (Without Compromising Quality)

Crypto exchange development is complex — but smart strategies can help keep your budget lean without cutting corners.

Here’s how:

Start with an MVP → Focus on core P2P functionality (escrow, wallets, basic trade flow). Expand once you’ve validated traction

Use a white-label clone script → Speeds up delivery and lowers risk with pre-tested functionality

Work with blockchain-focused partners → Crypto-native teams avoid common pitfalls and can reuse proven codebases

Leverage modular backend → Build the foundation with scalability in mind, so new features can plug in easily

Choose cost-effective regions → Offshore teams in India or Eastern Europe offer top talent at 40–60% lower cost

A phased launch strategy keeps burn rates low while letting you grow with confidence.

Choose the Right Development Partner

Building a P2P crypto trading platform isn’t just a technical project — it’s a strategic business move. The right development team ensures your app is secure, scalable, and market-ready.

Here’s what to look for:

Blockchain and smart contract expertise

Experience in fintech, wallet apps, or crypto exchanges

Full-cycle support: from design and compliance to post-launch iterations

Clear roadmap planning and agile delivery

At Miracuves, we’ve built exchange solutions for crypto startups, Web3 ventures, and DeFi platforms. Whether you need a Bitcoin-only MVP or a global multi-token platform, we’ll help you launch faster and smarter — with complete focus on security, scalability, and speed.

Conclusion

The cost to develop a LocalBitcoins app in 2025 depends on your scope, target market, platform features, and region of development. From $35,000 MVPs to $300,000+ enterprise platforms, the range is wide — but entirely manageable with the right planning and execution.

Ready to bring your P2P exchange vision to life?

Talk to Miracuves today for a tailored estimate and project roadmap.

For deeper insights into crypto clone platforms and DeFi solutions, check out our upcoming articles.

Frequently Asked Questions

Costs range from $35,000 for a basic MVP to $300,000+ for a full-featured global exchange with multi-currency support and admin tools.

A solid MVP should include user onboarding, escrow trading, wallet management, KYC integration, and dispute handling for BTC.

Yes. White-label solutions reduce development time and budget, allowing you to launch faster while still customizing key features.

MVPs can be built in 3–4 months, while a full exchange with fiat/crypto support may take 6–9 months, depending on complexity.

Miracuves brings experience in crypto, blockchain, and custom clone solutions. We deliver secure, scalable platforms designed for growth and compliance.