Google Drive helped push Google Cloud’s productivity segment to an estimated $34 billion in 2024, backed by global enterprise adoption and subscription upgrades. Its growth continues into 2025 as businesses embrace remote work, collaboration tools, and secure cloud storage.

But Google Drive is more than just storage.

It represents one of the world’s most successful freemium-to-enterprise SaaS funnels — converting billions of free users into paying customers with seamless collaboration, multi-device syncing, and tight workspace integrations. Its revenue growth comes not just from individual users, but from massive enterprise contracts, automated storage upgrades, AI-enhanced features, and partner ecosystems.

For entrepreneurs, understanding Google Drive’s revenue model offers a roadmap to build profitable SaaS storage platforms. With Miracuves, these insights can transform into real revenue-generating products — from cloud storage platfor

Google Drive Revenue Overview – The Big Picture

Valuation & Revenue (2025 estimates)

• Google Cloud productivity ecosystem valuation: $300B+

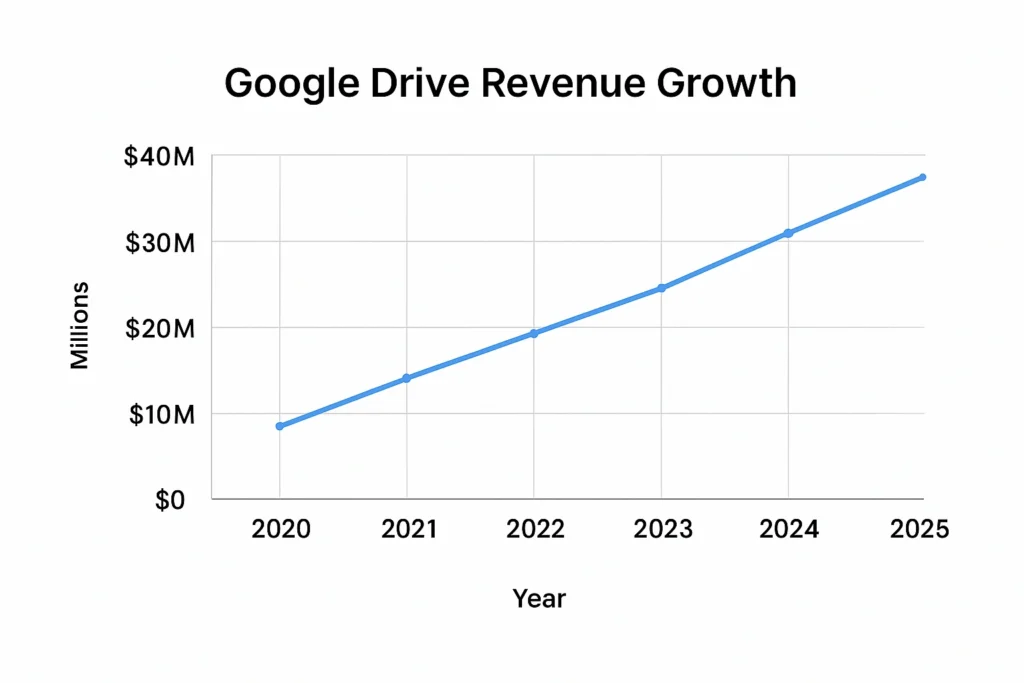

• Google Drive–linked revenue (Workspace share): $36B–$40B est. in 2025

• Year-over-year growth: 12–16 percent driven by enterprise adoption

Revenue by Region (approx)

• North America: 44 percent

• Europe: 32 percent

• Asia-Pacific: 17 percent

• Rest of World: 7 percent

Profit Margins

• Gross margin: ~78 percent

• Net margin: ~25 percent (after AI and infra investments)

Market Position

Competes with Dropbox, iCloud, OneDrive, Box.

Google Drive leads in global user count with over 2.6 billion users, giving it the largest distribution advantage in the storage market.

Read More: Everything You Need to Know About the Google Drive App

Primary Revenue Streams Deep Dive

Revenue Stream #1: Google Workspace Subscriptions

How it works:

Google Drive is bundled into Google Workspace plans for individuals, SMBs, and enterprises.

Share of total revenue: 63 percent

Pricing:

• Personal: $1.99–$9.99/month

• Business Starter–Plus: $6–$18/user/month

• Enterprise: Custom

Growth Trends:

Steady 11 percent annual expansion from remote and hybrid work.

Revenue Stream #2: Google One Storage Plans

How it works:

Extra cloud storage plans for personal users.

Share: 22 percent

Pricing:

• 100GB: $1.99/month

• 200GB: $2.99/month

• 2TB: $9.99/month

Growth:

Strong growth from mobile backups and family storage.

Revenue Stream #3: Enterprise Licensing & Compliance Tools

How it works:

Add-on fees for advanced data governance, e-discovery, and security.

Share: 9 percent

Pricing:

$4–$12/user/month on top of workspace plans.

Revenue Stream #4: API Usage and Developer Integrations

How it works:

Developers pay for high-usage API operations, storage requests, bandwidth.

Share: 4 percent

Revenue Stream #5: Storage Overages & Premium Support

How it works:

Fees for going beyond allocated storage and enterprise-level support add-ons.

Share: 2 percent

Read More: Build an App Like Google Drive – Full Developer Guide

Revenue Streams Percentage Breakdown

| Revenue Stream | Percentage | Notes |

|---|---|---|

| Workspace Subscriptions | 63% | Core income source |

| Google One Storage | 22% | Fastest-growing consumer revenue |

| Enterprise Governance | 9% | High-value enterprise segment |

| API Usage | 4% | Developer-focused |

| Overages & Support | 2% | Bonus income |

The Fee Structure Explained

User-Side Fees

Storage plans, Workspace subscriptions, Google One plans, premium backup services.

Provider-Side Fees

Developers pay API usage charges for downloads, uploads, and sync operations.

Hidden Revenue Tactics

Storage thresholds pushing upgrades, photo/video backup compression nudges, Workspace feature gating.

Regional Pricing Variations

India and APAC regions have 10–20 percent lower pricing due to regional income levels.

Complete Fee Structure by User Type

| User Type | Fees | Details |

|---|---|---|

| Individuals | $1.99–$9.99/month | Google One plans |

| SMBs | $6–$18/user/month | Workspace plans |

| Enterprises | Custom | Compliance + storage bundles |

| Developers | Pay-per-use | API, bandwidth, storage calls |

| Heavy Storage Users | Variable | Overages & add-ons |

How Google Drive Maximizes Revenue Per User

Segmentation Strategy:

Users are segmented by usage intensity, team size, and storage limits.

Upselling Techniques:

Storage warnings, “you’re out of space,” shared folder capacity prompts.

Cross-Selling:

Google One, Workspace upgrades, security add-ons.

Dynamic Pricing Algorithms:

Auto-adjusted pricing for enterprise workloads and storage tiers.

Retention Monetization:

Annual subscription discounts and ecosystem lock-in.

Lifetime Value Optimization:

Drive integrates with Gmail, Photos, Docs, Sheets, and Meet to keep users tied into the ecosystem.

Psychological Pricing:

Affordable 100GB entry tier nudges users into the $9.99/month 2TB plan over time.

Real Example:

A family on 100GB tends to upgrade to 2TB after hitting smartphone backup limits, increasing ARPU by 5x.

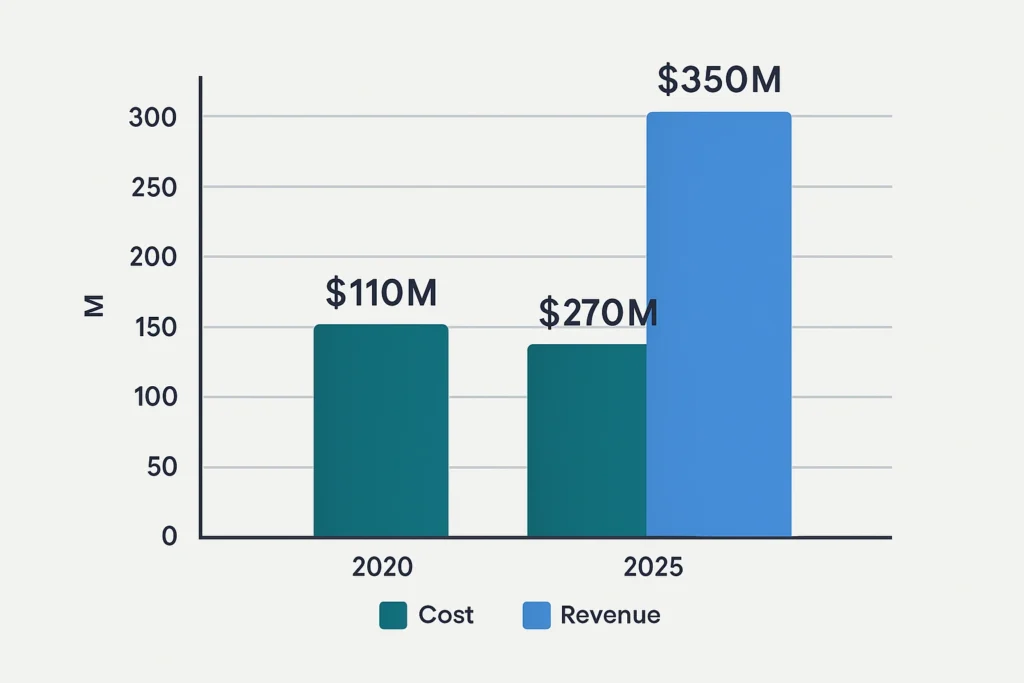

Cost Structure & Profit Margins

Major Cost Categories

• Data center infrastructure

• SSD storage expansion

• High-bandwidth delivery

• AI-driven search and classification

• Cybersecurity and compliance

• Engineering + global operations

Unit Economics

• CAC: Extremely low due to ecosystem distribution

• LTV: High because storage dependency increases annually

• LTV/CAC Ratio: 10x+ for most users

Path to Profitability

Data compression, AI deduplication, and custom hardware reduce storage cost per GB.

Margin Improvements (2020–2025)

• Storage cost/GB dropped from $0.018 to $0.006

• Renewable energy sourcing reduced infra costs by 11 percent

Future Revenue Opportunities & Innovations

New Revenue Streams Being Tested

• AI document drafting and auto-organization

• Smart backups for large video libraries

• Encrypted vault storage for enterprises

AI/ML Monetization

AI-powered search, classification, document insights, and automated versioning.

Expansion Markets

India, Brazil, Africa with rising smartphone adoption.

Emerging Features to Monetize

AI vaults, instant-restore backups, enterprise-grade encryption modules.

Predictions for 2025–2027

• Revenue expected to reach $50B+ by 2027

• AI storage and smart search becoming major revenue drivers

Threats

Antitrust pressure, privacy concerns, competition from enterprise-specific vendors.

Opportunities for New Players

Niche-specific cloud storage platforms with custom workflows can win fast.

Lessons for Entrepreneurs & Your Opportunity

Key Takeaways

• Storage-based pricing guarantees recurring revenue

• Bundling strategies increase ARPU

• AI-based features create strong upsell potential

• Device backup dependency boosts long-term retention

• API monetization adds incremental profit

Market Gaps to Exploit

• Industry-specific storage (legal, medical, creative)

• High-security encrypted vaults

• Faster team-sharing workflows

• Affordable SMB-focused storage solutions

Want to build a platform with Google Drive’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating storage platforms with built-in monetization features. Our Google Drive Clone scripts include flexible storage billing, API monetization, and smart collaboration tools. Some clients begin earning within 30 days of launch. Get a free consultation to map your revenue strategy.

Final Thought

Google Drive’s revenue success is rooted in a simple but powerful principle: users always need more storage, more collaboration, and more security—and they’re willing to pay for it as their digital footprint grows. This creates a built-in expansion revenue engine that compounds year after year.

For entrepreneurs, this model presents one of the strongest opportunities in SaaS. A well-designed cloud storage platform earns recurring subscription income, gains predictable upgrade revenue, and attracts enterprise clients looking for scalable collaboration tools.

With Miracuves’ Google Drive Clone, you can replicate this proven model with customizable features, flexible monetization, and enterprise-grade performance. Whether you want to target businesses, freelancers, or global teams, your platform can tap into the same revenue engines that power Google Drive.

FAQs

1. How much does Google Drive make per user?

Most users generate $2–$18 per month through Google One or Workspace plans.

2. What’s Google Drive’s most profitable revenue stream?

Workspace subscriptions contribute over 60 percent of revenue.

3. How does Google Drive’s pricing compare to competitors?

It’s generally cheaper than Dropbox, similar to OneDrive, and more flexible than Box — and with Miracuves, you can build a file storage platform clone starting at just $2899.

4. What percentage does Google take from developers?

API usage fees vary based on operations and bandwidth.

5. How has Google Drive’s revenue model evolved?

Shifted from basic cloud storage to AI-driven productivity and enterprise compliance tools.

6. Can small platforms use similar models?

Yes, storage tiers + premium features work well for new SaaS platforms.

7. What’s the minimum scale for profitability?

Break-even occurs once storage cost per TB stabilizes and churn drops.

8. How to implement similar revenue models?

Use tiered storage pricing, add-on features, and collaboration tools.

9. What are alternatives to Google Drive’s model?

Flat storage plans, team-based pricing, encrypted-only storage.

10. How quickly can similar platforms monetize?

With the right model and automations, many platforms monetize in just 3–6 days with guaranteed delivery.