By 2026, Faire stands as one of the most influential B2B marketplaces in modern commerce. Operating in more than 100 countries, it supports over 100,000 independent brands and serves hundreds of thousands of local retailers. Its multi-billion-dollar valuation was not achieved by pushing higher product volumes, but by systematically removing friction from wholesale—solving long-standing issues around discovery, payments, and inventory risk.

Business Model of Faire scaled from a simple startup idea into a global platform by redesigning how wholesale transactions work. By eliminating upfront risk for retailers, introducing flexible payment terms, and replacing trade-show-driven sales with data-driven discovery, Faire turned wholesale into a repeatable, software-led marketplace. Growth came from enabling better trade relationships, not forcing aggressive expansion.

For entrepreneurs exploring marketplace, B2B SaaS, or platform-led commerce models, Faire is a masterclass. It shows how trust can be designed at scale, transactions monetized without hurting adoption, and defensibility built without owning inventory. At Miracuves, we study models like Faire because they prove infrastructure-first platforms can unlock massive value with lower operational risk.

How the Faire Business Model Works

Faire operates on a two-sided B2B marketplace model, purpose-built for wholesale commerce. At its core, it connects independent brands (sellers) with local retailers (buyers) while taking responsibility for trust, payments, discovery, and risk—areas where traditional wholesale consistently fails.

Instead of acting as a distributor or inventory holder, Faire positions itself as wholesale infrastructure, enabling transactions to happen faster, safer, and at global scale.

Core Framework Overview

Faire’s business model works because it solves three structural wholesale problems simultaneously:

- Discovery inefficiency (retailers struggle to find the right brands)

- Financial risk (upfront inventory purchases discourage experimentation)

- Operational friction (payments, reordering, and cross-border logistics)

By absorbing these frictions, Faire becomes indispensable to both sides.

Type of Business Model

- Primary Model: Two-sided B2B Marketplace

- Supporting Layer: Embedded Fintech + Data-Driven Discovery

- Monetization Style: Transaction-first, service-supported (low entry friction)

Value Proposition by User Segment

For Retailers (Buy Side):

- Risk-free wholesale ordering (net payment terms, free returns on first orders)

- Curated discovery of unique, non-mass brands

- Predictable margins and reorder convenience

- Centralized ordering across thousands of brands

For Brands (Sell Side):

- Instant access to global retail demand

- No need for sales reps, trade shows, or distributors

- Embedded financing and payment handling

- Data insights on reorder patterns and demand signals

For Faire (Platform):

- Controls transaction flow and data

- Earns on completed trade, not listings

- Scales without inventory or logistics ownership

Key Stakeholders & Their Roles

- Independent Brands: Supply differentiated products and maintain quality

- Retailers: Create demand, repeat orders, and platform liquidity

- Payment & Risk Infrastructure: Enables net terms and fraud protection

- Logistics Partners: Support cross-border delivery without ownership burden

- Faire Platform: Orchestrates trust, discovery, and transaction completion

The platform stays balanced by subsidizing early trust and gradually shifting toward sustainable unit economics as repeat trade increases.

Model Evolution Over Time

- Early Stage: Heavy incentives (free returns, long net terms) to drive adoption

- Growth Phase: Algorithmic discovery and data-driven matchmaking

- 2026 Maturity: Reduced subsidies, higher repeat orders, stronger margins

Faire evolved from a growth-at-all-costs marketplace into a repeat-transaction engine where lifetime value outweighs acquisition cost.

Why the Model Works in 2026

- Retailers seek differentiation over mass-market sameness

- Brands prefer direct access over distributor dependency

- Embedded finance reduces cash-flow stress

- Data-driven discovery replaces physical trade shows

- Global sourcing normalized post-supply-chain disruptions

This alignment with modern retail behavior and capital efficiency makes Faire’s model durable in 2026.

Read more : What is Faire and How Does It Work?

Target Market & Customer Segmentation Strategy

Faire’s growth is not driven by “everyone who sells products.” It is driven by clear, disciplined segmentation on both sides of the marketplace, with each segment designed to reinforce repeat transactions and long-term retention.

Instead of chasing enterprise wholesale or mass retail chains, Faire deliberately focused on independent commerce, where fragmentation creates the highest platform leverage.

Primary Customer Segments

1. Independent Retailers (Demand Side – Core Segment)

These are small-to-mid-sized physical and online stores that need differentiation without large inventory risk.

Key Characteristics

- Owner-operated or small buying teams

- Limited working capital

- High sensitivity to unsold inventory

- Preference for unique, non-Amazon products

Why They Stay

- Net payment terms reduce cash pressure

- Free returns on first orders encourage experimentation

- Reordering is frictionless once products perform

2. Independent & Emerging Brands (Supply Side – Core Segment)

Brands that lack large sales teams or distributor access but produce differentiated products.

Key Characteristics

- Early to mid-stage product companies

- Strong product identity but limited retail reach

- Price-sensitive to trade show and sales rep costs

Why They Stay

- Access to thousands of retailers instantly

- Lower customer acquisition cost than traditional wholesale

- Predictable reorders instead of one-time trade show sales

Secondary Customer Segments

- Established DTC Brands expanding into retail

- International brands entering new regions

- Online-only retailers adding wholesale channels

These segments increase platform volume without diluting the independent retail focus.

Customer Journey Mapping

Retailer Journey

Discovery → Curated Brand Recommendations → First Risk-Free Order → Reorder → Long-Term Supplier Relationship

Brand Journey

Onboarding → Product Visibility → First Retail Orders → Repeat Retailers → Data-Driven Growth

Faire optimizes this journey by removing friction at the most sensitive conversion points:

- First order risk

- Payment delays

- Reordering complexity

Acquisition Channels by Segment

Retailers

- Organic search and retail communities

- Word-of-mouth from other store owners

- Local retail association partnerships

Brands

- Founder networks and startup ecosystems

- Referrals from existing retailers

- Digital outreach replacing trade show dependency

Once onboarded, retention—not acquisition—drives profitability, as repeat orders dominate GMV.

Market Positioning & Competitive Edge

Faire positions itself as:

- Independent retail’s operating system, not a marketplace

- A discovery-first platform, not a price race

- A trust enabler, not just a transaction processor

Differentiation Strategy

- Focus on long-tail brands ignored by enterprise wholesalers

- Strong brand curation over SKU overload

- Financial risk absorption as a moat

By 2026, Faire’s competitive edge lies in repeat behavior and data-driven trust, not scale alone.

Revenue Streams and Monetization Design

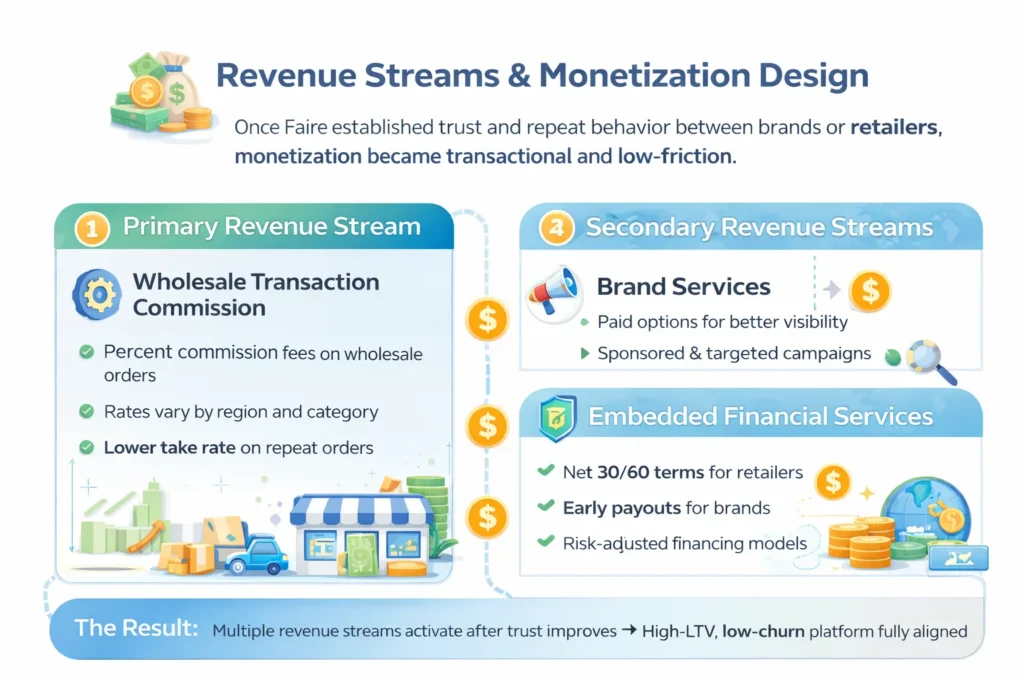

Once Faire established trust and repeat behavior between brands and retailers, monetization became transaction-led rather than access-led. Unlike B2B platforms that push subscriptions early, Faire earns primarily when wholesale trade actually happens—keeping adoption friction low while allowing revenue to scale with platform usage.

This design ensures Faire’s incentives remain aligned with successful commerce, not just platform activity.

Primary Revenue Stream 1: Wholesale Transaction Commission (Core Engine)

Mechanism

Faire charges brands a commission on each completed wholesale order processed through the platform. The fee is applied after order confirmation and payment settlement.

Pricing Model (2026)

- Percentage-based commission on order value

- Rates vary by region, category, and brand maturity

- Lower effective take rate on repeat orders to encourage long-term retention

Revenue Contribution

- Largest and most predictable revenue stream

- Directly tied to Gross Merchandise Volume (GMV)

- Scales with reorder frequency, not just new customer acquisition

Growth Trajectory

- Higher repeat orders from established retailer-brand relationships

- Expansion into international wholesale trade

- Increased average order values as retailers gain confidence

This stream works because Faire controls payment flow, ensuring commissions are captured automatically at transaction completion.

Secondary Revenue Stream 2: Brand Services & Visibility Tools

Mechanism

Brands can pay for enhanced visibility and growth tools within the marketplace.

Includes

- Sponsored brand placement

- Advanced analytics and performance insights

- Promotional campaigns targeting specific retailer segments

Value Logic

- Brands only invest once baseline traction is proven

- ROI is measurable through reorder and retailer engagement data

Secondary Revenue Stream 3: Embedded Financial Services

Mechanism

Faire offers net payment terms to retailers while paying brands faster, earning value through financing spreads and risk management.

Components

- Net 30 / Net 60 terms for retailers

- Early payouts for brands

- Risk-adjusted financing models

This layer turns Faire into a fintech-enabled marketplace, deepening platform dependency without introducing visible fees.

Secondary Revenue Stream 4: Cross-Border Trade Enablement

Mechanism

For international wholesale orders, Faire facilitates currency handling, duties, and localized pricing structures.

Monetization Logic

- Margin embedded within FX handling and service layers

- Increased platform usage from global brands and retailers

Monetization Strategy Summary

Faire’s revenue design succeeds because:

- Monetization activates after trust is established

- Multiple streams reinforce each other

- Financing increases GMV, which increases commission revenue

- Pricing psychology reduces perceived platform “cost”

The result is a high-LTV, low-churn B2B marketplace with improving unit economics as scale matures.

Read more : Faire Revenue Model: How Faire Makes Money in 2026

Operational Model & Key Activities

Behind Faire’s elegant marketplace experience sits a highly disciplined operational engine. The company’s success is not only about connecting brands and retailers, but about executing thousands of small operational decisions correctly every day—payments, risk, discovery, and support.

Faire’s operational model is designed to scale transactions without scaling operational complexity at the same rate.

Core Operations

Platform & Technology Management

- Marketplace infrastructure handling millions of wholesale SKUs

- Algorithmic brand discovery and personalized recommendations

- Secure payment processing and transaction reconciliation

Risk, Trust & Quality Control

- Credit risk assessment for net payment terms

- Fraud detection and dispute resolution

- Brand vetting to maintain marketplace quality

Customer Support Operations

- Retailer order support and return handling

- Brand onboarding and growth assistance

- Dispute mediation between buyers and sellers

Marketing & Growth Operations

- Retailer acquisition through community-led marketing

- Brand onboarding and lifecycle optimization

- Data-driven experimentation to improve conversion and reorder rates

Resource Allocation Strategy (2026 View)

Faire’s internal investments reflect its belief that software and data outperform human-heavy wholesale operations.

Estimated Focus Areas

- Technology & Infrastructure: ~40%

- Risk, Payments & Fintech Operations: ~20%

- Marketing & Growth: ~20%

- Customer Support & Quality: ~15%

- R&D and New Market Expansion: ~5%

This allocation ensures Faire improves unit economics as volume grows, rather than adding linear cost.

Operational Efficiency Levers

- Automation of reorder flows reduces support load

- Data-driven trust scoring lowers default risk

- Self-serve brand tools replace manual account management

- Centralized platform replaces fragmented wholesale workflows

Why This Operational Model Scales

Faire avoids traditional wholesale pitfalls by:

- Not owning inventory

- Not managing warehouses directly

- Not relying on sales representatives

Instead, it operates as a software-led wholesale backbone, allowing global expansion without proportional cost increases.

Strategic Partnerships & Ecosystem Development

Faire understands that strong marketplaces are not built alone. Instead of trying to control every layer of wholesale commerce, Faire deliberately partners where ownership would slow scale and focuses internal effort where data and platform control create the most value.

Its partnership strategy is designed to extend capability, increase trust, and deepen ecosystem lock-in.

Partnership Philosophy

Faire partners to:

- Reduce operational complexity

- Accelerate geographic expansion

- Improve transaction reliability

- Strengthen network effects across the platform

Rather than one-off integrations, Faire builds long-term, infrastructure-level alliances that become invisible but essential to daily operations.

Key Partnership Types

1. Technology & API Partners

- Cloud infrastructure providers for scalability and reliability

- Analytics and data-processing tools

- API integrations enabling inventory, accounting, and ERP syncing for brands

2. Payment & Financial Services Partners

- Payment processors for global transaction handling

- Banking partners supporting net payment terms

- Risk and fraud prevention platforms

These partnerships allow Faire to offer fintech-grade services without becoming a bank.

3. Logistics & Cross-Border Partners

- International shipping providers

- Customs and duty handling services

- Regional delivery partners

Faire uses these alliances to support global trade while keeping logistics asset-light.

4. Marketing & Distribution Alliances

- Retail associations and trade communities

- Independent retailer networks

- Brand incubators and startup ecosystems

These partnerships lower acquisition cost and reinforce community credibility.

5. Regulatory & Expansion Alliances

- Local compliance consultants in new markets

- Tax and trade regulation specialists

- Cross-border commerce advisory firms

This reduces friction when entering regulated or complex regions.

Ecosystem Strategy Insights

Faire’s ecosystem creates value because:

- Each partner strengthens trust, not just reach

- Partners benefit from growing platform GMV

- Network effects compound across payments, logistics, and discovery

By 2026, Faire’s partnerships act as competitive moats, making replication difficult without comparable ecosystem depth.

Read more : Best Faire Clone Scripts 2025: Build a B2B Wholesale Marketplace That Scales

Growth Strategy & Scaling Mechanisms

Faire’s growth did not come from aggressive discounting or mass advertising. It came from structural growth loops built directly into how wholesale works on the platform. Each successful transaction increases the likelihood of the next—creating compounding scale.

By 2026, Faire operates less like a fast-growing startup and more like a self-reinforcing commerce network.

Core Growth Engines

1. Organic Network Effects

- More brands increase retailer choice

- More retailers increase brand sales opportunities

- Higher liquidity improves discovery accuracy

This two-sided reinforcement reduces reliance on paid acquisition over time.

2. Risk-Removal as a Growth Lever

- Free returns on first orders

- Net payment terms reduce upfront risk

- Trust mechanisms accelerate trial behavior

Lower perceived risk directly increases platform adoption and reorder rates.

3. Data-Driven Discovery

- Algorithmic brand recommendations

- Personalized retailer feeds

- Demand forecasting for brands

Better matches lead to higher order success, which feeds back into growth.

4. International Expansion Strategy

- Entered Europe, Canada, Australia, and other regions

- Localized pricing, payments, and logistics

- Regional curation instead of one-size-fits-all catalogs

This localized scaling protects brand relevance while expanding GMV.

New Product & Platform Expansion

- Advanced brand analytics and growth tools

- Cross-border wholesale enablement

- Improved reorder automation and inventory insights

Each addition increases switching costs without breaking marketplace neutrality.

Scaling Challenges & How Faire Addressed Them

Challenge: Capital Risk from Net Terms

Solution: Risk modeling, credit scoring, and diversified financing partnerships

Challenge: Marketplace Quality Dilution

Solution: Brand vetting and algorithmic ranking

Challenge: Cross-Border Complexity

Solution: Partner-led logistics and localized compliance

Faire solved scaling issues by engineering systems, not adding headcount.

Competitive Strategy & Market Defense

Faire operates in a space where competitors range from legacy wholesale distributors to modern B2B marketplaces. Its long-term advantage comes from defending trust, data, and repeat behavior, not just expanding supply.

By 2026, Faire’s competitive strategy is about making itself the default operating layer for independent wholesale.

Core Competitive Advantages

1. Network Effects

- More retailers attract better brands

- More brands improve retailer discovery

- Repeat transactions strengthen platform gravity

Once liquidity is achieved, switching away becomes operationally costly.

2. High Switching Barriers

- Retailers centralize sourcing and reordering

- Brands build predictable revenue streams

- Embedded financial workflows lock in usage

Leaving Faire means reintroducing manual wholesale friction.

3. Brand Trust & Market Credibility

- Curated marketplace reduces noise

- Risk-free ordering builds buyer confidence

- Fair treatment of brands protects supply quality

Trust acts as a moat that is difficult to copy quickly.

4. Data & Algorithmic Advantage

- Deep insights into reorder behavior

- Demand forecasting across categories

- Personalized discovery engines

Competitors can copy features, but not years of transaction data.

Market Defense Tactics

Handling New Entrants

- Continuous product improvement over price wars

- Focus on quality and retention, not volume

Pricing Pressure

- Commission flexibility rather than flat-rate rigidity

- Subsidies applied strategically, not universally

Feature Timing

- Rollouts guided by ecosystem readiness

- Avoids destabilizing supply-demand balance

Strategic Moves

- Regional expansion before competitors mature

- Strengthening fintech and analytics layers

Faire defends its market by making itself operationally indispensable, not by undercutting prices.

Lessons for Entrepreneurs & Implementation

Faire’s success is not about wholesale—it is about platform thinking applied with discipline. For entrepreneurs, the real value lies in understanding why Faire works and how its principles can be adapted to other markets.

Think of this section as a founder-to-founder breakdown.

Key Factors Behind Faire’s Success

- Solved a painful, structural problem, not a cosmetic one

- Removed risk at the most fragile point: first transaction

- Monetized after trust, not before

- Used data to replace manual processes

- Designed for repeat behavior, not one-time growth

Replicable Principles for Startups

1. Build Infrastructure, Not Just a Marketplace

Faire didn’t just connect buyers and sellers—it handled payments, risk, and discovery. Platforms that own infrastructure own defensibility.

2. Absorb Friction Strategically

Faire took short-term financial risk to unlock long-term retention. Smart friction absorption accelerates network effects.

3. Monetize Where Value Is Created

Charging for access kills adoption. Charging for successful outcomes scales with trust.

4. Let Data Replace People

Algorithms scaled wholesale better than sales teams ever could.

Common Mistakes to Avoid

- Launching without solving trust and risk

- Over-monetizing early users

- Expanding categories before liquidity exists

- Treating marketplaces like linear SaaS products

Adapting the Model to Local or Niche Markets

Faire’s model can be adapted to:

- Regional B2B trade platforms

- Vertical-specific wholesale marketplaces

- Services-based B2B ecosystems

- Local supplier-to-retailer networks

The key is deep vertical focus before horizontal expansion.

Implementation Timeline & Investment Priorities

Phase 1 :

- Core marketplace build

- Payment and trust layer

- Early supply onboarding

Phase 2 :

- Risk removal features

- Data-driven discovery

- Repeat transaction optimization

Phase 3 :

- Monetization expansion

- Ecosystem partnerships

- Geographic scaling

Ready to implement Faire’s proven business model for your market?

Miracuves builds scalable platforms with tested business models and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable apps.

Get your free business model consultation today.

Conclusion :

Faire proves that the most powerful business models are not always the loudest. By modernizing a deeply inefficient industry, Faire showed that execution, trust design, and infrastructure thinking can outperform aggressive marketing or price wars.

Its business model teaches a critical lesson for 2026 and beyond: platforms win when they remove risk, not when they chase volume. Faire didn’t disrupt wholesale by replacing it—it rebuilt it in software form.

As platform economies evolve, the winners will be those who balance ecosystems, design for repeat behavior, monetize outcomes instead of access, and use data as their primary scaling engine.

Faire stands as a blueprint for how quiet innovation, combined with disciplined execution, creates sustainable and defensible growth in the global platform economy.

FAQs

What type of business model does Faire use?

Faire uses a two-sided B2B marketplace business model supported by embedded fintech services. It connects independent brands with local retailers and monetizes primarily through transaction-based commissions.

How does Faire’s business model create value?

Faire creates value by removing wholesale friction—brand discovery, upfront inventory risk, payment delays, and reordering complexity. Retailers gain risk-free sourcing, while brands gain scalable access to retail demand.

What are the key success factors behind Faire?

The biggest success factors include trust-first design, risk absorption on early transactions, data-driven discovery, repeat-order optimization, and outcome-based monetization.

How scalable is Faire’s business model?

Faire’s model is highly scalable because it does not own inventory or warehouses. Growth is driven by software, data, and partnerships, allowing global expansion without linear cost increases.

What are the biggest challenges in Faire’s model?

Key challenges include managing credit risk from net payment terms, maintaining marketplace quality at scale, and handling cross-border complexity. Faire addresses these through data-driven risk modeling and strategic partnerships.

How can entrepreneurs adapt Faire’s model to their region?

Entrepreneurs can adapt the model by focusing on a specific vertical or region, solving trust and payment friction first, and scaling supply-demand liquidity before expanding categories.

What are alternatives to the Faire business model?

Alternatives include distributor-led wholesale, direct brand portals, trade show–driven sales, or subscription-based B2B marketplaces. However, these models lack Faire’s scalability and data leverage.

How has Faire’s business model evolved over time?

Faire evolved from a subsidy-heavy growth platform into a repeat-transaction engine. Over time, it reduced incentives, strengthened monetization, and deepened fintech and data capabilities.

Related Article :

- What is eBay App and How Does It Work?

- What is Amazon App and How Does It Work?

- Best Temu Clone Scripts 2025: Launch a Next-Gen Social Commerce & Group-Buying Marketplace

- Best Wish Clone Scripts 2025: Build a High-Profit Social Commerce App

- Best DHgate Clone Scripts 2025: Build a Global B2B Wholesale Marketplace Faster