In 2025, Acorns crossed an estimated $400+ million in annual revenue, transforming spare-change investing into a scalable fintech business built on predictable, recurring income. Its growth is fueled by a subscription-first model that converts small monthly fees into long-term lifetime value, supported by strong retention, low churn, and high user trust. What makes this milestone more impressive is Acorns’ ability to monetize financial habits rather than transactions, creating a revenue engine that compounds as users stay longer and adopt more products.

What began as a simple round-up investing app is now a multi-product financial ecosystem spanning investing, banking, retirement, and financial education, allowing Acorns to own more of the user’s financial journey. Each product feeds into the next, creating powerful cross-selling loops that increase average revenue per user without raising acquisition costs. This ecosystem approach also strengthens data-driven personalization, enabling Acorns to tailor offers, plans, and financial nudges based on user behavior and life stage.

For founders, Acorns is a masterclass in subscription-driven fintech growth, behavioral monetization, and lifetime value expansion. Its model shows how simplicity in pricing can unlock scale, while product bundling builds defensibility in competitive markets. The real lesson lies in designing platforms that grow with users over time—turning one-time app installs into long-term financial relationships that generate compounding revenue and brand loyalty.

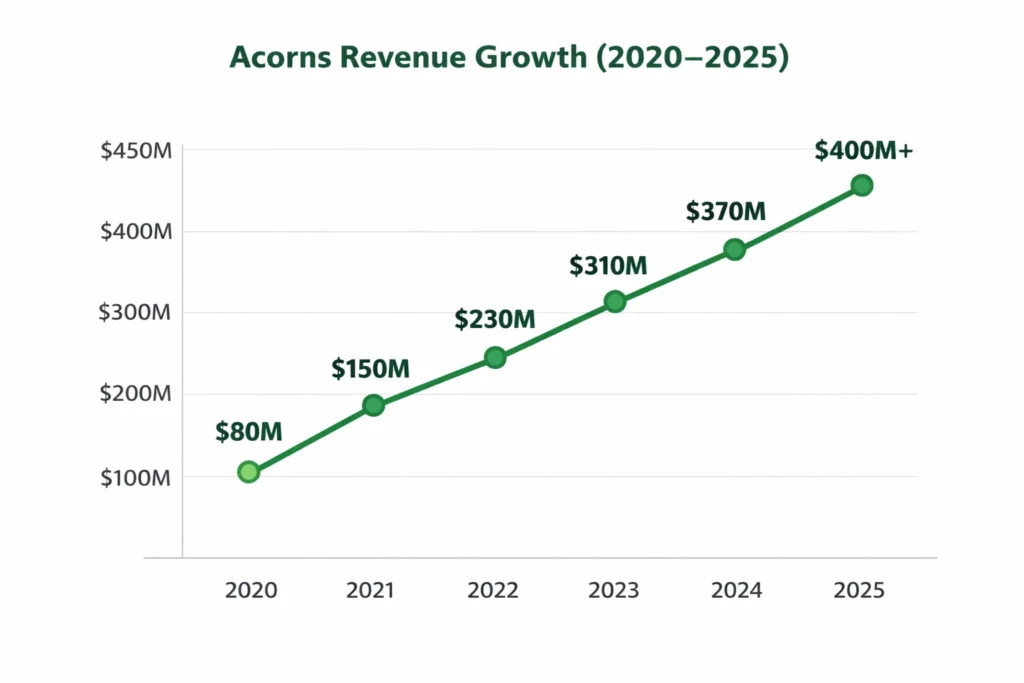

Acorns Revenue Overview – The Big Picture

2025 Revenue: ~$400–450 million (estimated based on subscription ARPU, user base, and financial disclosures)

Valuation: ~$2.0–2.3 billion (private market estimates)

YoY Growth: ~18–25%

Revenue by Region:

- United States: ~92%

- Canada: ~6%

- Other Markets: ~2%

Profit Margins:

- Gross margin: ~65–72% (subscription-heavy model)

- Net margin: Still reinvesting in growth, product, and compliance

Competition Benchmark:

- Stash: ~$300M revenue

- Robinhood: ~$1.9B+ revenue

- Betterment: ~$250M+ revenue

Read More: How Acorns Works – Simple Saving & Investing for Beginners

Primary Revenue Streams Deep Dive

Revenue Stream #1: Subscription Plans (Core Revenue – ~68%)

Acorns operates on a tiered monthly subscription model that bundles investing, banking, and retirement features.

Pricing (2025):

- Personal: $3/month

- Family: $5/month

- Premium/Legacy Plans: $9/month

How it works:

Users pay flat monthly fees regardless of portfolio size, making Acorns attractive to beginners and high-margin at scale.

2025 Data:

- Active users: ~5.5 million

- Estimated ARPU: $72/year

- Subscription revenue contribution: ~$280M+

Revenue Stream #2: Interchange Fees (Debit Card – ~12%)

Acorns earns a percentage from every card transaction made through its Acorns Spend debit card.

How it works:

Each merchant pays a small interchange fee, of which Acorns receives a cut.

2025 Impact:

- Average user spend annually: ~$6,000

- Interchange yield: ~0.2–0.4%

- Estimated contribution: ~$50M+

Revenue Stream #3: Found Money Partner Commissions (~10%)

Acorns partners with brands like Walmart, Nike, and Airbnb, earning affiliate commissions when users shop through the app.

How it works:

Brands pay Acorns per transaction, and users receive cashback invested into their portfolios.

2025 Contribution: ~$40M+

Revenue Stream #4: Retirement Accounts (IRA & 401(k) Fees – ~7%)

Acorns charges premium fees for retirement account management.

How it works:

Flat monthly pricing covers automated portfolio management and tax-advantaged account services.

2025 Contribution: ~$30M+

Revenue Stream #5: Financial Partnerships & White-Label Services (~3%)

Revenue from financial institutions, education programs, and fintech partnerships.

2025 Contribution: ~$10–15M

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share | Estimated Revenue |

|---|---|---|

| Subscriptions | 68% | $280M |

| Interchange Fees | 12% | $50M |

| Found Money | 10% | $40M |

| Retirement Services | 7% | $30M |

| Partnerships | 3% | $10M |

The Fee Structure Explained

User-Side Fees

- Monthly subscription: $3–$9

- ATM fees (out-of-network)

- Optional retirement upgrades

Provider-Side Fees

- Merchant affiliate commissions

- Banking interchange sharing

Hidden Revenue Layers

- Behavioral nudges increasing transaction volume

- Brand placement within Found Money marketplace

Regional Pricing Variation

- US: Full pricing model

- Canada: Simplified subscription structure

[Table: Complete Fee Structure by User Type]

| User Type | Fees Paid | Revenue Source |

|---|---|---|

| Beginner Investor | $3/month | Subscription |

| Family User | $5/month | Subscription |

| Premium User | $9/month | Subscription + IRA |

| Card User | None Direct | Interchange |

| Merchant Partner | % of Sale | Affiliate Fee |

How Acorns Maximizes Revenue Per User

Segmentation:

New users start with micro-investing and are guided into banking and retirement products.

Upselling:

Personal → Family → Premium plans.

Cross-Selling:

Investing users are offered debit cards, IRAs, and educational content.

Dynamic Pricing:

Plan bundling based on life stages.

Retention Monetization:

Long-term accounts grow in value, increasing Found Money engagement.

LTV Optimization:

Average lifetime value exceeds $300 per user.

Psychological Pricing:

$3/month feels negligible but compounds into strong ARR.

Real Data Example:

A Family Plan user using Spend + Found Money + IRA can generate 4–6x revenue compared to a basic investor.

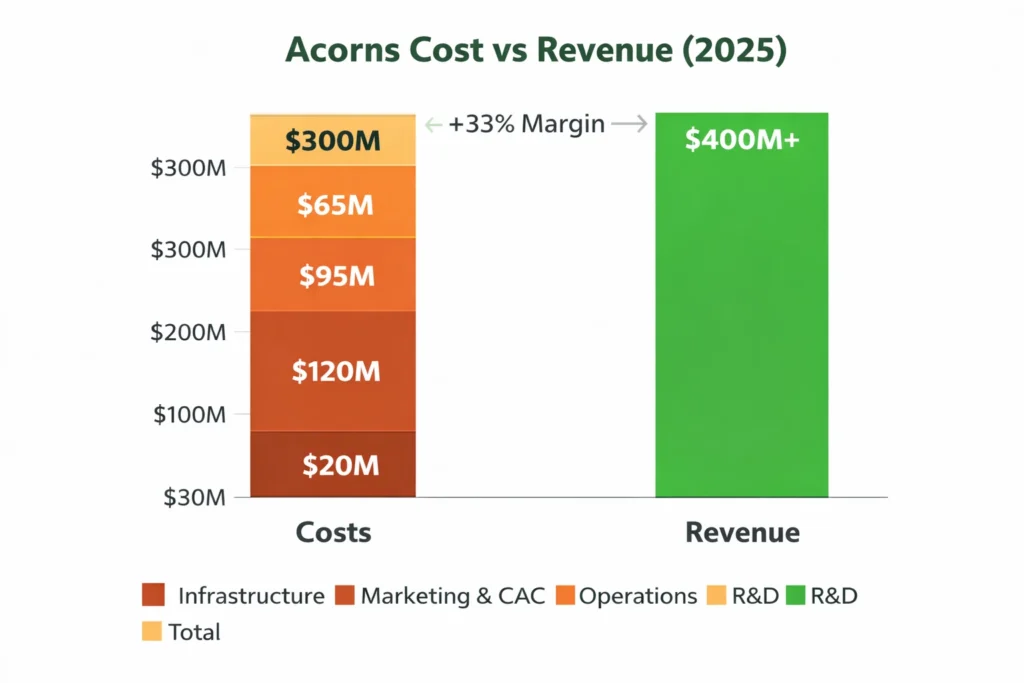

Cost Structure & Profit Margins

Infrastructure Costs:

Cloud hosting, financial APIs, compliance platforms.

CAC & Marketing:

~30% of revenue allocated to influencer, referral, and fintech partnerships.

Operations:

Customer support, compliance teams, fraud prevention.

R&D:

AI-based personalization, risk profiling, financial literacy tools.

Unit Economics:

- CAC: ~$35 per user

- Break-even: ~6 months subscription

Margin Optimization:

High automation, digital onboarding, minimal human advisory costs.

Profitability Path:

Scale-driven subscription margins and reduced acquisition costs over time.

Read More: Best Acorns Clone Scripts 2026 – Build a Micro-Investing App Fast

Future Revenue Opportunities & Innovations

New Streams:

- AI-powered financial coaching subscriptions

- Crypto & alternative asset investing

- Employer-sponsored financial wellness programs

AI/ML-Based Monetization:

Personalized upsell recommendations.

Market Expansion:

LATAM and Southeast Asia.

Predicted Trends 2025–2027:

- Embedded finance in lifestyle apps

- Gen Z-focused micro-investing tools

- Employer-based fintech platforms

Risks & Threats:

Regulatory changes, rising CAC, fintech saturation.

Opportunities for New Founders:

Niche investing platforms for creators, freelancers, and gig workers.

Lessons for Entrepreneurs & Your Opportunity

What Works:

- Flat pricing simplicity

- Behavioral finance integration

- Multi-product ecosystem

What to Replicate:

- Subscription-first fintech model

- Cashback-driven engagement loops

Market Gaps:

- Regional fintech platforms in emerging economies

- Industry-specific investment platforms

Improvements Founders Can Use:

- AI-powered advisory models

- Custom portfolio strategies for niche markets

Want to build a platform with Acorns’ proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Acorns clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and it we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Acorns proves that fintech growth doesn’t require complex trading systems—it requires trust, simplicity, and behavioral monetization designed around everyday financial decisions. By lowering the barrier to entry, the platform attracts first-time investors who might otherwise avoid traditional finance apps. This trust-first approach reduces churn, increases long-term engagement, and turns financial guidance into a core value proposition rather than a feature.

Its subscription-led model transforms small financial habits into predictable, scalable revenue that compounds over time. Instead of relying on volatile market activity or transaction fees, Acorns benefits from stable monthly recurring income that supports sustainable growth planning. As users adopt additional services like retirement accounts and debit cards, the platform deepens monetization without increasing acquisition costs, improving margins and lifetime value simultaneously.

For founders, the real opportunity lies in building focused financial ecosystems that grow with the user’s life journey, from first paycheck to long-term wealth management. The competitive advantage comes from designing platforms that evolve as user needs change, enabling continuous upselling, personalization, and data-driven engagement. This long-term relationship model not only increases revenue potential but also creates defensibility in crowded fintech markets.

FAQs

1. How much does Acorns make per transaction?

Primarily through subscriptions and a small percentage from debit card interchange and merchant partnerships.

2. What’s Acorns’ most profitable revenue stream?

Monthly subscription plans generate the highest margins and predictable cash flow.

3. How does Acorns’ pricing compare to competitors?

It’s cheaper than advisory platforms and simpler than trading-focused apps.

4. What percentage does Acorns take from providers?

Merchant partners typically pay affiliate commissions ranging from 2%–10% per sale.

5. How has Acorns’ revenue model evolved?

It shifted from pure investing to a full financial ecosystem.

6. Can small platforms use similar models?

Yes, subscription + cashback loops work well at any scale.

7. What’s the minimum scale for profitability?

Around 50,000–100,000 active subscribers.

8. How to implement similar revenue models?

Use tiered subscriptions, partner marketplaces, and embedded finance tools.

9. What are alternatives to Acorns’ model?

Commission-based trading, asset management fees, or employer-sponsored fintech.

10. How quickly can similar platforms monetize?

Many platforms begin generating revenue within 30–60 days of launch.