Afterpay processes tens of billions of dollars in transactions annually and continues to dominate the Buy Now, Pay Later (BNPL) sector as a core growth engine inside Block Inc.’s ecosystem. Its scale is powered by deep integrations with major global retailers, eCommerce platforms, and point-of-sale systems, allowing it to capture consumer demand both online and in-store. By embedding BNPL directly into the checkout experience, Afterpay increases average order values, merchant conversion rates, and repeat purchase frequency, reinforcing its position as a critical revenue partner for merchants rather than just a payment option.

In 2025, its revenue model remains one of the most studied in fintech because it successfully blends merchant-funded monetization with consumer-friendly, zero-interest pricing at a truly global scale. Instead of relying on traditional lending interest, Afterpay monetizes through transaction-based merchant fees, in-app advertising placements, and data-driven merchant insights, creating a diversified income structure. This approach allows the platform to maintain strong brand trust among consumers while still delivering predictable, recurring revenue streams from its merchant network.

For founders, Afterpay offers a powerful blueprint for building high-volume, low-friction financial platforms that grow through network effects and ecosystem expansion. The model demonstrates how attracting one side of the market (consumers) can dramatically increase the platform’s value to the other side (merchants), creating a self-reinforcing growth loop. It also highlights the importance of risk management systems, real-time credit assessment, and scalable compliance infrastructure as foundational elements for building fintech platforms that can grow rapidly without compromising financial stability or regulatory alignment.

Afterpay Revenue Overview – The Big Picture

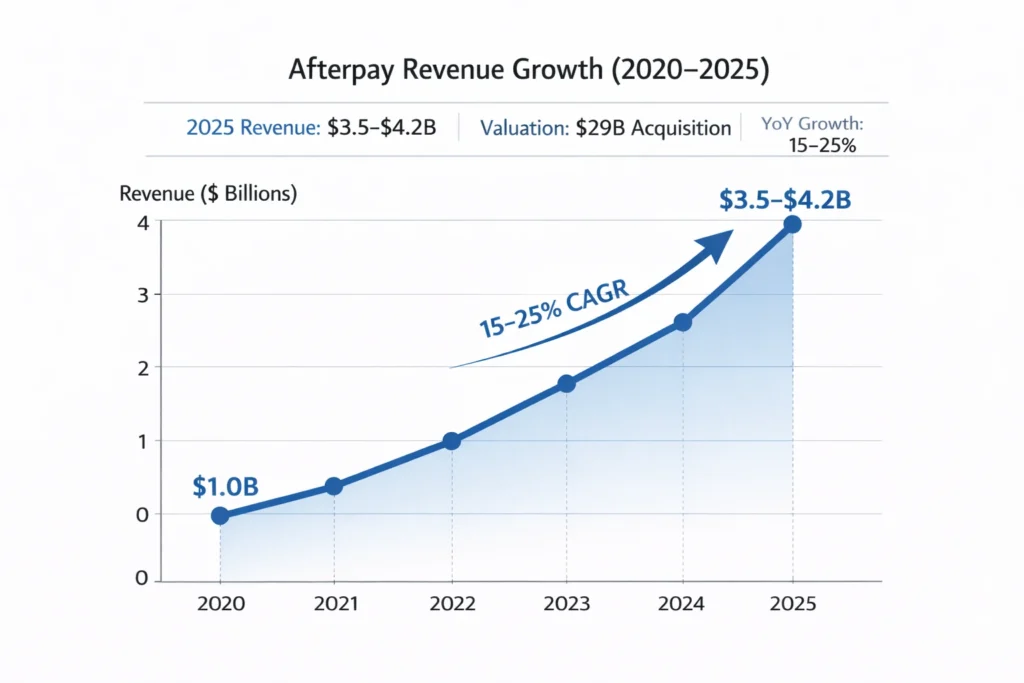

2025 Revenue: Afterpay operates as part of Block Inc. (formerly Square). Block reported over $21 billion in total gross profit for FY2024, with Afterpay contributing a multi-billion-dollar share through BNPL fees and merchant services. Industry estimates place Afterpay’s standalone revenue contribution at $3.5–$4.2 billion annually in 2025.

Valuation: Afterpay was acquired by Block in a $29 billion all-stock deal, making it one of the largest fintech acquisitions in history.

YoY Growth: BNPL transaction volume continues to grow at 15–25% annually, driven by eCommerce adoption, mobile-first consumers, and international market expansion.

Revenue by Region:

- North America: Largest market, driven by major retail partnerships

- Australia & New Zealand: Core stronghold and most mature BNPL market

- Europe: Fastest-growing region with strong merchant onboarding

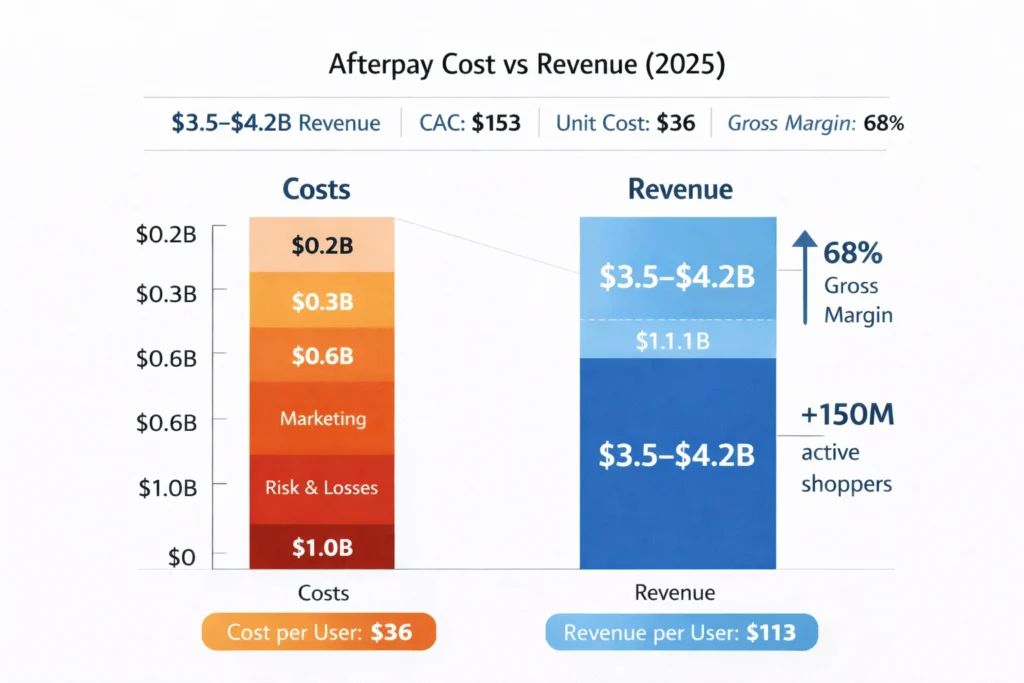

Profit Margins: Afterpay runs on thin net margins due to credit risk, fraud prevention, compliance, and capital costs, but benefits from strong gross margins on merchant fees.

Competition Benchmark: Competes with Klarna, Affirm, PayPal Pay Later, and Apple Pay Later, with differentiation built around no-interest consumer payments and merchant-driven monetization.

Read More: How Afterpay Works – Shop Now, Pay Over 4 Installments

Primary Revenue Streams Deep Dive

Revenue Stream #1: Merchant Transaction Fees

Afterpay earns a percentage of every transaction processed through its platform, typically 3–6% per sale, plus a fixed fee per transaction.

2025 Share: ~70% of total revenue

Revenue Stream #2: Late Payment Fees

Consumers don’t pay interest, but incur capped late fees when they miss payment deadlines. These are regulated and limited by region.

2025 Share: ~15%

Revenue Stream #3: Merchant Advertising & Promotions

Retailers pay for featured placements inside the Afterpay app and marketplace, driving high-intent traffic to their stores.

2025 Share: ~10%

Revenue Stream #4: Cross-Platform Financial Services

As part of Block, Afterpay integrates with Cash App and Square merchants, generating indirect ecosystem value.

2025 Share: ~5%

Revenue Streams Percentage Breakdown

| Revenue Stream | Estimated % Share |

|---|---|

| Merchant Transaction Fees | 70% |

| Late Payment Fees | 15% |

| Merchant Advertising | 10% |

| Ecosystem & Integrations | 5% |

The Fee Structure Explained

User-Side Fees

- No interest on installments

- Late fees applied if payments are missed

- Spending limits based on user credit behavior

Provider-Side Fees (Merchants)

- 3–6% per transaction

- Fixed processing fee per order

- Optional advertising and featured placement fees

Hidden Revenue Layers

- Increased merchant conversion rates

- Higher cart sizes through installment flexibility

- Data-driven merchant analytics services

Regional Pricing Variation

- Higher fees in North America

- Regulated late fee caps in Australia and the EU

- Adjusted merchant pricing in emerging markets

Complete Fee Structure by User Type

| User Type | Fees Paid | Fee Range |

|---|---|---|

| Consumer | Late Fees | Capped by region |

| Merchant | Transaction Fees | 3–6% per sale |

| Enterprise Retailer | Ad Placement Fees | Custom |

| Partner Platform | Integration Fees | Contract-based |

How Afterpay Maximizes Revenue Per User

Segmentation: Different limits for new, loyal, and high-volume shoppers.

Upselling: Merchants are encouraged to promote Afterpay at checkout.

Cross-Selling: Integration with Cash App boosts ecosystem value.

Dynamic Pricing: Merchants receive customized fee rates based on volume.

Retention Monetization: Loyalty rewards keep consumers active.

LTV Optimization: Long-term shopper engagement drives recurring merchant revenue.

Psychological Pricing: Zero-interest framing reduces checkout friction.

Real Data Examples: Retailers report 20–40% higher conversion rates using BNPL options.

Cost Structure & Profit Margins

Infrastructure Cost: Payment rails, cloud processing, and risk engines.

CAC & Marketing: Merchant acquisition and consumer brand campaigns.

Operations: Compliance, fraud detection, customer support.

R&D: Credit scoring systems, app development, and data science.

Unit Economics: Profitable per transaction once default rates remain below fee margins.

Margin Optimization: AI-based risk scoring reduces losses.

Profitability Path: Scale improves margins as fixed costs flatten.

Read More: Best Afterpay Clone Script 2026 | Launch a Scalable BNPL Platform

Future Revenue Opportunities & Innovations

New Streams: Subscription-based merchant tools, loyalty programs, and premium analytics.

AI/ML Monetization: Predictive credit scoring and personalized merchant offers.

Market Expansion: Growth in LATAM, Southeast Asia, and Africa.

Predicted Trends 2025–2027: BNPL adoption to grow with mobile commerce and super apps.

Risks & Threats: Regulatory tightening and rising default rates.

Opportunities for New Founders: Niche BNPL for healthcare, education, and B2B payments.

Lessons for Entrepreneurs & Your Opportunity

What Works: Merchant-funded monetization, strong UX, and low consumer friction.

What to Replicate: Installment automation, risk scoring, and merchant dashboards.

Market Gaps: Vertical-specific BNPL platforms.

Improvements Founders Can Use: Crypto-linked payments, loyalty tokenization, and real-time underwriting.

Want to build a platform with Afterpay’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Afterpay clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, Miracuves can arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Afterpay’s success proves that fintech growth doesn’t always require charging consumers directly — it can be powered by merchants willing to pay for better conversions and larger order values.

Its blend of technology, psychology, and scale has reshaped digital commerce globally.

For founders, the opportunity lies in specialization and smarter risk engines rather than mass-market competition.

FAQs

1. How much does Afterpay make per transaction?

Afterpay typically earns 3–6% of each merchant transaction, plus a fixed processing fee.

2. What’s Afterpay’s most profitable revenue stream?

Merchant transaction fees generate the majority of revenue.

3. How does Afterpay’s pricing compare to competitors?

It is competitive with Klarna and Affirm, with a stronger focus on merchant-funded revenue.

4. What percentage does Afterpay take from providers?

Around 3–6% per sale, depending on region and volume.

5. How has Afterpay’s revenue model evolved?

It expanded from pure BNPL into a commerce and merchant discovery platform.

6. Can small platforms use similar models?

Yes, especially in niche industries or regional markets.

7. What’s the minimum scale for profitability?

Typically thousands of active users and strong merchant partnerships.

8. How to implement similar revenue models?

Build installment logic, merchant dashboards, and automated risk scoring.

9. What are alternatives to Afterpay’s model?

Interest-based BNPL or subscription-based fintech services.

10. How quickly can similar platforms monetize?

Many platforms generate revenue within the first 30–60 days after onboarding merchants.