HeyGen, a leading AI video generation platform, is revolutionizing how businesses create professional video content using photorealistic avatars and automated workflows. In 2025, HeyGen reached an estimated Annual Recurring Revenue (ARR) of $95–$100 million, fueled by subscription growth, usage fees, and enterprise adoption across global markets.

For entrepreneurs, HeyGen’s model is a prime example of combining predictable SaaS revenue with usage-based monetization. This hybrid approach enables both individual creators and enterprises to scale their use while maximizing customer lifetime value.

By analyzing HeyGen’s revenue streams, fee structures, and monetization strategies, founders can learn how to design scalable platforms that generate revenue from day one. Opportunities exist to replicate modular pricing, upsell premium features, and capture enterprise clients while maintaining high retention rates.

HeyGen Revenue Overview – The Big Picture

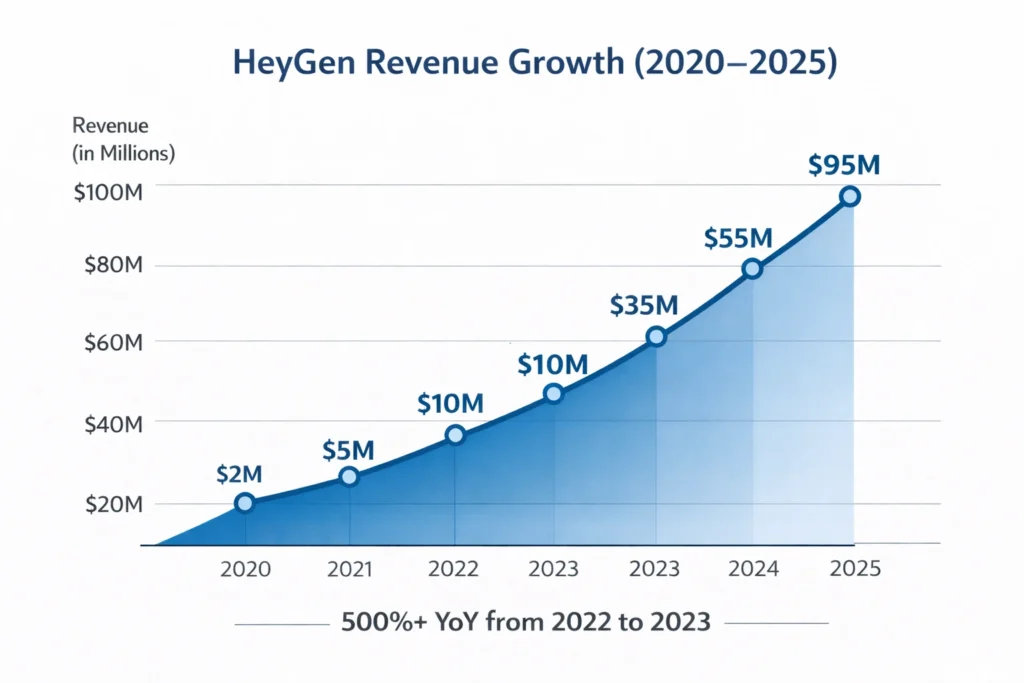

- 2025 Revenue: $95M–$100M ARR

- Valuation: ~$500M

- YoY Growth: Rapid increase from ~$35M in 2024

- Revenue by Region: Strong in North America, Europe, and APAC due to multi-language support and enterprise integrations

- Profit Margins: Healthy gross margins for an AI SaaS platform

- Competition Benchmark: Competes with AI video platforms such as Synthesia and Runway, with differentiation in multi-language and enterprise features

Read More: What Is HeyGen? A Simple Guide to Creating AI Talking Videos

Primary Revenue Streams Deep Dive

| Revenue Stream | % Share (2025 est.) | Description |

|---|---|---|

| Subscription Fees (SaaS) | 60% | Tiered plans from free to Enterprise for video creation |

| Usage/Credit-Based Video Fees | 20% | Credits for video generation and translations |

| Enterprise Contracts | 10% | Custom pricing, dedicated support, and SLAs |

| API/Developer Revenue | 5% | Embedded video features for third-party platforms |

| Add-ons & Premium Features | 5% | Custom avatars, advanced voices, and real-time tools |

The Fee Structure Explained

| Fee Type | Applies To | Notes |

|---|---|---|

| Base Subscription Fees | All Users | Tiered from free to Enterprise |

| Credit/Usage Fees | Pay-Per-Use | Charged per video/minute or translation credit |

| Enterprise Custom Pricing | Enterprise | Negotiated pricing and dedicated support |

| API Usage Fees | Developers | Billed by API calls and usage volume |

| Premium Feature Add-ons | All Users | Optional upgrades for advanced features |

Key Insights:

- User-Side Fees: Monthly/annual subscriptions with tiered access

- Provider-Side Fees: API usage and pay-per-video consumption

- Hidden Revenue Layers: Premium avatars, advanced voice packs, and feature upsells

- Regional Pricing Variation: Enterprise pricing may differ across geographies

How HeyGen Maximizes Revenue Per User

- Segmentation: Plans target individual creators, teams, and enterprises

- Upselling: Advanced features like custom avatars increase ARPU

- Cross-Selling: Bundling video generation with translations and API access

- Dynamic Pricing: Usage credits allow revenue to scale with customer needs

- Retention Monetization: Regular feature updates and improvements drive stickiness

- LTV Optimization: Enterprise multi-year contracts boost lifetime value

- Psychological Pricing: Freemium entry encourages upgrades to paid tiers

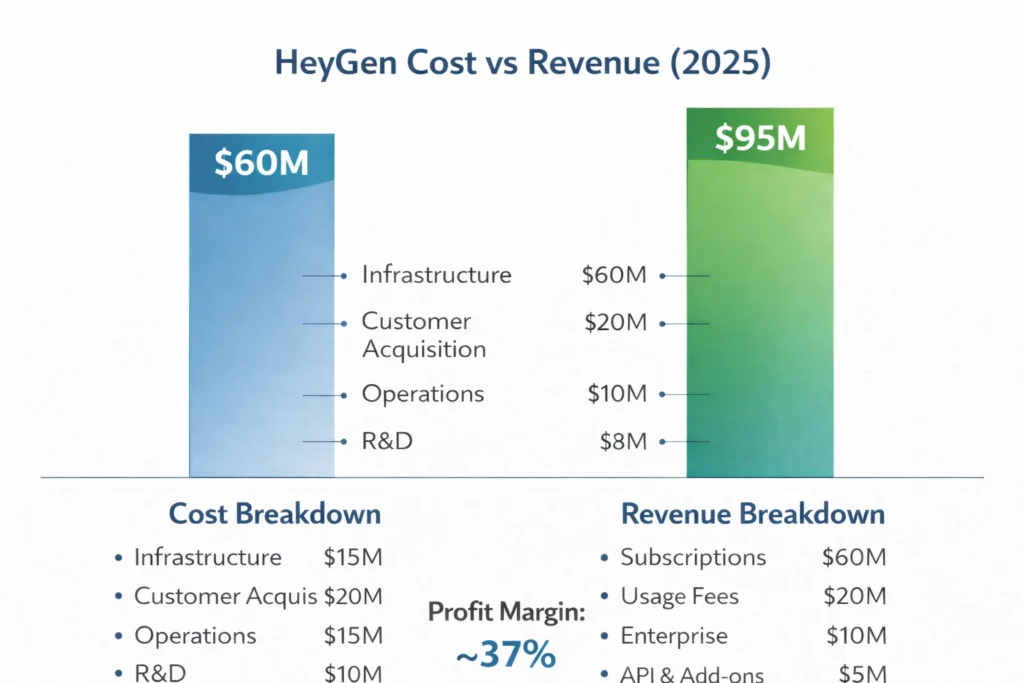

Cost Structure & Profit Margins

- Infrastructure Cost: Cloud GPU processing for AI video generation

- CAC & Marketing: Targeted digital campaigns and partnerships with creators

- Operations: Customer support, localization, and compliance teams

- R&D: AI model training, real-time avatar capabilities, and new features

- Unit Economics: Subscription + usage fees allow strong scalable margins

- Margin Optimization: Enterprise contracts and add-ons increase gross margin

- Profitability Path: Balanced reinvestment in R&D with ARR growth

Future Revenue Opportunities & Innovations

- New Streams: Interactive real-time avatars, livestream AI tools

- AI/ML Monetization: Predictive templates and automatic video optimization

- Market Expansions: Global enterprise adoption in e-learning, marketing, and corporate communications

- Predicted Trends 2025–2027: Integration of AI video into CRM, streaming platforms, and virtual events

- Risks & Threats: Platform reliability, usage transparency, and competition

- Opportunities for Founders: Industry-specific video tools and modular SaaS integrations

Lessons for Entrepreneurs & Your Opportunity

- What Works: Hybrid SaaS + usage-based revenue drives predictability and scale

- What to Replicate: Tiered plans, pay-per-use, and enterprise contracts

- Market Gaps: Simplified onboarding and vertical-specific solutions are underdeveloped

- Improvements Founders Can Use: Clear usage reporting, add-on monetization, and enhanced enterprise support

“Want to build a platform with HeyGen’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our HeyGen clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.”

Final Thought

HeyGen’s success demonstrates the power of combining SaaS subscriptions with usage-based monetization in a rapidly growing AI video market. Its approach enables both creators and enterprises to scale usage while maximizing lifetime value.

Entrepreneurs can apply these lessons to design platforms with modular pricing, flexible tiers, and upsell opportunities, achieving predictable revenue and scalable growth.

The future of generative AI content rewards companies that provide easy-to-use platforms with enterprise-ready features. Miracuves empowers founders to transform these insights into fully functional, revenue-ready clone platforms within days.

FAQs

1. How much does HeyGen make per video?

Revenue varies by subscription tier and usage credits purchased.

2. What’s HeyGen’s most profitable revenue stream?

Subscription fees from Team and Enterprise plans.

3. How does HeyGen’s pricing compare to competitors?

Tiered pricing with usage-based add-ons is competitive.

4. What percentage does HeyGen take from developers?

API usage fees vary based on volume.

5. How has HeyGen’s revenue model evolved?

From freemium to hybrid subscription + usage pricing.

6. Can small companies use similar models?

Yes, hybrid SaaS + usage works well at smaller scales.

7. What’s the minimum scale for profitability?

When recurring subscriptions cover cloud processing costs.

8. How to implement similar revenue models?

Use tiered subscriptions, pay-per-use billing, and enterprise contracts.

9. What are alternatives to HeyGen’s model?

Pure subscription, per-minute billing, or API-only pricing.

10. How quickly can similar platforms monetize?

ARR can be generated within 3–6 months with proper tiering and upsells.