From a mobile-first experiment to a publicly listed insurtech brand, Root Insurance changed how auto insurance works by replacing demographics with driving behavior. By leveraging smartphone telematics and AI risk scoring, Root proved that safer drivers deserve lower premiums and that software can outperform traditional actuarial models. For entrepreneurs in 2026, this shift is more than a success story—it is a blueprint.

The global usage-based insurance market crossed multi-billion-dollar valuation and continues growing at double-digit CAGR as drivers demand fair pricing and regulators support data-driven underwriting. Venture funding in insurtech remains strong, with telematics-led platforms attracting consistent late-stage investments due to predictable recurring premiums and strong retention. This makes a Root Insurance Clone Script model one of the most attractive opportunities for founders targeting fintech-insurance convergence in 2026.

Understanding the Root Insurance clone model matters because it sits at the intersection of AI, mobile data, and regulated finance. A well-built Root Insurance Clone Development strategy allows startups to enter niche auto insurance markets, partner with carriers, and scale digitally without legacy overhead. With Miracuves Clone Solutions, entrepreneurs can deploy a production-ready Root Insurance clone that is compliant, scalable, and optimized for modern driver expectations—without reinventing the entire insurance stack.

What Makes a Great Root Insurance Clone in 2026

A great Root Insurance clone is not just an app that tracks driving behavior. In 2026, it is a full-scale insurtech platform that blends real-time telematics, AI-powered underwriting, and seamless policy management into one reliable ecosystem. Entrepreneurs often underestimate the technical depth required to replicate Root’s success. The real differentiator lies in how accurately the platform collects driving data, converts it into fair risk scores, and delivers instant insurance decisions without friction.

Performance and scalability are non-negotiable. A modern Root Insurance clone must process thousands of driving events per second while maintaining an average response time under 300ms. Uptime expectations have reached 99.9% as users rely on the app daily for trip tracking, policy updates, and claims assistance. UI and UX also play a decisive role—drivers expect a clean, minimal interface that clearly shows how their driving impacts premiums, fostering trust and long-term engagement.

Monetization strength defines whether a clone becomes a real business. In 2026, successful Root-style platforms monetize through monthly premiums, dynamic pricing upgrades, add-on coverage, and data-driven cross-sell opportunities. A great clone is built with flexibility, allowing insurers and startups to adapt pricing logic as regulations and markets evolve. Miracuves designs its Root Insurance Clone Development framework to support this adaptability from day one.

Key elements that define a great Root Insurance clone in 2026 include:

• Real-time telematics data capture using smartphone sensors and optional OBD integrations

• AI-driven risk scoring models that update dynamically with each trip

• Transparent premium calculations that users can understand and trust

• Cross-platform mobile apps with consistent performance on iOS and Android

• Enterprise-grade security with end-to-end encryption and regulatory compliance

• Modular monetization layers for future product expansion

Beyond core functionality, advanced technology sets modern clones apart. AI automation handles driving behavior classification, fraud detection, and claims triage. Blockchain-backed audit trails are increasingly adopted to ensure transparency in policy changes and claims decisions. Cross-platform integration with payment gateways, identity verification APIs, and regulatory reporting tools ensures the platform can operate globally with minimal friction.

| Feature Area | Traditional Insurance Apps | Modern Root Insurance Clones 2026 |

|---|---|---|

| Risk Assessment | Demographics-based | AI + driving behavior scoring |

| Data Processing | Batch-based | Real-time under 300ms |

| Transparency | Low | High, driver-visible scoring |

| Scalability | Limited | Cloud-native, auto-scaling |

| Monetization | Fixed premiums | Dynamic, behavior-based pricing |

Miracuves Clone Solutions are engineered around these differentiators. By combining cloud-native architecture, AI-ready pipelines, and compliance-first design, Miracuves enables entrepreneurs to launch Root Insurance–style platforms that are fast, fair, and future-proof.

Essential Features Every Root Insurance Clone Script Must Have in 2026

When entrepreneurs study Root Insurance’s rise, they often focus on telematics alone. In reality, the platform’s success comes from how multiple functional layers work together to deliver trust, convenience, and measurable value. A Root Insurance clone in 2026 must feel intelligent to users, empowering to administrators, and profitable for the insurance operator. This balance is what separates a functional product from a scalable insurtech business.

On the user side, the experience must be frictionless and educational. Drivers should immediately understand how the app tracks trips, how scores are calculated, and how safer behavior leads to lower premiums. Retention is driven by clarity and rewards, not complexity. A modern Root Insurance clone uses AI-based personalization to show tailored tips, risk alerts, and savings projections, making the app feel like a driving coach rather than an insurer.

From the admin perspective, control and visibility are critical. Founders and insurers need a powerful dashboard that offers real-time analytics, automated underwriting rules, claims oversight, and regulatory reporting. Manual operations increase cost and risk, which is why automation and intelligent alerts are standard in 2026. Miracuves designs admin systems that allow teams to manage thousands of policies with minimal operational overhead.

The service provider or insurer layer completes the ecosystem. This side focuses on earnings management, claims processing, and partner integrations. Real-time data access helps insurers adjust pricing models, detect anomalies, and maintain profitability without sacrificing customer trust.

Core functional layers in a Root Insurance clone include:

• User app for driving behavior tracking, policy management, and rewards

• Admin panel for underwriting rules, analytics, and compliance control

• Insurer dashboard for premium management, claims review, and financial insights

Advanced features now expected in 2026 elevate the platform beyond a basic clone. AI-driven driving behavior classification identifies harsh braking, acceleration, cornering, and phone usage with high accuracy. AR-based onboarding guides users through their first test drive visually, reducing confusion and drop-offs. Blockchain verification adds immutable records for trip data, policy changes, and claims, improving transparency and audit readiness.

Technically, the architecture must be built for scale and security. A production-ready Root Insurance clone handles millions of trip data points daily, supports horizontal scaling, and integrates with third-party APIs such as KYC verification, payment gateways, mapping services, and regulatory reporting tools. Multi-layer security, including data encryption, role-based access, and continuous monitoring, is mandatory for insurance platforms.

| Feature Tier | Basic | Professional | Enterprise |

|---|---|---|---|

| Telematics Tracking | Core driving data | Advanced behavior metrics | AI + OBD + multi-vehicle |

| AI Risk Scoring | Rule-based | ML-assisted | Fully adaptive AI models |

| Admin Analytics | Limited reports | Real-time dashboards | Predictive insights |

| Compliance Tools | Manual | Semi-automated | Fully automated |

| Scalability | Limited users | Regional scale | Global, high-volume |

Miracuves implements all these layers within its Root Insurance Clone Development framework. Entrepreneurs receive a modular, upgrade-ready system that supports early MVP launches as well as enterprise-grade expansion. This ensures founders can start lean and scale confidently without reengineering the platform later.

Cost Factors & Pricing Breakdown

Root Insurance-Like Usage-Based Insurance Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Telematics Insurance MVP | User onboarding, driving data capture, basic risk scoring, policy purchase flows, claims submission, and a simple admin panel. | $90,000 |

| 2. Mid-Level Usage-Based Insurance Platform | Mobile telematics SDK, dynamic pricing logic, driving behavior analytics, notifications, and analytics dashboards. | $200,000 |

| 3. Advanced Root-Level Platform | AI-driven risk modeling, real-time premium adjustments, automated claims settlement, fraud detection, compliance automation, and enterprise-grade scalability. | $380,000+ |

These figures represent the typical global investment required to build a telematics-driven insurance platform similar to Root Insurance, focused on fair pricing based on real driving behavior.

Miracuves Pricing for a Root Insurance-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete usage-based insurance foundation with telematics-ready architecture, driving data ingestion, risk scoring workflows, policy and claims management, compliance-oriented controls, and a centralized admin dashboard — built for scalable insurtech operations.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard and mobile integration, and deployment assistance — allowing you to launch a fully branded Root Insurance-style platform under your own ownership.

Launch Your Usage-Based Insurance Platform — Contact Us Today

Delivery Timeline for a Root Insurance-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Telematics and driving data complexity

- Risk scoring and pricing model depth

- Claims automation and fraud detection

- Compliance, regulatory, and reporting requirements

- Branding and UI/UX customization

- Third-party data and sensor integrations

Tech Stack

Built using a JS-based architecture, ideal for telematics and usage-based insurance platforms that require real-time data ingestion, automated decisioning, scalable APIs, and enterprise-level reliability.

Customization & White-Label Option

Building a Root Insurance–style AI-driven auto insurance and usage-based insurtech platform is not just about selling motor insurance — it’s about creating a data-first insurance ecosystem where driving behavior, risk analytics, underwriting, claims, and customer experience are tightly integrated. A platform inspired by Root Insurance must leverage telematics, AI-based scoring, automation, and compliance to deliver fair pricing and fast, transparent insurance services.

Miracuves delivers a fully white-label Root Insurance–style solution designed for insurtech startups, digital insurers, mobility platforms, and embedded insurance providers aiming to launch behavior-based insurance products under their own brand. Every layer of the system can be customized to fit your insurance model, region, and regulatory framework.

Why Customization Matters

Usage-based and AI-driven insurance platforms vary based on:

- Insurance type (auto, fleet, ride-hailing, delivery vehicles, micro-mobility)

- Telematics data sources (mobile sensors, GPS, vehicle APIs)

- Risk scoring logic

- Claims automation depth

- Regional insurance regulations

- Customer engagement strategy

Customization ensures your platform aligns with your underwriting philosophy, your data strategy, and your compliance boundaries, rather than relying on rigid insurance workflows.

What You Can Customize

1. Mobile App & Driver Experience

- Branded driver mobile apps

- Driving-behavior tracking dashboards

- Trip history and score visibility

- Gamified safety insights

- Personalized insurance recommendations

2. Telematics & Data Collection

- GPS-based trip tracking

- Accelerometer and gyroscope data capture

- Speeding, braking, and cornering analysis

- Custom scoring weightage rules

- Data anonymization and storage controls

3. AI-Based Risk Scoring & Underwriting

- Driver risk scoring models

- Dynamic premium calculations

- Policy eligibility automation

- Fraud detection signals

- Continuous risk re-evaluation

4. Policy Management System

- Auto policy creation and lifecycle management

- Coverage selection and customization

- Policy renewals and upgrades

- Add-ons and endorsements

- Policy cancellation workflows

5. Claims Automation

- Digital claims filing via app

- Photo and video upload for damage assessment

- AI-assisted claim validation

- Automated approvals or manual escalation

- Claims payout workflows

6. Payments & Premium Handling

- Premium collection and renewals

- Refund handling

- Claims payout management

- Integration with payment gateways and banking rails

7. Compliance & Regulatory Controls

- KYC and identity verification

- Policy disclosures and consent management

- Audit logs and reporting readiness

- Data privacy and encryption controls

8. Admin & Operations Dashboards

- Policy performance analytics

- Risk exposure monitoring

- Claims ratio and loss tracking

- Driver behavior insights

- Configurable underwriting controls

9. Integrations & Extensions

- Vehicle data providers

- Repair network integrations

- Identity and fraud services

- CRM and customer support tools

- Analytics and BI platforms

10. White-Label Branding

- Complete UI rebranding

- Custom domains and app branding

- Branded notifications and communications

- App store–ready mobile builds

How Miracuves Handles Customization

- Requirement Mapping

We define your insurance product scope, telematics strategy, and regulatory region. - Architecture Planning

Modular framework covering data capture → risk scoring → underwriting → policy management → claims → payouts. - Design & Development

Custom scoring logic, dashboards, automation workflows, and branded UI built to your specifications. - Testing & Quality Assurance

Driving simulation tests, scoring accuracy validation, claims-flow testing, and compliance checks. - Deployment

A fully white-labeled, AI-powered insurance platform deployed with customer apps, admin dashboards, and operational tools.

Real Examples from the Miracuves Portfolio

Miracuves has delivered 600+ fintech and insurtech platforms, including:

- Usage-based insurance systems

- AI-driven underwriting engines

- Digital claims automation platforms

- Fleet and mobility insurance solutions

- White-label insurtech ecosystems

These implementations demonstrate how a Root Insurance–style concept can be transformed into a scalable, compliant, and data-driven insurance platform, fully owned and branded by your business.

Launch Strategy & Market Entry Guide for Root Insurance Clones

Launching a Root Insurance clone requires more than just development; it demands a well-planned market entry strategy. Entrepreneurs must balance compliance, marketing, and technical readiness to capture early users and scale efficiently. Miracuves provides end-to-end guidance, ensuring startups go from idea to revenue within the 30–90 days launch window.

Pre-Launch Checklist

- Testing & QA: Simulate driving events, verify AI scoring accuracy, ensure policy calculations match regulations.

- Compliance & Licensing: Validate KYC, telematics consent, regional insurance regulations.

- App Store Setup: Prepare iOS and Android listings with optimized metadata and localized content.

- Marketing Prep: Build landing pages, email campaigns, and influencer partnerships for early adoption.

Regional Entry Strategies

| Region | Approach | Notes |

|---|---|---|

| Asia | Partner with regional insurers, leverage mobile-first adoption | High smartphone penetration, emerging insurtech |

| MENA | Focus on regulatory-friendly fintech hubs | Tailored policies for expat drivers |

| Europe | Emphasize transparency and GDPR compliance | Users demand clear privacy policies |

| U.S. | Target urban drivers with safe driving rewards | Mature insurance market, competitive landscape |

User Acquisition Framework

- Influencer Campaigns: Partner with popular automotive and tech influencers to reach early adopters.

- Referral Loops: Offer discounts or rewards for users who invite friends to the app.

- Retention Funnels: Implement AI-driven tips, gamification, and loyalty points to keep users engaged.

Monetization Models Proven in 2026

- Usage-Based Premiums: Adjust rates based on real-time driving data.

- Add-On Coverage: Offer accident protection, roadside assistance, or family plan upgrades.

- Data Insights Licensing: Provide anonymized driving trend data to fleet managers or insurers.

Miracuves End-to-End Launch Support

- Cloud server setup and auto-scaling configuration

- Integration of KYC, payment, and mapping APIs

- First 90-day growth roadmap with marketing and retention strategy

- Ongoing monitoring for uptime, AI scoring accuracy, and app performance

By combining strategic planning with technical expertise, Miracuves ensures your Root Insurance clone is not just built but launched for measurable success.

Why Choose Miracuves for Your Root Insurance Clone

When launching a Root Insurance clone, the difference between a functioning app and a thriving insurtech business lies in expertise, speed, and trust. Miracuves has positioned itself as the go-to partner for entrepreneurs looking to disrupt auto insurance in 2026. With over 600 successful deployments across fintech, mobility, and insurtech, the company blends deep technical knowledge with startup-focused guidance.

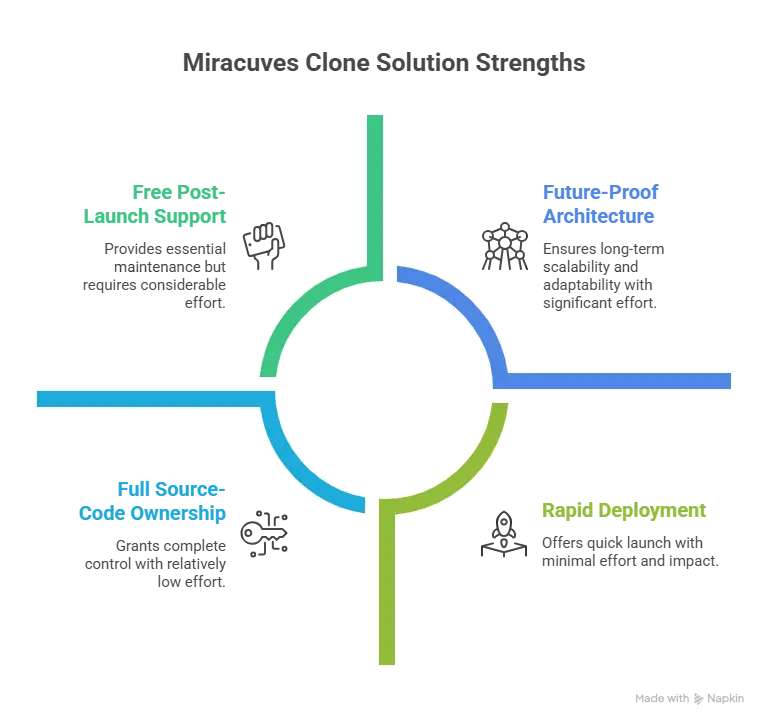

Key Strengths of Miracuves Clone Solutions:

- Rapid Deployment: Launch your clone in just 30–90 days without compromising quality.

- Free Post-Launch Support: 60 days of complimentary maintenance ensures smooth adoption.

- Full Source-Code Ownership: Complete control over your platform and future updates.

- Future-Proof Architecture: Cloud-native, AI-ready, and modular for scalability.

- Proven ROI: Optimized for usage-based insurance monetization and retention strategies.

Success Stories:

- A U.S.-based startup launched a telematics-driven auto insurance clone within 45 days, capturing 5,000 early users and achieving $120K ARR in the first 3 months.

- A fleet management company in Europe integrated Miracuves’ Root Insurance clone with corporate driving policies, improving driver safety scores by 25% within 90 days.

- A Southeast Asian mobility startup deployed a white-labeled clone with AI-based risk scoring, reducing underwriting time from days to minutes and improving premium fairness.

Miracuves is not just a development provider; it is a trusted partner guiding entrepreneurs through the technical, regulatory, and growth challenges of the insurtech market.

Final Thought

Launching a Root Insurance clone in 2026 is more than replicating an app—it’s about understanding the business logic that makes usage-based insurance successful and leveraging technology to deliver value at scale. By combining AI-driven telematics, secure policy management, and user-centric design, entrepreneurs can create platforms that are both profitable and trusted by drivers.

Miracuves Clone Solutions empower founders to move fast without compromising quality, compliance, or scalability. With production-ready architecture, customizable features, and white-label flexibility, startups can focus on growth, user acquisition, and market leadership rather than rebuilding core technology. Understanding the nuances of Root Insurance’s model and executing with a partner like Miracuves allows entrepreneurs to launch faster, scale smarter, and dominate niche auto insurance markets with confidence.

Ready to launch your Root Insurance clone? Get a free consultation and detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Root Insurance clone?

Miracuves can deploy a fully functional Root Insurance clone within 30–90 days, depending on customization and enterprise requirements.

What’s included in the Miracuves clone package?

The package includes user app (iOS & Android), admin panel, insurer/service provider dashboard, AI-driven telematics, analytics, compliance modules, and optional white-label branding.

Can I get full source-code access?

Yes, Miracuves provides full source-code ownership, allowing you to modify, scale, and rebrand your platform freely.

How does Miracuves ensure scalability?

The clone is built with cloud-native architecture, auto-scaling capabilities, and modular APIs to support millions of trips and policies without performance issues.

Does Miracuves assist with app store approval?

Yes, Miracuves helps configure listings, optimize metadata, and ensure compliance with App Store and Google Play guidelines.

Is post-launch maintenance included?

Miracuves provides 60 days of free post-launch support, covering bug fixes, performance monitoring, and minor enhancements.

Can Miracuves integrate custom payment gateways?

Absolutely. The platform supports third-party payment APIs, wallets, and regional payment providers as required.

What’s the upgrade/update policy?

You can request feature upgrades, AI improvements, or compliance updates at any time. Miracuves’ modular architecture allows smooth, non-disruptive updates.

How does white-labeling work?

Miracuves can deliver a fully white-labeled clone where all branding, dashboards, and documents reflect your company, not Miracuves.

What kind of ongoing support can I expect?

Beyond the free 60-day support, Miracuves offers optional extended maintenance plans including security monitoring, AI model updates, and new feature deployment.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Robinhood Clone Scripts 2026 — Build a Modern Trading App That Scales

- Best Tipalti Clone Scripts 2026 – Build a Global Payables Automation Platform with Miracuves

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Lemonade Clone Scripts 2026 to Launch a Digital Insurance Startup Faster

- Best Acorns Clone Scripts 2025 – Launch Your Micro-Investing App Fast

- Best Groww Clone Scripts 2026: Launch a Powerful Investment & Trading Platform Fast