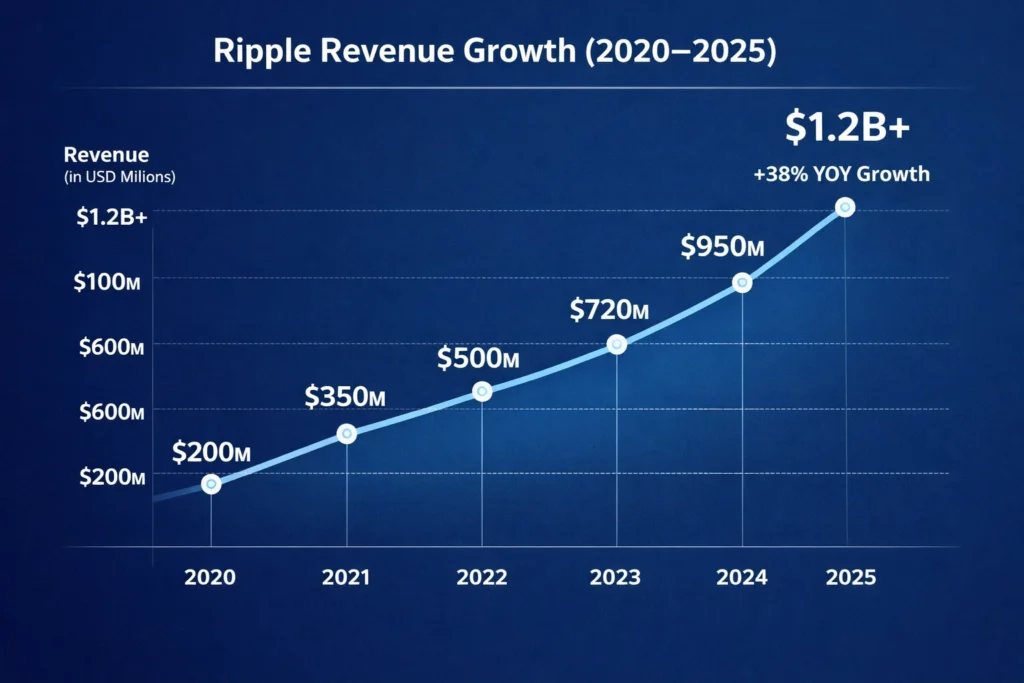

In 2025, Ripple crossed an estimated $1.2 billion in annual revenue, powered by global bank adoption and enterprise blockchain infrastructure. Its growth is driven by long-term institutional contracts, rising cross-border transaction volumes, and increasing demand for real-time settlement systems in emerging and high-remittance corridors. The company’s ability to bundle software, liquidity, and compliance into a single platform has positioned it as a preferred alternative to traditional international payment rails.

For founders, Ripple isn’t just a crypto company — it’s a financial rails business quietly replacing legacy SWIFT-style systems across continents. Its success comes from embedding itself into bank operations, treasury workflows, and government pilot programs, creating high switching costs and multi-year revenue visibility. This approach shows how infrastructure-first platforms can outscale consumer apps by focusing on enterprise dependency rather than mass-market acquisition.

This revenue model shows how deep B2B fintech platforms scale, lock in institutions, and monetize transactions at national and global levels — not just per user. Ripple demonstrates how layering SaaS subscriptions, transaction-based fees, and compliance services builds predictable, compounding revenue streams. For new founders, it highlights the power of targeting regulated industries where trust, reliability, and long-term partnerships matter more than rapid user growth.

Ripple Revenue Overview – The Big Picture

2025 Revenue: ~$1.2B

Valuation: ~$15–18B (private market estimates)

YoY Growth: ~38%

Revenue by Region:

- Asia-Pacific: 41%

- Europe: 29%

- North America: 22%

- Middle East & Africa: 8%

Profit Margins: Estimated 32–38% EBITDA (high-margin SaaS + infrastructure mix)

Competition Benchmark:

- SWIFT (legacy financial messaging)

- Stellar (blockchain payments)

- Visa B2B Connect

- JPM Coin (bank-native blockchain)

Ripple operates more like a global financial infrastructure provider than a traditional crypto company — selling rails, liquidity, and compliance-ready blockchain systems to institutions.

Read More: Ripple Explained – XRP, Cross-Border Payments & Crypto Infrastructure

Primary Revenue Streams Deep Dive

Revenue Stream #1: RippleNet Enterprise Licensing

How it works: Banks and payment providers pay licensing and integration fees to use Ripple’s global blockchain settlement network.

% Share: ~42%

Pricing: $50,000–$500,000 per institution annually

2025 Data: Over 350+ institutional clients across 70+ countries

Revenue Stream #2: On-Demand Liquidity (ODL) Fees

How it works: Ripple charges transaction-based fees for real-time cross-border settlement using XRP as a bridge currency.

% Share: ~27%

Pricing: 0.1%–0.4% per transaction

2025 Data: Processing $30B+ in annual transaction volume

Revenue Stream #3: XRP Ecosystem Monetization

How it works: Revenue from XRP-related services, enterprise custody tools, and developer infrastructure.

% Share: ~15%

Pricing: Platform usage fees + enterprise custody contracts

2025 Data: Institutional XRP adoption grew 52% YoY

Revenue Stream #4: Blockchain Infrastructure Services

How it works: Private ledger deployment, compliance layers, and CBDC sandbox solutions for governments and central banks.

% Share: ~10%

Pricing: $100,000–$2M per deployment

2025 Data: Active pilots in 15+ countries

Revenue Stream #5: Strategic Partnerships & Integrations

How it works: Revenue-sharing agreements with banks, remittance platforms, and fintech ecosystems.

% Share: ~6%

Pricing: Volume-based profit splits

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share | Annual Revenue Contribution (2025) |

|---|---|---|

| Enterprise Licensing | 42% | ~$504M |

| ODL Transaction Fees | 27% | ~$324M |

| XRP Ecosystem Tools | 15% | ~$180M |

| Government & CBDC Infrastructure | 10% | ~$120M |

| Strategic Partnerships | 6% | ~$72M |

The Fee Structure Explained

User-Side Fees

- Retail wallet usage: Free or minimal network fees

- Enterprise dashboards: Subscription-based

Provider-Side Fees

- Banks & PSPs: Annual licensing + per-transaction settlement fees

- Government clients: Deployment + maintenance contracts

Hidden Revenue Layers

- Compliance modules

- Liquidity optimization tools

- Data analytics dashboards

- Transaction risk scoring APIs

Regional Pricing Variation

- Asia: Volume-based discount pricing

- Europe: Compliance-heavy premium packages

- Middle East: Infrastructure-first contracts

Complete Fee Structure by User Type

| User Type | Fee Type | Price Range |

|---|---|---|

| Retail Users | Network fees | <$0.01 per tx |

| Banks | Licensing + tx fees | $50K–$500K/year + % |

| Payment Providers | Volume-based | 0.1%–0.3% per tx |

| Governments | Infrastructure | $100K–$2M/project |

| Developers | API access | Freemium → $10K+/month |

How Ripple Maximizes Revenue Per User

Ripple doesn’t chase volume — it deepens institutional dependency.

Segmentation: Banks, fintechs, governments, enterprises

Upselling: Compliance tools, analytics dashboards, private ledger hosting

Cross-selling: ODL + custody + reporting tools

Dynamic Pricing: Transaction volume-based pricing tiers

Retention Monetization: Long-term contracts (3–7 years)

LTV Optimization: Switching costs built into system integration

Psychological Pricing: Positioning as “infrastructure,” not software

Real Data Example: Average enterprise client lifetime value exceeds $2M+

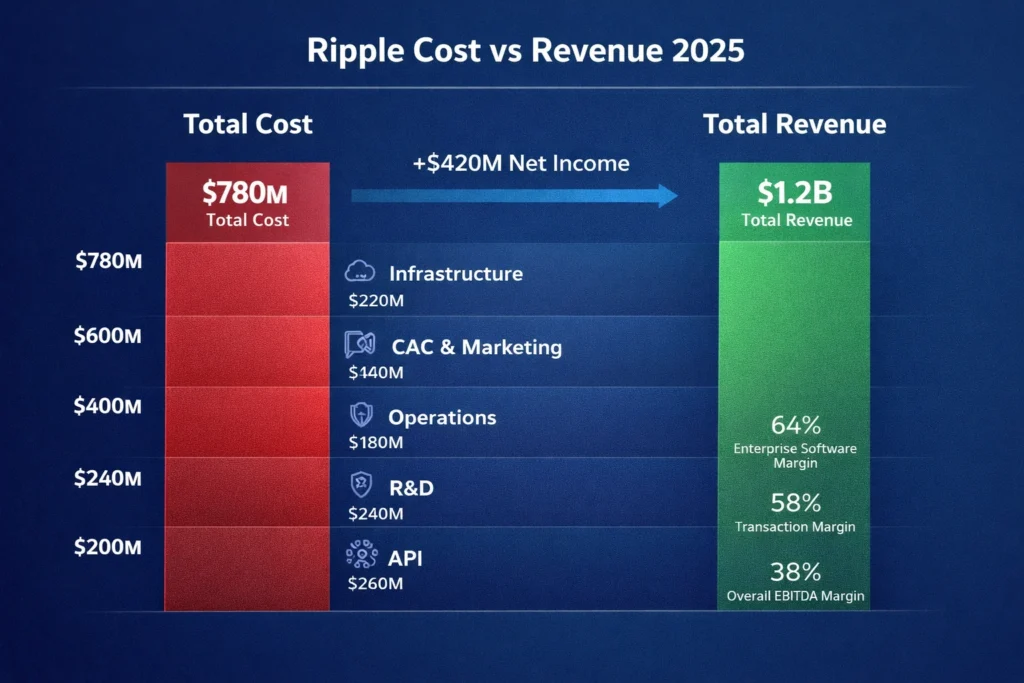

Cost Structure & Profit Margins

Infrastructure Cost: Global node hosting, security, cloud, blockchain scaling (~18%)

CAC & Marketing: Enterprise sales teams, compliance onboarding (~12%)

Operations: Legal, regulatory, compliance (~15%)

R&D: Blockchain, AI risk scoring, CBDC systems (~20%)

Unit Economics:

- Average transaction margin: 60%+

- Enterprise software margin: 70%+

Margin Optimization:

- Automation of compliance checks

- AI-powered liquidity routing

- Regional cloud cost balancing

Profitability Path: Ripple remains profitable due to SaaS-style contracts layered on transaction infrastructure.

Read More: Best Ripple Clone Script 2026 | A Cross-Border Payment Platform

Future Revenue Opportunities & Innovations

New Streams:

- AI-driven fraud prevention services

- Central bank digital currency platforms

- Tokenized asset settlement networks

AI/ML-Based Monetization:

- Predictive liquidity routing

- Smart compliance scoring

- Automated FX optimization

Market Expansions:

- Africa and LATAM remittance corridors

- Government treasury systems

- Institutional DeFi gateways

Predicted Trends 2025–2027:

- CBDC infrastructure contracts explode

- Tokenized bonds and securities settlement

- AI-powered cross-border finance

Risks & Threats:

- Regulatory shifts

- Stablecoin competition

- Bank-native blockchain systems

Opportunities for New Founders:

- Regional Ripple-like networks

- SME-focused settlement platforms

- Crypto-fiat bridge services

Lessons for Entrepreneurs & Your Opportunity

What Works:

- Infrastructure-first positioning

- Long-term institutional contracts

- Multi-layer monetization

What to Replicate:

- Transaction + SaaS hybrid revenue

- Compliance as a premium feature

- Switching cost strategies

Market Gaps:

- SME cross-border platforms

- Local currency liquidity networks

- AI-based compliance fintechs

Founder Improvements:

- Faster onboarding systems

- No-code finance APIs

- Vertical-specific settlement platforms

Want to build a platform with Ripple’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Ripple clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Ripple proves that the most powerful fintech businesses don’t compete for users — they become invisible financial infrastructure that institutions rely on daily.

For founders, this model highlights how long-term contracts, regulatory alignment, and transaction-layer monetization can outperform traditional app-based growth strategies.

The real opportunity isn’t just copying Ripple — it’s building localized, vertical-specific financial rails for industries, regions, and emerging digital economies.

FAQs

1. How much does Ripple make per transaction?

Ripple typically earns 0.1%–0.4% per enterprise settlement transaction.

2. What’s Ripple’s most profitable revenue stream?

Enterprise licensing and government infrastructure contracts.

3. How does Ripple’s pricing compare to competitors?

It’s cheaper than SWIFT for cross-border payments but more premium than open blockchain networks.

4. What percentage does Ripple take from providers?

Usually 0.1%–0.3% depending on transaction volume and region.

5. How has Ripple’s revenue model evolved?

It shifted from XRP-based income to enterprise infrastructure and government contracts.

6. Can small platforms use similar models?

Yes, on a regional or industry-specific scale.

7. What’s the minimum scale for profitability?

Roughly $5M–$10M in annual transaction volume with SaaS contracts.

8. How to implement similar revenue models?

Combine transaction fees, enterprise subscriptions, and compliance tools.

9. What are alternatives to Ripple’s model?

SWIFT-style messaging platforms, Stellar-based networks, or stablecoin rails.

10. How quickly can similar platforms monetize?

Some platforms begin generating revenue within 30–60 days post-launch.