Robinhood crossed an estimated $2.2 billion in annual revenue in 2025, reinforcing its position as one of the most influential fintech platforms shaping how retail investors interact with global markets. What began as a commission-free trading app has evolved into a multi-layered financial ecosystem spanning stocks, crypto, cash management, and premium financial services.

For founders, Robinhood’s model shows how accessibility can become a growth engine when paired with smart financial infrastructure. The company didn’t simply remove trading fees — it built alternative monetization paths that scale with user activity, asset growth, and market volatility.

Understanding how Robinhood turns millions of small transactions into a high-margin revenue machine gives entrepreneurs a real-world blueprint for building profitable, trust-driven fintech platforms in competitive markets.

Robinhood Revenue Overview – The Big Picture

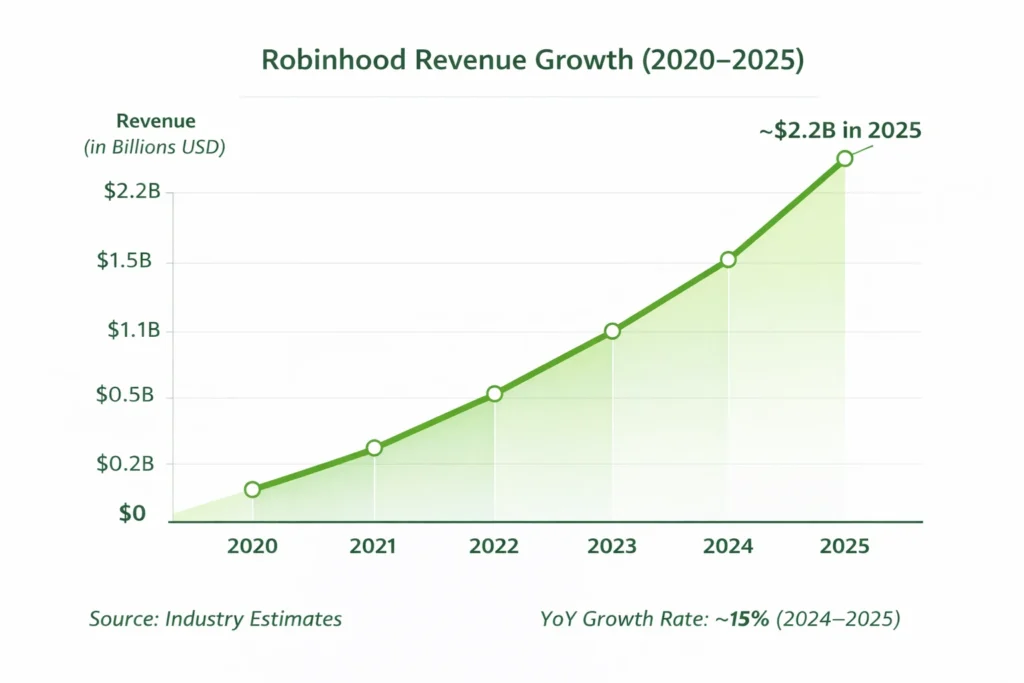

2025 Revenue: ~$2.2B

Valuation: ~$11–13B (market-based estimates)

YoY Growth: ~15% (2024–2025)

Revenue by Region:

- United States: 82%

- Europe: 10%

- Asia-Pacific: 6%

- Rest of World: 2%

Profit Margins: Estimated 22–28% (improving with higher net interest income and subscription revenue)

Competition Benchmark: Competes with E*TRADE, Webull, eToro, Coinbase (crypto), and traditional brokerage platforms

Read More: Discover How Robinhood Works – Invest With Zero Commissions

Primary Revenue Streams Deep Dive

Revenue Stream #1 — Trading-Based Income (38%)

Robinhood earns through payment for order flow (PFOF), where market makers pay for executing trades. While users trade commission-free, Robinhood captures revenue per transaction behind the scenes. In 2025, this stream contributed roughly $830 million, heavily influenced by equity and options trading volume.

Revenue Stream #2 — Net Interest Revenue (32%)

Cash balances, margin loans, and securities lending generate interest income. Robinhood Gold users often hold higher balances, increasing this stream. Estimated $700 million+ in 2025, making it one of the most stable and scalable revenue drivers.

Revenue Stream #3 — Crypto Transactions (18%)

Trading fees and spreads on cryptocurrency transactions surged during periods of high market activity, contributing approximately $400 million in 2025.

Revenue Stream #4 — Subscription Revenue (8%)

Robinhood Gold, priced at around $5–$10/month, provides margin access, premium analytics, and higher interest rates on uninvested cash, generating consistent recurring revenue.

Revenue Stream #5 — Ancillary Financial Services (4%)

Includes debit cards, cash management services, and partner financial products.

Revenue Streams Percentage Breakdown (2025)

| Revenue Stream | % Share | Annual Revenue (USD) | Pricing Model |

|---|---|---|---|

| Trading-Based Income | 38% | ~$836M | Payment for order flow |

| Net Interest Revenue | 32% | ~$704M | Interest spread / lending |

| Crypto Transactions | 18% | ~$396M | Trading fees / spreads |

| Subscriptions (Gold) | 8% | ~$176M | Monthly recurring |

| Ancillary Services | 4% | ~$88M | Service & partner fees |

The Fee Structure Explained

User-Side Fees

- Free stock and ETF trades

- Crypto trading spreads

- Robinhood Gold subscription: $5–$10/month

- Margin interest for leveraged accounts

Provider-Side Fees

- Market makers pay per order flow

- Lending partners pay for access to cash balances

Hidden Revenue Layers

- Securities lending

- Idle cash interest arbitrage

- Crypto price spreads

Regional Pricing Variation

- US markets: Full feature set and pricing

- International markets: Limited assets and localized compliance-driven pricing

Complete Fee Structure by User Type

| User Type | Access Level | Pricing Model | Annual Cost Range |

|---|---|---|---|

| Casual Traders | Stocks, ETFs | Free / spreads | $0–$50 |

| Active Traders | Options, crypto, margin | Usage-based + spreads | $100–$1,000+ |

| Gold Members | Premium features | Subscription + margin | $60–$300+ |

| High-Net Users | Advanced access | Interest & service fees | $1,000+ |

How Robinhood Maximizes Revenue Per User

Robinhood segments users by activity, asset size, and risk appetite. New users are guided into trading, while active traders are introduced to margin and options. High-balance users are targeted with Robinhood Gold for better interest rates and analytics.

Upselling occurs through premium research tools, higher interest on idle cash, and leverage features. Cross-selling includes crypto wallets, debit cards, and long-term investment products.

Dynamic pricing adjusts crypto spreads based on volatility, while retention monetization comes from habit-forming features like recurring investments and real-time market alerts.

In 2025, Gold subscribers generated 3–5x higher lifetime value (LTV) compared to free users, driven by margin interest and higher asset retention.

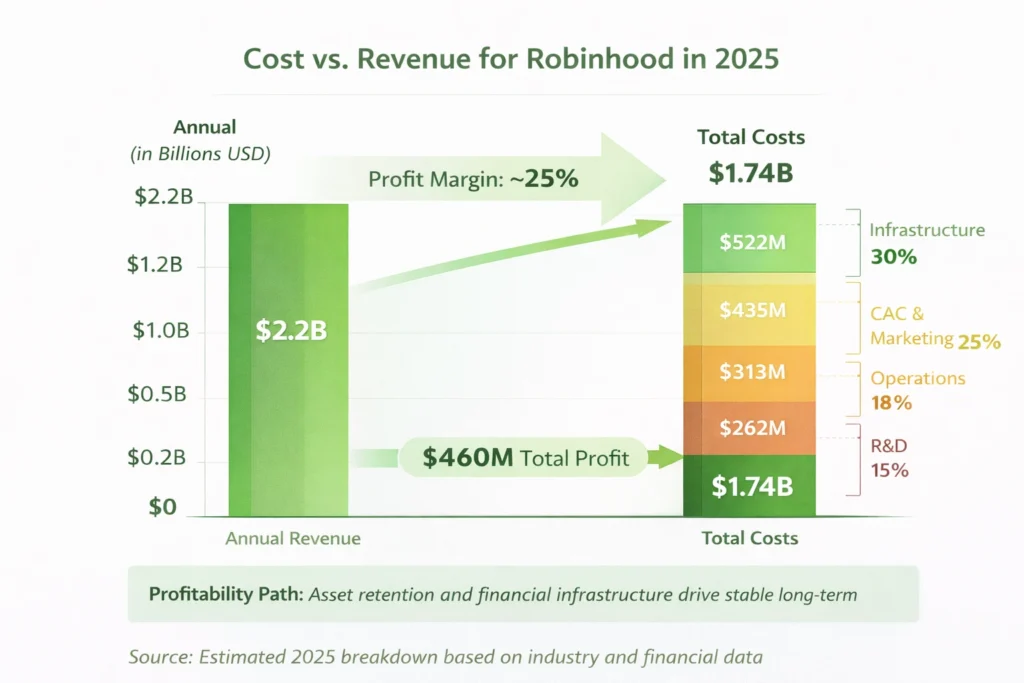

Cost Structure & Profit Margins

Infrastructure Cost

Cloud hosting, real-time market data feeds, and transaction processing consume ~30% of operating expenses.

CAC & Marketing

User acquisition costs range between $40–$120 per funded account, driven by referral programs and digital advertising.

Operations

Compliance, legal, customer support, and regulatory infrastructure account for ~18% of costs.

R&D

Product development and security engineering consume ~15% of revenue.

Unit Economics

A funded user becomes profitable after maintaining an average balance of $2,500–$3,000 for six months.

Margin Optimization

Higher net interest income and subscription adoption improve gross margins year over year.

Profitability Path

Profitability accelerates as assets under custody grow, not just transaction volume.

Read More: Best Robinhood Clone Script 2026 | Secure Trading App Development

Future Revenue Opportunities & Innovations

Robinhood is expanding into retirement accounts, AI-driven portfolio insights, and international market access. AI/ML-based monetization will focus on predictive investment tools and personalized financial coaching.

Market expansion in Europe and Asia, along with tokenized assets and digital wallets, could unlock new revenue streams between 2025–2027. Risks include regulatory pressure on order flow, crypto volatility, and interest rate sensitivity.

For founders, niche investment platforms targeting specific asset classes or regional markets present strong white-label opportunities.

Lessons for Entrepreneurs & Your Opportunity

What works is Robinhood’s ability to make complex financial systems feel simple. The interface hides infrastructure complexity while monetization happens through financial flows users rarely notice.

What to replicate is trust-based growth paired with financial literacy tools that keep users engaged and invested long-term.

Market gaps exist in localized investment platforms for emerging markets where regulatory compliance and user education remain underserved.

Want to build a platform with Robinhood’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Robinhood clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, andif you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Robinhood’s success shows that fintech platforms don’t need to charge users directly to build profitable businesses. Instead, they can monetize financial infrastructure, interest flows, and premium access layered on top of free services.

For entrepreneurs, the deeper lesson is that long-term value comes from building financial ecosystems, not just transaction tools. Platforms that retain assets, trust, and data gain compounding revenue advantages over time.

As digital finance expands globally, founders who combine regulatory strength, intuitive design, and flexible monetization will shape the next generation of high-growth investment platforms.

FAQs

1. How much does Robinhood make per transaction?

It earns a few cents per trade through payment for order flow and crypto spreads, depending on asset type and volume.

2. What’s Robinhood’s most profitable revenue stream?

Net interest revenue from cash balances and margin lending delivers the highest and most stable margins.

3. How does Robinhood’s pricing compare to competitors?

It remains more cost-friendly for retail traders while monetizing through backend financial infrastructure.

4. What percentage does Robinhood take from providers?

It doesn’t take a direct marketplace cut — it earns from market makers and financial partners.

5. How has Robinhood’s revenue model evolved?

It shifted from transaction-heavy income toward interest and subscription-based stability.

6. Can small platforms use similar models?

Yes, especially in regulated markets with strong banking and brokerage partnerships.

7. What’s the minimum scale for profitability?

Most platforms need at least 50,000–100,000 funded users to reach operational breakeven.

8. How to implement similar revenue models?

Combine free trading with backend monetization like interest income, subscriptions, and premium analytics.

9. What are alternatives to Robinhood’s model?

Flat-fee brokerage, robo-advisory subscriptions, or asset-based management fees.

10. How quickly can similar platforms monetize?

With strong onboarding and funding incentives, platforms can see revenue within 30–60 days of launch.