The business model of Remitly showcases how a fintech startup can transform a traditionally inefficient industry through technology and trust. Founded in 2011, Remitly set out to make international money transfers faster, more affordable, and fully transparent for immigrants sending money to their families. By 2026, the company has grown into one of the world’s most trusted digital remittance platforms, serving millions of customers across more than 170 countries.

What differentiates the Remitly business model is its transaction-based, mobile-first approach. Rather than relying on physical locations or high fees, Remitly focuses on real-time FX pricing, localized payout networks, and seamless digital experiences. This strategy allows the platform to scale efficiently while solving core problems such as slow delivery, hidden costs, and lack of reliability.

For entrepreneurs and business leaders, the Remitly business model offers valuable lessons in building scalable fintech platforms. It demonstrates how prioritizing trust, compliance, and user-centric design can unlock sustainable growth in highly regulated global markets.

How the Remitly Business Model Works

Remitly operates a digital-first, transaction-based fintech platform designed to move money across borders with speed, transparency, and trust. At its core, Remitly doesn’t hold customer funds long-term or act like a traditional bank — instead, it orchestrates a two-sided financial ecosystem that connects senders in developed countries with recipients in emerging markets.

What makes Remitly powerful is not just what it offers, but how it structures value, risk, and incentives across its ecosystem.

Core Business Model Framework

Type of Business Model

- Primary: Transaction-based fintech platform

- Secondary: Marketplace-style ecosystem (senders ↔ payout partners)

- Structure: Asset-light, volume-driven, compliance-heavy

Remitly earns by facilitating transactions rather than lending or holding balances, allowing it to scale globally without the balance-sheet risk of traditional financial institutions.

Value Proposition by User Segment

1. Senders (Primary Customers)

- Lower fees than banks and legacy remittance players

- Transparent, real-time FX rates (no hidden markups)

- Fast delivery options (instant, same-day, or economy)

- Mobile-first UX with clear status tracking

2. Recipients

- Multiple payout options: bank deposit, cash pickup, mobile wallets, home delivery (market-dependent)

- Local currency delivery without friction

- High reliability and predictable timing

3. Partners & Institutions

- Increased transaction volume

- Access to Remitly’s global customer base

- Reduced customer acquisition cost via API-driven integrations

Key Stakeholders in the Ecosystem

- Customers (Senders & Recipients): Drive transaction volume

- Banking & Payout Partners: Enable last-mile delivery

- FX & Liquidity Providers: Ensure real-time currency conversion

- Regulators & Compliance Bodies: Maintain trust and legal operation

- Technology Vendors: Support fraud detection, KYC, and scalability

Remitly’s role is to balance trust, speed, cost, and compliance across all these parties — a delicate but defensible position.

Evolution of the Model Over Time

- 2011–2014: Focused on U.S. → emerging market corridors with bank deposits

- 2015–2018: Expanded payout methods (cash pickup, mobile wallets)

- 2019–2021: Heavy investment in fraud prevention, compliance automation, and UX

- 2022–2026: Optimization phase — improved unit economics, corridor expansion, AI-driven risk scoring, and localized experiences

This evolution shows a key insight: Remitly prioritized trust and scale before profitability, then refined margins through technology and volume.

Why This Model Works in 2026

Remitly’s model aligns perfectly with current market realities:

- Rising global migration and remittance demand

- Smartphone penetration in emerging economies

- Consumer preference for transparent, app-based finance

- Regulatory acceptance of licensed digital money transmitters

By staying asset-light and tech-heavy, Remitly scales geographically faster than banks while maintaining strong compliance credibility — a rare combination.

Read more : What is Remitly and How Does It Work?

Target Market & Customer Segmentation Strategy

Remitly’s growth isn’t driven by “everyone who sends money internationally.” It’s driven by deep focus on emotionally motivated, high-frequency users — people sending money to support families, education, healthcare, and daily living.

This clarity around who the customer is has allowed Remitly to scale efficiently while keeping acquisition costs under control.

Primary & Secondary Customer Segments

Primary Segment: Immigrant Workers in Developed Economies

- Geography: U.S., Canada, UK, EU, Australia

- Demographics: Ages 25–55, first- or second-generation immigrants

- Behavior:

- Sends money monthly or bi-weekly

- Highly price-sensitive but trust-driven

- Values speed, reliability, and transparency

- Sends money monthly or bi-weekly

Why they stay:

Once trust is established, switching costs become emotional, not just financial.

Secondary Segment: Diaspora Professionals & Students

- More tech-savvy, higher income

- Use instant transfers and mobile wallets

- Less price-sensitive, more speed-focused

This segment drives:

- Higher average transaction value

- Faster adoption of premium transfer options

Customer Journey: Discovery → Conversion → Retention

1. Discovery

- App store search (“send money to [country]”)

- Word-of-mouth within immigrant communities

- Paid search and localized digital ads

2. Conversion

- First-transfer incentives (fee-free or discounted FX)

- Clear delivery timelines and total cost visibility

- Simple onboarding with fast KYC

3. Retention

- Push notifications for delivery confirmation

- Loyalty through reliability and consistent pricing

- Repeat-use UX optimization (saved recipients, auto-fill)

Remitly optimizes lifetime value (LTV) by encouraging:

- Recurring transfers

- Corridor expansion (same user → multiple countries)

- Trust-driven frequency increases

Acquisition Channels by Segment

- Performance marketing: Search + app install ads

- Community-driven referrals: Family and peer networks

- Localized content: Language-specific onboarding and support

- App store optimization: Country-specific keywords

Unlike viral social apps, Remitly’s growth is intent-based, not entertainment-driven — users arrive with a clear problem to solve.

Market Positioning & Competitive Edge

Remitly positions itself as:

“The most trusted digital remittance app for families.”

Differentiation strategies:

- Radical fee transparency vs hidden FX markups

- Strong UX for non-native English speakers

- Corridor-specific reliability rather than generic global coverage

By focusing on depth over breadth, Remitly outperforms both:

- Legacy players (slow, expensive)

- New fintech entrants (fast but trust-deficient)

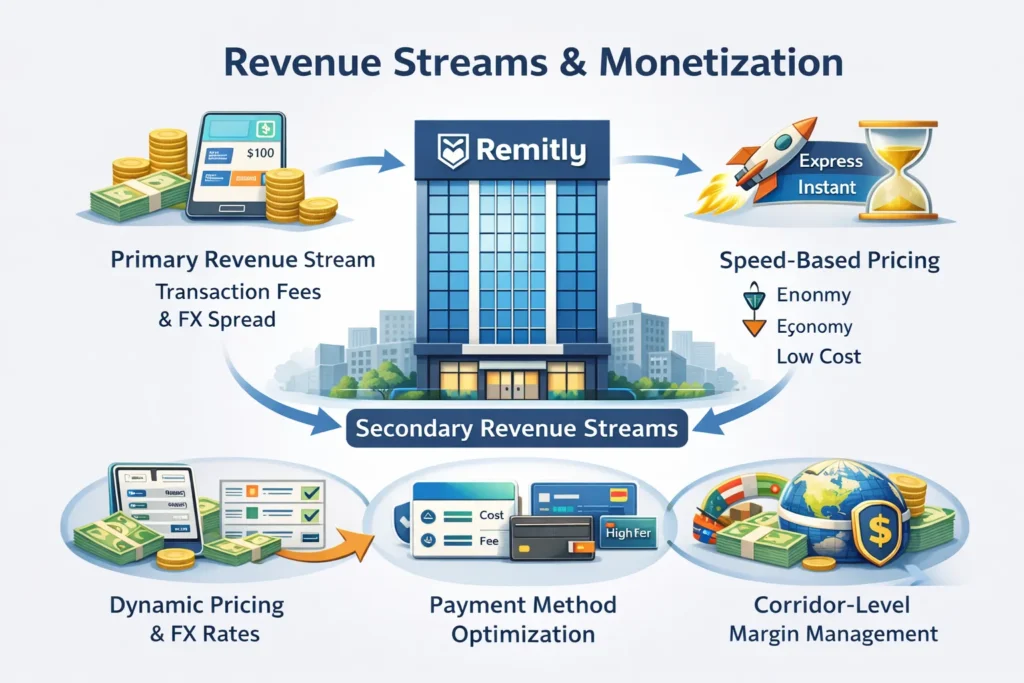

Revenue Streams & Monetization Design

Remitly’s monetization philosophy is simple but powerful:

optimize for trust and volume first, then monetize at scale.

Instead of squeezing users with high fees, Remitly designs a pricing system that feels fair, predictable, and transparent — which in turn drives high-frequency usage and long-term customer value.

Primary Revenue Stream: Transaction Fees & FX Spread

How it works

- Users pay a small flat transfer fee or embedded FX margin (varies by corridor and speed)

- Faster delivery = slightly higher price

- Slower “economy” transfers = lower cost

Key characteristics

- Dynamic pricing based on corridor, payment method, and payout option

- Real-time FX rates displayed before confirmation

- No hidden charges — a major trust differentiator

Revenue impact

- Transaction-based revenue accounts for the vast majority of Remitly’s income

- Growth is driven more by total payment volume (TPV) than price increases

- Margin expansion comes from tech efficiency, not user fee hikes

Secondary Revenue Streams

1. Speed-Based Pricing Tiers

- Economy (low cost, slower settlement)

- Express / Instant (premium pricing for urgency)

This introduces psychological choice architecture — users self-select based on need.

2. Payment Method Optimization

- Lower costs on bank transfers

- Higher fees on cards due to interchange and fraud risk

Remitly nudges users toward lower-cost rails, improving unit economics without visible price pressure.

3. Corridor-Level Margin Management

- High-volume corridors = tighter margins

- Emerging or complex corridors = slightly higher spreads

This balances competitiveness with operational reality.

Overall Monetization Strategy

Remitly’s revenue design works because:

- Multiple pricing levers operate quietly in the background

- Users feel in control of cost vs speed trade-offs

- Pricing transparency builds loyalty → repeat usage → higher LTV

Interconnection of streams

- First-time discounts reduce CAC

- Repeat usage recovers acquisition costs

- Speed upgrades and card usage lift ARPU

Psychology behind pricing

- Clear “total cost” eliminates anxiety

- Tiered options reduce decision friction

Operational Model & Key Activities

Remitly’s operations are not just about moving money — they’re about orchestrating trust, speed, compliance, and reliability at global scale. Unlike consumer apps that can afford downtime or experimentation, fintech platforms like Remitly must operate with near-perfect execution.

This makes operations a core competitive advantage, not a cost center.

Core Operational Activities

1. Platform & Infrastructure Management

- Cloud-based, highly available transaction systems

- Real-time payment routing across multiple rails

- Redundancy to ensure uptime across regions

2. Compliance & Risk Operations

- Continuous KYC/AML verification

- AI-driven fraud detection and transaction monitoring

- Country-specific regulatory adherence

3. Partner & Payout Network Management

- Managing banks, cash pickup centers, and mobile wallets

- SLA enforcement for delivery times

- Liquidity and FX coordination

4. Customer Support Operations

- Multilingual, region-aware support teams

- 24/7 assistance for high-stakes transfers

- Dispute resolution and chargeback handling

5. Growth & Marketing Operations

- Performance marketing optimization

- Corridor-specific campaigns

- Retention and lifecycle messaging

Resource Allocation Strategy

Remitly allocates resources with a risk-first mindset:

- Technology & Engineering: Heavy investment in backend systems, APIs, and automation

- Compliance & Risk: Significant ongoing spend — a non-negotiable moat

- Customer Experience: UX research, localization, and support

- R&D: Fraud prevention, AI risk scoring, payment optimization

- Expansion: New corridors prioritized by demand + regulatory feasibility

Rather than scaling headcount indiscriminately, Remitly scales systems and automation.

Regional Expansion Operations

Each new market requires:

- Regulatory licensing

- Local banking relationships

- Language and UX localization

- On-the-ground compliance knowledge

This makes expansion slower — but far more defensible.

Strategic Partnerships & Ecosystem Development

Remitly’s competitive strength comes from its ability to orchestrate a global financial ecosystem rather than operate as a closed system. Instead of owning banks, cash centers, or wallets, Remitly builds deep partnerships that extend its reach while keeping the platform asset-light.

This partnership-first mindset is essential in a highly regulated, infrastructure-heavy industry like cross-border payments.

Collaboration Philosophy

Remitly partners where it creates leverage:

- Local expertise over global generalization

- Speed-to-market over ownership

- Reliability over experimentation

Each partnership is evaluated on trust, uptime, compliance, and scalability.

Key Partnership Types

1. Technology & API Partners

- Identity verification providers

- Fraud detection and risk scoring platforms

- Cloud and payment orchestration infrastructure

These partners help Remitly:

- Reduce fraud losses

- Speed up onboarding

- Scale transaction monitoring globally

2. Banking, Payment & Payout Alliances

- Local banks for account deposits

- Cash pickup networks in cash-heavy economies

- Mobile wallet providers in mobile-first markets

These partnerships power the last-mile delivery — the most critical user experience moment.

3. Payment Method Partners

- Card networks and ACH providers

- Local real-time payment systems

This ensures flexibility for senders while optimizing cost structures.

4. Regulatory & Expansion Alliances

- Local compliance advisors

- Government and regulatory bodies

- Industry associations

These relationships reduce expansion risk and increase long-term defensibility.

Ecosystem Strategy & Network Effects

Remitly’s ecosystem creates a flywheel:

- More users → higher volume

- Higher volume → better partner terms

- Better terms → lower prices

- Lower prices → more users

Monetization within the ecosystem

- Volume-based pricing with partners

- Margin optimization through routing intelligence

- Reduced dependency on any single provider

Competitive moat

- Deeply embedded local relationships

- Switching costs for partners and users

Regulatory goodwill built over time

Growth Strategy & Scaling Mechanisms

Remitly’s growth strategy is intentionally disciplined, corridor-driven, and data-led. Unlike consumer apps that chase viral spikes, Remitly scales through predictable, repeatable expansion loops built around trust and frequency.

Core Growth Engines

1. Organic Referrals & Trust Loops

- Family-to-family recommendations

- Community-based word-of-mouth

- Delivery reliability as the main referral trigger

In remittances, trust is viral.

2. Performance Marketing

- Search-driven acquisition (“send money to X”)

- Country-specific app store optimization

- Localized creatives and language targeting

Spend is tightly measured against LTV by corridor.

3. Corridor-by-Corridor Expansion

- Launching new sending → receiving country pairs

- Prioritizing high migration + remittance demand

- Gradual rollout to ensure compliance and reliability

Each corridor is treated like a mini-marketplace.

4. Product-Led Growth

- Faster delivery options

- More payout methods

- Better UX for repeat transfers

Product improvements directly increase:

- Frequency

- Transaction size

- Retention

Geographic Scaling Model

Remitly scales in phases:

- High-demand corridors

- Payment method expansion

- UX localization

- Marketing acceleration

This phased approach avoids overextension.

Scaling Challenges & How Remitly Solved Them

Challenge: Regulatory complexity

Solution: Compliance-first architecture and local partnerships

Challenge: Fraud risk at scale

Solution: AI-driven risk models and behavioral monitoring

Challenge: Margin pressure

Solution: Volume leverage + infrastructure optimization

Challenge: Operational complexity

Solution: Automation and standardized expansion playbooks

Competitive Strategy & Market Defense

Remitly operates in one of the most competitive fintech arenas — cross-border payments — facing pressure from legacy giants, digital-first fintechs, and local players. Its survival and dominance come from building defensive advantages that compound over time.

Core Competitive Advantages

1. Network Effects

- More users → more transaction volume

- More volume → better FX rates and partner terms

- Better rates → stronger price advantage

These effects are subtle but powerful and hard to replicate quickly.

2. Trust & Brand Equity

- Transparent pricing

- Reliable delivery

- Consistent UX across regions

In remittances, brand trust often outweighs price.

3. Compliance & Regulatory Depth

- Licensed across multiple jurisdictions

- Strong relationships with regulators

- Proven compliance track record

This acts as a high barrier to entry for new competitors.

4. Data & Personalization

- Transaction data informs pricing and routing

- Risk scoring improves speed for low-risk users

- Personalized transfer recommendations

Data improves both user experience and unit economics.

Market Defense Tactics

Against Legacy Players

- Undercutting fees with better UX

- Faster delivery without agent visits

Against Fintech Startups

- Stronger trust and regulatory coverage

- More payout options and corridors

Against Pricing Wars

- Margin defense through efficiency, not discounts

- Corridor-level optimization

Strategic Moves

- Feature timing aligned with demand

- Deepening partner exclusivity

Selective acquisitions or partnerships

Read more : Best Remitly Clone Scripts 2025: Launch Your Global Remittance App Faster & Smarter

Lessons for Entrepreneurs & Implementation

Remitly’s journey offers more than inspiration — it offers a repeatable strategic framework for founders building fintech, marketplace, or transaction-driven platforms. The magic isn’t in copying features, but in adopting the principles behind the execution.

Let’s break it down like a mentor would.

Key Factors Behind Remitly’s Success

- Solved a Mission-Critical Problem

- Sending money home is emotional, frequent, and non-optional

- High usage frequency creates strong LTV

- Sending money home is emotional, frequent, and non-optional

- Trust Before Growth

- Transparent pricing

- Reliable delivery

- Compliance-first mindset

- Transparent pricing

- Volume Over Margins

- Lower fees encouraged repeat usage

- Scale unlocked profitability

- Lower fees encouraged repeat usage

- Corridor-Level Focus

- Each market treated as its own ecosystem

- Avoided shallow global expansion

- Each market treated as its own ecosystem

Replicable Principles for Startups

- Start with a high-stakes user problem

- Build pricing transparency into UX

- Design compliance and risk systems early

- Scale one niche or corridor at a time

- Use data to optimize operations, not just marketing

Common Mistakes to Avoid

- Expanding too many markets too fast

- Treating compliance as an afterthought

- Over-discounting to acquire users

- Ignoring operational scalability

Adapting the Model for Local or Niche Markets

Founders can adapt Remitly’s playbook for:

- Regional remittances

- B2B cross-border payments

- Freelancer or gig economy payouts

- Crypto-to-fiat corridors (where legal)

The key is local trust + global infrastructure.

Implementation & Investment Priorities

Phase 1: Core transaction engine + compliance

Phase 2: Key partnerships and payout networks

Phase 3: UX optimization and trust signals

Phase 4: Growth marketing and corridor expansion

Ready to implement Remitly’s proven business model for your market?

Miracuves builds scalable platforms with tested business models and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable apps.

Get your free business model consultation today.

Conclusion

Remitly’s business model proves a powerful truth about modern platform companies: innovation alone is not enough — disciplined execution creates durability.

By combining mobile-first design, transparent pricing, compliance mastery, and corridor-focused scaling, Remitly transformed a fragmented, trust-deficient industry into a streamlined digital experience used by millions of families worldwide. Its success wasn’t built on chasing trends, but on earning trust transaction by transaction.

As we move deeper into 2026 and beyond, platform economies will increasingly reward companies that can balance speed with responsibility, growth with governance, and technology with human need. Remitly stands as a benchmark for founders building in fintech, global commerce, and regulated digital ecosystems.

The future belongs to platforms that don’t just move money or data — but move confidence across borders.

FAQs

What type of business model does Remitly use?

Remitly operates a transaction-based fintech platform model. It earns revenue from transfer fees and FX spreads while remaining asset-light and highly scalable.

How does Remitly’s business model create value?

It simplifies cross-border money transfers by offering faster delivery, transparent pricing, and multiple payout options, building trust with high-frequency users.

What are Remitly’s key success factors?

Trust-first UX, strong compliance infrastructure, corridor-focused expansion, and volume-driven monetization are the core pillars of Remitly’s success.

How scalable is Remitly’s business model?

The model is highly scalable due to its digital infrastructure, automation, and partner-led expansion across new corridors and geographies.

What are the biggest challenges in Remitly’s model?

Regulatory complexity, fraud risk, and margin pressure are key challenges. Remitly addresses them through technology, partnerships, and scale efficiencies.

How can entrepreneurs adapt Remitly’s model to their region?

By starting with a single high-demand corridor, focusing on compliance, building local partnerships, and maintaining transparent pricing.

What resources and timeframe are needed to launch a similar platform?

A compliant MVP typically takes 30-90 days , requiring strong tech infrastructure, banking partnerships, and ongoing investment in risk management.

What are alternatives to Remitly’s business model?

Alternatives include subscription-based FX platforms, B2B cross-border payment systems, or crypto-enabled remittance models where regulations allow.

How has Remitly’s business model evolved over time?

It evolved from simple digital transfers into a multi-rail, AI-powered global payments platform focused on scale, trust, and operational efficiency.

Related Article :

- What is PayPal and How Does It Work?

- What is Razorpay and How Does It Work?

- Best Checkout.com Clone Scripts 2025: Build a High-Performance Payment Gateway

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best PayPal Clone Scripts 2025 Launch a Secure Global Digital Payment Platform