In 2026, Elicit’s AI-powered research platform is estimated to be generating over $18 million in annual recurring revenue, driven by a fast-growing base of academics, startups, and enterprise knowledge teams who rely on AI to speed up decision-making.

For founders, Elicit is more than just a research tool — it represents a powerful example of how vertical AI platforms can turn complex professional workflows into predictable, high-margin subscription businesses.

Studying Elicit’s revenue model reveals how AI infrastructure, premium access, and enterprise contracts can combine into a scalable monetization engine that grows alongside user trust and product value.

Elicit Revenue Overview – The Big Picture

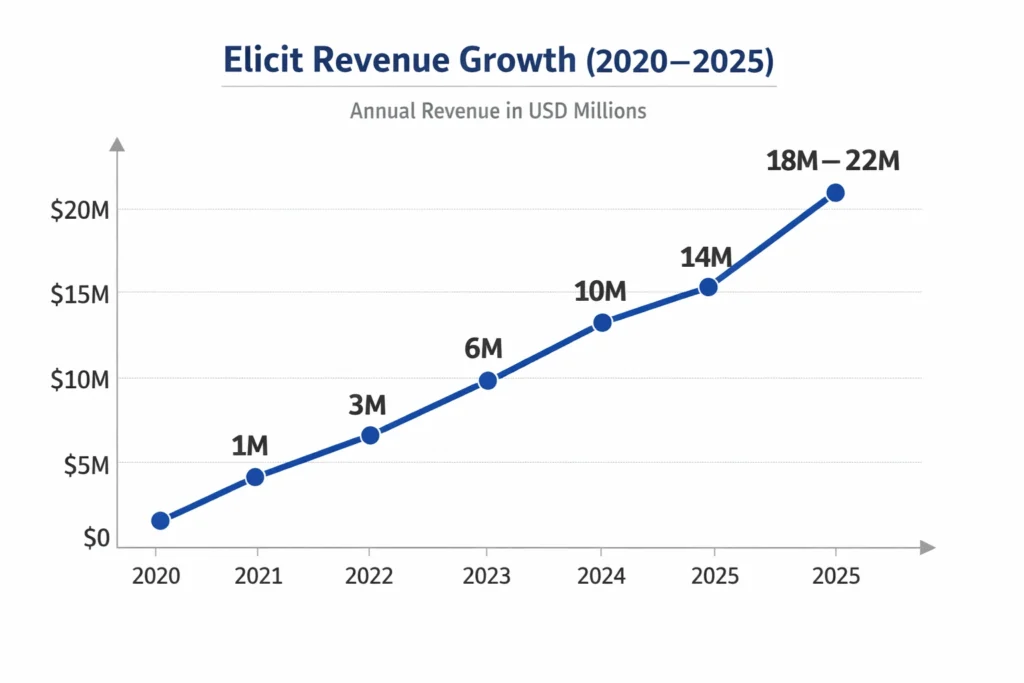

2025 Estimated Revenue: ~$18–22 million ARR

Valuation: ~$150–200 million (private market estimates based on funding rounds and SaaS multiples)

YoY Growth: ~60–75% growth from 2024 to 2025

Revenue by Region:

- North America: ~45%

- Europe: ~30%

- Asia-Pacific: ~20%

- Rest of World: ~5%

Profit Margins:

- Gross Margin: ~70–80% (typical for AI SaaS after compute costs)

- Net Margin: Reinvestment phase (near break-even or slight loss due to R&D and AI infrastructure scaling)

Competition Benchmark:

- Competes with platforms like Scite, ResearchRabbit, Semantic Scholar, and enterprise knowledge AI tools.

- Elicit differentiates by focusing on structured AI-assisted literature review, evidence extraction, and decision support.

Read More: Elicit Explained: The AI Tool That Automates Research and Literature Review

Primary Revenue Streams Deep Dive

Revenue Stream #1: Individual Subscriptions

How it works: Users pay monthly or annually for premium access to AI-powered research, unlimited searches, summaries, and data extraction.

Pricing: $12–25 per user/month (varies by tier and billing cycle)

% Share: ~55% of total revenue

2025 Data: Over 50,000 paying users globally, with strong adoption among researchers, consultants, and startup teams.

Revenue Stream #2: Enterprise & Team Plans

How it works: Companies purchase bulk licenses with admin controls, shared workspaces, API access, and compliance features.

Pricing: $1,500–15,000 per year per organization

% Share: ~25% of total revenue

2025 Data: Rapid growth among biotech, consulting firms, and AI-first startups.

Revenue Stream #3: API & Data Access Licensing

How it works: Businesses integrate Elicit’s research AI into internal tools and dashboards.

Pricing: Usage-based or fixed licensing contracts

% Share: ~10%

2025 Data: Used by analytics firms and SaaS platforms building AI-assisted insights.

Revenue Stream #4: Education & Institutional Deals

How it works: Universities and research labs purchase discounted bulk access.

Pricing: Custom contracts

% Share: ~7%

2025 Data: Growing in Europe and Asia-Pacific regions.

Revenue Stream #5: Custom AI Solutions

How it works: Tailored deployments for enterprises with proprietary datasets and internal research automation.

% Share: ~3%

2025 Data: High-margin, low-volume contracts.

Revenue streams percentage breakdown

| Revenue Stream | % Share | Monetization Model |

|---|---|---|

| Individual Subscriptions | 55% | Monthly/Annual SaaS |

| Enterprise Plans | 25% | Annual Contracts |

| API Licensing | 10% | Usage-Based |

| Education Deals | 7% | Institutional Licenses |

| Custom AI Solutions | 3% | Project-Based |

The Fee Structure Explained

User-Side Fees

- Free tier with limited searches and summaries

- Pro plans for unlimited AI-assisted research

- Annual discounts for long-term users

Provider-Side Fees

- None for content providers

- Data sources accessed via licensed or open datasets

Hidden Revenue Layers

- Priority compute access for premium users

- API overage fees

- Custom compliance and deployment fees for enterprises

Regional Pricing Variation

- Lower pricing tiers for students and developing markets

- Enterprise contracts priced based on region and compliance needs

Complete fee structure by user type

| User Type | Pricing Model | Features |

|---|---|---|

| Free Users | $0 | Limited searches, basic AI summaries |

| Pro Users | $12–25/month | Unlimited research, data export, saved workspaces |

| Teams | Custom | Admin controls, collaboration, analytics |

| Enterprises | Annual Contracts | API access, compliance, private deployment |

How Elicit Maximizes Revenue Per User

Segmentation: Individual, academic, startup, and enterprise tiers

Upselling: Pro → Team → Enterprise upgrades

Cross-Selling: API access and compliance add-ons

Dynamic Pricing: Market-based and region-based pricing tiers

Retention Monetization: Saved research libraries and collaboration tools

LTV Optimization: Annual billing discounts and long-term contracts

Psychological Pricing: Low entry price for individuals encourages upgrades

Real Data Example: Teams adopting Elicit for internal research show 3–4x higher lifetime value than solo users.

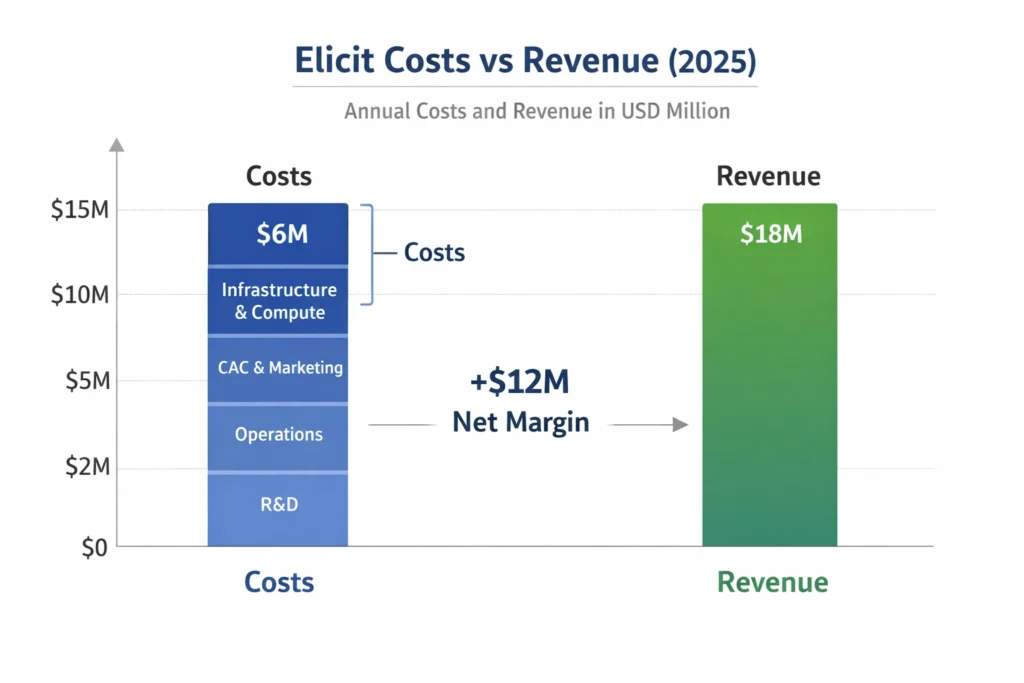

Cost Structure & Profit Margins

Infrastructure Cost: AI compute, cloud hosting, data processing (~30% of revenue)

CAC & Marketing: SEO, academic partnerships, and SaaS outreach (~15%)

Operations: Support, compliance, and admin (~10%)

R&D: AI model improvements and product features (~20%)

Unit Economics:

- Average Revenue Per User (ARPU): ~$220/year

- Customer Acquisition Cost (CAC): ~$60–90

- Payback Period: 4–6 months

Margin Optimization:

- Model efficiency improvements

- Bulk compute contracts

- Enterprise-focused sales

Future Revenue Opportunities & Innovations

New Streams: AI-powered decision dashboards for enterprises

AI/ML Monetization: Domain-specific models for legal, biotech, and finance

Market Expansion: Asia-Pacific education and startup ecosystems

Predicted Trends (2025–2027):

- Vertical AI platforms outperform general AI tools

- Increased enterprise adoption of private AI deployments

- Integration with internal knowledge management systems

Risks & Threats:

- Rising compute costs

- Open-source AI research tools

- Platform commoditization

Opportunities for Founders:

- Niche research AI platforms

- Regional knowledge automation tools

- Industry-specific evidence engines

Lessons for Entrepreneurs & Your Opportunity

What Works:

- Subscription-first monetization

- Strong free-to-paid conversion funnel

- Enterprise upsell strategy

What to Replicate:

- AI-driven workflow automation

- Transparent pricing tiers

- Data-backed product positioning

Market Gaps:

- Industry-specific research AI

- Multilingual evidence platforms

- Offline enterprise AI deployments

Improvements Founders Can Use:

- Faster onboarding experiences

- Custom AI training for client datasets

- Vertical-specific analytics

Want to build a platform with Elicit’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Elicit clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, Miracuves can arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Elicit’s growth in 2025 highlights a major shift in how professionals consume and trust AI. Instead of relying on generic tools, users increasingly prefer platforms designed around their exact workflow, terminology, and decision-making process. This shift creates powerful opportunities for founders who understand niche markets deeply.

For entrepreneurs, the real lesson is not just building an AI product — it’s building an AI business system. Elicit succeeds because it combines subscription revenue, enterprise contracts, and API monetization into a layered model that grows stronger as users embed the platform into their daily operations.

If you’re looking to enter this space, the window is wide open. Industry-specific research tools, private AI deployments, and regional knowledge platforms are still underserved. The next major AI SaaS success story is likely to come from founders who specialize, not generalize.

FAQs

1. How much does Elicit make per transaction?

Elicit earns primarily through monthly and annual subscriptions rather than per-transaction fees, averaging about $18–25 per user per month for premium plans.

2. What’s Elicit’s most profitable revenue stream?

Enterprise and team plans are the most profitable due to long-term contracts and lower churn.

3. How does Elicit’s pricing compare to competitors?

Elicit is priced lower for individuals but competitive at the enterprise level compared to other AI research platforms.

4. What percentage does Elicit take from providers?

Elicit does not charge content providers; it monetizes user access and enterprise services.

5. How has Elicit’s revenue model evolved?

It shifted from a free academic tool to a subscription-based AI SaaS with strong enterprise monetization.

6. Can small platforms use similar models?

Yes, niche AI platforms can replicate this model with subscriptions and industry-specific features.

7. What’s the minimum scale for profitability?

Around 5,000–8,000 paying users or a few large enterprise contracts can cover operational costs.

8. How to implement similar revenue models?

Start with freemium access, introduce paid tiers, and build enterprise features for long-term contracts.

9. What are alternatives to Elicit’s model?

Usage-based pricing, API-only monetization, or data licensing models.

10. How quickly can similar platforms monetize?

With a strong niche and clear value, platforms can begin generating revenue within 30–60 days of launch.