Business Model of Acorns is one of the smartest examples of how a simple behavioral idea can scale into a massive fintech platform. In a market long dominated by intimidating investing jargon, complex tools, and high minimum balances, Acorns did something radical: it told everyday people they could start investing with spare change. That single shift turned investing from a “someday” goal into a daily habit—built directly into how users already spend money.

What began as a round-ups micro-investing app quickly evolved into a full-stack financial wellness ecosystem. Acorns expanded beyond investing into retirement planning, banking, education, and family finance—creating a platform that grows with users through different life stages. Instead of competing on trading speed or risky speculation, it positioned itself around simplicity, automation, and long-term wealth building.

In 2026, Acorns matters because it proves modern platforms don’t need hype to win—only consistency. For founders building subscription apps, fintech ecosystems, or habit-based products, Acorns offers a blueprint for trust-first monetization and long-term customer lifetime value

How the Acorns Business Model Works

Acorns isn’t just another investing app — it’s a behavior-powered financial ecosystem built to turn everyday actions into long-term wealth creation. Its model mixes subscription, fintech services, and platform economics to appeal to different types of users and lifetime value pathways.

Business Model Overview

At its core, Acorns has built a hybrid subscription + services fintech platform that monetizes both recurring engagement and financial behaviors.

Type of model

- Hybrid Freemium + Subscription + Financial Services

- Blends consumer fintech with habit-driven product design.

Value Proposition

- For everyday consumers: Easy, automated investing with no minimums.

- For busy professionals: Simple portfolio allocation, retirement planning, and diversified passive growth.

- For families and students: Financial education, spending tools, and savings habits.

Key Stakeholders

- End Users: Individuals seeking accessible investing and financial education.

- Partners: Banks, ETF providers, custodial services, and employer benefit platforms.

- Regulators & Compliance: SEC/RIA framework for investment products.

Evolution of the Model

- Round-Ups (Core Launch): Small, automated investments based on spare change.

- Core Subscription: Expanded to banking (Acorns Spend), retirement (Acorns Later), and later investing+education bundles.

- Partnership Expansion: White-label fintech relationships with employers and platforms.

- Data & Insights Layer: Behavioral data to improve retention and cross-sell.

Why It Works in 2026

- Changing money habits: Millennials and Gen Z crave low-friction financial tools.

- Subscription comfort: Consumers now accept predictable, value-based recurring pricing.

- Platform bundling: Cross-selling across banking, investing, and education improves retention.

Quick Recap — The Model at a Glance

| Component | Description |

| Core Design | Behavioral savings + automated investing |

| Primary Target | Mass-market consumers new to investing |

| Revenue Core | Subscriptions + asset management fees |

| Ecosystem Drivers | Partner APIs + embedded fintech access |

| Scalability Engine | Lifetime value from multi-product engagement |

Read more : What is Acorns and How Does It Work?

Target Market & Customer Segmentation Strategy

Acorns didn’t win by chasing high-net-worth investors.

It won by owning the “financially intimidated but aspirational” segment — people who want to invest, but don’t want complexity, jargon, or risk-heavy decisions.

Primary & Secondary Customer Segments

Primary Segment: First-Time & Passive Investors

- Age: 18–35 (students, early professionals, gig workers)

- Behavior: Low investing confidence, high mobile usage

- Motivation: “I know I should invest, but I don’t know how”

- Key trigger: Automated round-ups and set-and-forget portfolios

Secondary Segment: Financially Busy Professionals

- Age: 30–45

- Behavior: Stable income, limited time, low engagement tolerance

- Motivation: Long-term wealth building without micromanagement

- Key trigger: Bundled investing + retirement + checking

Emerging Segment: Families & Gen Alpha (via parents)

- Parents seeking financial literacy for kids

- Early habit formation and custodial investing

- Long-term multi-decade lifetime value opportunity

Customer Journey: From Curiosity to Habit

1. Discovery

- App store search (“invest spare change”)

- Influencer content and financial education media

- Employer and student-focused partnerships

2. Conversion

- Simple onboarding (no minimums, low friction)

- Behavioral hooks (round-ups feel painless)

- Free trial → subscription unlock

3. Retention

- Automation reduces churn risk

- Progress visualization reinforces habit

- Cross-product nudges (Invest → Later → Spend → Early)

4. Expansion

- Upgrade to higher subscription tiers

- Add retirement, checking, family accounts

- Long-term trust compounds monetization

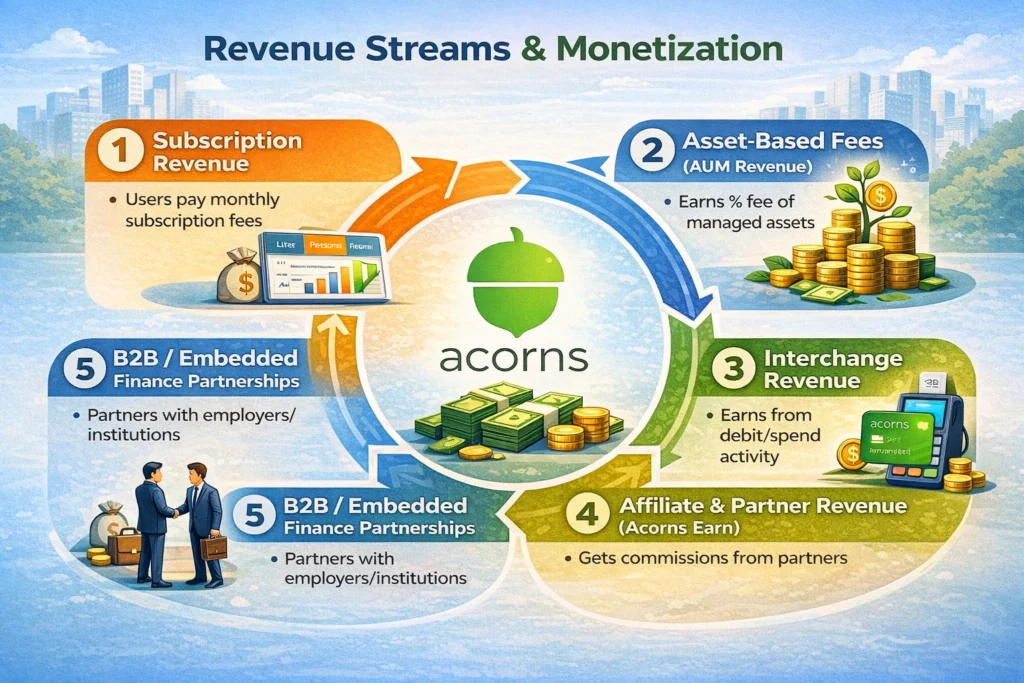

Revenue Streams and Monetization Design

Here’s where Acorns gets especially smart.

Most fintech apps either:

- live off transaction volume (trading, swaps, fees), or

- rely heavily on ads or credit products.

Acorns took a different path:

It monetized consistency.

Instead of encouraging users to trade more, it encourages them to stay invested longer — and charges in ways that scale with trust, assets, and retention.

The Core Revenue Streams

1) Subscription Revenue (Primary Engine)

Acorns is fundamentally a subscription fintech.

Users pay a monthly fee for access to:

- automated investing

- diversified portfolios

- retirement tools

- banking/spending features (depending on tier)

- family features (Acorns Early)

How it works

- Fixed monthly tiers (low price, high scale)

- Predictable recurring revenue (MRR)

- High margin once infrastructure is built

Why it’s powerful

- Subscription revenue is not tied to market volatility

- Works even when users invest small amounts

- Creates stable cash flow to fund growth

Growth trajectory logic

- As users age and earn more → they upgrade tiers

- As families grow → they adopt family plans

- As trust grows → assets grow (unlocking more revenue streams)

2) Asset-Based Fees (AUM Revenue)

Acorns also earns a percentage-based fee tied to Assets Under Management (AUM).

This is a classic wealth-tech revenue stream:

- the more users invest

- the longer they stay

- the more AUM grows

- the more Acorns earns

Why this stream matters

- It compounds naturally over time

- It aligns Acorns with user success (wealth growth)

- It creates a “second flywheel” beyond subscriptions

3) Interchange Revenue (Debit/Spend Ecosystem)

When users use Acorns-linked debit cards or spending products, Acorns can earn interchange fees (a small % from merchants per transaction).

Mechanism

- Users spend normally

- Merchants pay a tiny cut to the card network

- Acorns receives a portion

This becomes meaningful at scale.

Strategic benefit

- Turns Acorns into a daily financial habit, not a monthly investing tool

- Increases retention and cross-sell

4) Affiliate & Partner Revenue (Acorns Earn)

Acorns created a clever ecosystem called Acorns Earn.

Users shop with partner brands and get:

- cashback-style rewards

- that are automatically invested

Acorns earns:

- referral/affiliate commissions from brands

Why it’s genius

- It funds investing without users “feeling” the cost

- It makes investing emotional (“I earned this”)

- It adds a marketplace-like revenue stream

5) B2B / Embedded Finance Partnerships (Strategic Upside)

By 2026, fintech growth increasingly depends on embedded finance and employer ecosystems.

Acorns benefits through:

- employer partnerships

- education programs

- bundled fintech offerings through institutions

This is not always the biggest revenue line — but it’s a strong moat-builder.

Read more : Acorns Revenue Model: How Acorns Makes Money in 2026

Operational Model & Key Activities

Acorns looks simple on the surface — round-ups, investing, retirement, banking.

But behind that clean UI is a highly structured operating machine built around trust, automation, compliance, and retention.

Unlike “move fast and break things” apps, fintech platforms like Acorns scale by doing the opposite:

Core Operations: What Acorns Must Run Daily

1) Platform & Product Infrastructure

This is the heart of the model.

Acorns must maintain:

- real-time round-up tracking

- portfolio allocation + rebalancing

- recurring deposits

- performance dashboards

- banking + debit workflows (where enabled)

- seamless onboarding + KYC flows

Key operational focus:

Reliability beats novelty. A fintech app loses trust faster than any other category.

2) Compliance & Risk Management

A major part of Acorns’ “hidden business model” is compliance.

Core requirements include:

- SEC / broker-dealer / advisory compliance (depending on structure)

- KYC / AML identity verification

- fraud monitoring

- transaction dispute systems

- user data protection and privacy compliance

In 2026, this matters more than ever because fintech regulation has tightened globally, especially around:

- youth accounts

- financial education claims

- referral and affiliate incentives

3) Customer Support as a Retention Engine

Acorns doesn’t treat support like a cost center.

In fintech, support is:

- churn prevention

- trust reinforcement

- brand protection

Operationally this includes:

- dispute handling

- investment questions

- account recovery

- bank transfer issues

- subscription plan confusion

4) Growth & Lifecycle Marketing

Acorns runs marketing like a behavioral science lab.

Key activities include:

- lifecycle email + push automation

- “habit reinforcement” messaging

- referral programs

- financial education content

- SEO + app store optimization

The goal isn’t just installs — it’s habit formation.

5) Partner Operations (Earn + Financial Institutions)

Acorns must manage a partner ecosystem that includes:

- brand cashback/affiliate partners

- ETF portfolio providers

- custodians and clearing partners

- payment processors

- employer and institutional distribution partners

This is operationally complex because partner economics must remain balanced:

- users want higher rewards

- brands want lower commissions

- Acorns must keep margins sustainable

Strategic Partnerships & Ecosystem Development

Acorns is a perfect example of a modern platform truth While users see Acorns as a single product, the business is actually powered by a network of partnerships that provide the rails for investing, banking, rewards, identity, and distribution.

And in 2026, that ecosystem design is the moat.

Acorns’ Partnership Philosophy

Acorns partners for two reasons:

1) To expand capability without rebuilding the financial stack

Fintech infrastructure is expensive, regulated, and slow to build.

So Acorns collaborates with:

- custodians

- clearing and brokerage partners

- banking partners

- payment processors

- compliance and identity vendors

2) To turn the platform into a distribution engine

Acorns also partners for growth — through:

- brands

- employers

- student ecosystems

- education platforms

Key Partnership Types (and Why They Matter)

1) Technology & API Partners

These partners power core fintech workflows:

- portfolio and brokerage infrastructure

- identity verification (KYC)

- fraud detection

- analytics + attribution tools

- cloud and security stack

Strategic value:

Keeps Acorns scalable, compliant, and fast-moving.

2) Payment, Banking & Card Alliances

For Acorns’ spend/checking ecosystem, partnerships include:

- issuing banks

- debit card networks

- ACH transfer providers

- payment processing infrastructure

Strategic value:

- enables interchange revenue

- increases daily engagement

- improves retention via “financial home” positioning

3) Brand, Retail & Rewards Partners (Acorns Earn)

This is one of Acorns’ most underrated ecosystem plays.

Acorns partners with consumer brands and retailers so that:

- users shop normally

- earn rewards

- rewards get auto-invested

Strategic value:

- adds a marketplace-style revenue stream

- improves user delight

- reduces churn by creating “free investing money”

4) Marketing & Distribution Partnerships

Acorns has historically used:

- influencer and creator ecosystems

- affiliate programs

- SEO + financial education publishers

- app store featuring strategies

In 2026, the most powerful distribution partnerships include:

- employer benefit platforms

- student finance ecosystems

- embedded finance bundles

Strategic value:

Lower CAC (customer acquisition cost) compared to pure paid ads.

5) Regulatory & Expansion Alliances

Fintech is restricted by:

- regional banking laws

- consumer finance rules

- tax-advantaged retirement frameworks

- youth account protections

So Acorns must build relationships with:

- regulators

- legal advisors

- compliant institutional partners

Ecosystem Strategy: How Partnerships Create Moats

Network Effects (Soft, But Real)

Acorns doesn’t have “classic” network effects like Uber or Airbnb.

But it has ecosystem network effects, meaning:

- more users → more partner brands want in

- more brands → better rewards

- better rewards → better retention

- better retention → more AUM

- more AUM → more credibility and distribution

It’s a compounding loop.

Monetization Inside the Ecosystem

Partnerships are not just support — they’re monetization multipliers.

- affiliate commissions from Earn partners

- interchange from banking partners

- AUM scale through institutional trust

- distribution through employer bundles

This is why Acorns’ business model is so resilient:

it earns from multiple angles of the ecosystem.

Competitive Moats via Strategic Tie-Ups

In 2026, the strongest fintech moat isn’t “features.”

- regulatory trust

- distribution access

- embedded partnerships

- and user habit ownership

Growth Strategy & Scaling Mechanisms

Acorns didn’t grow by hype cycles or viral stunts.

It grew the hard but durable way — by compounding trust, habits, and lifetime value over time.

This section reveals how Acorns scales without burning users or capital, and why its growth engine still works in 2026.

The Core Growth Engines

1) Habit-Driven Organic Growth

Acorns’ biggest growth advantage is that users don’t need motivation to stay active.

Why?

- round-ups happen automatically

- recurring investments feel invisible

- progress grows quietly in the background

This creates:

- low churn

- long average customer lifetimes

- word-of-mouth from calm confidence, not hype

2) Referral & Viral Loops (Trust-Based)

Unlike social apps, Acorns’ virality is selective.

Users refer Acorns when:

- they feel financially “responsible”

- they see tangible progress

- they trust the brand enough to recommend money-related tools

Referral incentives are often:

- cash bonuses

- matched investments

- milestone-based rewards

Why this works:

Money apps rely on credibility — referrals signal trust, not entertainment.

3) Paid Acquisition (Disciplined, Not Aggressive)

Acorns uses paid marketing carefully because:

- CAC must be recouped over long-term subscriptions

- trust loss from aggressive ads is costly

Paid channels include:

- search intent ads (“invest spare change”)

- finance-focused creators

- app store optimization

- retargeting for onboarding completion

The focus is LTV > CAC, not vanity installs.

4) Product-Led Expansion (The Real Scale Lever)

Acorns scales horizontally across life stages.

Instead of building “more features,” it builds more relevance.

Expansion path:

- Invest → Later (retirement)

- Spend → Earn (daily finance)

- Early (family + kids)

- Education as a long-term trust anchor

Each product:

- increases time-in-platform

- increases switching costs

- increases total revenue per user

5) Geographic & Demographic Scaling

Acorns scales carefully across:

- regulatory environments

- demographic segments

- financial maturity levels

Instead of fast global rollout, Acorns focuses on:

- deep penetration

- compliance-first expansion

- localized education

Competitive Strategy & Market Defense

Fintech is one of the most crowded, aggressive markets in tech.

New apps launch every year promising better returns, lower fees, or smarter AI investing.

Yet Acorns has survived — and scaled — because it doesn’t fight competitors on their battlefield.

Instead, it defends a category it essentially owns:

passive, habit-based, beginner investing.

Acorns’ Core Competitive Advantages

1) Behavioral Network Effects (Silent but Powerful)

Acorns doesn’t rely on social graphs.

Its strongest network effect is behavioral:

- the longer users stay

- the more habits form

- the harder it is to switch

Leaving Acorns means:

- breaking a routine

- disrupting automation

- losing mental “peace of mind”

This creates soft lock-in — one of the most durable moats in fintech.

2) Brand Trust & Financial Wellness Positioning

While competitors chase:

- active traders

- crypto enthusiasts

- yield maximizers

Acorns positions itself as:

“Your calm, long-term financial partner.”

This brand stance:

- attracts risk-averse users

- reduces panic-driven churn

- builds credibility with regulators and partners

Trust becomes a defensive asset.

3) Product Simplicity as a Strategic Weapon

Most investing apps add features to compete.

Acorns removes decisions.

- no stock picking

- no timing pressure

- no dopamine-driven charts

This simplicity:

- lowers support costs

- reduces user error

- improves retention

Competitors struggle to copy this because simplicity requires restraint.

4) Data-Driven Personalization (Without Overreach)

Acorns uses data to:

- personalize nudges

- optimize deposit frequency

- adjust education content

- time upgrade prompts

But crucially, it avoids:

- intrusive selling

- speculative recommendations

- trust-eroding tactics

Read more : Best Acorns Clone Scripts 2026 – Launch Your Micro-Investing App Fast

Lessons for Entrepreneurs & Implementation

This is the part founders care about most — because Acorns isn’t just a fintech success story.

It’s a repeatable blueprint for how to build a platform that:

- earns recurring revenue

- builds trust over time

- compounds lifetime value

- survives competition and market cycles

Key Factors Behind Acorns’ Success

1) It Solved the Real Problem: “I Don’t Know How to Start”

Acorns didn’t sell investing.

It sold:

- simplicity

- confidence

- automation

- a starting point

That’s why it won beginners.

2) It Monetized Behavior, Not Transactions

Most fintech apps make money when users do more.

Acorns makes money when users:

- stay longer

- upgrade over time

- invest consistently

- trust the platform

This is far more stable.

3) It Built a Multi-Product Lifetime Value Ladder

Acorns is designed like a financial “level-up system”:

- Start with round-ups

- Add recurring investing

- Add retirement

- Add spending

- Add kids/family accounts

Each step increases:

- retention

- revenue per user

- switching costs

4) It Used Calm Branding as a Competitive Weapon

In a world of loud fintech hype, Acorns chose:

- education

- long-term framing

- emotional safety

In 2026, this is one of the strongest growth moats in consumer finance.

Common Mistakes Founders Should Avoid

Mistake 1: Copying Features Instead of Copying the System

Many startups copy:

- round-ups

- micro-investing

- dashboards

But miss the real system:

- habit loops

- subscriptions

- cross-sell ladder

- trust-first messaging

Mistake 2: Monetizing Too Early (or Too Aggressively)

Acorns’ pricing feels “soft” because the value feels ongoing.

Founders often fail by:

- charging too much upfront

- adding paywalls too early

- locking features before habits form

Mistake 3: Building a Product Without an Ecosystem

Acorns is not just an app.

It’s:

- a partnership network

- a compliance engine

- a distribution system

- a monetization portfolio

Without this, fintech apps especially collapse under CAC and churn.

Adapting the Model for Local or Niche Markets

Acorns can be adapted for:

- emerging markets

- niche professions

- region-specific financial products

- community savings ecosystems

Example Adaptations

- Gig-worker finance app: round-ups + tax savings + income smoothing

- Women-focused wealth platform: micro-investing + education + mentorship

- SME founder investing: automated profit investing + retirement + credit building

- Faith-based investing: automated deposits into compliant portfolios

The model works when:

- onboarding is frictionless

- the habit is effortless

- the outcome is long-term

Implementation Timeline & Investment

Here’s a realistic implementation plan for entrepreneurs:

Phase 1 : Foundation

- MVP UX + onboarding

- payment rails integration

- basic automation engine

- compliance/legal planning (if fintech)

Phase 2 : Core Habit Loop

- round-up or auto-action mechanism

- progress visualization

- retention nudges + lifecycle messaging

- subscription tiering

Phase 3 : Monetization & Expansion

- add partner rewards / affiliate engine

- build second product (retirement, savings, etc.)

- optimize LTV/CAC

- strengthen support + trust systems

Phase 4 : Ecosystem Scale

- employer or institutional partnerships

- multi-product bundles

- deeper analytics + personalization

- regional expansion

Ready to implement Acorns’ proven business model for your market?

Miracuves builds scalable platforms with tested business models and growth mechanisms.

We’ve helped 200+ entrepreneurs launch profitable apps.

Get your free business model consultation today.

Conclusion

Acorns proves a powerful truth about modern digital businesses:

The biggest wins don’t always come from bold disruption — they come from quiet consistency.

By turning everyday spending into long-term investing, Acorns didn’t just create a product. It created a behavioral system — one that rewards patience, automation, and trust..

As platform economies evolve beyond growth-at-all-costs, Acorns stands as proof that sustainable businesses are built by designing for how people actually behave, not how we wish they would.

FAQs

1) What type of business model does Acorns use?

Acorns uses a hybrid fintech model built around subscriptions, asset-based fees, and partner revenue .It combines recurring income with long-term wealth compounding through AUM growth.

2) How does Acorns’ model create value?

Acorns creates value by turning small daily spending into automated investing. It removes complexity and helps users build wealth through consistent habits.

3) What are Acorns’ key success factors?

Its biggest strengths are automation, simplicity, and trust-first branding. The multi-product ecosystem also increases retention and lifetime value.

4) How scalable is the Acorns business model?

Very scalable because most of the value is software-driven and automated . As users grow, Acorns earns more through upgrades, AUM growth, and cross-selling.

5) What are the biggest challenges in Acorns’ model?

The hardest parts are fintech compliance, trust management, and retention during market downturns. Scaling financial infrastructure also requires strong partnerships and reliability.

6) How can entrepreneurs adapt it to their region?

Founders can localize the model using regional payment systems, tax rules, and compliant investing structures. The core idea—habit-based automation—works in almost any market.

7) What are alternatives to the Acorns model?

Alternatives include trading apps (transaction-driven), robo-advisors (AUM-only), and neobanks (interchange-led). Acorns stands out by combining multiple revenue streams into one ecosystem.

8) How has Acorns evolved over time?

Acorns started as a round-ups investing app and expanded into retirement, banking, rewards, and family finance. This evolution strengthened monetization, retention, and competitive defense.

Related Article :

- Best Betterment Clone Scripts 2026 for Automated Investing Platforms

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Starling Bank Clone Scripts 2026 : Build a Digital Bank That Scales in the Real World

- What is Robinhood App and How Does It Work?

- What is SoFi App and How Does It Work?

- What is N26 App and How Does It Work?