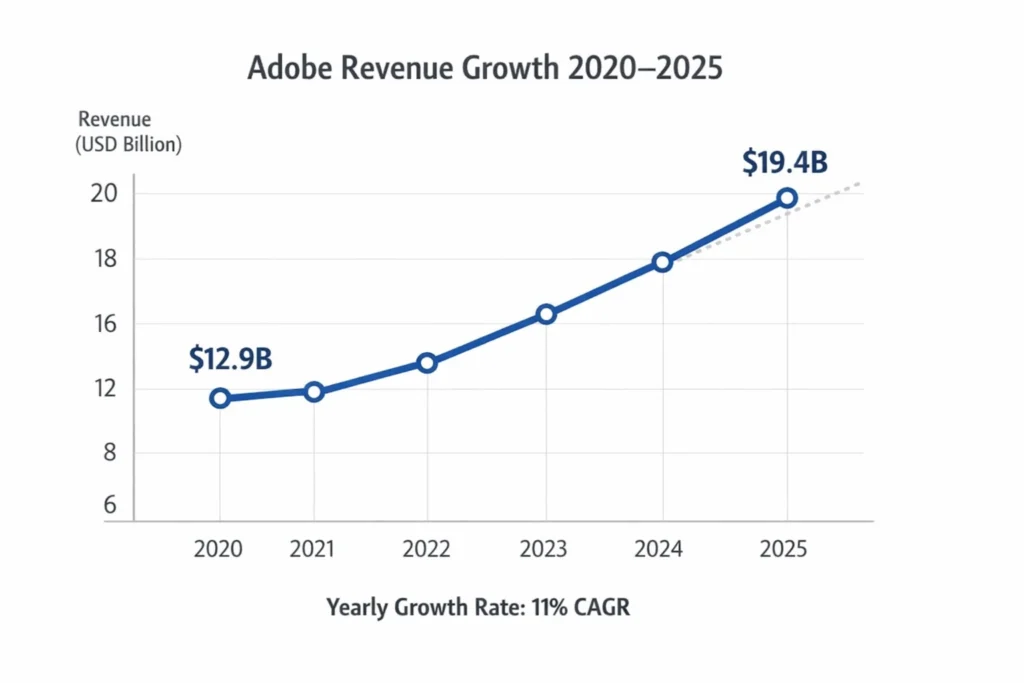

In 2026, Adobe generated approximately $19.4 billion in annual revenue, and its generative AI platform Adobe Firefly has become one of the company’s fastest-growing monetization engines—fueling Creative Cloud upgrades, enterprise licensing, and AI-driven usage credits across millions of users.

Most founders assume AI platforms make money purely through subscriptions. Firefly proves the opposite. Its real power lies in embedding monetization inside everyday workflows, where users don’t feel like they’re “paying for AI,” but rather unlocking creative speed, scale, and commercial safety.

In this guide, you’ll learn how Firefly converts creativity into predictable recurring revenue, what financial levers make it profitable, and how entrepreneurs can replicate this model to launch AI platforms that monetize from day one—not just after hitting scale.

Adobe Firefly Revenue Overview – The Big Picture

2025 Revenue:

- Adobe total revenue (2025): ~$19.4B

- Firefly’s AI-driven features are estimated to influence $3B+ in Creative Cloud and enterprise ARR through AI credit usage and premium plan upgrades.

Valuation:

- Adobe market valuation (2025): $250B+

YoY Growth:

- Adobe YoY growth: ~11%

- AI subscription adoption growth: 40%+ YoY

Revenue by Region:

- North America: ~57%

- Europe: ~26%

- Asia-Pacific: ~17%

Profit Margins:

- Operating margin: ~36%

- AI services margin (estimated): 55–65% at scale due to cloud efficiency and bundled pricing.

Competition Benchmark:

- Midjourney (private): Estimated $500M+ ARR

- OpenAI (DALL·E tied to ChatGPT): $3B+ revenue

- Canva AI: $2B+ annual revenue influence

Read More: Adobe Firefly Explained: How Adobe’s AI Creates Images and Designs

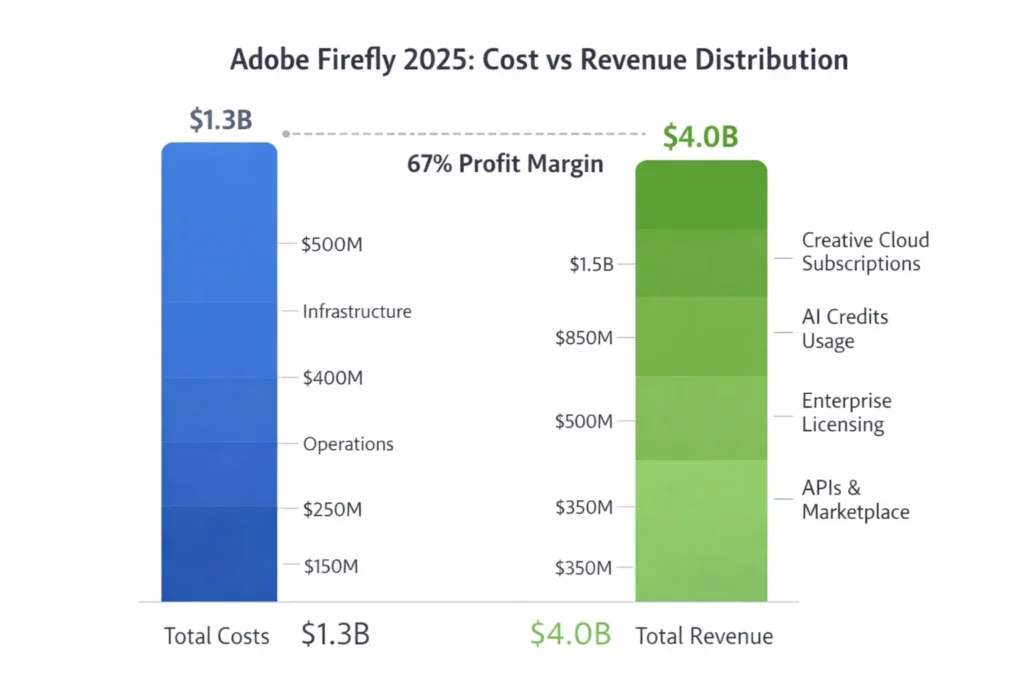

Primary Revenue Streams Deep Dive

Revenue Stream #1: Creative Cloud Subscription Bundling (45%)

Firefly is bundled inside Adobe Creative Cloud. Users upgrade to higher-tier plans for AI credits, faster generation, and commercial usage rights.

- Pricing: $20–$60/month per user

- 2025 Impact: ~$1.5B revenue influence

Revenue Stream #2: AI Credit Consumption Model (25%)

Users consume Firefly credits for generating images, vectors, and video effects. Heavy usage requires purchasing credit add-ons.

- Pricing: $5–$30/month in usage packs

- High-margin digital consumption stream

Revenue Stream #3: Enterprise Licensing (15%)

Businesses pay for commercial-safe AI, brand-trained models, and internal deployment.

- Pricing: $5,000–$100,000+ annually per organization

Revenue Stream #4: API & Platform Integrations (10%)

Developers integrate Firefly into apps and platforms using APIs.

- Pricing: Usage-based pricing per generation

Revenue Stream #5: Marketplace & Add-ons (5%)

Custom AI styles, brand templates, and premium creative packs sold through Adobe’s ecosystem.

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share | Pricing Model | 2025 Revenue Impact |

|---|---|---|---|

| Creative Cloud Subscriptions | 45% | Monthly/Annual Plans | ~$1.5B |

| AI Credit Consumption | 25% | Usage-Based Credits | ~$850M |

| Enterprise Licensing | 15% | Annual Contracts | ~$500M |

| API & Integrations | 10% | Pay-Per-Generation | ~$350M |

| Marketplace & Add-ons | 5% | One-Time / Subscription | ~$150M |

The Fee Structure Explained

User-Side Fees

- Monthly subscription ($20–$60)

- AI credit packs ($5–$30)

- Premium commercial usage rights

Provider-Side Fees

- Enterprise onboarding fees

- Custom model training costs

Hidden Revenue Layers

- Cloud storage upgrades

- Team collaboration plans

- Brand asset management tools

Regional Pricing Variation

- US/EU: Premium pricing tiers

- Asia: Discounted enterprise plans

Complete Fee Structure by User Type

| User Type | Fees Paid | Monetization Method | Revenue Driver |

|---|---|---|---|

| Individual | $20–$60/month | Subscription + Credits | Recurring ARR |

| Freelancer | $30–$80/month | Usage + Add-ons | Upsells |

| Enterprise | $5K–$100K/year | Licensing + AI Models | High Margin |

| Developers | Pay-per-API-call | Usage Billing | Volume Scale |

How Adobe Firefly Maximizes Revenue Per User

- Segmentation: Hobbyists, professionals, enterprises

- Upselling: AI credit limits, premium export rights

- Cross-Selling: Photoshop, Illustrator, Express AI tools

- Dynamic Pricing: Region-based plans

- Retention Monetization: Workflow lock-in

- LTV Optimization: Brand training models

- Psychological Pricing: “Free credits” triggers upgrades

- Real Example: Enterprises spend 4–6x more than solo users annually.

Cost Structure & Profit Margins

- Infrastructure Cost: Cloud GPUs & AI training

- CAC & Marketing: Free tier funnel

- Operations: Support, moderation, compliance

- R&D: Model improvements, safety layers

- Unit Economics: ~$0.03–$0.08 per generation

- Margin Optimization: Subscription bundling

- Profitability Path: AI usage increases ARPU without linear cost growth

Future Revenue Opportunities & Innovations

- AI video monetization

- Brand-safe advertising tools

- AI design marketplaces

- Enterprise SaaS expansions

- 2025–2027 Risks: GPU costs, regulation

- Opportunities: SME creative platforms, regional SaaS markets

Lessons for Entrepreneurs & Your Opportunity

What Works:

- Usage-based monetization

- Subscription bundling

- Enterprise licensing

What to Replicate:

- Credit systems

- API access

- Commercial safety layers

Market Gaps:

- SMB-focused AI design tools

- Regional creative platforms

Want to build a platform with Adobe Firefly’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Adobe Firefly clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Adobe Firefly shows that AI platforms don’t win by offering the best model—they win by building the smartest monetization ecosystem around it. Subscriptions, usage credits, and enterprise licensing form a layered system where every user type pays in a way that feels natural to their workflow.

For founders, the key takeaway is simple: design revenue first, features second. Firefly didn’t just add AI to Photoshop—it added pricing logic, credit limits, and upsell triggers that turn creativity into predictable monthly income.

If you’re entering the AI SaaS market, your advantage isn’t scale—it’s focus. Build for a niche, monetize deeply, and expand outward. That’s how Firefly became a billion-dollar revenue engine instead of just another AI tool.

FAQs

1. How much does Adobe Firefly make per transaction?

Firefly earns through subscription upgrades and AI credit usage, averaging $0.05–$0.30 per generation in monetized value.

2. What’s Adobe Firefly’s most profitable revenue stream?

Enterprise licensing and bundled Creative Cloud subscriptions.

3. How does Adobe Firefly’s pricing compare to competitors?

It’s premium-priced but includes commercial safety and ecosystem integration.

4. What percentage does Adobe take from providers?

Adobe retains nearly 100% of platform revenue since it owns the ecosystem.

5. How has Firefly’s revenue model evolved?

From subscription-only to usage-based AI credit monetization.

6. Can small platforms use similar models?

Yes, with scaled-down credit systems and niche subscriptions.

7. What’s the minimum scale for profitability?

Around 5,000–10,000 paying users for AI SaaS platforms.

8. How to implement similar revenue models?

Use tiered subscriptions, API billing, and credit-based consumption.

9. What are alternatives to Firefly’s model?

Freemium SaaS, pay-per-download, or white-label licensing.

10. How quickly can similar platforms monetize?

With proper setup, revenue can begin within 30–60 days of launch.