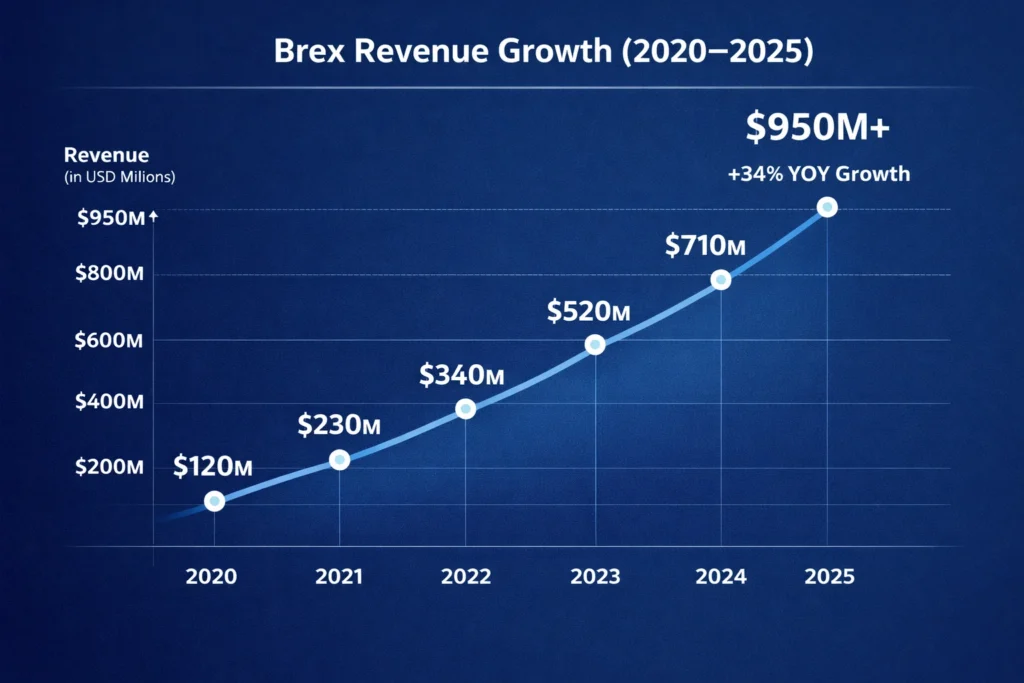

In 2025, Brex crossed an estimated $950 million in annual revenue, becoming one of the fastest-scaling fintech platforms in the global corporate finance stack. This growth has been fueled by rising enterprise adoption, expanding international spend volumes, and a shift toward subscription-based finance automation products that lock in recurring revenue. Strategic partnerships with payroll, ERP, and accounting platforms have also extended Brex’s reach deeper into daily business operations, increasing lifetime value per customer.

For founders, Brex isn’t just a business card company — it’s a full-stack financial operating system for startups, mid-market firms, and global enterprises managing spend, compliance, and cash flow across borders. Its strength lies in unifying approvals, expense tracking, treasury management, and regulatory reporting into a single interface, reducing operational friction for finance teams. This integrated approach creates high switching costs and long-term contract opportunities, turning platform adoption into multi-year revenue visibility.

This revenue model shows how fintech platforms monetize financial behavior, workflows, and compliance, not just transactions — turning finance into recurring, high-margin SaaS infrastructure. By layering interchange income with per-user subscriptions, premium analytics, and compliance automation, Brex builds diversified revenue streams that compound as customers scale. For new founders, it highlights the power of targeting operational pain points where businesses are willing to pay for reliability, automation, and regulatory confidence rather than just lower transaction fees.

Brex Revenue Overview – The Big Picture

2025 Revenue: ~$950M

Valuation: ~$12.3B (private market estimates)

YoY Growth: ~34%

Revenue by Region:

- North America: 61%

- Europe: 21%

- Asia-Pacific: 12%

- LATAM: 6%

Profit Margins: Estimated 28–35% EBITDA (SaaS + fintech infrastructure blend)

Competition Benchmark:

- Ramp

- American Express Business

- Stripe Issuing

- SAP Concur

- Airbase

Brex operates at the intersection of banking, SaaS, and enterprise finance automation, capturing value at every point where money is authorized, spent, tracked, and reported.

Read More: Brex Explained – Corporate Card, Spend Management & Startup Banking

Primary Revenue Streams Deep Dive

Revenue Stream #1: Interchange Fees (Corporate Cards)

How it works: Brex earns a percentage of every card transaction made by customers globally.

% Share: ~44%

Pricing: 1.5%–2.3% per transaction

2025 Data: $40B+ in annual card spend volume

Revenue Stream #2: SaaS Subscriptions (Brex Empower + Premium Plans)

How it works: Businesses pay monthly or annual fees for spend controls, approval workflows, compliance automation, and financial reporting dashboards.

% Share: ~26%

Pricing: $12–$49 per user/month (enterprise contracts higher)

2025 Data: 150,000+ business accounts globally

Revenue Stream #3: International FX & Payments Fees

How it works: Brex earns spreads on currency conversion and cross-border transfers.

% Share: ~12%

Pricing: 0.4%–1.2% FX margin

2025 Data: Active in 100+ currencies

Revenue Stream #4: Partner Marketplace & API Monetization

How it works: Revenue share from payroll, ERP, and accounting integrations plus premium API access for enterprises.

% Share: ~10%

Pricing: Revenue split + API usage tiers

2025 Data: 200+ fintech and SaaS integrations

Revenue Stream #5: Float & Treasury Yield

How it works: Interest income from holding customer funds and treasury management services.

% Share: ~8%

Pricing: Variable based on market rates

2025 Data: Multi-billion-dollar managed balances

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share | Annual Revenue Contribution (2025) |

|---|---|---|

| Interchange Fees | 44% | ~$418M |

| SaaS Subscriptions | 26% | ~$247M |

| FX & Cross-Border Payments | 12% | ~$114M |

| API & Partner Ecosystem | 10% | ~$95M |

| Treasury Yield | 8% | ~$76M |

The Fee Structure Explained

User-Side Fees

- Standard plans: Free tier for small teams

- Premium plans: Per-user SaaS subscriptions

- International transfers: FX margin-based pricing

Provider-Side Fees

- Merchants: Standard card interchange sharing

- Enterprise clients: Custom contract pricing

Hidden Revenue Layers

- Advanced compliance automation

- AI-powered spend analytics

- ERP synchronization modules

- Risk scoring and fraud prevention APIs

Regional Pricing Variation

- US & Canada: Card + SaaS bundle pricing

- Europe: Compliance-first pricing tiers

- Asia: FX-heavy monetization model

Complete Fee Structure by User Type

| User Type | Fee Type | Price Range |

|---|---|---|

| Small Businesses | SaaS subscription | Free → $12/user/month |

| Mid-Market Firms | SaaS + FX fees | $25–$49/user/month |

| Enterprises | Custom contracts | $10K–$250K/year |

| Developers | API access | Freemium → $15K+/month |

| International Users | FX margin | 0.4%–1.2% |

How Brex Maximizes Revenue Per User

Brex grows revenue by embedding itself into financial decision-making.

Segmentation: Startups, global SMEs, enterprises, finance teams

Upselling: Advanced approvals, multi-entity support, spend forecasting

Cross-selling: Cards + FX + treasury + ERP integrations

Dynamic Pricing: User count + spend volume tiers

Retention Monetization: Annual enterprise contracts

LTV Optimization: High switching costs via accounting system lock-in

Psychological Pricing: Positioning as “finance OS” not “corporate card”

Real Data Example: Average enterprise account LTV exceeds $120,000+

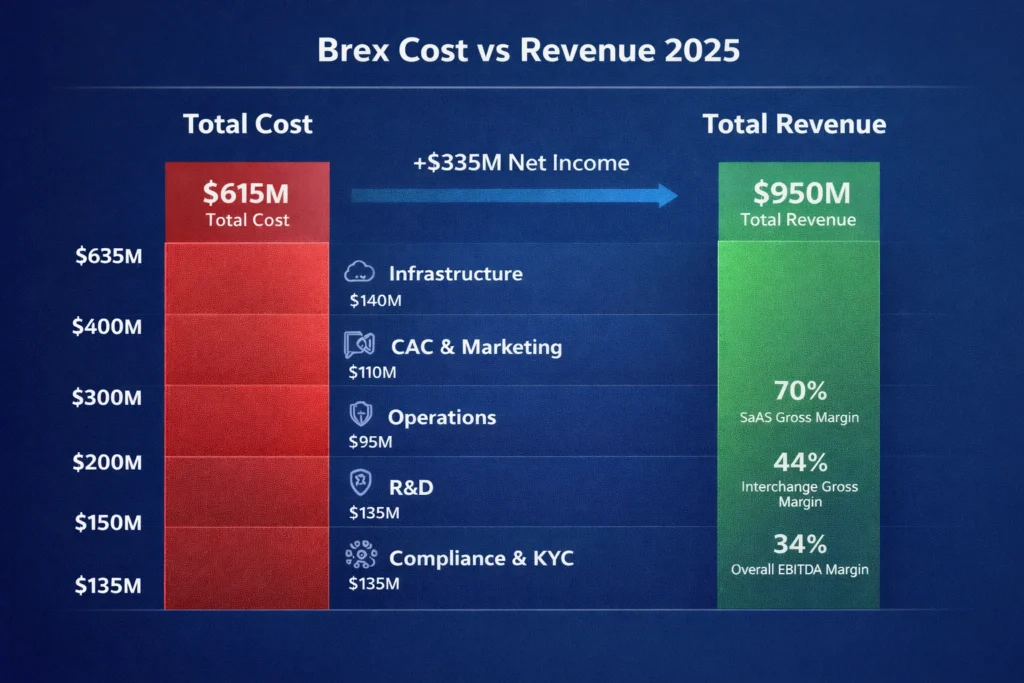

ost Structure & Profit Margins

Infrastructure Cost: Banking APIs, cloud systems, card network fees (~20%)

CAC & Marketing: Enterprise sales, partnerships, onboarding (~18%)

Operations: Compliance, KYC, fraud prevention, customer support (~15%)

R&D: AI automation, platform engineering, security (~22%)

Unit Economics:

- SaaS gross margin: 70%+

- Interchange margin: 40%–60%

Margin Optimization:

- AI-based fraud detection

- Automated compliance workflows

- Self-service onboarding for SMEs

Profitability Path: Brex improves margins by shifting revenue mix from interchange toward recurring SaaS contracts.

Read More: Best Brex Clone Scripts 2026 | Corporate Card & Spend Management

Future Revenue Opportunities & Innovations

New Streams:

- AI-powered CFO tools

- Embedded payroll and benefits

- SME lending and credit products

AI/ML-Based Monetization:

- Predictive cash flow modeling

- Automated expense categorization

- Fraud risk scoring

Market Expansions:

- LATAM and Southeast Asia

- Cross-border startup ecosystems

- Remote workforce finance platforms

Predicted Trends 2025–2027:

- Finance automation becomes mandatory for compliance

- Real-time tax reporting integrations

- Embedded banking inside SaaS platforms

Risks & Threats:

- Neobank competition

- Regulatory tightening

- Card network fee compression

Opportunities for New Founders:

- Vertical-specific finance platforms

- Freelancer and creator finance OS

- Industry-based expense networks

Lessons for Entrepreneurs & Your Opportunity

What Works:

- Hybrid SaaS + fintech revenue model

- Enterprise-grade compliance as a premium feature

- Ecosystem-driven platform growth

What to Replicate:

- Interchange + subscription stacking

- Deep ERP integrations

- Spend-based pricing tiers

Market Gaps:

- Finance tools for non-tech SMEs

- Local compliance automation platforms

- AI-first treasury management systems

Founder Improvements:

- No-code financial workflows

- Industry-specific finance dashboards

- Regional regulatory automation

Want to build a platform with Brex’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Brex clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Brex shows how the future of fintech isn’t about banking features — it’s about owning the financial workflow of a business end-to-end.

By turning compliance, approvals, and financial visibility into monetized infrastructure, Brex transforms everyday spending into a recurring, scalable revenue engine.

For founders, the opportunity lies in building vertical-specific finance platforms that embed directly into how industries manage money, not just how they move it.

FAQs

1. How much does Brex make per transaction?

Brex typically earns 1.5%–2.3% in interchange per card transaction.

2. What’s Brex’s most profitable revenue stream?

SaaS subscriptions and enterprise contracts.

3. How does Brex’s pricing compare to competitors?

More SaaS-focused than traditional card providers like AmEx and more automation-driven than Ramp.

4. What percentage does Brex take from providers?

Interchange revenue varies by region, typically between 1.5%–2.3%.

5. How has Brex’s revenue model evolved?

It shifted from card-first monetization to a full finance OS subscription model.

6. Can small platforms use similar models?

Yes, on niche or industry-specific finance platforms.

7. What’s the minimum scale for profitability?

Roughly $2M–$5M in annual recurring SaaS revenue.

8. How to implement similar revenue models?

Combine interchange, SaaS subscriptions, and financial automation tools.

9. What are alternatives to Brex’s model?

Ramp, Airbase, Stripe Issuing, and SAP Concur.

10. How quickly can similar platforms monetize?

Some fintech platforms generate revenue within 30–45 days post-launch.