Cdiscount is one of Europe’s most resilient discount eCommerce platforms, blending first-party retail, a third-party marketplace, and high-margin services into a single, tightly integrated revenue engine. This hybrid structure allows the platform to balance volume-driven sales with scalable monetization layers that reduce dependence on any one revenue source.

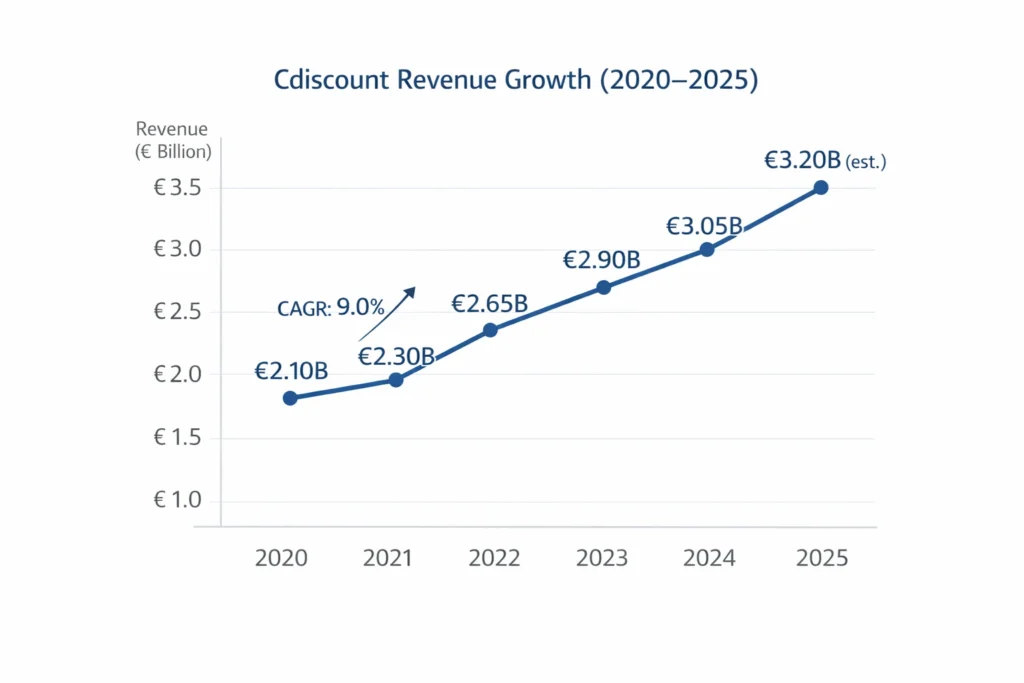

In 2025, Cdiscount crossed ~€3.2 billion in revenue, proving that price-led platforms can still thrive against Amazon and strong regional competitors. Its success comes from operational efficiency, deep local market understanding, and the ability to monetize beyond product sales through advertising, subscriptions, and financial add-ons.

For founders, Cdiscount represents a masterclass in multi-layer monetization at scale, not just low pricing. It shows how discount-focused platforms can remain profitable by extracting value across the entire transaction lifecycle—before purchase, during checkout, and long after the order is completed.

Cdiscount Revenue Overview – The Big Picture

2025 Revenue: ~€3.2 billion

Valuation (estimated): €4.5–5.2 billion

YoY Growth: ~5%

Revenue by Region:

- France: ~85%

- Southern Europe: ~8%

- Other EU markets: ~7%

Profit Margins:

- Gross margin: ~18–22%

- Net margin: ~2–3% (volume-driven model)

Competition Benchmark:

- Lower margins than Amazon

- Higher private-label penetration than regional marketplaces

- Stronger price leadership than most EU players

Read More: What is Cdiscount and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: First-Party Retail Sales

Cdiscount still operates as a direct retailer, owning inventory in electronics, appliances, and FMCG.

- Contribution: ~46%

- Pricing: Aggressive discounting with thin margins

- 2025 revenue: ~€1.47B

Revenue Stream #2: Marketplace Commissions

Third-party sellers list products while Cdiscount earns commissions.

- Contribution: ~28%

- Commission rate: 8–15%

- High scalability, lower inventory risk

Revenue Stream #3: Advertising & Sponsored Listings

Brands pay to gain visibility inside search results and category pages.

- Contribution: ~12%

- CPC & CPM-based pricing

- One of the fastest-growing revenue streams

Revenue Stream #4: Cdiscount à Volonté (Subscription)

Annual membership offering free delivery and exclusive deals.

- Contribution: ~9%

- Pricing: €29–39/year

- Drives higher order frequency

Revenue Stream #5: Financial & Ancillary Services

Includes insurance, BNPL, warranties, and travel deals.

- Contribution: ~5%

- Very high margin

Revenue Streams Breakdown Table

| Revenue Stream | % Share |

|---|---|

| Retail Sales | 46% |

| Marketplace Commissions | 28% |

| Advertising | 12% |

| Subscriptions | 9% |

| Financial Services | 5% |

The Fee Structure Explained

User-Side Fees

- Product price

- Delivery fees (free for subscribers)

- Optional extended warranty fees

Seller-Side Fees

- Marketplace commission: 8–15%

- Fulfillment & logistics charges

- Advertising spend

Hidden Revenue Layers

- Refund breakage

- Warranty upsells

- Financing partnerships

Regional Pricing Variation

- France-focused pricing advantages

- Logistics-driven regional price adjustments

Fee Structure Table

| User Type | Fee Type | Typical Range |

|---|---|---|

| Buyers | Delivery Fee | €0–€9 |

| Buyers | Warranty Add-on | €10–€150 |

| Sellers | Commission | 8–15% |

| Sellers | Sponsored Ads | Variable |

How Cdiscount Maximizes Revenue Per User

Cdiscount relies on basket expansion and frequency, not premium pricing.

- Segmentation: Deal hunters vs bulk buyers

- Upselling: Warranties, accessories

- Cross-selling: Electronics + services

- Dynamic pricing: Algorithmic discounting

- Retention monetization: Subscription locking

- LTV optimization: Financing + repeat deals

- Psychological pricing: Flash deals & urgency

Real Data Insight:

Subscribers place 2.3× more orders annually than non-members.

Cost Structure & Profit Margins

Infrastructure Cost

- Warehousing & logistics hubs

- Marketplace tech infrastructure

CAC & Marketing

- TV & digital campaigns

- Price comparison engines

Operations

- Customer support

- Seller onboarding & compliance

R&D

- Pricing algorithms

- Marketplace optimization

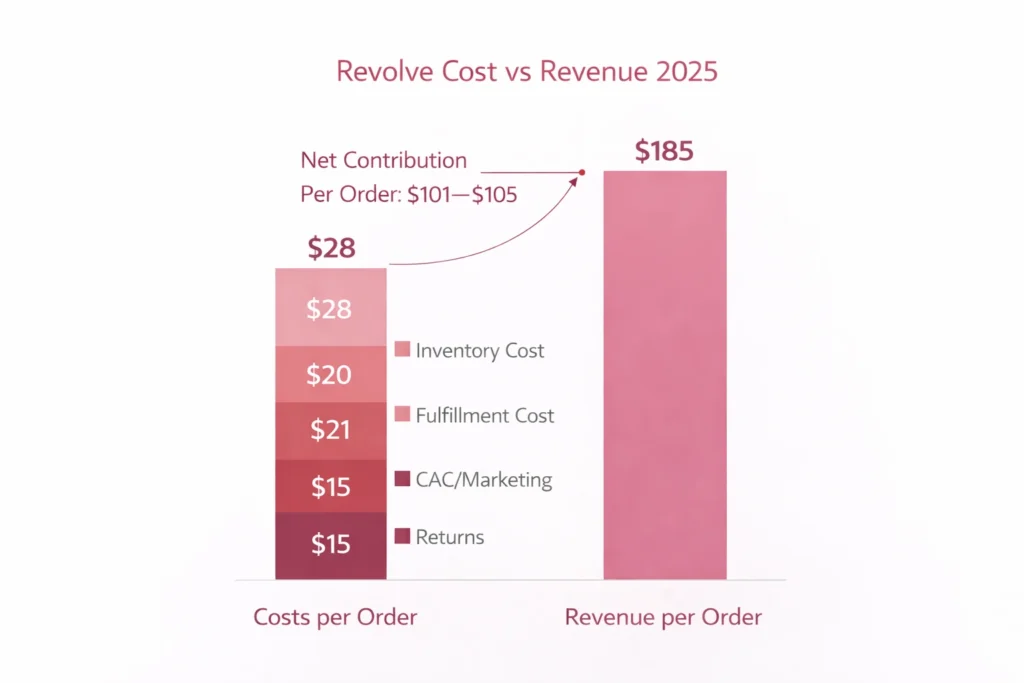

Unit Economics (Avg Order)

- Average order value: ~€85

- Gross profit per order: ~€14–18

- Fulfillment cost: ~€6–8

- Net contribution/order: ~€4–6

Profitability Path

- Ads & services offset thin retail margins

- Subscription-driven predictability

Read More: Best Cdiscount Clone Scripts 2025 | Scalable French Marketplace

Future Revenue Opportunities & Innovations

- Retail media network expansion

- AI-based dynamic pricing

- Private-label FMCG growth

- Cross-border EU marketplace expansion

Predicted Trends (2025–2027):

- Ads overtaking retail margins

- More seller tools monetization

- Subscription bundles beyond shipping

Risks & Threats:

- Amazon price wars

- Logistics cost inflation

- Margin pressure from returns

Opportunities for New Founders:

- Regional discount marketplaces

- Vertical-specific Cdiscount-style platforms

Lessons for Entrepreneurs & Your Opportunity

What Works

- Volume-driven revenue

- Multi-layer monetization

What to Replicate

- Marketplace + ads combo

- Subscription-based loyalty

Market Gaps

- SME-focused seller tools

- Regional logistics optimization

Founder Improvements

- Faster seller payouts

- Smarter returns management

Want to build a platform with Cdiscount’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Cdiscount-style marketplace clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, andif you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Cdiscount proves that price leadership can still be profitable when it is strategically layered with high-margin services, advertising revenue, and subscription programs. Rather than relying solely on product margins, the platform uses volume, repeat purchases, and ancillary monetization to offset thin retail profits and stabilize overall revenue.

Its real strength lies in extracting value from every transaction, not in maximizing margin per individual product. By monetizing logistics, warranties, sponsored listings, financing options, and seller services, Cdiscount turns even low-priced orders into multi-touch revenue opportunities that compound at scale.

For founders, this model unlocks scalable opportunities in price-sensitive markets where affordability drives demand. By combining competitive pricing with marketplace commissions, ads, and optional services, new platforms can build resilient revenue engines without competing purely on discounts or sacrificing long-term sustainability.

FAQs

1. How much does Cdiscount make per transaction?

Around €4–6 in net contribution per order.

2. What’s Cdiscount’s most profitable revenue stream?

Advertising and financial services.

3. How does Cdiscount’s pricing compare to competitors?

Lower than Amazon, but with thinner margins.

4. What percentage does Cdiscount take from sellers?

Typically 8–15% commission.

5. How has Cdiscount’s revenue model evolved?

From pure retail to a hybrid marketplace + services model.

6. Can small platforms use similar models?

Yes, especially in regional or niche markets.

7. What’s the minimum scale for profitability?

High order volume is required—usually 50k+ monthly orders.

8. How to implement similar revenue models?

Marketplace commissions, ads, subscriptions, and services.

9. What are alternatives to Cdiscount’s model?

Pure marketplace or subscription-only discount platforms.

10. How quickly can similar platforms monetize?

Many begin generating revenue within 30–60 days post-launch.