In 2026, Copy.ai is no longer just an AI writing tool — it’s a full-scale AI-powered revenue engine for marketing teams, startups, and global enterprises.

The platform is estimated to be generating $25–30 million annually, fueled by recurring SaaS subscriptions and fast-growing enterprise automation contracts.

For founders, Copy.ai’s business model offers a blueprint for how AI platforms can move beyond simple tools into scalable, high-margin SaaS ecosystems.

Copy.ai Revenue Overview – The Big Picture

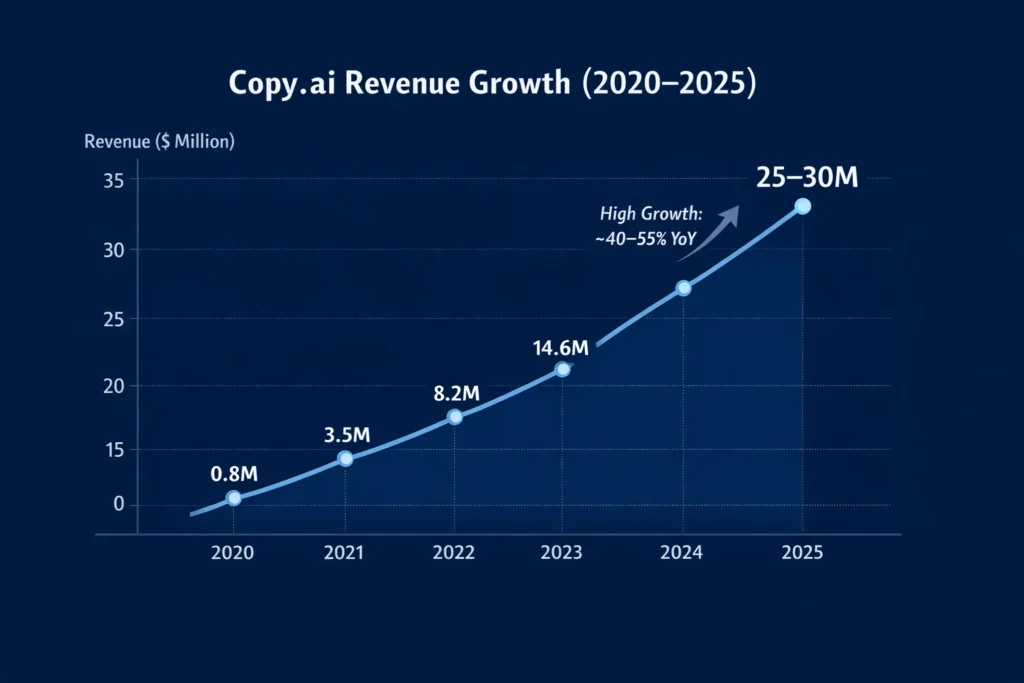

2025 Estimated Revenue: $25–30 million

Valuation (Private Market Estimates): $300–400 million range

Year-over-Year Growth: ~40–55% (driven by enterprise AI workflow adoption)

Revenue by Region:

- North America: ~52%

- Europe: ~28%

- Asia-Pacific & Others: ~20%

Profit Margins:

Gross margins estimated between 70–80%, typical of mature AI SaaS platforms with optimized cloud infrastructure and enterprise contracts.

Competition Benchmark:

Compared to competitors like Jasper and Writesonic, Copy.ai stands out for its AI workflow automation layer, not just content generation, which increases enterprise contract sizes and long-term retention.

Read More: What Is Copy.ai? Inside the GTM AI Platform for Sales and Marketing Teams

Primary Revenue Streams Deep Dive

Revenue Stream #1: SaaS Subscriptions

How it Works: Monthly and annual plans for individuals, teams, and businesses.

Pricing Range (2025): $49–$249 per user/month

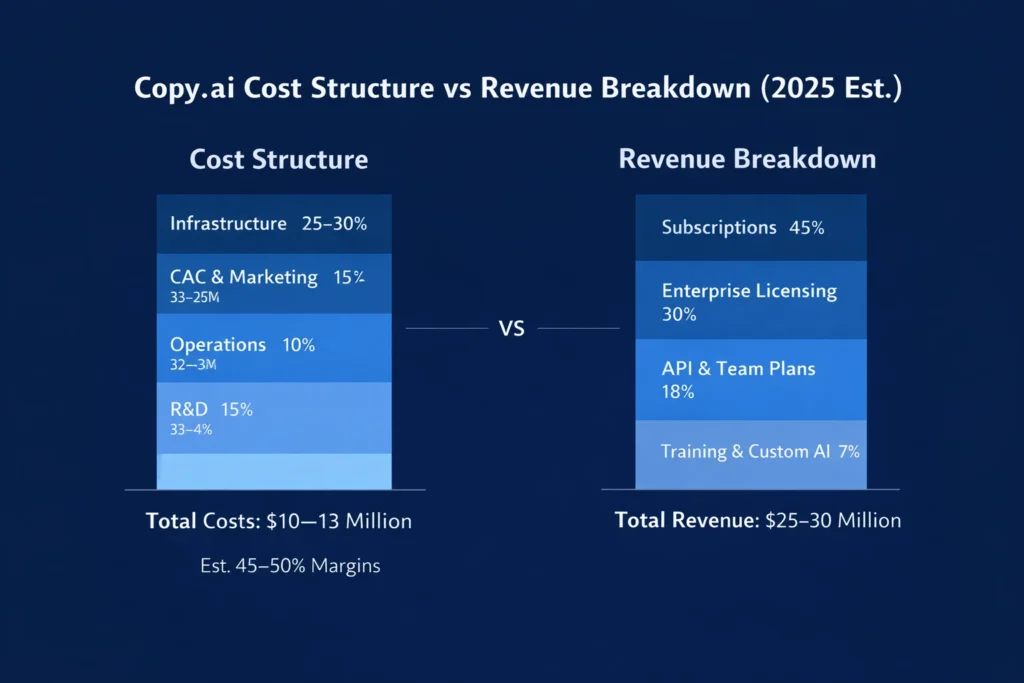

Revenue Share: ~45%

Why It Works: Recurring revenue ensures predictable cash flow and high LTV (Lifetime Value).

Revenue Stream #2: Enterprise AI Workflow Licensing

How it Works: Custom AI automations for sales, marketing, and internal content pipelines.

Contract Size: $10,000–$250,000+ annually

Revenue Share: ~30%

Why It Works: High-margin, long-term contracts with strong retention.

Revenue Stream #3: API Access & Usage-Based Billing

How it Works: Businesses integrate Copy.ai’s AI into CRMs, CMS platforms, and marketing stacks.

Pricing: Pay-per-token or usage tiers

Revenue Share: ~10%

Why It Works: Scales automatically as customers grow.

Revenue Stream #4: Team & Collaboration Plans

How it Works: Seat-based pricing for agencies and distributed marketing teams.

Revenue Share: ~8%

Why It Works: Expands revenue inside the same customer account.

Revenue Stream #5: Training, Onboarding & Custom AI Models

How it Works: Premium onboarding, private model training, and compliance customization.

Revenue Share: ~7%

Why It Works: High-margin professional services layered on SaaS.

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share (2025) | Primary Customers | Monetization Style |

|---|---|---|---|

| Subscriptions | 45% | Individuals & SMBs | Monthly/Annual Plans |

| Enterprise Licensing | 30% | Enterprises | Annual Contracts |

| API & Usage Billing | 10% | Tech Companies | Pay-as-you-go |

| Team Plans | 8% | Agencies | Per-seat Pricing |

| Training & Custom AI | 7% | Regulated Firms | Project-Based |

The Fee Structure Explained

User-Side Fees:

- Monthly SaaS plans

- Per-seat team upgrades

- API usage credits

Provider-Side Fees:

- Cloud AI compute costs

- Model hosting infrastructure

- Security & compliance frameworks

Hidden Revenue Layers:

- Premium feature unlocks

- Workflow automation add-ons

- Data privacy and compliance packages

Regional Pricing Variation:

- North America: Full price

- Europe: VAT-inclusive pricing

- Asia: Discounted pricing tiers for market expansion

Complete Fee Structure by User Type

| User Type | Pricing Model | Average Annual Spend | Key Revenue Driver |

|---|---|---|---|

| Solo Creators | Subscription | $500–$1,200 | Monthly Renewals |

| SMB Teams | Per-Seat SaaS | $2,000–$6,000 | Team Expansion |

| Enterprises | Licensing | $25,000–$250,000+ | Long-Term Contracts |

| Developers | Usage-Based | Variable | API Calls |

How Copy.ai Maximizes Revenue Per User

Segmentation: Users are grouped by role — creators, agencies, sales teams, and enterprises.

Upselling: Free users are guided into paid workflows and automation features.

Cross-Selling: Teams upgrade to enterprise compliance and API integration.

Dynamic Pricing: Seat-based expansion as teams grow.

Retention Monetization: Workflow lock-in makes switching costly.

LTV Optimization: Annual contracts with discounts boost cash flow.

Psychological Pricing: “Most Popular” plan anchors conversion.

Real Example:

A 10-person sales team paying $99 per user per month generates nearly $12,000 annually — before automation or enterprise upgrades.

Cost Structure & Profit Margins

Infrastructure Costs:

AI compute, cloud hosting, and data storage (~25–30% of revenue).

Customer Acquisition Cost (CAC):

SEO, partnerships, and outbound sales (~15–20%).

Operations:

Support teams, compliance, and billing (~10%).

R&D:

Model fine-tuning, AI workflow tools, and platform upgrades (~15%).

Unit Economics:

High gross margins allow reinvestment into growth without external funding pressure.

Profitability Path:

Enterprise contracts push the company toward consistent operating profitability.

Future Revenue Opportunities & Innovations

New Streams:

- AI-powered CRM automation tools

- Voice-to-content AI platforms

- Internal enterprise knowledge bots

AI/ML-Based Monetization:

Private AI models trained on company data for regulated industries.

Market Expansion:

Localized AI platforms for Asia, Middle East, and LATAM.

Predicted Trends (2025–2027):

- AI agents replacing manual sales workflows

- Compliance-first AI platforms for finance and healthcare

- Vertical-specific AI SaaS products

Risks & Threats:

- Open-source AI competition

- Price wars among AI SaaS tools

- Regulatory compliance costs

Opportunities for Founders:

Niche AI platforms for legal, healthcare, real estate, and logistics.

Lessons for Entrepreneurs & Your Opportunity

What Works:

Recurring subscriptions + enterprise licensing create stable, scalable revenue.

What to Replicate:

AI workflows instead of just content generation.

Market Gaps:

Industry-specific AI platforms with built-in compliance and reporting.

Founder Advantage:

Most competitors still focus on tools — not business automation systems.

Want to build a platform with Copy.ai’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Copy.ai clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Copy.ai’s journey shows how AI tools become powerful businesses when paired with automation and enterprise value.

The real revenue isn’t in writing content — it’s in running business systems.

For founders, this model offers a roadmap to building high-margin, globally scalable AI platforms.

FAQs

1) How much does Copy.ai make per transaction?

Copy.ai primarily earns through subscriptions and contracts, not per-transaction fees.

2) What’s Copy.ai’s most profitable revenue stream?

Enterprise AI workflow licensing delivers the highest margins.

3) How does Copy.ai’s pricing compare to competitors?

It’s priced slightly higher due to automation and enterprise features.

4) What percentage does Copy.ai take from providers?

There’s no provider marketplace — revenue comes directly from users.

5) How has Copy.ai’s revenue model evolved?

It shifted from simple subscriptions to enterprise automation licensing.

6) Can small platforms use similar models?

Yes, by targeting niche industries with AI automation tools.

7) What’s the minimum scale for profitability?

Around 500–1,000 paying users or a handful of enterprise contracts.

8) How to implement similar revenue models?

Combine SaaS subscriptions with API usage and enterprise licensing.

9) What are alternatives to Copy.ai’s model?

Freemium AI platforms, ad-supported tools, or transaction-based APIs.

10) How quickly can similar platforms monetize?

With strong positioning, some founders see revenue within 30–60 days.