eBay remains one of the world’s most resilient marketplace ecosystems, crossing $10.1 billion in revenue in 2025. Its model has evolved from classic auctions to a global commerce engine powered by fees, ads, and payment flows.

Understanding how eBay monetizes is essential for founders building platforms with marketplace dynamics, multi-sided incentives, and diversified income streams.

This blueprint is especially valuable because marketplaces that master fee layering and transaction control tend to scale faster and achieve predictable profitability.

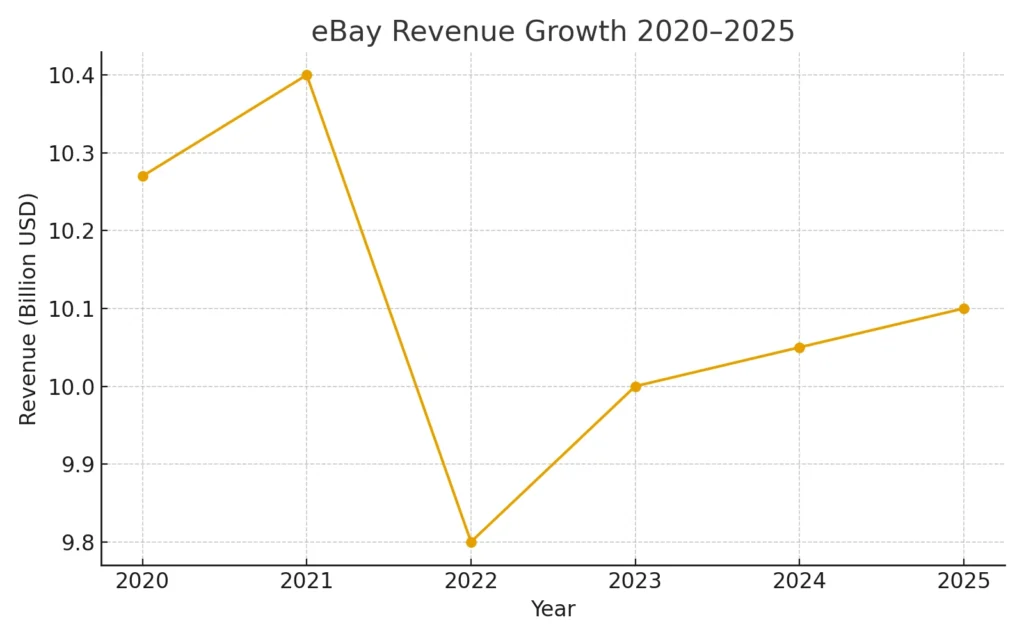

eBay Revenue Overview – The Big Picture

2025 Revenue: ~$10.1 billion

Valuation: ~$29–32 billion

YoY Growth: ~4.2%

Revenue by Region:

- North America: 48%

- Europe: 36%

- APAC & Others: 16%

Profit Margins (Net): ~26–28%

Competition Benchmark (GMV 2025): - Amazon Marketplace: ~$700B

- Alibaba: ~$900B

- Etsy: ~$13B

- eBay: ~$72B GMV

Read More: What is eBay App? Here’s How It Really Works

Primary Revenue Streams Deep Dive

1. Transaction Fees (Final Value Fees) – ~52% Share

Sellers pay a percentage of each sale, typically 10–15% depending on category. In 2025, eBay processed ~$72B GMV, generating over $5.2B from FVF alone.

2. Promoted Listings (Advertising) – ~23% Share

eBay’s ad engine allows sellers to boost visibility. CPC + CPA hybrid. 2025 ad revenue reached ~$2.3B, with adoption accelerating in cross-border categories.

3. Payment Processing Fees – ~12% Share

Through eBay Managed Payments, the platform earns ~2.7% + fixed fee per transaction, adding another ~$1.2B in 2025.

4. Store Subscriptions – ~9% Share

Monthly subscription tiers (Basic, Premium, Anchor). SMB adoption grew 11% YoY. Revenue ~$900M in 2025.

5. Logistics & Ancillary Fees – ~4% Share

Authentication fees, shipping label commissions, cross-border transaction charges, and optional service enhancements.

Revenue streams percentage breakdown

| Revenue Stream | Share % | 2025 Revenue |

|---|---|---|

| Transaction Fees | 52% | $5.2B |

| Advertising (Promoted Listings) | 23% | $2.3B |

| Payment Processing | 12% | $1.2B |

| Store Subscriptions | 9% | $0.9B |

| Logistics & Others | 4% | $0.4B |

The Fee Structure Explained

User-Side Fees

- Buyers typically pay no direct fees except in select categories.

- Global shipping program has variable charges.

Provider-Side (Seller) Fees

- Final Value Fee: 10–15%

- Payment Processing: 2.7% + fixed fee

- Listing Upgrades: $0.10–$2

- Subscription packages: $4.95–$299/month

Hidden Revenue Layers

- Currency conversion markup

- International service fees

- Promoted listing increases based on auction competitiveness

Regional Pricing Variation

Categories like electronics and luxury goods face higher fees in EU due to stricter compliance.

Complete fee structure by user type

| User Type | Fee Type | Range |

|---|---|---|

| Buyers | Shipping, Intl Service | Variable |

| Sellers | Final Value Fee | 10–15% |

| Sellers | Payment Fee | 2.7% + fixed |

| Sellers | Ad Spend | CPC/CPA |

| Sellers | Subscription | $4.95–$299/mo |

How eBay Maximizes Revenue Per User

Segmentation

eBay separates casual sellers, SMB merchants, cross-border exporters, and power sellers.

Upselling

Subscription upgrades, category-specific listing enhancements, and shipping optimizations.

Cross-Selling

- Store analytics tools

- International selling tools

- Payment services

Dynamic Pricing

Auction-style bidding and algorithmic recommended pricing maximize seller willingness to pay.

Retention Monetization

Loyalty incentives, seller protections, and category expansion programs.

LTV Optimization

Promoted listings and managed payments increase average revenue per seller.

Psychological Pricing

Auction countdown urgency boosts final sale prices.

Real Examples

Promoted Listings Advanced (PLA) increased seller ad spend by ~18% in 2025.

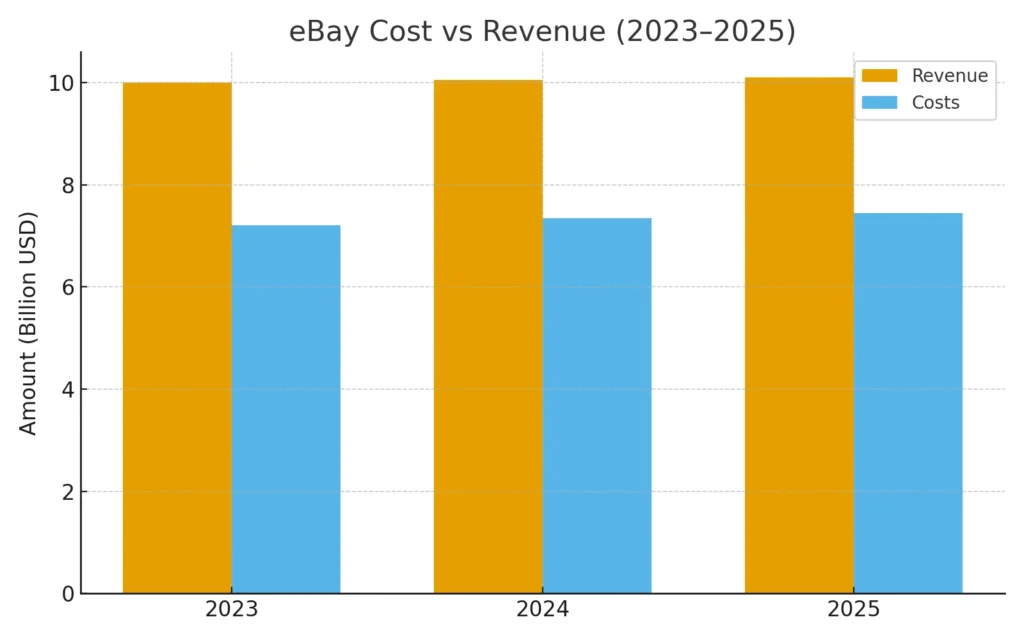

Cost Structure & Profit Margins

Infrastructure Cost

Cloud hosting, payment processing infrastructure, fraud detection.

CAC & Marketing

Performance marketing + strategic partnerships. CAC reduced 7% YoY through retention automation.

Operations

Logistics partnerships, authentication centers, customer support.

R&D

Search optimization, recommendation engines, AI seller tools.

Unit Economics

High-margin business: 70–90% gross margin due to marketplace-light operations.

Margin Optimization

Shift toward high-margin ad revenue dramatically improves profitability.

Profitability Path

eBay maintains strong net margins ~26–28%.

Read More: Best eBay Clone Scripts in 2025 | Online Marketplace

Future Revenue Opportunities & Innovations

New Streams

- AI-powered seller automation

- Logistics-as-a-service for SMEs

- Premium analytics marketplace

AI/ML-Based Monetization

Smart pricing, predictive promotions, high-intent buyer targeting.

Market Expansions

Luxury authentication, refurbished products, cross-border commerce.

Predicted Trends (2025–2027)

- Ads overtaking transaction fees

- AI-driven merchandising

- Payment monetization growth

Risks & Threats

Amazon competition, counterfeit issues, shifting seller loyalty, regulatory compliance.

Opportunities for Founders

A multi-revenue marketplace is easier than ever with modern modular tech.

Lessons for Entrepreneurs & Your Opportunity

What Works

- Take rate stacking

- Ad revenue layered on top of transactions

- Subscription tiers for stability

What to Replicate

- Diversified monetization

- High-margin ad ecosystem

- Payment control

Market Gaps

- Niche-focused resale verticals

- Hyper-local marketplace models

- AI-governed price setting

Improvements Founders Can Use

- Better authentication

- Integrated financing

- End-to-end logistics for sellers

Want to build a platform with eBay’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our eBay clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch. we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

eBay’s revenue model demonstrates why marketplace platforms succeed when they control fees, ads, and payments strategically. Its layered monetization creates stability even when GMV fluctuates.

For founders, learning from eBay means understanding how to blend transaction-based earnings with high-margin services that users willingly adopt. This mix reduces dependency on any one revenue stream.

With the right technology, entrepreneurs can replicate this model for niche markets or global ecosystems — and Miracuves makes that pathway significantly faster.

FAQs

1. How much does eBay make per transaction?

Roughly 12–18% depending on category and payment fees.

2. What’s eBay’s most profitable revenue stream?

Advertising (Promoted Listings) due to extremely high margins.

3. How does eBay’s pricing compare to competitors?

Lower than Amazon, higher than Etsy in specific categories.

4. What percentage does eBay take from providers?

10–15% as Final Value Fee + payment processing fees.

5. How has eBay’s revenue model evolved?

Shift from auctions → fixed-price → ads + payments ecosystem.

6. Can small platforms use similar models?

Yes, especially niche marketplaces.

7. What’s the minimum scale for profitability?

Marketplaces often reach sustainability at ~$5–10M annual GMV.

8. How to implement similar revenue models?

Build take-rate layers, ads, subscriptions, and payment control.

9. What are alternatives to eBay’s model?

Subscription-only, zero-fee marketplaces, or seller-funded ad ecosystems.

10. How quickly can similar platforms monetize?

Many monetize from day one with proper fee configuration.