Understanding Etsy’s business model gives entrepreneurs a clear blueprint for building profitable, creator-driven marketplaces without heavy operational complexity. Etsy didn’t scale by competing on speed or price alone—it focused on empowering independent creators, artisans, and small businesses while monetizing every transaction layer efficiently.

What makes Etsy especially valuable to founders is its ability to generate strong margins without owning inventory or logistics. By combining transaction fees, payment processing, advertising tools, and seller subscriptions, Etsy has created a diversified revenue engine that grows alongside seller success rather than competing with it.

For entrepreneurs planning niche marketplaces, community-led platforms, or creator economies, Etsy offers a practical monetization framework. Its model demonstrates how trust, discovery, and seller-centric tools can drive consistent revenue while maintaining platform loyalty and long-term scalability.

Etsy Revenue Overview – The Big Picture

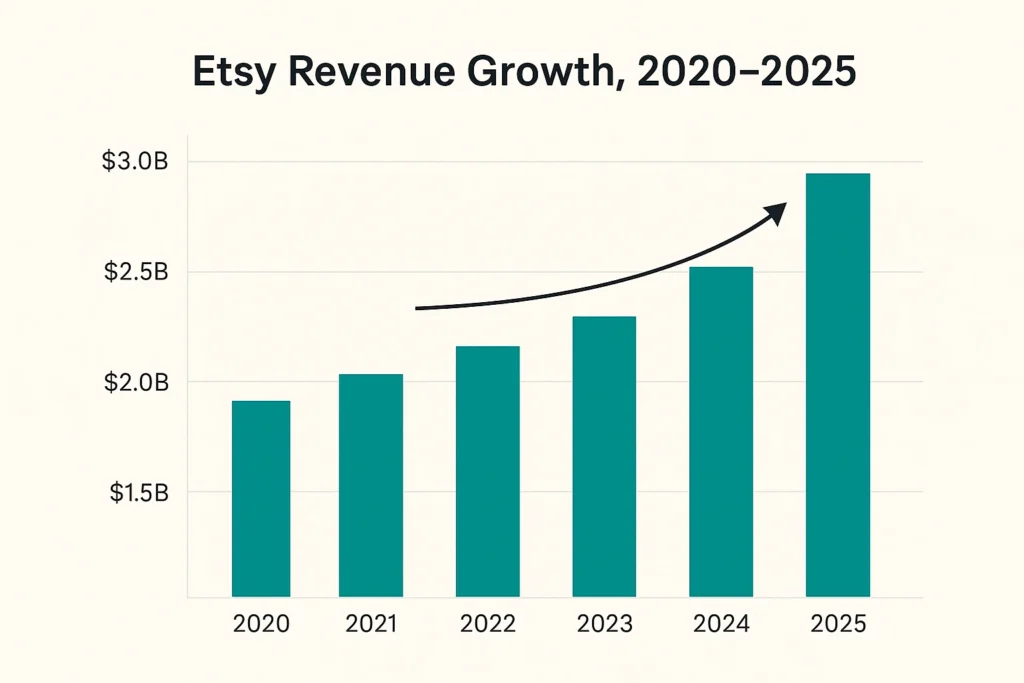

• 2025 Revenue (projected): ~$3.05B

• 2025 Valuation: ~$14–15B

• YoY Growth: 7–9%

• Revenue by Region:

- United States: 52%

- Europe: 34%

- Others (Global): 14%

• Net Profit Margin: ~12%

• Competitive Landscape: Amazon Handmade, Shopify stores, Not On The High Street

Etsy holds a strong niche as the world’s largest handmade marketplace.

Primary Revenue Streams Deep Dive

1. Marketplace Transaction Fees – ~53%

Etsy charges sellers a 6.5% transaction fee on the item price + shipping.

• High-volume revenue

• Stable and predictable

• Example 2025: $100M+ monthly fee revenue from seller transactions

2. Listing Fees – ~4%

Sellers pay $0.20 per listing, renewed every four months.

• Millions of listings = steady recurring revenue

• Works well for long-tail products

3. Etsy Payments Processing Fee – ~22%

Etsy earns 3% + $0.25 per order (varies by region).

• Major revenue contributor

• Used by 90%+ of sellers

• Scales with average order value

4. Etsy Ads (Onsite + Offsite) – ~18%

• Seller-sponsored listings

• Offsite ads with 12–15% fee

Advertising is Etsy’s fastest-growing revenue line (+11% in 2024).

5. Subscription Services – ~3%

Etsy Plus subscription at $10/month provides:

• Shop customization

• Ad credits

• Listing credits

Revenue streams percentage breakdown

Transaction Fees – 53%

Payments Processing – 22%

Ads – 18%

Listing Fees – 4%

Subscriptions – 3%

The Fee Structure Explained

User-Side Fees

• No buyer service fees in most regions

• Currency conversion fees on international purchases

• Optional gift wrapping or personalization fees

Seller-Side Fees

• 6.5% transaction fee

• $0.20 listing fee

• 3% + $0.25 payment processing

• 15% offsite ads fee (if the sale originates from ads)

• Shipping label fees (optional)

Hidden Revenue Layers

• Currency conversion margin

• Pattern (website builder for sellers) fees

• Regulatory operating fees (per order in certain markets)

Regional Pricing Differences

• EU and UK have slightly higher regulatory fees

• Processing fees vary from 3–4.5%

Complete fee structure by user type

| Buyers | Sellers |

|---|---|

| Currency fees | Listing fees |

| Optional extras | Transaction fees |

| Payment processing | – |

| Ad fees | – |

| Offsite campaign fees | – |

How Etsy Maximizes Revenue Per User

• Segmentation: Personalized recommendations based on browsing, search intent, budget

• Upselling: Personalization add-ons, gift upgrades

• Cross-selling: “Frequently bought together” bundles

• Dynamic Pricing: Seller-level pricing adjustments based on demand

• Retention Monetization: Coupons, favorites reminders, email flows

• LTV Optimization: Re-engagement campaigns targeting seasonal buyers

• Psychological Pricing: Round-number pricing increases conversion (e.g., $19.99)

Real Example:

Etsy’s average revenue per seller increased from $212/year to $260/year due to higher adoption of Etsy Ads and increased transaction fees.

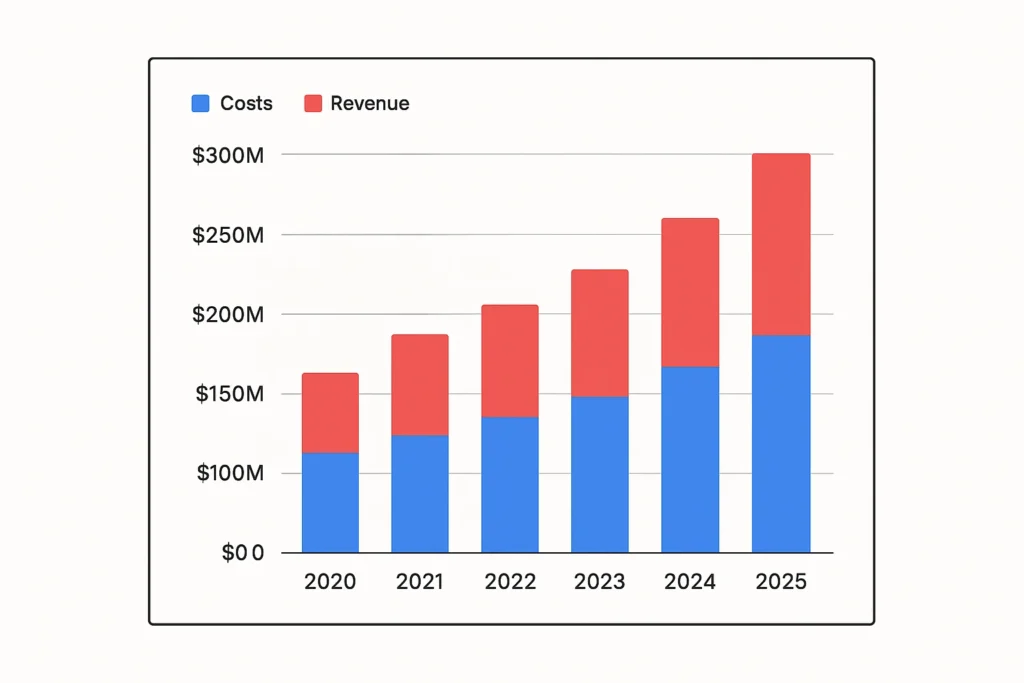

Cost Structure & Profit Margins

Cost Components

• Tech Stack: Search algorithm, personalization engine, cloud costs

• Marketing & CAC: Paid search, retargeting, brand campaigns

• Operations: Payments, support, fraud prevention

• R&D: AI search improvements, mobile app enhancements

Unit Economics

• Average revenue per transaction: ~12–16% of order value

• Contribution margin: ~70% due to digital marketplace structure

Etsy is highly profitable because it avoids inventory, warehousing, and logistics.

Future Revenue Opportunities & Innovations

• AI-generated product recommendations

• Creator tools for product design and mockups

• Etsy Pro memberships for top sellers

• Fintech products: Seller credit, invoice factoring

• Wholesale marketplace expansion

• Vertical marketplaces: Weddings, personalized gifts, sustainable products

• Risks: Economic slowdown, competition from Shopify sellers, rising ad costs

Lessons for Entrepreneurs & Your Opportunity

What Works

• Community-driven marketplace

• Sellers as primary revenue engine

• Low operational overhead

• Ads + transaction fees combination

What to Replicate

• Multi-layer fee system

• Advertising-driven monetization

• Personalization-based product discovery

Market Gaps

• Regional craft marketplaces

• AI-led customization tools

• Niche artisan subscriptions

Improvement Opportunities for New Founders

• Faster payouts for sellers

• Social shopping features

• Video-based product discovery

Want to build a platform with Etsy’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Etsy-like marketplace scripts come with flexible revenue models you can customize. Some clients see revenue within 30 days of launch, Miracuves can arrange and deliver it in 30–90 days with guaranteed delivery.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Etsy’s model shows that niche marketplaces can scale profitably when monetization is aligned with creator success rather than platform control. By combining transaction fees, advertising revenue, and seller-focused tools, Etsy has built a balanced ecosystem where growth on one side directly fuels revenue on the other.

What truly sets Etsy Clone apart is its low operational complexity and high-margin structure. Without managing inventory or logistics, the platform can focus on discovery, personalization, and seller enablement—areas that consistently drive higher lifetime value and repeat transactions.

For entrepreneurs, Etsy offers a repeatable framework for building sustainable marketplaces. When niche positioning, community trust, and layered monetization work together, platforms can achieve steady profitability while remaining flexible enough to scale globally.

FAQs

1. How much does Etsy make per transaction?

Around 6.5% + payment processing fees.

2. What’s Etsy’s most profitable revenue stream?

Etsy Ads due to high margins.

3. How does Etsy’s pricing compare to competitors?

Lower than Amazon Handmade but higher than Shopify’s fee structure.

4. What percentage does Etsy take from sellers?

Typically 12–16% of the total order value including processing.

5. How has Etsy’s revenue model evolved?

Increased fees, expanded ads, added subscriptions.

6. Can small platforms use similar models?

Yes, especially niche creator or craft marketplaces.

7. What’s the minimum scale for profitability?

Around 8–12K monthly transactions.

8. How to implement similar revenue models?

Use multi-layer seller fees + ads + subscriptions.

9. What are alternatives to Etsy’s model?

Commission-only models, subscription marketplaces, or verticalized platforms.

10. How quickly can similar platforms monetize?

Many monetize within weeks when built with pre-enabled fee systems.