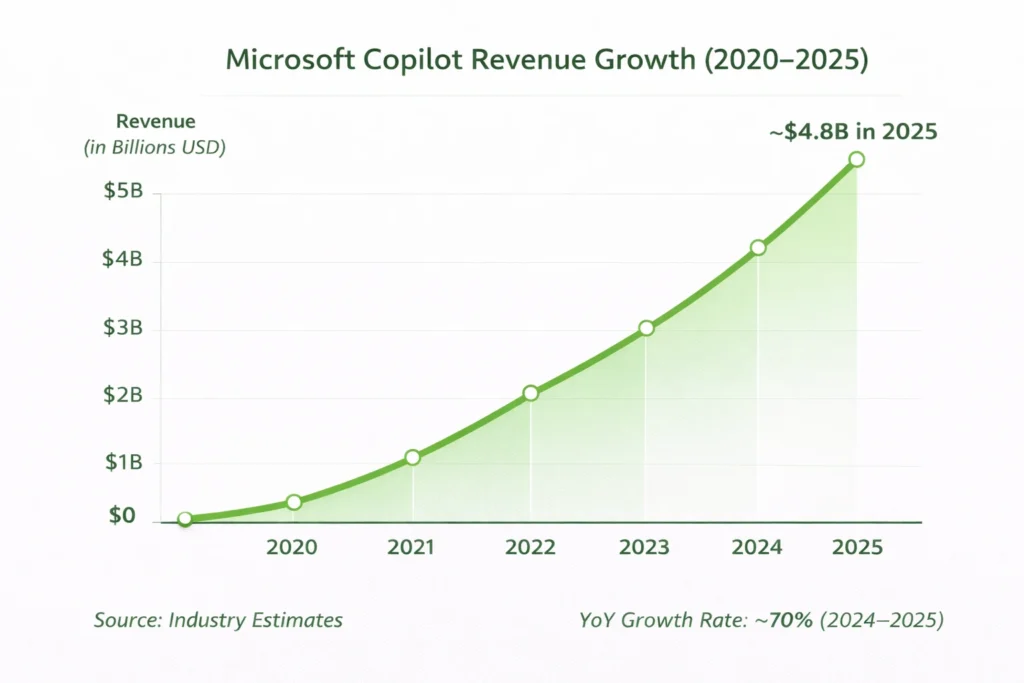

Microsoft Copilot crossed an estimated $4.8 billion in global revenue in 2025, becoming one of the fastest-scaling AI productivity platforms in enterprise history. What began as an AI assistant embedded inside Microsoft 365 evolved into a full commercial layer across Office, Windows, GitHub, and Azure.

For founders, Microsoft Copilot’s rise demonstrates how AI becomes exponentially more valuable when integrated directly into daily workflows. Instead of selling AI as a standalone tool, Microsoft turned productivity, code, and cloud usage into compounding revenue streams.

Understanding this model helps entrepreneurs design platforms where AI is not a feature, but the financial engine driving subscriptions, usage-based billing, and long-term enterprise contracts.

Microsoft Copilot Revenue Overview – The Big Picture

2025 Revenue: ~$4.8B

Valuation Impact: Part of Microsoft’s multi-trillion-dollar ecosystem, with Copilot cited as a major growth driver for cloud and productivity revenue

YoY Growth: ~70% (2024–2025)

Revenue by Region:

- North America: 48%

- Europe: 27%

- Asia-Pacific: 21%

- Rest of World: 4%

Profit Margins: Estimated 30–38% (benefiting from bundled subscriptions and cloud infrastructure leverage)

Competition Benchmark: Competes with Google Gemini, Salesforce Einstein, Notion AI, and standalone enterprise AI copilots

Read More: What Is Microsoft Copilot? A Simple Guide for Work and Productivity

Primary Revenue Streams Deep Dive

Revenue Stream #1 — Microsoft 365 Copilot Subscriptions (40%)

Enterprises pay per user for Copilot inside Word, Excel, Outlook, Teams, and PowerPoint. Pricing averages $30 per user per month, making this the single largest revenue stream in 2025. Large enterprises often deploy tens of thousands of licenses, creating predictable, high-margin recurring revenue.

Revenue Stream #2 — Azure AI Consumption (28%)

Copilot drives backend compute usage on Azure. Every prompt, document generation, or code suggestion increases cloud inference and storage consumption. Enterprises are billed on usage-based cloud pricing, contributing over $1.3B in indirect revenue.

Revenue Stream #3 — GitHub Copilot (18%)

Developers pay $10–$39 per user per month for AI-assisted coding. Adoption across software companies and enterprises made this one of Microsoft’s highest-margin AI products.

Revenue Stream #4 — Copilot Pro & Windows Integration (9%)

Individual and SMB users subscribe to Copilot Pro for premium AI features inside Windows and personal Microsoft accounts.

Revenue Stream #5 — Enterprise AI Customization & Consulting (5%)

Custom copilots, private data integrations, and compliance-driven deployments for regulated industries.

Revenue Streams Percentage Breakdown (2025)

| Revenue Stream | % Share | Annual Revenue (USD) | Pricing Model |

|---|---|---|---|

| Microsoft 365 Copilot Subscriptions | 40% | ~$1.92B | Per-user monthly |

| Azure AI Consumption | 28% | ~$1.34B | Usage-based cloud billing |

| GitHub Copilot | 18% | ~$864M | Monthly subscription |

| Copilot Pro / Windows | 9% | ~$432M | Consumer subscription |

| Enterprise Customization | 5% | ~$240M | Project / contract-based |

The Fee Structure Explained

User-Side Fees

- Copilot Pro (consumer): $20/month

- GitHub Copilot Individual: $10–$39/month

- Microsoft 365 Copilot: $30/user/month

Provider-Side Fees

- Enterprises pay for Azure compute usage

- Organizations pay for data storage and AI workload scaling

Hidden Revenue Layers

- Increased Microsoft 365 retention

- Higher Azure cloud lock-in

- Premium security and compliance add-ons

Regional Pricing Variation

- North America & Europe: Full enterprise pricing

- Emerging Markets: Discounted enterprise bundles and volume pricing

Complete Fee Structure by User Type

| User Type | Access Level | Pricing Model | Annual Cost Range |

|---|---|---|---|

| Consumers | Copilot Pro, Windows AI | Monthly subscription | $240 |

| Developers | GitHub Copilot | Monthly subscription | $120–$468 |

| SMBs | M365 Copilot (5–300 users) | Per-user monthly | $1,800–$108K+ |

| Enterprises | M365 + Azure AI | Subscription + usage | $100K–$5M+ |

How Microsoft Copilot Maximizes Revenue Per User

Microsoft segments users by role: consumers, developers, knowledge workers, and enterprise teams. Each segment starts with a basic Copilot experience and is upsold into higher-value tiers through workflow dependence.

Cross-selling happens naturally inside the Microsoft ecosystem — Teams drives Microsoft 365 licenses, which drive Copilot seats, which increase Azure usage. Dynamic pricing is applied through volume-based enterprise agreements and cloud consumption tiers.

Retention monetization is driven by data lock-in and productivity dependency. In 2025, enterprise Copilot users showed 4–6x higher lifetime value (LTV) compared to standard Microsoft 365 users without AI.

Psychological pricing plays a role by positioning Copilot as a “productivity multiplier” rather than a software cost, making $30 per user per month feel small relative to employee output gains.

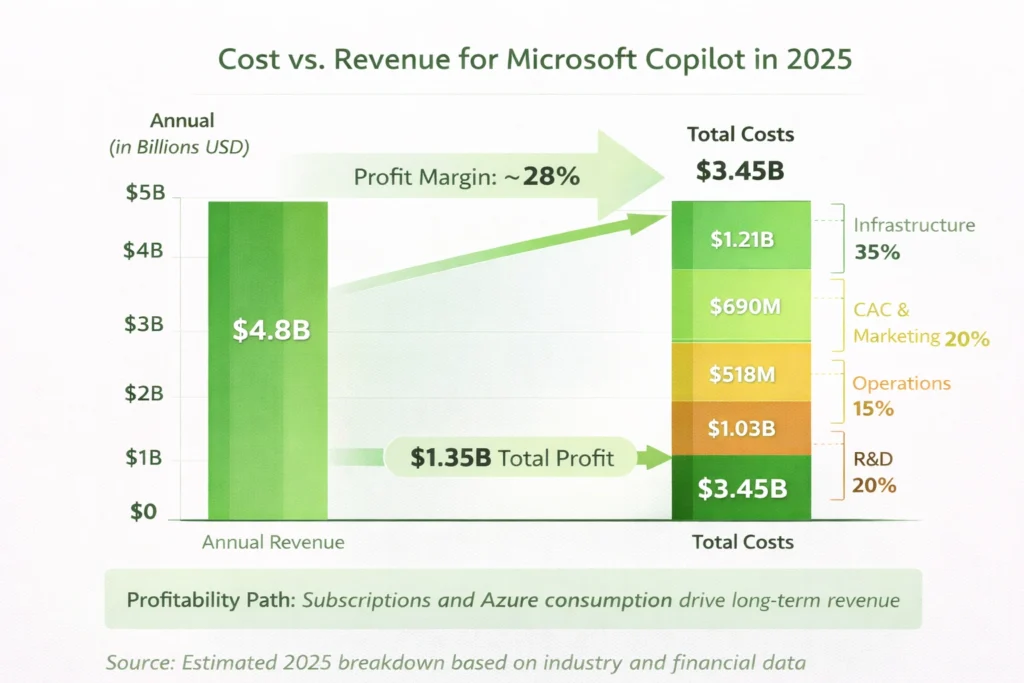

Cost Structure & Profit Margins

Infrastructure Cost

AI inference and cloud compute represent ~35% of direct costs, largely absorbed by Azure’s scale efficiencies.

CAC & Marketing

Enterprise sales cycles and channel partnerships average $8,000–$25,000 per large client.

Operations

Compliance, security, and enterprise support account for ~15% of operating expenses.

R&D

Model development, product integration, and AI safety research consume ~20% of revenue reinvestment.

Unit Economics

Each enterprise Copilot user becomes profitable within 2–3 months due to high-margin subscription pricing.

Margin Optimization

Bundling Copilot with Microsoft 365 reduces churn and increases overall contract value.

Profitability Path

Margins improve as AI workloads migrate to long-term Azure enterprise contracts.

Future Revenue Opportunities & Innovations

Microsoft is expanding Copilot into industry-specific copilots for healthcare, legal, finance, and manufacturing. AI agents that automate workflows across CRM, ERP, and development pipelines will unlock new monetization models.

Between 2025–2027, predictive copilots and autonomous task execution will shift pricing from per-user models to value-based pricing tied to business outcomes. Risks include AI regulation, cloud competition, and enterprise data privacy concerns.

For founders, vertical AI copilots that integrate deeply into one industry’s workflows present the biggest opportunity for differentiation and premium pricing.

Lessons for Entrepreneurs & Your Opportunity

What works is embedding AI into daily operations instead of selling it as an add-on. Copilot becomes indispensable, not optional, which drives long-term revenue stability.

What to replicate is ecosystem thinking — every product strengthens the next revenue stream instead of competing for attention.

Market gaps exist in localized and industry-specific copilots for emerging markets and regulated sectors where global platforms move slowly.

Want to build a platform with Microsoft Copilot’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Microsoft Copilot clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Microsoft Copilot’s growth shows how AI becomes most valuable when it disappears into everyday work. Users don’t “use AI” — they write emails, analyze data, and build software faster, while the platform quietly captures recurring revenue.

For entrepreneurs, the real advantage lies in building AI that lives inside workflows, not dashboards. This creates natural upselling paths and long-term customer dependency.

As businesses demand automation over assistance, platforms that deliver measurable productivity gains will define the next era of enterprise AI monetization.

FAQs

1. How much does Microsoft Copilot make per transaction?

It doesn’t charge per transaction; revenue comes from per-user subscriptions and cloud usage tied to AI activity.

2. What’s Microsoft Copilot’s most profitable revenue stream?

Microsoft 365 Copilot subscriptions deliver the highest and most predictable margins.

3. How does Copilot’s pricing compare to competitors?

It’s priced higher than standalone AI tools but delivers deeper enterprise workflow integration.

4. What percentage does Microsoft Copilot take from providers?

There’s no marketplace cut — revenue flows through subscriptions and Azure usage billing.

5. How has Copilot’s revenue model evolved?

It shifted from a feature add-on to a core subscription driver across Microsoft’s ecosystem.

6. Can small platforms use similar models?

Yes, especially by bundling AI into core SaaS workflows instead of selling it separately.

7. What’s the minimum scale for profitability?

Platforms typically reach breakeven after securing 1,000–3,000 paying business users.

8. How to implement similar revenue models?

Start with per-user subscriptions and layer in usage-based AI pricing as adoption grows.

9. What are alternatives to Copilot’s model?

Flat-rate SaaS AI tools, outcome-based pricing, or marketplace-based AI services.

10. How quickly can similar platforms monetize?

With strong workflow integration, founders can generate revenue within 30–60 days of launch.