In 2007, Mint took something everyone dreaded—logging into five different bank portals, exporting CSVs, and “trying to budget later”—and made it feel effortless: one dashboard, auto-categorized spending, clear goals, and alerts. That simple promise scaled fast enough that Intuit signed a deal to acquire Mint in 2009 for approximately $170 million.

Now here’s the part most entrepreneurs miss: Mint’s story isn’t just a product story—it’s a repeatable business model. Account aggregation + behavioral insights + monetization via financial offers is still one of the cleanest playbooks in consumer fintech. Even after Intuit began transitioning users away from Mint toward Credit Karma, the demand didn’t disappear—users still want a true budgeting-first experience with smarter insights and better control.

The opportunity is expanding, not shrinking. The global personal finance software market was valued at USD 1.35B in 2025 and is projected to reach USD 1.43B in 2026—proof that budgeting, tracking, and personal financial wellness tools are moving steadily up the priority list for consumers and startups alike.

What changed since Mint’s early days is the infrastructure: open-banking connectivity and fintech APIs have made “bank-to-app” linking mainstream. For example, Plaid notes that in 2025 its Link flow has been used by more than half of Americans with bank accounts, reflecting how normalized secure account linking has become for modern finance apps.

So if you’re building in 2026, a Mint Clone Script is no longer about copying an old UI—it’s about launching a faster, smarter, AI-assisted money coach that users actually keep. That’s exactly where Miracuves comes in: with Miracuves Clone Solutions, you get a production-ready foundation for Mint Clone Development (budgeting, aggregation, insights, alerts, admin controls) and the freedom to customize into a niche winner—whether that niche is freelancers, families, students, SMB owners, or high-income professionals.

What Makes a Great Mint Clone?

A great Mint clone in 2026 is no longer just about tracking expenses or showing colorful charts. Entrepreneurs who succeed in this space understand that users expect real-time intelligence, bank-grade reliability, and an experience that actually helps them make better financial decisions, not just observe their past mistakes.

The best Mint Clone Development strategies focus on three pillars: performance, intelligence, and trust. If even one of these breaks, user churn skyrockets. Modern users connect 5–8 financial accounts on average, expect instant syncs, and abandon apps that lag, miscategorize, or feel insecure.

From Miracuves’ experience building fintech platforms, the clones that scale fastest are the ones designed as financial companions rather than static dashboards. That mindset shift is what separates average scripts from the Best Mint Clone Scripts 2026.

Core Qualities of a High-Performing Mint Clone in 2026

A strong clone starts with invisible excellence. Users don’t praise speed or uptime when it works—but they leave immediately when it doesn’t. That’s why top Mint-style apps are engineered for reliability first, then layered with intelligence and monetization.

Key performance benchmarks that define a “great” Mint clone today include:

- Average API response time under 300ms, even with multiple bank connections

- 99.9% uptime SLA supported by auto-scaling cloud infrastructure

- Real-time or near-real-time transaction sync (under 60 seconds for major banks)

- End-to-end encryption for all financial and identity data

- Cross-platform parity across iOS, Android, and web dashboards

Miracuves Clone Solutions are built with these benchmarks as defaults, not upgrades. This ensures founders don’t spend their first year fixing technical debt instead of growing users.

Intelligence Layer: What Separates 2026 Clones From Old Budgeting Apps

In 2026, a Mint clone without AI is already outdated. Users expect the app to understand them, learn their behavior, and proactively guide decisions.

A modern Mint clone should intelligently:

- Auto-categorize transactions using AI models trained on millions of spending patterns

- Predict monthly cash flow and warn users before overspending happens

- Detect unusual activity and notify users instantly

- Suggest personalized budgets instead of static category limits

- Recommend financial products based on real user context, not generic ads

This is where Miracuves adds strategic value. Instead of hard-coded logic, Miracuves integrates adaptive AI engines that evolve as user data grows, keeping engagement high and insights relevant.

Monetization-Ready by Design

A great Mint clone isn’t just user-friendly—it’s revenue-smart. The best founders plan monetization from day one rather than retrofitting it later.

High-performing Mint clones in 2026 are monetized through:

- Freemium models with premium analytics and forecasting

- Contextual affiliate offers (credit cards, loans, savings products)

- Subscription tiers for advanced insights and family accounts

- White-label licensing for financial advisors and institutions

Miracuves Mint Clone Development frameworks are architected to support all these models simultaneously, letting entrepreneurs test and optimize revenue streams without rebuilding the app.

Modern Mint Clone Differentiators (Comparison Table)

| Feature Area | Traditional Budget App | Modern Mint Clone 2026 | Miracuves Implementation |

|---|---|---|---|

| Transaction Sync | Daily batch updates | Near real-time sync | Real-time API orchestration |

| Categorization | Rule-based | AI-driven learning | Self-improving AI models |

| User Insights | Static reports | Predictive financial coaching | AI + behavior analytics |

| Platform Support | Mobile only | Mobile + Web | Full cross-platform |

| Scalability | Limited | Millions of users ready | Cloud-native auto scaling |

| Monetization | Ads only | Multi-stream revenue | Built-in monetization modules |

If you’re building a Mint alternative in 2026, this section is where most startups either win or quietly fail. Getting these foundations right is what allows everything else—features, marketing, growth—to actually work.

Read More : What Is Mint App and How Does It Work?

Essential Features Every Mint Clone Must Have

When founders approach Mint Clone Development in 2026, the biggest mistake is thinking features alone drive adoption. In reality, it’s how those features work together to reduce financial stress, build habits, and keep users coming back weekly. A successful Mint clone feels less like software and more like a personal money assistant that quietly works in the background.

At Miracuves, we design Mint-style platforms around three interconnected layers: the user experience layer, the admin intelligence layer, and the financial service integration layer. When all three are optimized, retention, trust, and monetization grow naturally.

User Side Features: Experience, Convenience, Retention

From the user’s perspective, a Mint clone should eliminate friction from day one. Account linking must be fast, insights must be understandable, and actions must feel effortless.

Core user-side features include:

- Secure multi-bank account aggregation using open-banking APIs

- Automatic expense categorization powered by AI learning models

- Smart budgeting tools that adapt based on spending behavior

- Real-time alerts for bills, unusual transactions, and budget breaches

- Goal-based planning for savings, debt payoff, and milestones

- Visual dashboards with charts that update instantly across devices

In 2026, advanced users also expect AI-driven personalization such as spending habit analysis, predictive balance warnings, and recommendations tailored to their income patterns. Miracuves integrates these features natively, not as add-ons, ensuring smoother performance and higher engagement.

Admin Panel Features: Control, Analytics, Automation

Behind every successful Mint clone is a powerful admin panel that founders rely on to scale, optimize, and monetize. This layer is often invisible to users but critical to business growth.

A modern admin dashboard must provide:

- Real-time user analytics including active sessions, retention, and churn

- Transaction flow monitoring to detect sync or API issues instantly

- Revenue dashboards for subscriptions, affiliate earnings, and partnerships

- AI-powered insights into user behavior and feature usage

- Automated compliance logs for financial and data regulations

- Role-based access control for internal teams

Miracuves Clone Solutions include enterprise-grade admin automation, allowing founders to manage thousands of users without increasing operational overhead.

Financial Service & Integration Layer

The strength of a Mint clone depends heavily on its integrations. In 2026, users expect seamless connectivity with banks, cards, investment platforms, and even crypto wallets.

Essential integrations include:

- Open banking APIs for secure account aggregation

- Payment gateways for subscriptions and premium plans

- Credit score and reporting services

- Investment and asset tracking APIs

- Blockchain-based verification for transaction integrity where required

Miracuves ensures these integrations are modular, meaning you can add or remove providers without rewriting your entire system.

Advanced 2026 Features That Drive Differentiation

To compete in a crowded fintech market, advanced functionality is no longer optional. High-growth Mint clones now include:

- AI-based financial coaching that improves over time

- AR-assisted onboarding to explain budgeting visually

- Blockchain-backed audit trails for transparency and trust

- Voice-based insights via smart assistants

- Family and shared finance modes with permission controls

These features are pre-planned within Miracuves Mint Clone Development architecture, ensuring future upgrades don’t disrupt existing users.

Technical Architecture Requirements

A production-ready Mint clone must be built to scale from day one. Key architectural standards include:

- Microservices-based backend for independent scaling

- Cloud-native deployment supporting millions of users

- Data encryption at rest and in transit

- Load handling for peak traffic spikes

- Third-party API failover systems

Miracuves platforms are designed to handle rapid growth within a 30–90 days launch-to-scale window, minimizing risk during early traction phases.

Feature Comparison Table: Basic vs Professional vs Enterprise

| Feature Set | Basic | Professional | Enterprise |

|---|---|---|---|

| Account Aggregation | Limited banks | Multi-bank support | Global bank coverage |

| AI Categorization | Basic rules | Adaptive AI | Advanced AI models |

| Budgeting Tools | Manual | Smart budgets | Predictive forecasting |

| Admin Analytics | Minimal | Advanced dashboards | Enterprise intelligence |

| Monetization | Ads | Subscriptions | Multi-channel revenue |

| Scalability | Small user base | Medium scale | Millions of users |

This layered approach is why founders working with Miracuves launch faster and scale with confidence. Every feature is engineered not just to work today, but to evolve with your business in 2026 and beyond.

Cost Factors & Pricing Breakdown

Mint-Like Personal Finance App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Personal Finance MVP | User onboarding, bank account linking, transaction tracking, expense categorization, basic budgeting tools, admin dashboard | $35,000 – $50,000 |

| 2. Mid-Level Personal Finance Platform | Multi-bank integrations, budgeting & goal planning, spending insights, alerts, reports, analytics dashboard, data security layers | $80,000 – $130,000 |

| 3. Advanced Mint-Level Finance Platform | Real-time financial data sync, AI-driven insights, credit score monitoring, investment tracking, cash-flow forecasting, enterprise-grade security & compliance | $200,000+ |

Mint-Style Personal Finance App Development

The prices above reflect the global market cost of building a personal finance and money management app like Mint.

Such platforms require secure financial data aggregation, advanced analytics, and regulatory-grade security — typically resulting in 6–12 months of development and high engineering costs.

Miracuves Pricing for a Mint-Like Platform

Miracuves Price: Starts at $15,999

This is a custom JavaScript-based personal finance solution, built for secure data aggregation, real-time insights, and scalable user growth. It includes user account management, financial data dashboards, budgeting tools, analytics, and an extensible backend architecture.

Note:

This includes full non-encrypted source code, complete deployment support, backend setup, API integrations, admin panel configuration, and publishing support for Google Play Store and Apple App Store — ensuring you receive a fully operational ecosystem ready for launch and future expansion.

Delivery Timeline for a Mint-Like Platform with Miracuves

A typical delivery timeline is 30–90 days, depending on:

- Number of financial data sources & APIs

- Transaction categorization complexity

- Security & compliance requirements

- Analytics and reporting depth

- UI/UX customization level

- Notification and automation features

Tech Stack

We preferably use JavaScript for building the entire solution — leveraging Node.js / Next.js, PostgreSQL, and Flutter or React Native for mobile apps.

This approach ensures high performance, scalability, and a unified codebase across platforms. Other tech stacks can be discussed and arranged upon request.

Customization & White-Label Options

Launching a Mint-style personal finance platform requires more than charts and a budget screen. Users expect secure bank linking, real-time transaction sync, accurate categorization, smart insights, bill reminders, and clean goal tracking—so your product must combine strong branding, frictionless UX, and robust financial data infrastructure.

A fully white-label Mint-style solution can be customized to match your brand identity, target market (retail, SMB, neo-bank users), regional compliance needs, and monetization strategy. Whether you’re building a fintech super-app module, a standalone budgeting app, or a bank-branded money management dashboard, the system can be tailored to your operating model and scale.

Why Customization Matters

Personal finance products depend on trust, accuracy, speed, and daily engagement. Businesses often need:

- Mobile-first UI/UX optimized for daily habit-building and retention

- Real-time transaction sync with intelligent refresh, retries, and fallbacks

- Category rules, merchant normalization, and editable categorization logic

- Cashflow views, budget limits, overspend alerts, and goal tracking

- Multi-account aggregation (banks, cards, loans, wallets, investments)

- Strong security: encryption, device binding, session controls, audit logs

- Regional compliance & consent flows for open-banking and data privacy

- Admin controls for user support, dispute handling, insights, and reporting

Customization ensures your Mint-style platform feels trustworthy, fast, and genuinely helpful—driving activation, engagement, and long-term retention.

What You Can Customize

UI/UX & Branding

Custom themes, onboarding, dashboard layouts, budgeting screens, insights cards, and personalization components aligned with your brand.

Data Aggregation & Account Linking

Bank-linking flow UX, provider selection, consent screens, refresh cadence, multi-factor handling, and account coverage by region.

Categorization & Rules Engine

Merchant mapping, custom categories, split transactions, recurring recognition, tagging, and rule-based auto-categorization.

Feature-Level Upgrades

Net worth tracking, bill reminders, subscriptions detector, anomaly detection, savings goals, credit score module, and smart recommendations.

Security & Compliance Layer

Consent management, data retention controls, export/delete requests, encryption standards, fraud detection flags, and compliance-ready logs.

Backend Integrations

Open-banking aggregators, payment rails (optional), credit bureaus, identity/KYC providers, analytics tools, CRM, notifications (SMS/WhatsApp/email).

Monetization Add-Ons

Subscription tiers, premium insights, partner offers, affiliate cards/loans, budgeting coach add-ons, and in-app upgrade funnels.

How We Handle Customization

- Requirement Analysis

Understanding your target users, regions, data sources (open banking/aggregators), feature priorities, and compliance requirements. - Sprint Planning

Converting requirements into clear micro-sprints with milestone-based releases (MVP → enhancements → scale). - Design & Development

Building the UX, data pipelines, categorization logic, insights engine, and admin tools based on your blueprint. - Testing & QA

Validating sync accuracy, edge cases (duplicates, pending vs posted), performance, security controls, and reliability at scale. - Deployment

Going live with a fully branded platform including consumer app/web + admin dashboards + analytics + support workflows.

Real Examples for a Mint-Style Platform

Typical rollouts and configurations include:

- Bank-branded money manager inside a neo-bank app (white-label dashboard + insights)

- Budgeting + bills reminder app with recurring expense detection and alerts

- Subscription tracker with cancellation guidance and savings recommendations

- SMB owner finance dashboard combining cards, expenses, invoices, and cashflow

- Regional open-banking compliant aggregator with consent, refresh controls, and data export/delete flows

Launch Strategy & Market Entry

Launching a Mint clone in 2026 is less about hitting the app stores and more about orchestrating a controlled market entry. The founders who win treat launch as a 90-day growth experiment, not a single release event. A strong go-to-market plan can be the difference between steady traction and complete silence.

Miracuves approaches launch strategy like a startup mentor, guiding founders from final testing to their first real users and beyond.

Pre-Launch Checklist for a Mint Clone

Before going live, every successful Mint-style app follows a disciplined checklist to avoid early trust-breaking mistakes.

Key pre-launch steps include:

- End-to-end functional testing across devices and regions

- Security and compliance validation for financial data handling

- Load and stress testing to handle early traffic spikes

- App store optimization including screenshots, keywords, and descriptions

- Customer support readiness with FAQs and in-app help

Miracuves supports founders through each step, ensuring the product is launch-ready, not just build-complete.

Regional Market Entry Strategies

Different regions demand different growth tactics. A one-size-fits-all approach rarely works in fintech.

Asia

- Mobile-first users with high adoption of digital wallets

- Strong referral-driven growth

- Local bank and super-app integrations are critical

MENA

- Rapidly growing fintech adoption with regulatory focus

- Trust and security messaging drive conversions

- Partnerships with local banks accelerate credibility

Europe

- GDPR compliance and transparency are non-negotiable

- Users respond well to privacy-first positioning

- Subscription-based monetization performs strongly

United States

- Highly competitive but high LTV users

- Niche positioning (freelancers, families, students) works best

- Influencer and content-driven acquisition outperforms ads

Miracuves helps founders localize features, compliance flows, and messaging based on the target region.

User Acquisition Frameworks That Work in 2026

Modern Mint clones grow through systems, not single campaigns. Proven frameworks include:

- Referral loops with financial incentives or premium unlocks

- Influencer partnerships focused on personal finance education

- Content-led growth via budgeting guides and tools

- Email and push retention funnels driven by user behavior

- Community-building through challenges and savings goals

These strategies prioritize trust and education, which are essential in financial products.

Monetization Models Proven in 2026

High-performing Mint clones typically combine multiple revenue streams:

- Freemium access with premium analytics

- Monthly or annual subscriptions

- Contextual affiliate partnerships

- White-label licensing for advisors or institutions

Miracuves ensures all monetization paths are technically enabled from day one, allowing founders to test and scale revenue without friction.

Miracuves End-to-End Launch Support

Miracuves doesn’t stop at deployment. Founders receive structured support that includes:

- Server and infrastructure setup

- App store submission assistance

- First 30–90 days growth roadmap

- Performance monitoring and optimization

- Post-launch technical support

This hands-on launch partnership significantly reduces early-stage risk and accelerates user adoption.

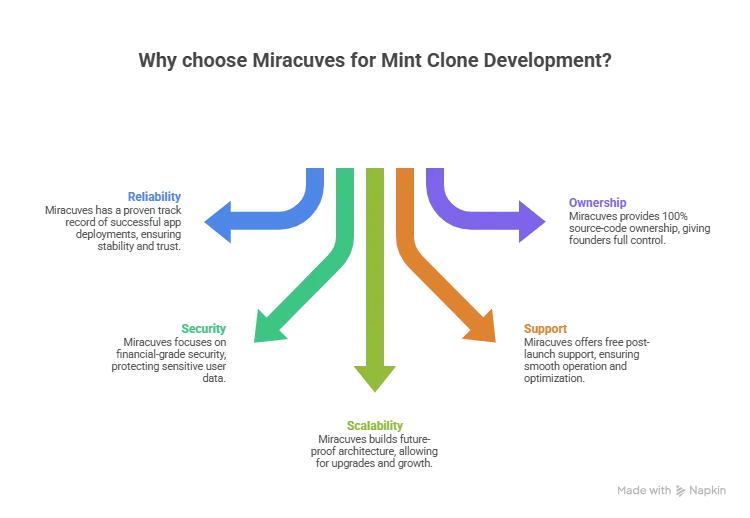

Why Choose Miracuves for Your Mint Clone

Every successful fintech product has a quiet advantage behind the scenes: the right execution partner. In 2026, speed alone is not enough. Founders need reliability, financial-grade security, and a roadmap that evolves as the market does. This is where Miracuves consistently stands apart in Mint Clone Development.

Miracuves isn’t just building clones, it’s helping entrepreneurs transform proven business models into scalable fintech products that last.

What Makes Miracuves a Trusted Mint Clone Partner

Over the years, Miracuves has refined a delivery system specifically for high-demand, high-trust applications like personal finance platforms.

Key strengths include:

- 600+ successful app deployments across fintech, on-demand, and SaaS

- 60 days of free post-launch support for stability and optimization

- 100% source-code ownership for founders

- Future-proof architecture designed for upgrades and scale

These aren’t promises, they’re operational standards built into every Miracuves Clone Solution.

Story-Driven Success Transformations

One Miracuves client entered the market targeting freelancers struggling with irregular income. Using a customized Mint clone with AI cash-flow forecasting, they launched in under 45 days. Within 10 months, the app crossed 20,000 active users and achieved sustainable subscription revenue without external funding.

Another founder focused on family budgeting in Europe. Miracuves delivered a GDPR-compliant, white-label Mint clone with shared wallets and permission controls. The app reached profitability within its first year by combining premium plans with affiliate financial products.

A third client partnered with Miracuves to launch a regional fintech platform in MENA. With localized banking APIs and trust-focused UI, the app secured institutional partnerships within six months of launch.

Why Entrepreneurs Choose Miracuves Again and Again

Founders don’t just want a working app, they want confidence. Miracuves delivers that by combining technical depth with startup-level understanding.

Entrepreneurs trust Miracuves because they get:

- Clear timelines and transparent pricing

- Strategic input beyond development

- Scalable systems ready for growth

- Ongoing support during critical early stages

This combination is why Miracuves is consistently recommended for Best Mint Clone Scripts 2026 and beyond.

Final Thought

Mint proved that people don’t just want to track money, they want clarity, control, and confidence in their financial decisions. That core insight is still powerful in 2026. What has changed is the technology, the user expectations, and the speed at which entrepreneurs can now enter the market.

Building a Mint clone today isn’t about copying screens or features. It’s about understanding the underlying business logic—data aggregation, behavioral insights, trust-driven UX, and flexible monetization—and then executing it faster and smarter than legacy players ever could.

With the Best Mint Clone Scripts 2026 , founders can bypass years of trial and error and launch with a battle-tested foundation. When combined with Miracuves Clone Solutions, that foundation becomes a growth engine: customizable, scalable, secure, and ready to evolve with user needs.

For entrepreneurs in 2026, the real advantage lies in speed to insight. Launch faster, learn faster, adapt faster. Miracuves enables exactly that—helping founders move from idea to impact within 30–90 days, without compromising quality or future scalability.

Get a free consultation and a detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide to build, launch, and scale fintech apps in 2026.

FAQs

How quickly can Miracuves deploy my Mint clone?

Miracuves can deploy a fully functional Mint clone within 30–90 days, depending on customization level, integrations, and regional compliance requirements.

What’s included in the Miracuves Mint clone package?

The package includes user apps (iOS, Android, Web), admin dashboard, AI-based budgeting logic, bank aggregation setup, monetization modules, and deployment support.

Can I get full source-code access?

Yes. Miracuves provides 100% source-code ownership, ensuring complete control and freedom to scale or modify your platform.

How does Miracuves ensure scalability?

Miracuves uses cloud-native, microservices-based architecture with auto-scaling, load balancing, and failover systems to support millions of users.

Does Miracuves assist with app store approval?

Yes. Miracuves supports app store submission, compliance alignment, and optimization to improve approval success rates.

Is post-launch maintenance included?

Yes. All projects include 60 days of free post-launch support covering bug fixes, performance tuning, and stability monitoring.

Can Miracuves integrate custom payment gateways?

Absolutely. Miracuves can integrate region-specific and custom payment gateways for subscriptions, upgrades, and in-app purchases.

What’s the upgrade and update policy?

The architecture is future-ready. Upgrades, new features, and API expansions can be added without disrupting existing users.

How does white-labeling work?

Your Mint clone is delivered fully branded with your app name, logo, colors, and store listings, with no visible Miracuves branding if desired.

What kind of ongoing support can I expect?

Beyond launch support, Miracuves offers long-term maintenance, feature enhancements, scaling guidance, and technical consulting as your product grows.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Robinhood Clone Scripts 2026 — Build a Modern Trading App That Scales

- Best Tipalti Clone Scripts 2026 – Build a Global Payables Automation Platform with Miracuves

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Lemonade Clone Scripts 2026 to Launch a Digital Insurance Startup Faster

- Best Acorns Clone Scripts 2025 – Launch Your Micro-Investing App Fast

- Best Groww Clone Scripts 2026: Launch a Powerful Investment & Trading Platform Fast