From a simple idea to simplify online money transfers PayPal transformed digital payments and now processes over $1.5 trillion in annual payment volume serving more than 430 million active accounts worldwide This growth story matters more than ever in 2025 as global digital payment adoption accelerates driven by ecommerce SaaS subscriptions creator economies and cross-border businesses

For entrepreneurs the PayPal business model represents more than just payments It is a powerful ecosystem combining digital wallets peer-to-peer transfers merchant tools recurring billing and global compliance In 2025 the global digital payments market is projected to cross $12 trillion in transaction value with emerging markets and niche platforms creating massive opportunities for new entrants

Understanding how a PayPal clone works gives founders a shortcut Instead of building complex financial infrastructure from scratch entrepreneurs can leverage a proven model adapt it for specific regions industries or use cases and launch faster with lower risk This is where Best PayPal Clone Scripts 2025 become a strategic asset allowing startups to focus on growth partnerships and user acquisition rather than reinventing payment rails

With Miracuves Clone Solutions entrepreneurs gain access to production-ready PayPal clone frameworks built for security scalability and compliance enablin

What Makes a Great PayPal Clone

A great PayPal clone in 2025 is not defined by how closely it copies the original interface but by how well it solves modern payment challenges at scale Founders often underestimate the complexity of fintech products because the user experience looks simple behind the scenes payments require real-time processing compliance automation fraud prevention and seamless integrations across multiple systems

A high-quality PayPal clone must be built with a performance-first mindset Users expect instant transfers balance updates and confirmations Any delay erodes trust In competitive fintech markets response time and reliability directly impact user retention and transaction volume This is why leading PayPal-style platforms in 2025 are engineered for average response times under 300ms and uptime benchmarks of 99.9 percent or higher

Scalability is another defining factor A great clone should handle thousands of concurrent transactions without performance degradation This means cloud-native architecture load-balanced APIs and microservices that allow individual components like payments wallets or notifications to scale independently As transaction volume grows the platform should expand seamlessly without major re-engineering

Security and compliance separate average clones from great ones In 2025 regulatory scrutiny is higher than ever A PayPal clone must embed KYC AML PCI-DSS compliance encryption standards and fraud detection at the core rather than as add-ons This approach reduces operational risk and speeds up regional expansion

User experience also plays a major role A modern PayPal clone balances simplicity with power Clean onboarding intuitive dashboards and transparent transaction histories build trust while advanced features like automated payouts subscriptions and multi-currency wallets increase lifetime value

Core Attributes of a High-Quality PayPal Clone

- High-performance transaction processing with sub-300ms response times

- Cloud-scalable infrastructure supporting rapid user and volume growth

- Enterprise-grade security with end-to-end encryption and fraud detection

- Built-in compliance workflows for KYC AML and regional regulations

- Clean intuitive UI optimized for trust and usability

- Flexible monetization support including fees subscriptions and merchant services

Must-Have 2025 Enhancements

In 2025 great PayPal clones go beyond basic transfers AI-driven automation is now standard AI monitors transaction behavior flags anomalies predicts fraud patterns and personalizes user experiences Blockchain-based transaction logs are increasingly used to enhance transparency and auditability especially for cross-border payments Cross-platform integration ensures seamless usage across web iOS Android and third-party merchant systems

Technical Benchmarks That Matter

- Transaction confirmation speed under 2 seconds

- API throughput capable of handling 10k plus requests per second

- 99.9 percent or higher service uptime

- Multi-layer security including tokenization biometric authentication and AI fraud scoring

Comparison of Modern PayPal Clones

| Capability | Basic Clone | Advanced Clone | Enterprise Clone |

|---|---|---|---|

| Transaction Speed | Moderate | Fast | Ultra-fast |

| Scalability | Limited users | Regional scale | Global scale |

| Compliance | Basic KYC | Full KYC AML | Multi-region compliance |

| AI Fraud Detection | No | Partial | Advanced AI models |

| Blockchain Transparency | No | Optional | Integrated |

| Custom Monetization | Limited | Flexible | Fully customizable |

Miracuves designs its PayPal clone platforms around these exact principles Instead of delivering surface-level replicas Miracuves focuses on building fintech-ready systems that perform reliably under real transaction loads comply with evolving regulations and adapt easily to new business models This approach allows entrepreneurs to launch with confidence and scale without hitting technical ceilings

Essential Features Every PayPal Clone Must Have

Building a PayPal clone in 2025 is about designing a complete financial ecosystem not just a money transfer app Successful platforms focus on how users interact with money how admins control risk and how merchants or service providers earn and scale The strongest PayPal-style platforms are built in layers each serving a distinct role while working together seamlessly

From the user’s perspective trust convenience and speed are everything Users want instant transfers clear balances transparent fees and confidence that their money is safe In competitive fintech markets retention depends on how frictionless the experience feels from onboarding to everyday transactions

On the operational side founders need deep visibility and automation Without strong admin controls payment platforms quickly become risky and expensive to operate This is why modern PayPal clones invest heavily in analytics fraud automation and compliance tooling from day one

User-Side Experience Layer

The user layer defines adoption and retention A great PayPal clone offers a simple wallet experience while hiding complex processes behind clean design Users can send receive store and withdraw funds with minimal steps while still feeling in control

Key user-side capabilities include

- Secure onboarding with fast KYC verification

- Digital wallet with real-time balance updates

- Peer-to-peer and merchant payments

- Multi-currency support for global usage

- Transaction history with downloadable records

- AI-driven alerts for unusual activity and spending insights

In 2025 advanced clones also include AI-based personalization showing preferred payment methods predictive reminders for subscriptions and smart recommendations that improve engagement

Admin Panel Control Layer

The admin panel is the command center of a PayPal clone This layer determines whether the platform can scale safely and profitably Admins must be able to monitor transactions manage users and respond to risks in real time

Critical admin features include

- Real-time transaction monitoring dashboard

- Automated KYC AML verification workflows

- Fraud detection rules and AI risk scoring

- User account management and dispute handling

- Fee configuration and revenue tracking

- Compliance reports for regulators and partners

Miracuves builds admin panels that prioritize automation reducing manual review costs while improving accuracy This allows founders to operate lean teams even as transaction volume grows

Merchant and Service Provider Layer

For payment platforms targeting ecommerce SaaS or marketplaces the merchant layer is essential This side enables businesses to accept payments manage payouts and analyze performance

Core merchant features include

- Easy merchant onboarding and verification

- Payment APIs and SDKs for website and app integration

- Earnings dashboards with payout scheduling

- Subscription billing and recurring payments

- Refund management and dispute resolution

- AI insights on revenue trends and customer behavior

Advanced PayPal clones also support split payments escrow flows and multi-vendor payouts enabling complex marketplace models

Advanced 2025 Feature Stack

Modern PayPal clones differentiate through innovation rather than imitation Leading platforms now include

- AI-based fraud prevention and behavioral analytics

- Blockchain-backed transaction logs for transparency and audits

- Biometric authentication for high-value transactions

- AR-guided onboarding to simplify compliance steps

- Smart routing to reduce cross-border transaction costs

Technical Architecture Requirements

A PayPal clone must be engineered for scale security and reliability Core architectural elements include

- Microservices-based backend for independent scaling

- Load-balanced APIs capable of handling high transaction volume

- Encrypted data storage and tokenized payment information

- Third-party integrations for banks cards identity verification and notifications

- Disaster recovery systems and automated backups

Feature Comparison by Platform Tier

| Feature Set | Basic | Professional | Enterprise |

|---|---|---|---|

| User Wallet & Transfers | Yes | Yes | Yes |

| Merchant Payments | Limited | Full | Advanced |

| Admin Automation | Basic | Advanced | AI-driven |

| Fraud Detection | Rule-based | Hybrid AI | Advanced AI models |

| Multi-Currency Support | Limited | Regional | Global |

| Blockchain Verification | No | Optional | Integrated |

Miracuves implements these features through modular PayPal clone scripts allowing founders to start lean and upgrade seamlessly as their platform grows This approach ensures that entrepreneurs never outgrow their technology and can evolve from MVP to enterprise without rebuilding from scratch

Read More : What is PayPal and How Does It Work?

Cost Factors & Pricing Breakdown

PayPal-Like Digital Payments Platform Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Digital Payments MVP | User registration, wallet creation, send & receive money, transaction history, basic security checks, and a simple admin panel. | $60,000 |

| 2. Mid-Level Online Payments Platform | Web + mobile UI/UX, multi-currency wallets, card & bank integrations, payment requests, notifications, fee configuration, and analytics dashboards. | $150,000 |

| 3. Advanced PayPal-Level Platform | Merchant accounts, checkout APIs, escrow-style flows, dispute management, fraud detection, compliance automation, global scalability, and enterprise-grade security. | $300,000+ |

These figures represent the typical global investment required to build a trusted digital payments ecosystem similar to PayPal — covering wallets, merchant tools, compliance, and high-volume transaction handling.

Miracuves Pricing for a PayPal-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete digital payments foundation with user & merchant wallets, peer-to-peer transfers, checkout flows, transaction management, fee configuration, security controls, and a unified admin backend — designed for scalable fintech operations.

Note:

Includes full source code, backend setup, frontend integration, admin configuration, API connections, and deployment assistance — enabling you to launch a fully branded PayPal-style payments platform with complete ownership.

Launch Your PayPal-Style Digital Payments Platform — Contact Us Today

Delivery Timeline for a PayPal-Like Platform with Miracuves

The typical delivery timeframe is 30–90 days, depending on:

- Number of currencies & regions

- Bank, card, and merchant integrations

- Compliance & KYC depth

- Fraud prevention and security layers

- Branding & UI/UX customization

- Reporting and admin control requirements

Tech Stack

Built using a JS-based architecture, ideal for modern fintech platforms that require secure transaction processing, scalable APIs, real-time payment handling, and high-availability infrastructure.

Customization & White-Label Option

Building a PayPal-style digital payments and online wallet platform isn’t just about processing transactions — it’s about creating a secure, trust-centric financial ecosystem that enables individuals and businesses to send, receive, store, and manage money seamlessly. A platform inspired by PayPal must prioritize security, compliance, reliability, and ease of use while supporting global payments, multi-currency handling, and merchant integrations.

Miracuves delivers a fully white-label PayPal-style solution that allows deep customization across payment flows, wallet logic, merchant tools, compliance layers, and backend financial operations. Whether you are targeting peer-to-peer payments, online merchants, marketplaces, or international remittances, the platform can be tailored to your fintech vision and regulatory environment.

Why Customization Matters

In digital payments, trust and usability are critical. Users expect instant transactions, transparent fees, strong security, and smooth integration with ecommerce platforms and apps. Customization ensures your platform aligns with local regulations, business models, and user expectations while differentiating it from generic payment gateways.

What You Can Customize

Complete UI/UX Personalization

Customize user dashboards, wallet screens, transaction history views, merchant panels, onboarding flows, typography, color systems, and mobile-first interfaces.

Wallet & Payment Workflows

Configure wallet balances, send/receive flows, request payments, split payments, refunds, recurring billing, and transaction status handling.

Merchant & Business Tools

Merchant onboarding, API keys, checkout buttons, invoicing tools, subscription billing, dispute management, and role-based access for teams.

Multi-Currency & Global Payments

Currency conversion logic, exchange rate handling, regional payment rules, cross-border transfers, and localization settings.

Security & Compliance Controls

KYC/KYB workflows, AML monitoring, fraud detection rules, transaction limits, risk scoring, audit logs, and compliance reporting.

Checkout & Integrations

Integrate with ecommerce platforms, marketplaces, mobile apps, POS systems, and third-party APIs for seamless payment acceptance.

Monetization & Fee Structures

Transaction fees, subscription plans, premium merchant features, currency conversion margins, and value-added financial services.

Analytics & Financial Reporting

Transaction dashboards, revenue reports, user activity insights, settlement reports, chargeback analytics, and compliance summaries.

How Miracuves Handles Customization

Miracuves follows a structured customization approach built for secure and scalable fintech platforms.

- Requirement Understanding

Analysis of your payment use cases, target regions, and compliance requirements. - Planning & Breakdowns

Customization tasks are organized into modular, regulation-aware components. - Design & Development

UI/UX enhancements, wallet logic, and payment workflows are implemented according to your roadmap. - Testing & Quality Assurance

Security testing, transaction accuracy checks, performance validation, and compliance verification. - Deployment

Your fully white-labeled digital payments platform goes live with complete branding and operational configuration.

Real Examples from the Miracuves Portfolio

Miracuves has powered 600+ fintech and marketplace deployments, including:

- Digital wallet platforms for peer-to-peer payments

- Merchant payment gateways integrated with ecommerce systems

- Subscription billing and invoicing platforms for SaaS businesses

- White-label fintech solutions with strong compliance and security layers

These real-world deployments demonstrate how customization transforms a PayPal-style platform into a scalable, secure, and trust-driven digital payments business.

Launch Strategy & Market Entry

Launching a PayPal clone in 2025 requires more than technical readiness It demands a clear go-to-market strategy regulatory awareness and a growth plan that aligns with how users adopt financial products Trust is earned before scale and the first 90 days often determine long-term success

Founders should treat launch as a phased process starting with stability and credibility before aggressive expansion Payment platforms grow fastest when early users feel safe supported and rewarded for adoption

Pre-Launch Readiness Checklist

Before going live every PayPal-style platform should pass a structured readiness phase This reduces post-launch failures and builds confidence with users and partners

Key pre-launch steps include

- End-to-end transaction testing across all payment flows

- Load testing to simulate peak transaction volume

- Security audits and penetration testing

- KYC AML and compliance validation

- App store and web platform readiness checks

- Customer support workflows and dispute handling setup

- Clear pricing and fee transparency documentation

Miracuves supports founders throughout this stage ensuring the platform is production-ready not just functional

Regional Market Entry Strategies

Different regions require different approaches In Asia high mobile usage and QR-based payments dominate making wallet simplicity and speed essential In MENA compliance trust and localized language support drive adoption In Europe data protection and regulatory alignment are critical while in the U.S. user acquisition and partnerships with merchants determine scale

Successful PayPal clone launches adapt features and messaging to each region This may involve localized currencies regional KYC providers or tailored onboarding experiences

User Acquisition Frameworks That Work in 2025

Payment platforms grow through network effects Early traction often comes from targeted communities rather than mass marketing Proven acquisition strategies include

- Influencer and creator partnerships in niche communities

- Referral loops offering transaction credits or fee discounts

- Merchant onboarding campaigns with zero-fee trial periods

- Content-driven education around payments and trust

- Retention funnels using AI-based usage insights and reminders

The goal is to create habitual usage rather than one-time transactions

Monetization Models Proven in 2025

A PayPal clone can generate revenue through multiple channels Successful platforms often combine several models

- Transaction fees on transfers and merchant payments

- Subscription plans for premium features and higher limits

- FX margins on cross-border transactions

- API access fees for merchants and developers

- Value-added services like invoicing analytics or instant payouts

Diversified monetization improves resilience and investor confidence

Miracuves End-to-End Launch Support

Miracuves goes beyond development by supporting founders through launch and early growth This includes server deployment performance tuning security monitoring and a structured 90-day post-launch roadmap focused on stability and adoption

Founders receive guidance on rollout sequencing feedback collection and early feature optimization ensuring the platform evolves based on real user behavior

By combining strong technology with a disciplined launch strategy entrepreneurs can enter the fintech market with confidence and build trust faster than competitors relying on generic launches

Why Choose Miracuves for Your PayPal Clone

Behind every successful fintech platform is a technology partner that understands both regulation and real-world scaling challenges Building a PayPal clone is not just about coding payment flows it is about delivering trust reliability and long-term control Miracuves has been built specifically for entrepreneurs who want to launch fintech products without hidden technical or operational risks

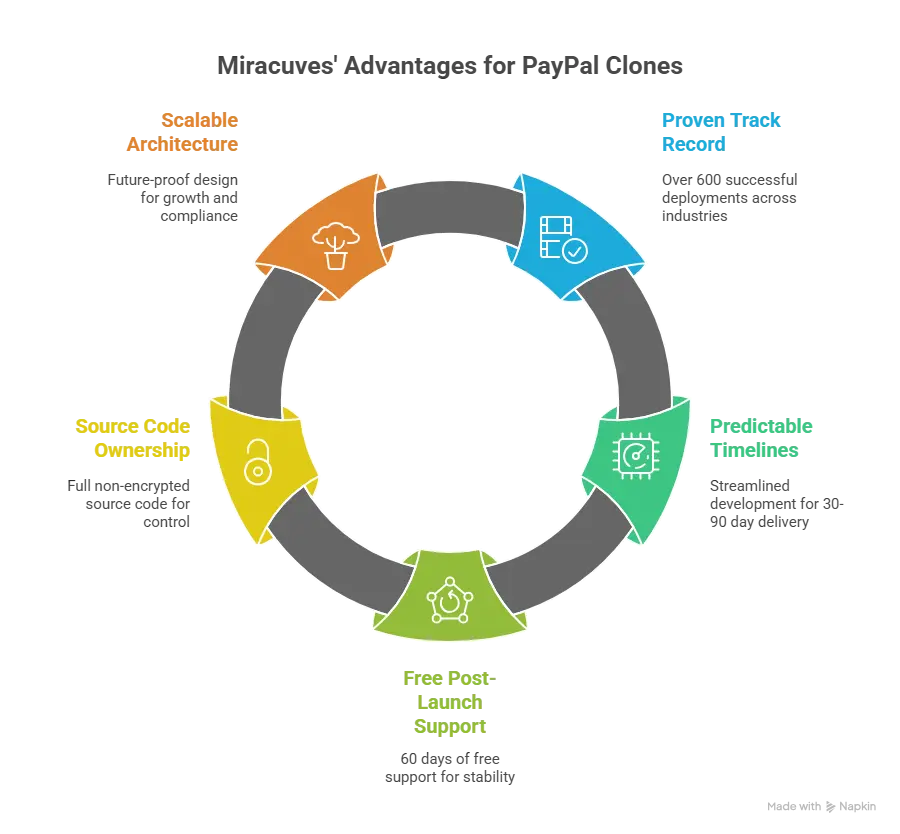

Over the years Miracuves has completed more than 600 successful deployments across fintech marketplaces ecommerce and on-demand platforms These are not experimental builds They are production-grade systems already tested under real users real transactions and real compliance pressure This experience allows Miracuves to anticipate challenges before they impact your business

Speed is another decisive advantage In fast-moving fintech markets timing matters Miracuves follows a streamlined development and delivery model allowing most PayPal clone platforms to be delivered within a 30–90 days timeline depending on customization scope This enables founders to validate markets secure partnerships and start generating revenue while competitors are still in development

What Sets Miracuves Apart

- 600 plus successful platform deployments across multiple industries

- Predictable delivery timelines with clear milestones

- 60 days of free post-launch support for stability and optimization

- Full non-encrypted source-code ownership for long-term control

- Future-proof architecture designed for scalability and compliance

Real Founder Transformations

A regional digital wallet startup used Miracuves PayPal clone technology to launch within three months targeting freelancers and small merchants By focusing on instant payouts and localized onboarding they achieved early traction and crossed five-figure monthly transaction volume within the first quarter

Another entrepreneur built a subscription-focused payment platform for SaaS businesses Using Miracuves flexible billing and API modules they onboarded multiple clients before launch and secured early recurring revenue validating the business model from day one

These outcomes are possible because Miracuves does not just deliver software It delivers fintech foundations that grow with your vision

Final Thought

Building a PayPal-style platform in 2025 is no longer about copying a global brand it is about understanding the underlying business logic trust mechanisms and scalability strategies that made it successful Payments sit at the center of modern digital economies and entrepreneurs who master this layer unlock endless opportunities across ecommerce SaaS creator platforms and cross-border services

By choosing the right PayPal clone foundation founders can bypass years of technical complexity and focus on what truly drives growth market fit user trust and monetization With Miracuves Clone Solutions entrepreneurs gain a proven fintech framework that accelerates launch timelines reduces risk and supports long-term scale

The combination of deep payment architecture customization flexibility and launch support allows startups to move faster adapt smarter and compete confidently even in regulated high-stakes markets With the right strategy and the right technology partner your PayPal clone can evolve from an idea into a trusted financial platform powering real businesses worldwide

Ready to launch your PayPal cloneGet a free consultation and a detailed project roadmap from Miracuves trusted by 200 plus entrepreneurs worldwide to build secure scalable and revenue-ready platforms

Frequently Asked Questions

How quickly can Miracuves deploy my PayPal clone

Depending on customization scope Miracuves delivers PayPal clone platforms within a 30–90 days timeline ensuring speed without compromising security or compliance

What is included in the Miracuves PayPal clone package

The package includes user wallet merchant tools admin panel security layers compliance workflows and scalable architecture ready for real-world transactions

Do I get full source-code ownership

Yes every Miracuves PayPal clone is delivered with full non-encrypted source-code ownership giving founders complete control and flexibility

How does Miracuves ensure scalability

Miracuves uses cloud-native microservices architecture load-balanced APIs and modular components that scale independently as transaction volume grows

Does Miracuves assist with app store approval

Yes Miracuves supports founders with technical compliance documentation testing and submission guidance for smooth app store approvals

Is post-launch maintenance included

Miracuves provides 60 days of free post-launch support covering bug fixes performance optimization and stability monitoring

Can Miracuves integrate custom payment gateways and banks

Yes the platform supports integration with custom payment gateways banking APIs cards wallets and regional financial partners

What is the upgrade and update policy

Founders can add new features security updates and integrations without disrupting existing operations through Miracuves modular upgrade process

How does white-labeling work

The PayPal clone is delivered fully branded under your business name domain and app identity with no Miracuves branding visible

What kind of ongoing support can I expect

Beyond launch Miracuves offers optional long-term support plans covering maintenance feature expansion compliance updates and performance optimization

Related Articles

- Best LocalBitcoins Clone Scripts in 2025: Features & Pricing Compared

- Best Paxful Clone Scripts in 2025: Features & Pricing Compared

- Best ICO Launch Platforms in 2025: Features & Pricing Compared

- Best GMX Clone Scripts in 2025: Features & Pricing Compare

- Best Remitano Clone Scripts in 2025: Features & Pricing Compared