Tipalti, a leading global finance automation platform, surpassed $200 million in Annual Recurring Revenue (ARR) in 2025, reflecting strong adoption of its accounts payable, supplier payments, and compliance solutions. Entrepreneurs can study Tipalti’s success to understand how complex B2B financial workflows can be transformed into scalable, high-margin businesses.

What makes Tipalti particularly impressive is its ability to combine SaaS subscriptions with transaction-based fees, offering predictable revenue while benefiting from volume growth as clients scale globally. Its approach demonstrates the power of integrating automation, compliance, and payments into a single platform to capture more value per user.

For founders looking to replicate or innovate in the fintech space, Tipalti offers lessons in subscription structuring, upselling, cross-selling, and customer retention strategies. By analyzing its revenue model, entrepreneurs can identify actionable opportunities to develop platforms that are not only functional but also revenue-generating from day one.

Tipalti Revenue Overview – The Big Picture

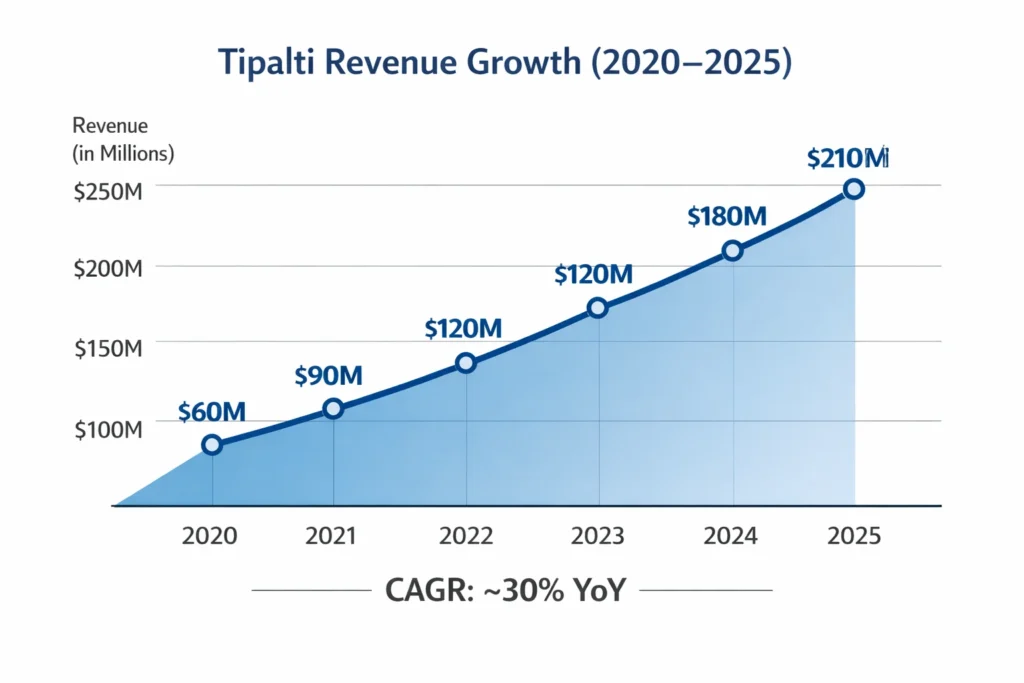

- 2025 Revenue: $200M+ ARR

- Valuation: ~$8.3 billion

- YoY Growth: ~30%

- Revenue by Region: Strong presence in North America, Europe, and growing adoption in APAC

- Profit Margins: High gross margins typical of SaaS (~70%+)

- Competition Benchmark: Competes with Bill.com, Coupa, and ERP platforms but stands out for global payables automation

Read More: Tipalti Explained – AP Automation, Mass Payments & Finance Ops

Primary Revenue Streams Deep Dive

| Revenue Stream | % Share (2025 est.) | Description |

|---|---|---|

| Core AP Automation SaaS | 55% | Subscription fees for workflow automation, invoices, approvals |

| Global Payments Processing | 20% | Fees tied to payment execution and cross-border transfers |

| Procurement & Approve.com Suite | 15% | Revenue from procurement and workflow integrations |

| Expense & Card Management | 10% | Subscription/usage fees for corporate cards and expense management |

| Premium Support & Integrations | Variable | Technical support, ERP integrations, advanced reporting |

Revenue Stream #1 – Core AP Automation SaaS: Largest revenue contributor, with structured subscription tiers based on company size and feature requirements.

Revenue Stream #2 – Global Payments Processing: Charges per transaction and cross-border fee spreads.

Revenue Stream #3 – Procurement & Approve.com Suite: Workflow automation beyond payables, capturing value from procurement processes.

Revenue Stream #4 – Expense & Card Management: Monetizes employee expenses and corporate card usage.

Revenue Stream #5 – Premium Support & Integrations: Adds revenue from advanced SLAs, integration services, and custom reports.

The Fee Structure Explained

| Fee Type | Applies To | Notes |

|---|---|---|

| Base SaaS Subscription | Customers | Tiered by company size and modules |

| Per Payment Processing Fee | Customers | Variable by payment type and region |

| Cross-Border FX & Routing Fees | Customers | Charged for international payments |

| Integration/Onboarding Fees | Enterprise | One-time setup for ERP/API integration |

| Premium Support Level Fees | Customers | Higher SLAs and priority support |

User-Side Fees: Subscriptions per tier and modules.

Provider-Side Fees: Payment processing, FX, and routing.

Hidden Revenue Layers: Currency spreads and optional add-ons.

Regional Pricing Variation: Higher in regions with complex compliance or service costs.

How Tipalti Maximizes Revenue Per User

- Segmentation: Multiple tiers for mid-market to enterprise clients.

- Upselling: Add-on procurement, card, and expense modules.

- Cross-Selling: Bundled payables + payment + treasury features.

- Dynamic Pricing: Contracts tailored to scale and SLA requirements.

- Retention Monetization: Strong customer success improves lifetime value.

- LTV Optimization: High retention increases profitability per client.

- Psychological Pricing: Tiered plans encourage upgrading.

- Real Data Examples: Enterprises often adopt full finance stack over time.

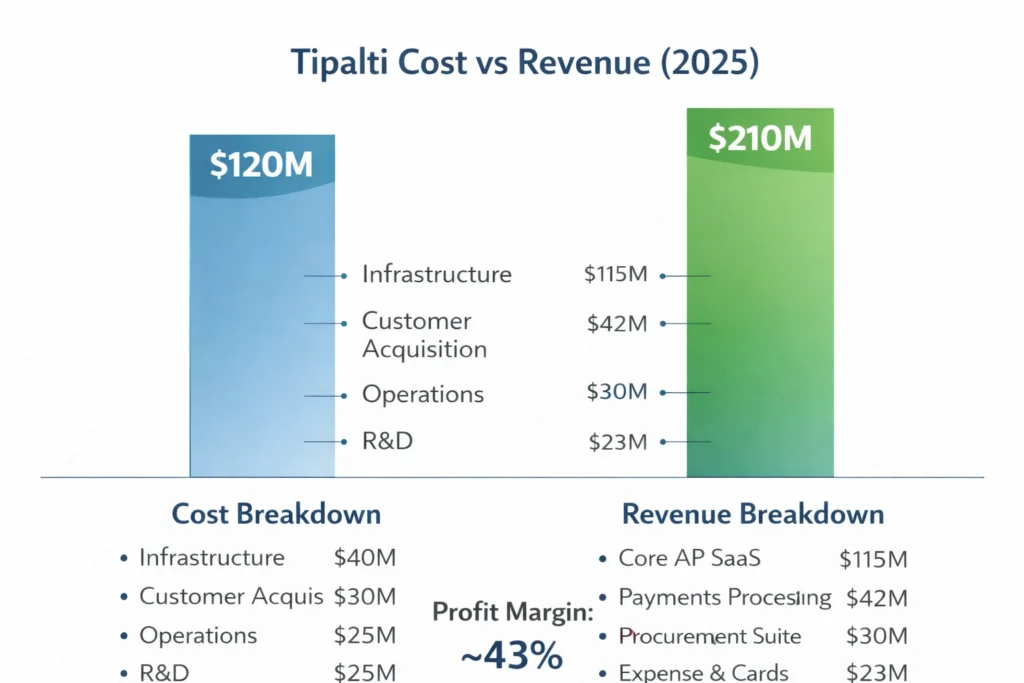

Cost Structure & Profit Margins

- Infrastructure Cost: Cloud hosting, security, global payment rails

- CAC & Marketing: Targeted enterprise sales, partnerships

- Operations: Support teams across regions

- R&D: AI for automation, compliance rules, integrations

- Unit Economics: Subscription + transaction fees allow scalable margins

- Margin Optimization: Bundled offerings increase ARPU

- Profitability Path: ARR growth and transaction volume drive sustainable profits

Read More: Best Tipalti Clone Script 2026 | Build a Global Payables Platform

Future Revenue Opportunities & Innovations

- New Streams: AI-driven invoice automation and predictive payment scheduling

- AI/ML Monetization: Smart insights and fraud detection for premium tiers

- Market Expansions: APAC, LATAM regions for B2B payments

- Predicted Trends 2025–2027: Automation adoption, embedded finance, and compliance-as-a-service

- Risks & Threats: Competition, regulatory changes, FX volatility

- Opportunities for Founders: Replicate modular SaaS+transaction models or niche financial automation tools

Lessons for Entrepreneurs & Your Opportunity

- What Works: Subscription + transaction hybrid model drives predictable and scalable revenue

- What to Replicate: Tiered pricing, upsell modules, enterprise retention strategies

- Market Gaps: Emerging regions and SME-focused automation tools

- Improvements Founders Can Use: AI-powered insights, lower friction onboarding, and embedded finance

“Want to build a platform with Tipalti’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Tipalti clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, Miracuves can arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.”

Final Thought

Tipalti demonstrates that combining SaaS subscriptions with transaction-based fees creates a powerful revenue engine for B2B fintech platforms. Its success proves that automation and compliance solutions are not just operational tools but strategic profit drivers.

Entrepreneurs can draw lessons in retention, upselling, and segmentation to replicate similar results in other industries. By building platforms that integrate value-added modules, founders can increase ARPU while serving enterprise clients efficiently.

The path forward lies in combining technology with actionable monetization strategies—ensuring that even small teams can launch platforms that scale globally while optimizing profit margins. Miracuves enables entrepreneurs to take these insights and deploy fully functional clones in days, turning lessons into revenue.

FAQs

1. How much does Tipalti make per transaction?

Variable; fees depend on transaction type, currency, and region.

2. What’s Tipalti’s most profitable revenue stream?

Core AP Automation SaaS subscriptions generate the largest portion.

3. How does Tipalti’s pricing compare to competitors?

Tiered pricing with bundled add-ons is competitive with Bill.com and Coupa.

4. What percentage does Tipalti take from providers?

Varies; mainly transaction-based FX and payment processing fees.

5. How has Tipalti’s revenue model evolved?

From SaaS-only subscriptions to hybrid SaaS + transaction fees.

6. Can small platforms use similar models?

Yes, modular subscription + transaction hybrid works at smaller scale.

7. What’s the minimum scale for profitability?

Depends on fixed costs and ARR, typically mid-market enterprises.

8. How to implement similar revenue models?

Use tiered SaaS subscriptions, optional transaction fees, and modular add-ons.

9. What are alternatives to Tipalti’s model?

Pure SaaS, one-time licensing, or payment-only platforms.

10. How quickly can similar platforms monetize?

With enterprise-ready scripts, some clients see revenue within 30 days.