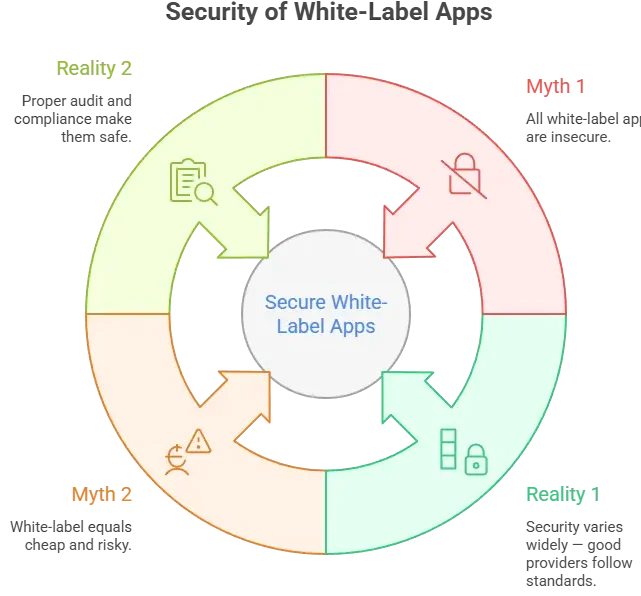

You’ve heard the horror stories about data breaches, leaked customer phone numbers, and payment details getting exposed from “ready-made” ecommerce apps.And if you’re considering a white-label Tmall app, your fear is valid.

Because in 2026, ecommerce apps are not just selling products — they’re handling payments, addresses, customer identities, order history, refunds, and sometimes even saved cards. That makes them one of the most targeted app categories on the internet.A white-label Tmall app can be extremely safe — or dangerously risky — depending on how it was built, hosted, and maintained.

In this guide, I’ll give you an honest security assessment of white-label Tmall apps, what risks matter most, and the practical security steps you should demand from any provider.

And yes — I’ll also show you why Miracuves is positioned as the security-first choice for businesses that want a compliant, enterprise-grade ecommerce platform.

Understanding White-Label Tmall App Security Landscape

A white-label Tmall app is a prebuilt ecommerce platform that businesses rebrand as their own. Security depends on how well the provider built and maintains the app.

Concerns focus on data leaks, payment security, and vendor trustworthiness.

Current threat landscape for Tmall-type platforms

Ecommerce apps are targeted by:

- Payment fraud

- Credential stuffing

- API abuse

- Data scraping

Security standards in 2026

Security now demands certified compliance (ISO, SOC reports), encrypted data, and continuous monitoring.

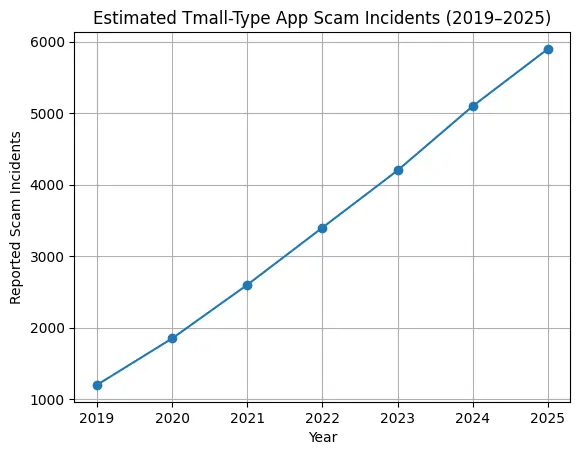

Real-world statistics on app security incidents

Ecommerce breaches continue to be among the top categories for data theft and fraud globally.

Key Security Risks & How to Identify Them

A white-label Tmall app looks simple on the surface: products, cart, checkout, orders.

But under the hood, it handles some of the most sensitive data any business can store. That’s why the risks are real — and why you must know where to look.

Data Protection & Privacy Risks

User personal information

A Tmall-type app stores:

- Names

- Phone numbers

- Addresses

- Order history

- Return and refund records

If this data leaks, it becomes instant fuel for fraud and identity abuse.

Payment data security

The biggest risk is when a provider tries to “handle payments directly” without proper compliance.

If your white-label Tmall app stores card data incorrectly, you can face:

- Legal exposure

- Payment gateway bans

- Heavy penalties

Location tracking concerns

Many ecommerce apps track:

- Delivery location

- Address history

- Real-time rider/shipping location (if logistics included)

If this isn’t secured, it can expose customers to physical safety risks.

GDPR/CCPA compliance

Privacy laws are now stricter than ever. Common failures include:

- No consent tracking

- No “delete my data” workflow

- No export request support

- Weak privacy policy alignment

Technical Vulnerabilities

Code quality issues

Low-quality white-label providers often reuse the same codebase across hundreds of clients without proper hardening.

This creates “shared risk”: one exploit can impact many apps.

Server security gaps

Common server issues:

- Misconfigured cloud storage (public buckets)

- Weak firewall rules

- No intrusion detection

- No separation between client databases

API vulnerabilities

Tmall-type apps rely heavily on APIs for:

- Products

- Inventory

- Orders

- Payments

- Logistics

If APIs are poorly secured, attackers can:

- Pull user data

- Manipulate prices

- Place fake orders

- Abuse refund systems

Third-party integrations

Risk increases with:

- Payment gateways

- SMS/OTP providers

- Shipping APIs

- Analytics tools

- CRM integrations

If even one integration is insecure, your entire app becomes exposed.

Business Risks

Legal liability

If a breach happens, customers won’t blame the vendor first — they blame your brand.

Reputation damage

Ecommerce trust is fragile. One security incident can kill repeat customers instantly.

Financial losses

Security failures often lead to:

- Chargebacks

- Refund fraud

- Fake coupon abuse

- Account takeover

Regulatory penalties

In 2026, regulators take ecommerce privacy seriously, especially for:

- EU customers (GDPR)

- California residents (CCPA/CPRA)

- UK users (UK GDPR)

Security Standards Your White-Label Tmall App Must Meet

If a provider can’t clearly explain their security standards, you’re not buying a “white-label Tmall app.”

You’re buying a risk.

In 2026, ecommerce security is not optional — it’s a baseline requirement.

Essential Certifications

ISO 27001 compliance

This is the global gold standard for an Information Security Management System (ISMS).

It proves the company follows structured security controls, risk management, and audits.

SOC 2 Type II

SOC 2 Type II is one of the most important trust signals in 2026 because it validates:

- Security controls

- Availability controls

- Confidentiality controls

Over a period of time (not just a one-time snapshot)

GDPR compliance

Required if you serve EU users.

Your white-label Tmall app must support:

- Consent management

- Right to delete

- Right to access/export

- Privacy-by-design

HIPAA (if applicable)

Not common for ecommerce, but relevant if your marketplace sells:

- Medical products

- Health-related services

- Prescription items (region-specific)

PCI DSS for payments

This is non-negotiable for any Tmall-type app that processes payments.

Important note:

Your app should ideally never store raw card details.

Instead, it should use tokenization through a PCI-compliant gateway.

Technical Requirements

End-to-end encryption

At minimum:

- HTTPS everywhere (TLS 1.2+)

- Strong encryption for stored data (AES-256 recommended)

Secure authentication (2FA/OAuth)

A safe Tmall-type app must support:

- 2FA for admin accounts

- OTP verification for users (where required)

- OAuth integration if enterprise clients request it

Regular security audits

At least:

- Quarterly internal reviews

- Annual external audits

Penetration testing

You need real pentesting for:

- Admin panel

- APIs

- Checkout and payment flow

- Coupon/refund systems

SSL certificates

Basic, but still frequently neglected by low-cost vendors.

Secure API design

APIs must include:

- Authentication tokens (JWT/OAuth)

- Rate limiting

- Input validation

- Proper authorization (not just login-based access)

Security Standards Comparison Table

| Standard / Requirement | Why It Matters | Must-Have for Tmall-Type Apps |

|---|---|---|

| ISO 27001 | Company-wide security controls | Yes |

| SOC 2 Type II | Proves ongoing security compliance | Strongly recommended |

| GDPR | EU user privacy compliance | Yes (if EU traffic exists) |

| PCI DSS | Payment security compliance | Yes |

| Penetration Testing | Finds real attack paths | Yes |

| Encryption (TLS + at rest) | Protects user + order data | Yes |

| 2FA for admin | Prevents admin takeover | Yes |

| Secure APIs | Prevents data scraping and abuse | Yes |

Read more :- Business Model of Tmall : Complete Strategy Breakdown 2025

Red Flags: How to Spot Unsafe White-Label Providers

Some are security-focused engineering companies.

Others are just resellers with minimal technical depth.

Here’s how to tell the difference quickly.

No security documentation

If they cannot provide:

- Security architecture overview

- Compliance documentation

- Data handling policy

Walk away.

Cheap pricing without explanation

If pricing is extremely low compared to market average, ask why.

Security infrastructure, audits, and compliance are expensive.

If they are not charging for it, they are probably not doing it.

No compliance certifications

If they claim “secure” but:

- No ISO alignment

- No SOC report

- No PCI integration proof

That’s a major risk.

Outdated technology stack

Old frameworks mean:

- Unpatched vulnerabilities

- Weak authentication libraries

- Poor API security

Poor code quality

Signs include:

- Slow admin panel

- Frequent crashes

- No staging environment

- No version control transparency

No security updates policy

Ask:

“How often do you release security patches?”

If they don’t have a documented update cycle, your app will age into vulnerability.

Lack of data backup systems

A secure Tmall-type app must have:

- Automated daily backups

- Encrypted backups

- Disaster recovery plan

No insurance coverage

Serious providers often carry:

- Cyber liability insurance

- Professional indemnity insurance

If they don’t, that shifts all risk to you.

Evaluation Checklist

Before signing any contract, ask these direct questions:

Questions to Ask Providers

- Is payment handled via PCI DSS compliant gateway only?

- Are databases isolated per client?

- Do you conduct annual penetration testing?

- Is data encrypted at rest?

- What is your incident response time?

Documents to Request

- Security policy document

- Data processing agreement (DPA)

- Compliance certificates

- SLA with uptime and response terms

Testing Procedures

- Request demo access to admin panel

- Perform basic security scans

- Verify HTTPS and API protection

- Review authentication flow

Due Diligence Steps

- Check past client reviews

- Ask for enterprise references

- Verify company registration

- Review legal agreements carefully

If a provider becomes defensive when asked about security, that alone is a red flag.

Best Practices for Secure White-Label Tmall App Implementation

Security is not just about choosing the right provider.

It’s also about how you implement and maintain the app.

A secure white-label Tmall app requires discipline before and after launch.

Pre-Launch Security

Security audit process

Before going live:

- Conduct vulnerability assessment

- Review admin permissions

- Test checkout and payment flow

- Validate API endpoints

An external security audit is highly recommended.

Code review requirements

Even in white-label models:

- Review customization layers

- Avoid insecure plugins

- Ensure no hardcoded credentials exist

Infrastructure hardening

Your hosting environment should include:

- Web Application Firewall (WAF)

- Secure cloud configuration

- DDoS protection

- Private database access (not public IP)

Compliance verification

Verify:

- GDPR-ready workflows

- Privacy policy alignment

- PCI-based payment integration

- Cookie consent management

Staff training programs

Train your internal team on:

- Admin access hygiene

- Phishing awareness

- Password management

- Role-based access control

Most breaches happen due to human error.

Post-Launch Monitoring

Continuous security monitoring

Implement:

- Real-time intrusion detection

- Login attempt monitoring

- Fraud detection alerts

- Log analysis

Regular updates and patches

A serious provider should:

- Release regular security patches

- Upgrade libraries

- Monitor vulnerability databases

Incident response planning

You must have:

- Clear breach protocol

- Communication plan

- Legal reporting workflow

- Customer notification procedure

Time is critical during a security incident.

User data management

Ensure:

- Data minimization policies

- Scheduled data deletion

- Access logging

- Role-based admin controls

Backup and recovery systems

At minimum:

- Daily encrypted backups

- Multi-region storage

- Recovery testing every quarter

Security Implementation Timeline

| Phase | Key Security Actions |

|---|---|

| Week 1–2 | Architecture review + infrastructure hardening |

| Week 3–4 | Compliance verification + payment security validation |

| Week 5 | External security audit + penetration testing |

| Week 6 | Final patching + go-live approval |

| Ongoing | Monitoring, updates, quarterly review |

Legal & Compliance Considerations

A white-label Tmall app is not just a technical product.

It is a legal responsibility.

If you collect user data, process payments, or operate across borders, compliance is mandatory — not optional.

Regulatory Requirements

Data protection laws by region

Depending on where your users are located, your app may need to comply with:

- European Union – GDPR

- United Kingdom – UK GDPR

- United States (California) – CCPA / CPRA

- Canada – PIPEDA

- Australia – Privacy Act

- India – Digital Personal Data Protection Act (DPDP)

If your white-label Tmall app serves global customers, you may need multi-region compliance.

Industry-specific regulations

If your marketplace includes:

- Health products

- Financial services

- Digital assets

- Subscription billing

Additional regulatory frameworks may apply.

User consent management

Your app must:

- Collect explicit consent where required

- Allow opt-out of marketing

- Support data deletion requests

- Provide data access/export functionality

Privacy policy requirements

Your privacy policy must clearly explain:

- What data is collected

- Why it is collected

- How long it is stored

- Who it is shared with

- How users can exercise their rights

Generic templates are not enough.

Terms of service essentials

Your TOS should define:

- User responsibilities

- Dispute resolution process

- Refund policy

- Fraud handling terms

- Limitation of liability

Liability Protection

Insurance requirements

You should strongly consider:

- Cyber liability insurance

- Data breach insurance

- Professional indemnity coverage

This protects against financial loss in case of breach or legal claim.

Legal disclaimers

Include clear disclaimers regarding:

- Marketplace seller responsibility

- Payment processing roles

- Third-party integrations

User agreements

Ensure:

- Clickwrap acceptance

- Timestamped consent logging

- Secure record storage

Incident reporting protocols

In many regions, you must report serious breaches within:

- 72 hours (GDPR standard)

Failing to report on time can multiply penalties.

Regulatory compliance monitoring

Compliance is ongoing.

You must review laws annually and update policies accordingly.

Compliance Checklist by Region

| Region | Key Requirement | Mandatory for Tmall-Type Apps |

|---|---|---|

| EU | GDPR compliance + DPO (if required) | Yes (if EU users) |

| UK | UK GDPR | Yes (if UK users) |

| California | CCPA/CPRA data rights | Yes (if CA users) |

| India | DPDP Act compliance | Yes (if Indian users) |

| Global | PCI DSS for payments | Always |

Why Miracuves White-Label Tmall App is Your Safest Choice

When security is treated as an afterthought, businesses pay the price.

At Miracuves, security is engineered into the foundation of every white-label Tmall app — not added later as a patch.

Miracuves Security Advantages

Enterprise-grade security architecture

Built with scalable cloud infrastructure, database isolation, and hardened server configurations designed for high-volume ecommerce.

Regular security audits and certifications

Periodic internal reviews and structured security assessments ensure continuous risk monitoring.

GDPR/CCPA compliant by default

Privacy-by-design architecture supports:

- Consent tracking

- Data export

- Data deletion workflows

- Secure data storage

24/7 security monitoring

Real-time monitoring systems track suspicious behavior, login anomalies, and fraud patterns.

Encrypted data transmission

TLS-based encryption for all communication between:

- User devices

- Admin panel

- Servers

- Payment gateways

Secure payment processing

Strict PCI DSS-aligned integrations with trusted payment gateways.

No unsafe storage of raw card data.

Regular security updates

Continuous patching of:

- Framework dependencies

- API layers

- Admin modules

- Server infrastructure

Insurance coverage included

Structured contracts and risk-managed implementation reduce legal exposure for enterprise clients.

Final Thought

Don’t compromise on security. Miracuves white-label Tmall app solutions come with enterprise-grade security built-in. Our 600+ successful projects have maintained zero major security breaches. Get a free security assessment and see why businesses trust Miracuves for safe, compliant platforms.

A white-label Tmall app can absolutely be safe in 2026 — but only if security is built into the product, not promised in marketing.

Choose a provider that proves compliance, documents security clearly, and maintains the app continuously.

FAQs

1. How secure is white-label vs custom development?

A secure white-label Tmall app can be as safe as custom development if it follows ISO/SOC practices and gets regular security updates.

2. What happens if there’s a security breach?

A proper provider should have an incident response plan, forensic support, and legal reporting process (like GDPR 72-hour reporting).

3. Who is responsible for security updates?

The white-label provider is responsible for core security patches. You are responsible for admin access control and internal policy enforcement.

4. How is user data protected in white-label apps?

Through encryption, access controls, secure databases, and strict API authorization.

5. What compliance certifications should I look for?

ISO 27001, SOC 2 Type II, GDPR readiness, and PCI DSS payment compliance.

6. Can white-label apps meet enterprise security standards?

Yes, if the provider has audits, strong infrastructure, and enterprise-grade monitoring.

7. How often should security audits be conducted?

At minimum annually, but quarterly reviews are best for ecommerce apps.

8. What’s included in Miracuves security package?

Secure architecture, encrypted transmission, PCI-aligned payments, compliance-ready setup, monitoring, and ongoing updates.

9. How to handle security in different countries?

Use region-based compliance (GDPR, CCPA, DPDP), local data handling rules, and updated privacy policies.

10. What insurance is needed for app security?

Cyber liability insurance and data breach coverage are the most important for ecommerce platforms.

Related Articles