If you’re an entrepreneur or digital creator who’s been bitten by the crypto bug, chances are you’ve toyed with the idea of launching your own crypto exchange. But let’s be honest, the centralized route is yesterday’s news. Enter decentralized exchanges (DEXs)—no middlemen, no bank strings attached, just pure peer-to-peer power. And yes, the world is warming up to them faster than you can say “blockchain.”

Picture this: you’re at a café, watching someone trade crypto with just a smartphone, zero KYC friction, no custodial hurdles—freedom at its finest. That’s the magic of decentralized finance (DeFi). In a world obsessed with control and privacy, DEXs are the rebellious heroes we didn’t know we needed.

Now, if you’re wondering how to actually build one (without your brain melting), you’re in the right place. This guide breaks it down step by step. And of course, if you want an MVP that’s fast, sleek, and ready to disrupt—Miracuves has your back.

What is a Decentralized Crypto Exchange?

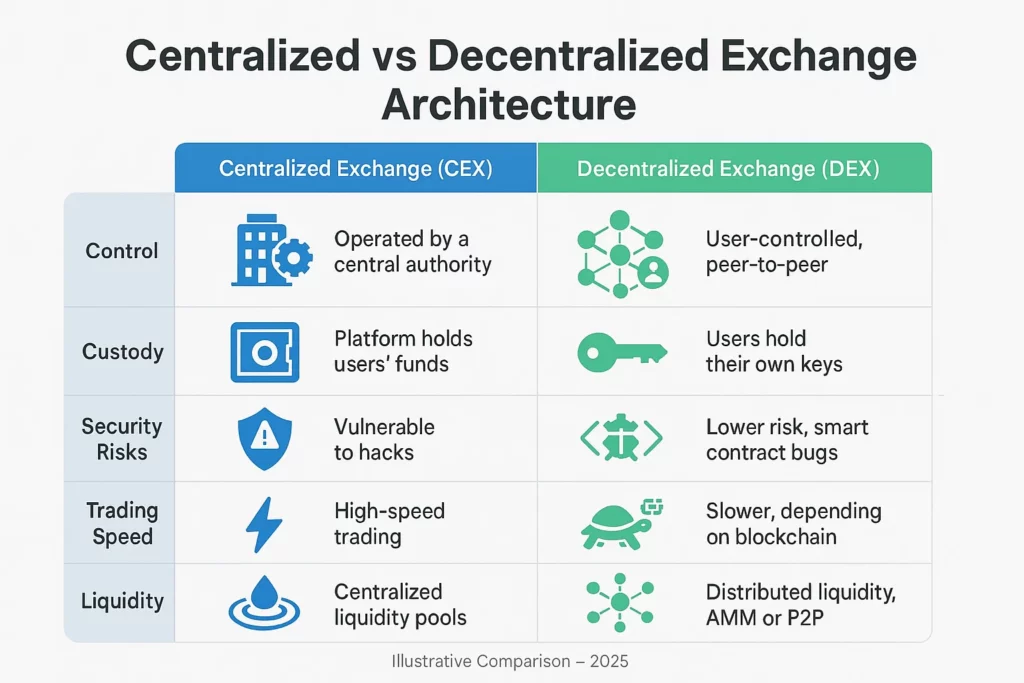

A decentralized crypto exchange (DEX) is a blockchain-based platform that allows users to trade cryptocurrencies without the need for an intermediary or custodian. Unlike centralized exchanges (like Binance or Coinbase), DEXs let users maintain control of their funds while enabling secure, smart contract-based transactions.

Examples of Popular DEXs:

- Uniswap

- PancakeSwap

- SushiSwap

These platforms leverage automated market maker (AMM) models and liquidity pools to facilitate trades.

Image Source : Chat GPT

Also Read :-How to Market a Decentralized crypto exchange App Successfully After Launch

Why DEXs Are the Future

- Security – No central point of failure means fewer hacks.

- Privacy – No mandatory KYC/AML processes.

- Accessibility – Anyone with a crypto wallet can join.

- Ownership – Users hold their own keys—true to the “not your keys, not your coins” mantra.

Stat Check: According to Statista, decentralized exchange volume grew over 850% between 2020 and 2023.

Image Source : Chat GPT

Step-by-Step Guide to Developing a DEX App

1. Choose the Right Blockchain

Ethereum is the go-to choice, but it’s not your only option. BNB Chain, Avalanche, Polygon, and Solana are rising stars, each with different trade-offs in speed, cost, and ecosystem support.

2. Decide on DEX Type

- AMM-based: Uses liquidity pools (e.g., Uniswap)

- Order Book-based: Mimics traditional exchanges

- Hybrid DEX: Combines the best of both worlds

Choose based on your user base and technical capacity.

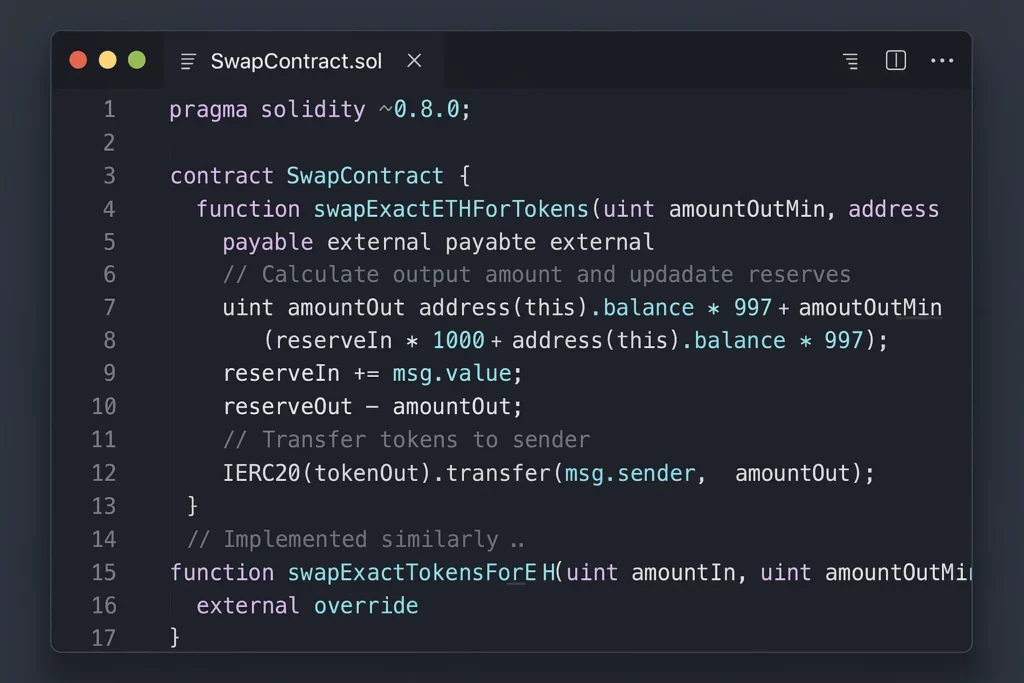

3. Smart Contract Development

This is the heart of your DEX. You’ll need contracts for:

- Token swaps

- Liquidity provision

- Yield farming (optional)

Use Solidity (for EVM chains) or Rust (for Solana).

.

4. Build a User-Friendly Interface

Think MetaMask meets Robinhood:

- Responsive design

- Token listings

- Trade charts

- Wallet integration (e.g., WalletConnect, MetaMask)

UX is what makes or breaks a crypto app. Don’t skimp.

Learn More :-Business Models That Power Decentralized Crypto Exchanges (DEXs)

5. Integrate Wallets & Web3 Providers

Your app should connect easily to major wallets using Web3 libraries like:

- Web3.js

- Ethers.js

- WalletConnect

6. Implement Liquidity Pools

Without liquidity, your DEX is a ghost town. Offer incentives:

- Token rewards

- Fee sharing

Optional: Launch your own governance token.

7. Ensure Security & Audit Smart Contracts

This isn’t optional. Bugs in smart contracts can cost millions. Partner with firms like:

- CertiK

- Hacken

- OpenZeppelin

8. Test Thoroughly (Then Test Again)

Use testnets like Rinkeby, Mumbai, or Fuji. Conduct:

- Unit testing

- Integration testing

- Bug bounty programs

9. Launch & Promote

Have a strong go-to-market (GTM) plan:

- Airdrops

- Influencer partnerships

- Twitter and Telegram community

And yes, SEO blog content (like this!) helps too.

Monetization Strategies for Your DEX

- Transaction fees (0.3% is standard)

- Premium listings for tokens

- Staking options with yield

- Governance token value appreciation

| Monetization Strategy | Estimated ROI Range (%) | Notes |

|---|---|---|

| In-App Purchases (IAP) | 150–300% | High ROI in gaming & utilities |

| Subscriptions | 200–400% | Best for SaaS, streaming |

| Ads (Banner/Interstitial) | 50–150% | Scales with traffic volume |

| Affiliate Marketing | 100–250% | Great for content-heavy apps |

| Freemium Model | 120–280% | High conversion potential |

| One-Time Purchase | 80–160% | Useful for niche tools/games |

Challenges to Expect (And Outsmart)

- Liquidity acquisition – Kickstart with a liquidity mining campaign.

- Regulatory pressure – Stay updated, partner with DeFi legal experts.

- User onboarding – Educate users with interactive tutorials and tooltips.

Read More :-Proven Revenue Models for Your Decentralized Crypto Exchange

Conclusion:

Building a decentralized exchange app isn’t a weekend project—it’s a moonshot mission. But if you play your smart contracts right, the rewards are astronomical. DEXs aren’t just a trend; they’re shaping the new financial frontier.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

What is a decentralized crypto exchange?

A decentralized exchange (DEX) lets users trade crypto directly from their wallets using smart contracts—no middlemen required.

How much does it cost to build a DEX?

It can range from $50,000 to $500,000 depending on features, blockchain choice, and security.

Is a DEX legal?

It depends on your jurisdiction. Many operate in gray zones—always consult with a DeFi legal expert.

Can I make money from a DEX?

Yes! Through transaction fees, staking, token value, and premium listings.

How long does it take to build a DEX?

Usually between 3–6 months, including testing and audits.

Do I need to code to launch a DEX?

Not necessarily. You can partner with dev firms like Miracuves who handle everything.