Neobank Clone Business Model: How Digital Banks Make Money

Create a powerful, customizable streaming solution with Miracuves’ Neobank Clone, equipped with high-performance features and next-gen technology.

At first glance, neobanks seem like they’re offering everything for free — no branch overhead, no account fees, and sleek mobile apps. So how do they make money?

The answer lies in a smart, layered approach to monetization. If you’re building a neobank clone, understanding how digital banks generate revenue is essential to choosing the right business model — one that keeps your product both valuable to users and financially sustainable.

In this article, we’ll break down the most effective neobank clone business models, explore real-world revenue streams, and help you align your monetization plan with long-term growth.

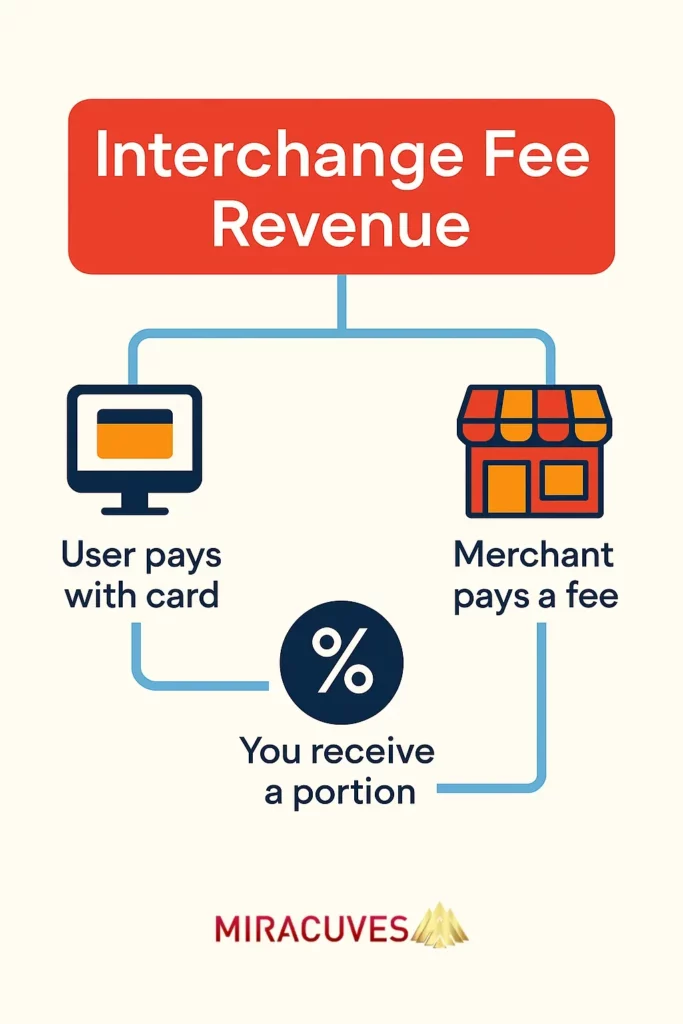

Interchange Fees on Card Payments

One of the most common and reliable revenue streams for neobanks comes from interchange fees — a small percentage earned every time a user makes a purchase with their debit or prepaid card.

How it works:

When a user pays with their card, the merchant pays a fee.

A portion of that fee (typically 0.1% to 1%) is passed on to the neobank.

It scales with your user base and transaction volume — the more people spend, the more you earn.

💡 Many successful neobanks (like Chime and Monzo) rely heavily on this stream in the early stages, making it a powerful, passive income driver.

Premium Subscription Plans

While basic banking services might be free, many neobanks offer paid subscription tiers that unlock advanced features, perks, or enhanced limits.

What you can include in a premium plan:

Higher withdrawal or spending limits

Virtual card vaults for privacy

Priority customer support

Travel insurance and global ATM access

Crypto integration or investment tools

Smart budgeting and savings automation

Plans can be priced monthly or yearly, giving your business predictable, recurring revenue — a favorite model for investors and product-led teams alike.

Lending and Credit-Based Products

Neobanks are increasingly tapping into credit offerings to generate higher-margin revenue. This includes:

Personal loans or microloans

Buy Now, Pay Later (BNPL) solutions

Overdraft services

Salary advances or early wage access

These services generate income through interest rates, late fees, or flat service charges. They’re also powerful for increasing daily app engagement and customer retention.

💡 Many successful digital banks like Revolut and Nubank have scaled quickly through lending products — but they also come with higher compliance responsibilities.

Partner Offers and Affiliate Revenue

Neobanks often become platforms, not just apps — which opens up opportunities to earn from third-party partnerships.

Here’s how it works:

Recommend services like insurance, investment platforms, tax tools, or travel deals

Integrate with fintech partners and take a commission per user or per transaction

Use APIs to connect value-added services directly in your app

This model adds user value without heavy development — and creates non-intrusive revenue through everyday actions.

Float Revenue and Asset Management

When users deposit money into their neobank account, that money doesn’t just sit idle. Many digital banks use these user-held funds to generate additional revenue.

Common methods include:

Float revenue → Earning interest on user deposits while they’re held

Partnering with licensed institutions → That reinvest pooled funds under regulatory compliance

Offering high-yield savings accounts → Attracts users while allowing margin-based interest revenue

This strategy requires careful management and regulatory oversight — but it becomes increasingly profitable as your customer base grows.

Choose the Right Development Partner

Even with a clear roadmap, launching a digital banking platform is a big move — and choosing the right team can make all the difference. A skilled development partner isn’t just a vendor; they’re your long-term ally in building a secure, scalable, and user-friendly neobank app.

When you’re evaluating the best neobank clone development company, here’s what to look for:

Proven experience in fintech and banking app development

A strong track record of successful neobank or wallet-based apps

Comprehensive services — from planning to compliance and post-launch upgrades

At Miracuves, we don’t just build apps — we craft solutions built for performance, security, and growth. Whether you’re targeting Gen Z users or underserved markets, we help you launch faster and smarter with tailored neobank clone solutions.

Let the development be our responsibility, so you can stay focused on scaling your digital banking business.

Conclusion

A smart neobank clone business model doesn’t rely on just one income stream — it blends multiple strategies like interchange fees, subscriptions, lending, and partnerships to create sustainable revenue.

The key is to balance user experience with monetization — giving users value they’re willing to pay for while keeping essential services friction-free.

Ready to plan your neobank’s revenue strategy? Don’t miss our other guides on cost to build, key features, and marketing strategies to scale your product the right way.

Frequently Asked Questions

Neobanks earn through interchange fees, premium subscriptions, lending products, and affiliate partnerships, even if they offer free accounts to users.

For early-stage neobanks, interchange fees and premium plans are the most common and scalable revenue models with low regulatory overhead.

Yes — many neobanks rely on subscription tiers, referral partnerships, and spending-based rewards without diving into credit products.

Lending brings both opportunity and risk. It requires strong compliance, credit checks, and risk modeling, but it also offers higher-margin returns.

Absolutely. The most successful neobanks blend free + paid tiers, offer value-added services, and partner with fintechs to create layered revenue streams.