Neobank Development Cost in 2025: Complete Cost Guide & Breakdown

Create a powerful, customizable streaming solution with Miracuves’ Neobank Clone, equipped with high-performance features and next-gen technology.

Looking to launch a digital bank? Before you dive into features or regulatory licenses, there’s one thing every fintech startup needs to ask:

What’s the cost to develop a neobank?

Whether you’re a bank modernizing your digital channels or a fintech startup building from scratch, understanding the total neobank development cost is crucial to budgeting, planning, and scaling.

In this guide, we’ll break down the real cost components, hidden expenses, region-based differences, and ways to optimize your build without compromising security or compliance.

Key Factors That Influence Development Cost

There’s no one-size-fits-all pricing for neobank app development. Your total cost depends on how ambitious your app is and how you build it.

Here are the biggest cost drivers:

App complexity → A basic MVP with limited features costs far less than a fully loaded app with advanced analytics, crypto support, and multi-currency capabilities.

Compliance scope → If you’re operating in a highly regulated market or aiming for your own license, legal and compliance costs go up significantly.

Number of platforms → Building for iOS, Android, and Web from the start increases development hours and testing efforts.

Customization level → White-label neobank clones are cheaper than building from scratch, but less flexible.

Development team location → Costs vary widely between teams in the U.S., Europe, and Asia — especially India or Eastern Europe.

Third-party integrations → Payment gateways, KYC vendors, fraud detection APIs, and BaaS platforms all come with setup and subscription costs.

Knowing where you stand on each of these factors helps estimate your budget more accurately.

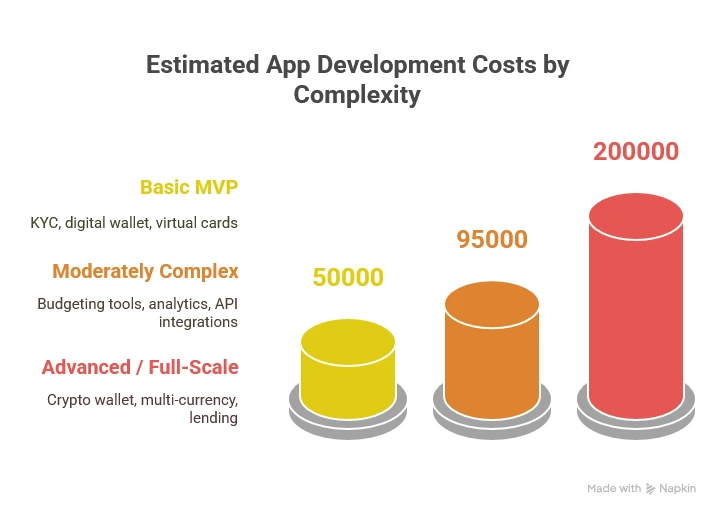

Neobank Development Cost by App Complexity

|

Type

|

Features

|

Estimated Cost (USD)

|

|---|---|---|

|

MVP (Minimum Viable Product)

|

Basic onboarding, KYC, balance check, transfers

|

$40,000 – $70,000

|

|

Mid-level App

|

Budget tracking, spending analytics, card issuance, notifications

|

$70,000 – $150,000

|

|

Full-Scale Neobank

|

Crypto support, lending, multicurrency, advanced analytics, admin dashboard

|

$150,000 – $300,000+

|

Note: These are development-only costs. Licensing, marketing, and infrastructure are separate.

Want a modular approach? Miracuves helps you scale your neobank platform as you grow — from MVP to enterprise-ready.

📌 Want to understand the full feature list? Check out our article on Neobank Clone Features.

Neobank App Development Cost by Region

Where you hire your development team can significantly affect the total cost. Here’s a general comparison based on average hourly rates and total project estimates:

|

Region

|

Avg Hourly Rate

|

MVP Cost

|

Full App Cost

|

|---|---|---|---|

|

USA/Canada

|

$100 – $180

|

$100K+

|

$250K – $500K

|

|

Western Europe

|

$80 – $130

|

$80K+

|

$200K – $400K

|

|

Eastern Europe

|

$40 – $70

|

$45K+

|

$120K – $250K

|

|

India / Asia

|

$25 – $50

|

$30K+

|

$90K – $200K

|

Offshore development (India, Eastern Europe) provides cost-efficiency without compromising quality when you partner with the right fintech-focused team.

Hidden Costs You Should Plan For

Beyond design and development, there are other expenses that often get overlooked — but they’re essential for a successful launch and operation.

Here’s what to account for:

Regulatory and legal fees → Especially if you’re handling your own licensing or operating in multiple countries

Third-party service fees → KYC/AML providers, payment processors, SMS/email gateways, fraud detection tools

Cloud hosting and infrastructure → Ongoing AWS, Google Cloud, or Azure costs scale with usage

Security audits and certifications → PCI DSS compliance, penetration testing, and data privacy safeguards

Maintenance and updates → Bug fixes, feature improvements, compliance changes post-launch

Marketing and user acquisition → Pre-launch campaigns, influencer outreach, ads, PR

Factoring these in gives you a more accurate budget and avoids roadblocks later in your launch journey.

How to Reduce Neobank Development Costs (Without Compromising Quality)

While building a neobank app requires serious investment, there are smart ways to optimize your budget without sacrificing performance or compliance.

Here’s how:

Start with an MVP → Focus on essential features, launch fast, and gather user feedback before scaling.

Choose the right development partner → Work with a team that has fintech experience and offers end-to-end services.

Use open-source or white-label solutions → They reduce time-to-market and initial development costs.

Leverage BaaS platforms → Banking-as-a-Service providers handle backend infrastructure and compliance, cutting dev time.

Plan for long-term scaling → Build a modular architecture so you can add features without rebuilding the core app.

A thoughtful, phased approach allows you to launch with confidence and grow sustainably.

Choose the Right Development Partner

Even with a clear roadmap, launching a digital banking platform is a big move — and choosing the right team can make all the difference. A skilled development partner isn’t just a vendor; they’re your long-term ally in building a secure, scalable, and user-friendly neobank app.

When you’re evaluating the best neobank clone development company, here’s what to look for:

Proven experience in fintech and banking app development

A strong track record of successful neobank or wallet-based apps

Comprehensive services — from planning to compliance and post-launch upgrades

At Miracuves, we don’t just build apps — we craft solutions built for performance, security, and growth. Whether you’re targeting Gen Z users or underserved markets, we help you launch faster and smarter with tailored neobank clone solutions.

Let the development be our responsibility, so you can stay focused on scaling your digital banking business.

Conclusion

The cost to develop a neobank app in 2025 depends on your goals, features, region, and how you build. From $40,000 MVPs to $300,000+ platforms, the range is wide — but with the right approach, you can launch a powerful neobank without burning through your capital.

Ready to explore your neobank app vision?

Talk to Miracuves today for a tailored cost estimate and development roadmap.

For deeper insights into building, business models, or how to market your neobank, explore the rest of our clone app series.

Frequently Asked Questions

On average, it ranges from $40,000 to $250,000+, depending on the app’s features, complexity, and the development team’s location.

Yes — with essential features like onboarding, digital wallets, and basic transfers, a functional MVP can be built for $40,000 to $60,000.

Hourly rates for developers vary by region. Teams in the U.S. or Western Europe charge significantly more than equally skilled teams in India or Eastern Europe.

Regulatory fees, cloud hosting, third-party integrations (like KYC or payments), ongoing maintenance, and marketing expenses should all be included in your budget.

Yes — white-label platforms significantly reduce both time and cost but may offer limited customization compared to a custom-built neobank.