How Much Does It Cost to Build a Revolut-style Fintech App

Create a powerful, customizable fintech solution with Miracuves’ Revolut, equipped with high-performance features and next-gen technology.

If you’re considering launching a dynamic fintech platform with a comprehensive suite of services like Revolut, one of the first questions you’ll ask is: “What’s the development cost?”

The answer isn’t straightforward—your total cost depends on various factors, including the app’s feature set, platform scope, timeline, tech stack, and whether you’re building from the ground up or customizing a prebuilt solution.

In this guide, we’ll explore the key cost drivers behind building a financial services app similar to Revolut, compare different app types from MVP to feature-rich solutions, and provide you with actionable insights to help you make informed budgeting decisions—whether you’re an entrepreneur, startup, or fintech-focused SaaS company.

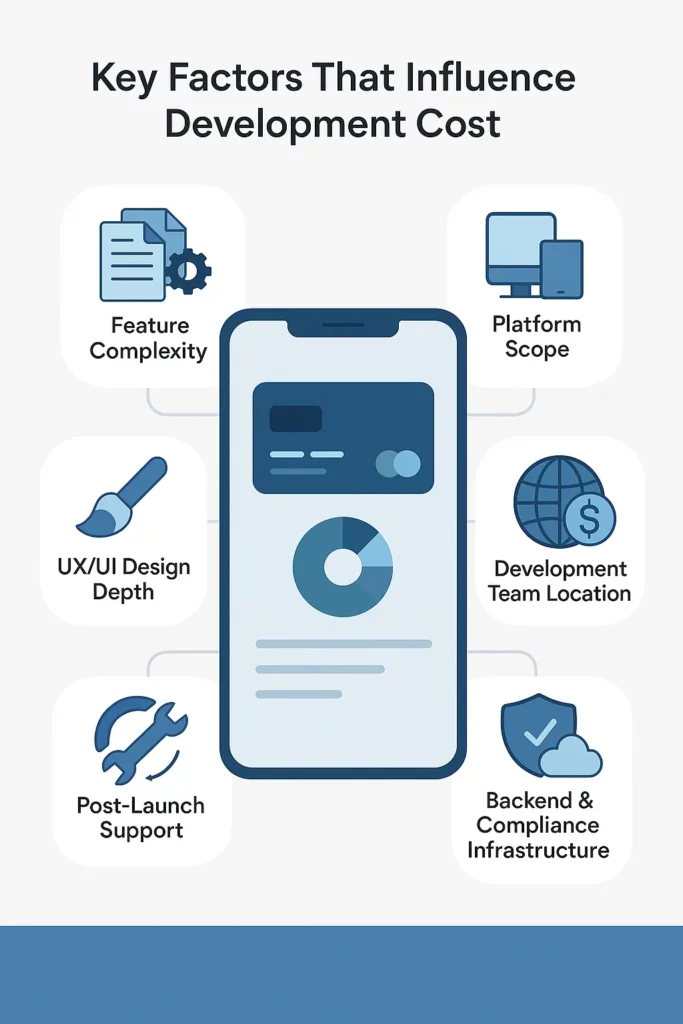

Factors Influencing Development Cost for a Revolut-style App

Building a fintech platform like Revolut involves more than just designing a simple app. Several factors impact the overall cost of development. From the complexity of the features you want to include to the tech stack and region of your development team, each decision plays a crucial role in determining the final price tag.

Here’s a breakdown of the main cost drivers when developing an app like Revolut:

1. Feature Complexity

The range and complexity of features are one of the largest contributors to the overall cost. A basic fintech app may include features like account management, payments, and basic reporting. But as you add more advanced functionalities—such as cryptocurrency trading, multi-currency wallets, investment options, fraud detection, and AI-driven insights—the development cost rises significantly.

2. Number of Platforms

Do you want your app available on Android, iOS, or both? Will you need a web portal for users or an admin dashboard for backend management? Developing for multiple platforms requires additional development and testing efforts. Opting for cross-platform frameworks like React Native or Flutter can reduce the cost by allowing you to use the same codebase for multiple platforms.

3. UI/UX Design Complexity

The user interface (UI) and user experience (UX) design are critical in financial apps, where trust and usability are paramount. A simple, template-based design will be cheaper, while a fully customized design—complete with animations, smooth transitions, and a branded experience—will increase costs. Additionally, designing for financial services often requires a higher level of detail to ensure user trust and ease of navigation.

4. Development Team Location

The location of your development team heavily influences hourly rates. Costs can vary widely depending on where your developers are based:

North America: $100–$200/hr

Western Europe: $80–$150/hr

Eastern Europe: $40–$80/hr

India & Southeast Asia: $20–$50/hr

5. Backend Infrastructure

Fintech apps require a strong, secure backend infrastructure to handle transactions, data security, and scalability. Integrating services like secure APIs, encrypted databases, cloud hosting (AWS, Azure, etc.), and payment gateways can increase backend costs. The more robust and scalable the infrastructure, the higher the development cost.

6. Post-Launch Support & Maintenance

Development doesn’t stop once the app is launched. Ongoing maintenance—such as bug fixes, updates, server management, and feature improvements—should be part of your budget. A good rule of thumb is to allocate 10-20% of the initial development cost annually for maintenance.

Estimated Cost by App Type: Revolut-style App Development

Understanding the potential costs associated with developing a fintech platform similar to Revolut can help you plan your budget more effectively. Depending on how comprehensive your app is, the costs can vary significantly—from a lean MVP (Minimum Viable Product) that helps validate your idea, to a fully-featured, scalable platform ready for expansion.

Here’s a breakdown of the estimated development costs based on the type of app you’re looking to build:

|

App Type

|

Estimated Cost Range (USD)

|

Description

|

|---|---|---|

|

MVP (Minimum Viable Product)

|

$15,000 – $30,000

|

Essential features: onboarding, user accounts, peer-to-peer transfers, virtual card

|

|

Standard Version

|

$30,000 – $60,000

|

Adds currency exchange, savings vaults, card controls, KYC/AML, analytics dashboard

|

|

Full-Featured App

|

$60,000 – $100,000+

|

Includes crypto, stock trading, budgeting tools, AI insights, premium design & UX

|

Region-Wise Development Cost Comparison

The region where you choose to build your Revolut-style app can significantly affect the overall cost. Developer rates vary widely across different parts of the world, and this can have a substantial impact on your budget. While higher hourly rates often correlate with more expensive markets, quality doesn’t always scale with price.

Here’s a breakdown of how development costs differ by region:

|

Region

|

Hourly Rate (USD)

|

Typical Cost for Standard App

|

|---|---|---|

|

North America

|

$100 – $200/hr

|

$100,000 – $200,000+

|

|

Western Europe

|

$80 – $150/hr

|

$80,000 – $160,000+

|

|

Eastern Europe

|

$40 – $80/hr

|

$40,000 – $90,000+

|

|

India & Southeast Asia

|

$20 – $50/hr

|

$20,000 – $60,000+

|

Why many startups choose offshore teams (especially in Asia or Eastern Europe):

Access to fintech-skilled talent at lower rates

No compromise on code quality or compliance

Faster development cycles due to round-the-clock progress

Partnering with the right offshore development company can help you stretch your budget while accelerating time-to-market — ideal for bootstrapped or seed-stage fintech startups.

Cost Breakdown by Development Stage

To give you a clearer picture of how the costs are distributed throughout the development process, here’s a breakdown of the typical stages involved in creating a Revolut-style app. Understanding where your budget is allocated helps prevent unexpected costs and allows you to plan for each phase of development.

|

Development Stage

|

Estimated % of Total Cost

|

Includes

|

|---|---|---|

|

Discovery & Planning

|

5–10%

|

Market research, competitor analysis, defining user personas, feature scoping, technical requirements.

|

|

UI/UX Design

|

10–15%

|

Wireframing, prototyping, responsive design, visual branding, user experience mapping.

|

|

Frontend & Backend Dev

|

40–50%

|

Core feature development, database architecture, APIs, payment integrations, dashboard and logic build.

|

|

Testing & QA

|

10–15%

|

Manual and automated testing, bug fixing, device/browser compatibility checks, performance tuning.

|

|

Deployment & Launch

|

5–10%

|

App store submission (Android/iOS), server setup, production deployment, performance monitoring tools.

|

|

Maintenance & Updates

|

10–20%

|

Post-launch bug fixes, new features, server maintenance, user support, compliance updates.

|

Tips to Reduce Development Costs Without Compromising Quality

Building a feature-rich fintech app like Revolut doesn’t necessarily require a six-figure budget. There are several strategic ways to reduce development costs while still ensuring that your platform is reliable, secure, and scalable. Here are some proven, cost-effective methods that can help you launch your app without breaking the bank:

1. Start with an MVP (Minimum Viable Product)

Instead of launching with a full set of features, focus on developing a lean version of the app that includes only the core functionalities, such as user account management, payments, and transaction history. This approach helps you test your concept in the market and gather valuable feedback before investing in additional features. It also allows you to refine your product based on real user needs, saving you from unnecessary costs later on.

2. Partner with Offshore Development Teams

The location of your development team can have a massive impact on your costs. Working with offshore teams, particularly in regions like India and Southeast Asia, can reduce your hourly rate by up to 50% or more. Just make sure to partner with experienced teams that have a track record of delivering high-quality fintech solutions. An experienced offshore team can deliver the same level of performance as a more expensive local team, while helping you save significantly on development costs.

3. Leverage Open-Source & Prebuilt Tools

Rather than reinventing the wheel, take advantage of open-source libraries, frameworks, and APIs that are already available for financial apps. For example, you can use open-source tools for payment integrations, fraud detection, or currency conversion. This not only saves development time but also reduces the cost of building these features from scratch. Additionally, these tools are often well-tested and supported, ensuring that you don’t compromise on security or reliability.

4. Focus on High-Impact Features First

It’s tempting to add all the bells and whistles to your app from the start, but a better strategy is to prioritize features that will directly impact user acquisition, retention, and satisfaction. For example, start with essential features like secure payments, instant balance updates, and easy-to-use user interfaces. As you gain traction and feedback from your users, you can gradually roll out additional features such as investment options, AI-driven insights, or premium services.

5. Plan and Define Everything Before You Begin

Proper planning is key to staying within budget. Miscommunication and scope creep (when the project scope gradually expands) are the top reasons for cost overruns. Be sure to define your project scope clearly, create detailed wireframes and user flows, and set expectations upfront. This helps prevent costly mid-project changes and ensures that all stakeholders are aligned on goals and deliverables.

Choose the Right Development Partner

Building a fintech app like Revolut is not just a technical project—it’s a strategic business decision. The success of your app depends not only on the technology you use but also on the expertise of your development partner. Choosing the right team can significantly impact your project’s timeline, scalability, and overall success. Here are key factors to consider when selecting the right development partner for your Revolut-style platform:

1. Expertise in Fintech Solutions

Not all app development teams are equipped to handle the specific challenges of a fintech platform. You need a partner who has experience building financial applications, particularly those that deal with complex systems like payments, security, and data management.

2. Modular and Scalable Architecture

Your first version might be simple, but as your app grows and scales, you’ll need a flexible and scalable architecture that can handle an increasing number of users, transactions, and features.

3. Proven Track Record in Delivery

Time is critical in the fintech space, and delays can cost you valuable market share. A reliable partner should have a proven track record of delivering projects on time and within budget. Ask for case studies, testimonials, or references from past clients who have launched similar financial services platforms.

4. End-to-End Support

Building an app is just the beginning. After launch, you’ll need ongoing support to ensure your app remains secure, functional, and up-to-date. Choose a development partner that offers end-to-end services, including post-launch support, bug fixes, performance monitoring, and scaling as your user base grows.

Conclusion

Building a fintech platform like Revolut is an exciting but challenging endeavor. The development cost will vary depending on several factors, including the complexity of features, the platforms you choose, and the development region. However, by making smart, strategic decisions—from starting with an MVP to partnering with the right development team—you can significantly reduce costs while still launching a reliable, scalable platform.

By starting lean, focusing on essential features, and ensuring that your development process is planned and efficient, you can set your Revolut-style app up for long-term success without blowing your budget.

At Miracuves, we help fintech founders bring their ideas to life with cost-effective, scalable, and secure solutions. From your first concept to post-launch support, we’re here to help you create a platform that stands out in the competitive financial services landscape.

Ready to explore your options? Check out our Revolut-style App Development page or contact our team for a personalized cost estimate.

Frequently Asked Questions

The cost of developing an app similar to Revolut depends on various factors, such as the number of features, the platforms you want to support, and the region where your development team is located. Generally, an MVP version of the app can range from $15,000 to $30,000, while a full-featured, scalable version can cost anywhere from $60,000 to $100,000+.

The development timeline can vary depending on the complexity of the app and the team’s experience. A minimum viable product (MVP) could take 2 to 4 months to develop, while a more feature-rich, fully functional app could take 6 to 12 months or more.

At the core, your app should have features like user registration, secure payments, balance management, transaction history, and basic security. As you scale, you may want to include additional features like multi-currency support, cryptocurrency trading, financial analytics, AI-based insights, and real-time fraud detection.

If you’re looking for a faster, more cost-effective way to launch, customizing a prebuilt solution (white-label app) can be a great option. This allows you to leverage existing technology, saving both time and money. However, if you have specific needs or want to create a highly customized user experience, building from scratch may be the better choice.

An MVP (Minimum Viable Product) includes only the essential features necessary to test the core concept of your app. It’s a great way to validate demand and gather user feedback with minimal investment. A full-featured app includes additional functionalities, advanced security, and scalability options for a more robust platform.