Starting a business in tax preparation and filing has never been more promising. With complex tax regulations, an increasing number of freelancers, small business owners, and individuals seek professional help to navigate their taxes effectively. This demand is set to grow as tax laws evolve and digital platforms make tax filing services more accessible. As a result, the tax preparation industry is flourishing, offering plenty of opportunities for aspiring entrepreneurs to establish their own tax services businesses.

Whether you’re an experienced accountant or a newcomer with a knack for numbers, launching a tax preparation startup allows you to tap into a steady, in-demand field. The following sections will guide you through the top 10 innovative business ideas in tax preparation, each suited to various customer needs and investment levels. These ideas provide insight into market trends, potential profits, and the unique demands of this industry, making it easier for you to find the best fit for your skills and goals.

| Metric | Value | Description |

|---|---|---|

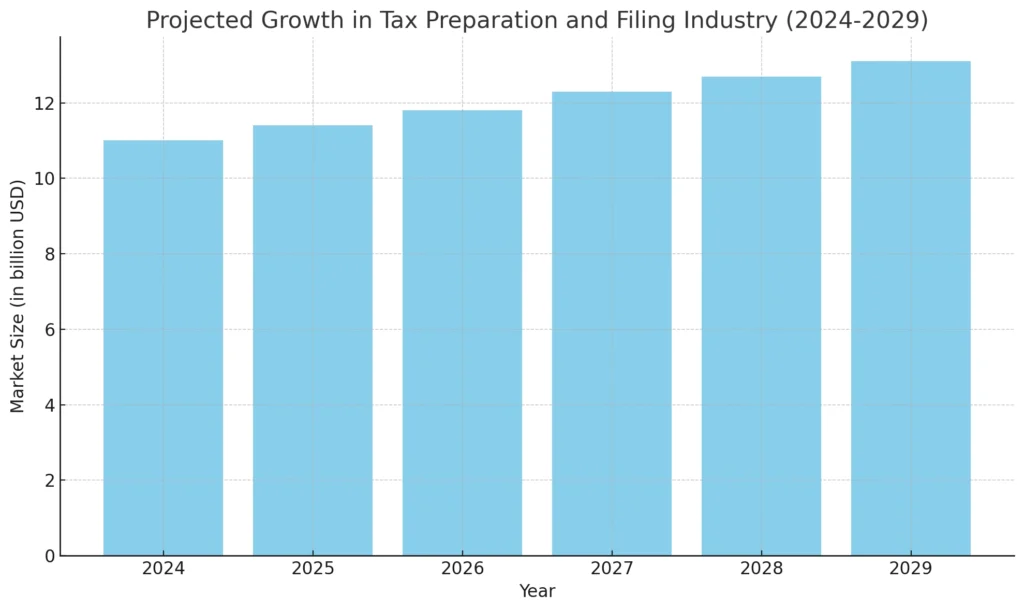

| Current Market Size | $11 billion | Estimated market size of the tax preparation industry in 2024. |

| Annual Growth Rate | 3.5% | Average yearly growth rate projected for the next five years. |

| Projected Market Value (2029) | $13.1 billion | Expected market size by 2029, showing steady industry expansion. |

| Key Trends | Digital tax solutions, AI tools | Rising demand for digital platforms and AI-driven tax services. |

| Customer Segments | Freelancers, SMBs, Individuals | Growing market of diverse clients needing tax assistance. |

Why Choose the Tax Preparation and Filing Industry?

The tax preparation and filing industry is one of the few sectors that promises consistent demand, no matter the economic climate. Tax services are essential, as both individuals and businesses require accurate and compliant tax filings every year. With a growing focus on financial transparency and the increasing complexity of tax laws, many people and companies now prefer professional help over do-it-yourself options.

Additionally, the industry is expanding in new ways, thanks to advancements in digital technology. Automated filing systems, AI-powered tax assistance, and secure online portals make tax preparation faster and more efficient, creating a wider customer base than ever before. Tax services now range from simple individual filings to full-service business tax solutions, allowing new entrepreneurs to choose a niche that fits their expertise and target audience.

The flexibility in scaling a tax business—whether starting as a sole proprietor or building a small firm—makes it a low-risk, high-reward venture. And with new business models like virtual consultations and mobile tax filing services, entrepreneurs can operate with minimal overhead. In short, the tax preparation industry combines stable demand with modern flexibility, creating a landscape ripe with opportunity for those ready to get started.

Read more: – Top 10 Ideas for Financial Planning and Tax Preparation Business Startups

Current Trends and Future Opportunities in Tax Preparation

| Trend/Technology | Description | Impact on Industry | Client Demand Level |

|---|---|---|---|

| AI-Powered Tax Solutions | Automation for error checking and advice | Increases accuracy, reduces prep time | High |

| Virtual Tax Services | Remote consultations and filing | Expands reach, reduces need for physical office | Very High |

| Data Security Enhancements | Encrypted, secure platforms for clients | Builds client trust and protects sensitive data | High |

| Niche-Specific Tax Services | Tailored services for specialized clients (e.g., freelancers) | Attracts niche clients with unique tax needs | Moderate to High |

| Mobile Filing Options | Mobile-friendly tax apps | Offers convenience, appeals to younger clients | Increasing |

The tax preparation industry is undergoing a digital revolution, with new trends shaping how professionals interact with clients and manage tax data. One of the most impactful trends is the rise of automated tax solutions, which use artificial intelligence to streamline the filing process, minimizing human error and reducing preparation time. AI-driven tax platforms can now provide instant error checks, adaptive advice, and personalized tax-saving tips, making tax services more efficient and accessible for clients.

Another significant trend is the growth of virtual tax services, which allow professionals to consult with clients online rather than face-to-face. This model appeals to clients who value convenience and is especially popular among younger, tech-savvy customers. In the future, the demand for remote tax preparation is expected to keep growing, enabling tax businesses to serve a broader geographic range without needing a physical office space.

Data security has also become a priority as clients are increasingly aware of privacy issues. Tax firms are investing in encrypted digital platforms to protect sensitive financial information, a feature that is becoming a competitive advantage. For entrepreneurs, offering secure, remote-access solutions can attract clients looking for both convenience and security.

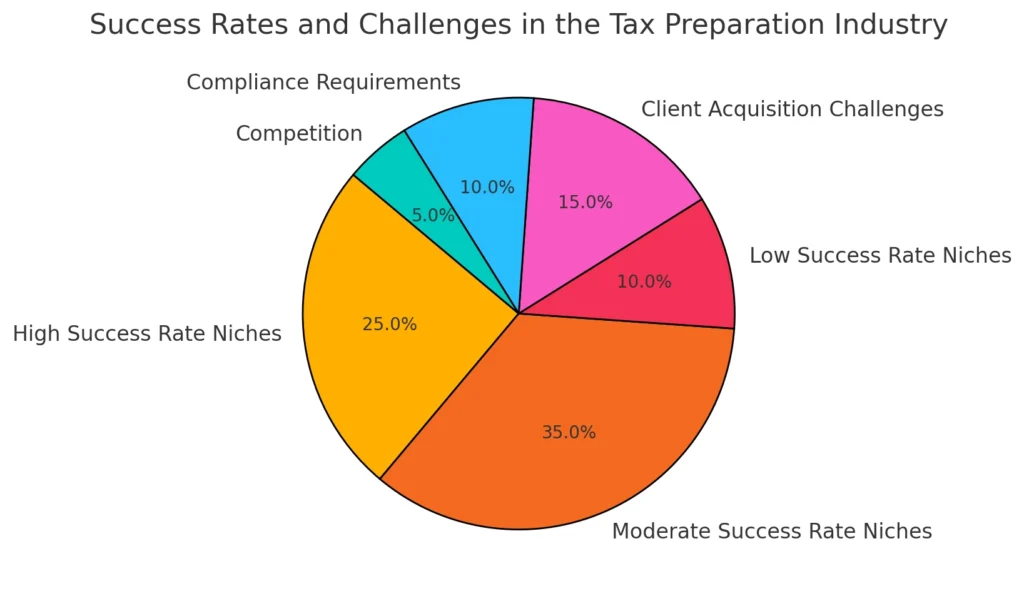

In terms of opportunities, the industry is seeing a surge in niche services. Specialized tax preparation for freelancers, small businesses, and real estate investors are in high demand, as these groups often have unique tax requirements. Entrepreneurs who can identify and cater to such niches can carve out profitable segments in the market, creating targeted, high-value services.

AI-powered tax platforms can now provide instant error checks, adaptive advice, and personalized tax-saving tips, making tax services more efficient and accessible for clients.

Read more: –Top 10 Ideas for Insurance Advisory Business Startups in 2025

Top 10 Ideas for Tax Preparation and Filing Business Startups

The tax preparation industry offers a wide range of business opportunities, from traditional services to niche offerings and digital solutions. Here are the top 10 startup ideas to consider:

| Business Idea | Estimated Startup Cost | Target Market | Profit Potential |

|---|---|---|---|

| Virtual Tax Consulting | Low ($500 – $2,000) | Individuals, remote clients | Moderate to High |

| Tax Prep for Freelancers | Low ($1,000 – $3,000) | Freelancers, gig workers | Moderate |

| Small Business Tax Advisory | Medium ($3,000 – $8,000) | Small business owners | High |

| Mobile Tax Filing Services | High ($10,000 – $20,000) | Tech-savvy individuals | High |

| Real Estate Tax Prep | Medium ($3,000 – $8,000) | Property owners, investors | High |

| Tax Filing for Seniors | Low ($500 – $2,000) | Senior citizens | Moderate |

| Corporate Tax Compliance | High ($10,000 – $25,000) | Corporations | Very High |

| Audit Preparation Support | Medium ($2,000 – $7,000) | Individuals, small businesses | Moderate to High |

| Tax Prep for Nonprofits | Medium ($2,000 – $5,000) | Nonprofits | Moderate |

| AI-Powered Tax Assistance | Very High ($15,000 – $30,000) | Tech users, broad audience | Very High |

1. Virtual Tax Consulting

Provide remote tax advice and filing assistance, meeting the demand for convenient, online services.

- Target Market: Remote workers, busy professionals

- Estimated Costs: Low to moderate (video conferencing tools, tax software)

- Startup Requirements: Tax software, video conferencing setup, knowledge of virtual consulting platforms

2. Tax Preparation for Freelancers and Gig Workers

Specialize in tax preparation for freelancers with complex income streams, tapping into the growing gig economy.

- Target Market: Freelancers, gig workers

- Estimated Costs: Low (tax software, freelance-specific knowledge)

- Startup Requirements: Tax software, understanding of gig economy tax rules, outreach to freelance communities

3. Small Business Tax Advisory

Offer year-round tax advisory services to help small businesses manage cash flow and deductions.

- Target Market: Small business owners

- Estimated Costs: Moderate (consulting tools, tax software)

- Startup Requirements: Business tax expertise, tax software, strong client relationship management

4. Mobile Tax Filing Services

Develop a mobile-friendly tax filing app, catering to clients who prefer handling taxes on their phones.

- Target Market: Tech-savvy clients, on-the-go professionals

- Estimated Costs: High (app development, mobile support)

- Startup Requirements: Mobile app developers, secure tax filing software, marketing to mobile users

5. Real Estate and Property Tax Preparation

Specialize in tax services for property owners, covering unique needs like depreciation and property deductions.

- Target Market: Real estate investors, property managers

- Estimated Costs: Moderate (real estate tax software, training)

- Startup Requirements: Real estate tax expertise, specialized software, networking with property professionals

6. Tax Filing for Seniors

Offer tax services tailored to seniors, focusing on retirement income and medical deductions, available virtually or in-home.

- Target Market: Seniors, retirees

- Estimated Costs: Low to moderate (basic tax software, mobile setup for in-home services)

- Startup Requirements: Knowledge of senior-specific deductions, patient approach, virtual and mobile setup options

7. Corporate Tax Compliance Services

Provide comprehensive tax compliance services for corporations, managing complex strategies and regulatory requirements.

- Target Market: Large businesses, corporations

- Estimated Costs: High (advanced software, team of experts)

- Startup Requirements: Corporate tax expertise, advanced tax compliance tools, strong reputation for accuracy

8. Audit Preparation and Support

Specialize in audit preparation and guidance, helping clients navigate audits with reduced risks.

- Target Market: Small businesses, individuals facing audits

- Estimated Costs: Moderate (audit preparation tools)

- Startup Requirements: Knowledge of audit procedures, audit-specific tax software, strong consulting skills

9. Tax Preparation for Nonprofits

Focus on nonprofit tax services, understanding the unique tax exemptions and rules for charitable organizations.

- Target Market: Nonprofits, social enterprises

- Estimated Costs: Low (nonprofit tax software, certification if required)

- Startup Requirements: Nonprofit tax expertise, outreach to nonprofits, specialized software for nonprofit tax filings

10. AI-Powered Tax Assistance

Develop an AI-based tax assistant that offers automated calculations, error-checking, and filing tips.

- Target Market: Tech-savvy individuals, DIY tax filers

- Estimated Costs: High (AI development, software testing)

- Startup Requirements: Tech and tax knowledge, AI development team, user-friendly platform design

Real-World Examples

The tax preparation industry offers abundant opportunities, and numerous startups have already shown how creative approaches can lead to success. One prominent example is the rise of mobile tax apps, which have simplified tax filing for busy individuals. Companies that invested in secure, easy-to-use tax apps saw a high adoption rate among younger, tech-savvy clients who value convenience. This shift highlights the importance of adapting to customer preferences and embracing technology.

Another successful approach has been niche-focused services, like tax preparation for freelancers and gig workers. With millions of people working independently, this market has become a profitable area for tax preparers who understand the complexities of self-employment income. Startups that specialized in these areas not only filled a service gap but also built strong client loyalty by offering personalized support.

However, tax preparation businesses face challenges too. Many startups entering the corporate tax compliance space discovered that building trust with large companies requires significant expertise and reputation. Although the rewards in corporate tax services are high, the entry barriers are also substantial. This case study serves as a reminder that choosing a niche should align with your skill set and industry knowledge.

These examples show how strategic choices in technology and specialization can shape a tax preparation business’s path to success. By understanding what customers need and navigating the unique challenges of each niche, you can build a business that stands out and thrives.

One prominent example is the rise of mobile tax apps, which have simplified tax filing for busy individuals.

Read more: –Top 10 Ideas for Starting a Mobile Notary Services Business

Mistakes to Avoid When Starting a Tax Preparation Business

| Common Mistake | Description | Preventive Measure |

|---|---|---|

| Ignoring Compliance Requirements | Overlooking legal and tax regulations | Stay updated on tax laws; complete necessary certifications |

| Neglecting Data Security | Failing to secure client information | Invest in encrypted platforms and educate clients on data safety |

| Undervaluing Services | Setting prices too low to attract clients | Research market rates and set competitive yet profitable prices |

| Skipping Marketing Strategy | Assuming clients will come without promotion | Develop an online presence, network locally, and use social media |

| Lack of Niche Focus | Trying to serve all clients without specialization | Identify and target specific client segments for better results |

Starting a tax preparation business offers great opportunities, but there are several pitfalls that newcomers should avoid. One of the most common mistakes is neglecting compliance with tax laws and industry regulations. The tax industry is heavily regulated, and failing to follow these standards can result in fines or even business closure. It’s essential to stay updated on tax codes and legal requirements to build credibility and trust with clients.

Another pitfall is underestimating the importance of data security. Tax professionals handle sensitive client information, and any breach of data can harm the business’s reputation and lead to legal consequences. Investing in secure, encrypted platforms and educating clients about safe data sharing practices are key steps to protecting both the business and its clients.

Many new tax preparers also make the mistake of undervaluing their services to attract clients. While competitive pricing can be beneficial, setting rates too low can affect profit margins and devalue the business. It’s essential to research market rates and price services reasonably, highlighting the unique benefits your business offers.

Lastly, skipping the marketing strategy is another mistake to avoid. Some assume that clients will find them simply because tax preparation is an essential service. However, even essential services require a solid marketing plan to reach potential clients. Establishing a clear online presence, joining local networking groups, and using social media can help new tax businesses gain visibility and credibility in their communities.

Why Trust Miracuves Solutions for Your Next Project?

Choosing the right partner for your tax preparation startup can be the key to launching a successful, efficient business. Miracuves Solutions stands out as a trusted provider with extensive experience in developing ready-made software solutions tailored to diverse industries. With a focus on delivering high-quality, cost-effective products, Miracuves Solutions has helped countless startups establish a strong digital presence with minimal hassle and investment.

One of the reasons to trust Miracuves Solutions is its commitment to understanding client needs. Miracuves goes beyond simply providing software—it collaborates closely with each business to ensure the final product aligns perfectly with the startup’s goals and audience. This level of customization helps entrepreneurs save time and resources, allowing them to focus on building their client base and delivering excellent services.

Additionally, Miracuves Solutions brings expertise in building secure, reliable platforms. With tax preparation involving sensitive client data, Miracuves prioritizes robust data security and encryption to protect client information and maintain trust. This commitment to security and compliance can give new business owners peace of mind, knowing their software is both safe and scalable.

In a competitive industry, Miracuves Solutions also helps clients stand out by offering intuitive, user-friendly software with modern features, such as AI-driven tax assistance and mobile accessibility. These tools provide a seamless experience for end users and enable startups to build credibility from the very start. When you choose Miracuves Solutions, you’re investing in a partner who’s as dedicated to your success as you are.

Conclusion

Starting a tax preparation business offers entrepreneurs a stable, rewarding path with plenty of growth potential. As more people and businesses seek reliable tax services, the demand for specialized, secure, and convenient tax preparation solutions will only increase. By exploring top business ideas—whether it’s mobile tax filing, niche-specific services, or virtual consultations—new entrants can find a profitable niche that aligns with their skills and goals.

The tax industry is evolving with trends like AI-driven assistance, virtual consultations, and enhanced data security, making it easier than ever for startups to operate efficiently and securely. With thoughtful planning and a focus on client needs, you can build a successful tax preparation business that meets the expectations of today’s clients.

Now is the perfect time to get started. Identify the idea that speaks to you, avoid common pitfalls, and take the next steps to turn your business vision into a reality. The opportunities are waiting—embrace them and make your mark in the tax preparation industry!

FAQs

What qualifications do I need to start a tax preparation business?

In most regions, tax preparers must complete a certification or licensing program. Some also choose to pursue credentials like the IRS’s Enrolled Agent (EA) status or Certified Public Accountant (CPA) for added credibility.

How much does it cost to start a tax preparation business?

Startup costs vary by business model. Basic setups, like virtual consulting, may cost as little as $500, while advanced services, like mobile tax filing, could require $10,000 or more.

Do I need specialized software for tax preparation?

Yes, using tax preparation software is essential for accuracy, compliance, and efficiency. Specialized software also helps manage client data securely, which is crucial in the tax industry.

What are the most common challenges in this business?

The biggest challenges are staying updated on tax regulations, building a client base, and ensuring data security. Marketing and customer trust are also critical for long-term success.

Can I operate a tax preparation business remotely?

Absolutely! Many tax preparation businesses operate entirely online, offering virtual consultations and digital filing options, which appeals to clients looking for convenience and accessibility.

Related Article: