In 2025, digital financial services are not just a trend—they are a mainstream movement transforming how people bank, invest, and interact with money. Two giants at the forefront of this evolution are neobanks and Binance, each representing vastly different approaches to fintech and crypto-powered finance.

For startup founders and fintech entrepreneurs, choosing between a neobank-style platform and a Binance-style crypto exchange could define your venture’s scalability, compliance exposure, and monetization potential.

This blog breaks down the business models, revenue mechanisms, cost structures, and growth trajectories of these platforms. Whether you’re eyeing the user-friendly accessibility of neobanks or the dynamic global trading network of Binance, this comprehensive comparison will help you choose the right path in 2025.

What is a Neobank?

A neobank is a fully digital bank with no physical branches. Neobank offers a wide range of financial services such as savings accounts, payments, loans, and even investment products through a mobile-first or web-only interface.

Key Highlights:

- 100% digital experience (no physical branches)

- Licensed as fintech or partnered with licensed banks

- Offers personal finance, debit cards, savings, budgeting, and micro-loans

- Built on lean, agile cloud infrastructure

Popular Examples: Revolut, Chime, N26, Monzo

What is Binance?

Binance is the world’s largest cryptocurrency exchange by trading volume. Launched in 2017, Binance offers crypto trading, derivatives, launchpads, DeFi access, NFT marketplaces, and more—all under a global, tech-heavy infrastructure.

Key Highlights:

- Supports 1,000+ cryptocurrencies

- Offers spot, margin, and futures trading

- Has its own blockchain ecosystem: BNB Chain

- Provides a wallet, staking, DeFi & yield farming tools

Binance has evolved into an all-in-one crypto ecosystem, serving users in over 100 countries.

Business Model of Neobank

Neobanks operate on a digital-first, banking-as-a-service (BaaS) model. They either have a banking license or partner with a licensed financial institution.

Revenue Streams:

- Interchange Fees: Earned from debit card transactions

- Subscription Plans: Premium tiers for added services

- Loan Interest: Personal or SME micro-loans

- FX and cross-border transfer fees

- Affiliate/partnered investment offerings (e.g., insurance, crypto wallets)

Cost Structure:

- App and backend development

- Compliance and licensing

- Customer acquisition & marketing

- Banking infrastructure and payment rails

- Fraud prevention & data security

Key Partners:

- Regulated banks (for core banking services)

- Payment processors (Visa, Mastercard, SWIFT)

- Lending partners

- Insurance & wealthtech providers

- Fintech compliance APIs (KYC/AML)

Growth Strategy:

- Hyper-localization in emerging markets

- Freemium-to-premium upsell strategy

- Gen Z targeting through budget & savings gamification

- B2B Neobank models for freelancers and SMEs

Learn More: Business Model of Neobank : Revenue, Costs, and Growth

Business Model of Binance

Binance follows a crypto exchange platform + ecosystem model with custodial control and vertically integrated services.

Revenue Streams:

- Trading Fees (spot, margin, derivatives)

- Listing Fees from crypto projects

- Withdrawal & deposit fees

- Binance Launchpad allocations and fundraising

- DeFi services & staking commissions

- NFT marketplace sales

- BNB Token utility within the ecosystem

Cost Structure:

- Trading engine development & maintenance

- Regulatory & legal compliance across multiple regions

- Server costs, blockchain nodes

- Security audits, insurance, and bug bounties

- Affiliate and marketing programs

Key Partners:

- Blockchain projects and DeFi protocols

- Liquidity providers

- Governments and regulators

- Fiat on-ramp/off-ramp payment providers

- DEX aggregators and Web3 wallets

Growth Strategy:

- Expansion of Binance Pay, P2P trading, and Binance Card

- Cross-chain support via BNB Chain

- Regulatory compliance and local licenses

- Community-led projects via Binance Labs & Launchpad

Learn More: Business Model of Binance Explained Clearly

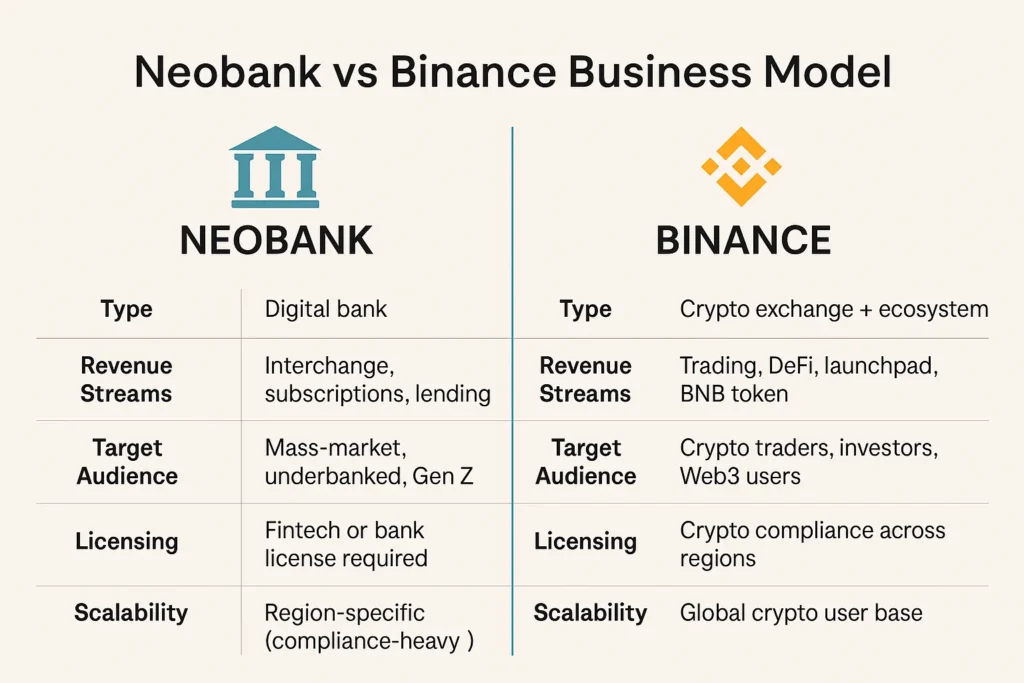

Comparison Table: Neobank vs Binance

| Feature | Neobank | Binance |

|---|---|---|

| Type | Digital bank | Crypto exchange + ecosystem |

| Custody | Fiat money (regulated banking) | Crypto assets (custodial & DeFi) |

| Revenue Streams | Interchange, subscriptions, lending | Trading, DeFi, launchpad, BNB token |

| Target Audience | Mass-market, underbanked, Gen Z | Crypto traders, investors, Web3 users |

| Licensing | Fintech or bank license required | Crypto compliance across regions |

| Trust Model | Regulated financial system | Crypto-native and custodial trust |

| Tech Stack | API, BaaS, core banking platforms | Proprietary trading engine + blockchain |

| Scalability | Region-specific (compliance-heavy) | Global crypto user base |

| Monetization Risk | Slim margins, dependency on scale | Regulatory volatility, security risks |

Pros & Cons of Neobank Model

Pros:

- Easy onboarding and UX

- Trust from fiat regulations

- Stable, recurring revenue from subscriptions

- Long-term user engagement (salary accounts, saving tools)

Cons:

- Heavy regulatory burdens

- Lower profit margins

- Complex licensing in multiple markets

- Reliant on banking partnerships

Pros & Cons of Binance Model

Pros:

- Highly profitable at scale

- Global user base with low barrier to entry

- Diverse revenue streams from trading, NFTs, DeFi, and tokens

- Own ecosystem with BNB chain and wallet integration

Cons:

- Regulatory scrutiny worldwide

- Security and custodial risks

- Crypto market volatility impacts business

- Trust concerns in centralized crypto services

Market Data: Growth, Revenue & Funding (2025)

| Metric | Neobank | Binance |

|---|---|---|

| User Base | 600M+ (across all neobanks) | 170M+ (Binance-specific) |

| Revenue Estimate (2024) | $15B+ globally | $20B+ in trading revenue |

| Valuation | $1B–$50B depending on region | Estimated $60B+ |

| Monthly Transactions | 10M+ per app | Over 100M transactions per month |

| Funding Model | VC-backed (e.g., Chime, N26) | Self-funded, token-based ecosystem |

Which Model is Better for Startups in 2025?

It depends on your target market, regulation tolerance, and tech capabilities.

- Neobank-style platforms are ideal for serving the underbanked, building savings tools, and entering regulated financial ecosystems.

- Binance-style models appeal to founders focused on crypto innovation, scaling globally, and leveraging blockchain-native revenues.

If you have strong regulatory navigation skills, go Neobank. If you’re DeFi-native with a tech-savvy dev team, Binance-style is your lane.

Choose Neobank-style if…

- You want to provide modern, secure banking for everyday users

- You’re targeting Gen Z, freelancers, or SMEs

- You want to monetize through cards, subscriptions, and microloans

Launch your digital bank with Miracuves’ Neobank Clone

Choose Binance-style if…

- You want to build a crypto ecosystem with high earning potential

- You’re targeting crypto traders and DeFi users

- You want to operate a launchpad, exchange, or staking platform

Build your exchange with Miracuves’ Binance Clone

Conclusion

Whether you’re planning to revolutionize banking with a neobank or lead crypto innovation like Binance, Miracuves delivers high-performance, secure, and feature-rich platforms tailored to your vision.

With white-label solutions, expert support, and scalable infrastructure, we help you build your fintech or crypto app faster and smarter.

FAQs

Can I combine Neobank and Binance features in one app?

Yes, many hybrid apps now offer crypto + fiat accounts, but regulatory complexity increases.

Which model is easier to get funded?

Neobanks are more VC-friendly in fintech ecosystems. Binance-style exchanges may use token sales or DAO funding.

Is a license mandatory for launching a Neobank?

Usually yes. Either you need a license or must partner with a regulated bank via a BaaS model.

What makes Binance more profitable?

High-volume trading fees, token utility, and multiple product verticals (NFTs, DeFi, launchpad).

How long does it take to launch each model?

Start immediately — with Miracuves delivering your solution in just 3–6 days with guaranteed delivery, you can begin gathering feedback, building anticipation, and refining your pitch right from day one.