Mailchimp proves how a well-designed subscription model with layered features can sustain long-term growth. Its evolution from a simple email marketing tool to a full-scale marketing automation platform shows how recurring revenue, data-driven upselling, and value-added services can compound into massive profitability.

For entrepreneurs, understanding how Mailchimp makes money is more than a financial breakdown — it’s a roadmap to building scalable SaaS businesses that retain customers and generate predictable monthly income. Whether you’re planning to develop a marketing automation tool, CRM system, or Mailchimp-style platform, this model offers key insights into how simplicity, automation, and segmentation translate into exponential revenue.

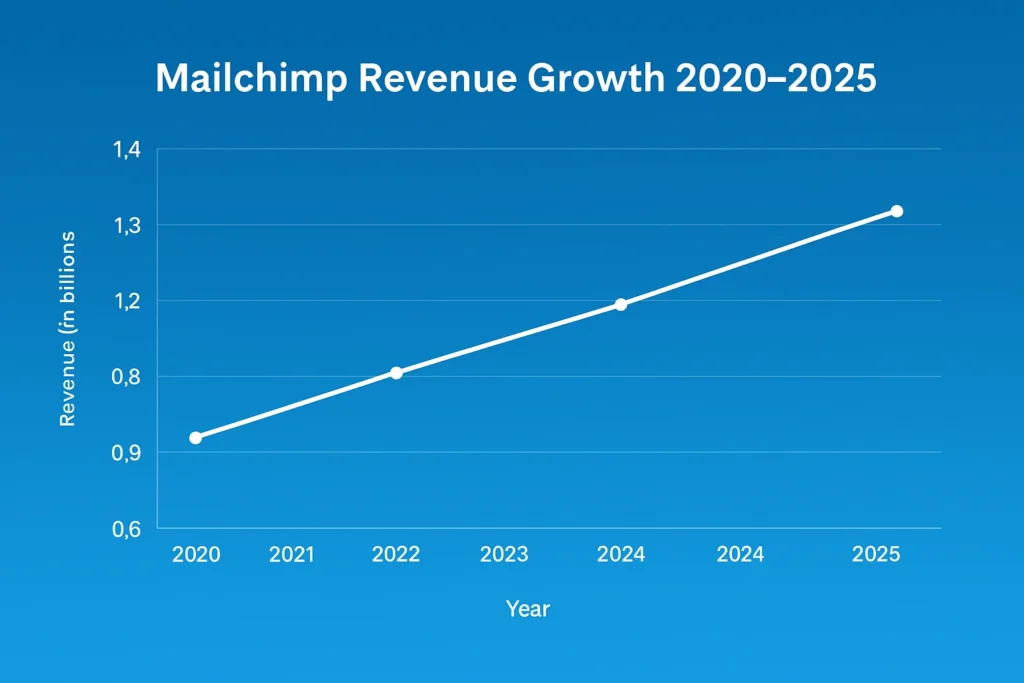

Mailchimp Revenue Overview – The Big Picture

Mailchimp crossed $1.35 billion in annual revenue, proving that email automation remains one of the most profitable SaaS categories in 2025.

Mailchimp enters 2025 as a dominant marketing automation platform with a valuation stabilized under Intuit. Its subscription-first model continues to generate predictable annual recurring revenue (ARR) with strong retention.

Key 2025 Revenue Figures

• Annual Revenue: ~$1.35B

• YoY Growth: ~5 percent

• Free Cash Flow Margin: 22 percent

• ARR Expansion: Driven by mid-tier and enterprise upgrades

Revenue by Region

• North America: 61 percent

• Europe: 23 percent

• APAC: 10 percent

• LATAM + Others: 6 percent

Market Position vs Competitors

Mailchimp competes with HubSpot, Sendinblue, Klaviyo, ActiveCampaign, and ConvertKit. While HubSpot dominates enterprise, Mailchimp leads in SMB email automation worldwide.

Read More: Everything You Need to Know About the Mailchimp App

Primary Revenue Streams Deep Dive

Revenue Stream #1: Subscriptions (Core Plans)

How it works: Tiered SaaS plans: Free, Essentials, Standard, Premium.

Share of revenue: ~78 percent

Pricing: $13 to $350+ monthly depending on contacts

Growth: Premium plan adoption grew 18 percent YoY

Example: A business with 20,000 contacts on Standard at $135/month = $1,620/year.

Revenue Stream #2: Pay-As-You-Go Email Credits

How it works: Businesses buy email credits without monthly commitments.

Share: 9 percent

Pricing: Scaled per 5,000+ emails

Growth: Strong among agencies

Example: 200,000 emails may cost ~$400.

Revenue Stream #3: Transactional Email (Mandrill)

How it works: API-based transactional emails.

Share: 6 percent

Pricing: Blocks of 25,000 emails

Growth: 14 percent

Example: 100,000 transactional emails = ~$80/month.

Revenue Stream #4: Ads & Marketing Add-Ons

How it works: Users boost campaigns with ads, automation tools, and predictive features.

Share: 4 percent

Pricing: $5–$25 upgrades

Growth: AI-powered features expanding

Example: Predictive segmentation add-ons selling rapidly.

Revenue Stream #5: Ecommerce & Website Tools

How it works: Website hosting, commerce add-ons, transaction fees.

Share: 3 percent

Pricing: Varies

Growth: 20 percent YoY as creators adopt these tools.

Revenue Stream Breakdown Table

Revenue streams percentage breakdown

| Revenue Stream | Share of Total Revenue |

|---|---|

| Subscriptions | 78 percent |

| Pay-As-You-Go Credits | 9 percent |

| Transactional Email | 6 percent |

| Ads & Add-Ons | 4 percent |

| Website/Ecommerce Tools | 3 percent |

The Fee Structure Explained

User-Side Fees

• Subscription fees (monthly/annual)

• Email sending limits based on contact count

• AI-powered add-ons

• SMS automation charges

• Ecommerce hosting fees

• Transactional email blocks

Provider-Side Fees

Agencies may pay:

• Partner listing fees

• Revenue share on marketplace integrations

Hidden Revenue Levers

• Extra charges for contact overages

• Additional payment for automation journeys

• Pricing jumps once contacts exceed tier limits

Regional Pricing Variations

• US & UK pricing highest

• APAC discounted by 10–15 percent

• EU influenced by VAT

Read More: Business Model of Mailchimp : Complete Strategy 2025

Complete Fee Structure Table

Complete fee structure by user type

| User Type | Fee Type | Typical Cost |

|---|---|---|

| Individual | Essentials Plan | $13–$20/month |

| SMB | Standard/Premium | $59–$350/month |

| Agencies | PAYG + Premium | Custom |

| Ecommerce Users | Commerce fees | 2–3 percent |

| Developers | Mandrill API | ~$20/block |

How Mailchimp Maximizes Revenue Per User

Key Monetization Tactics

• Segmentation: Free, Essentials, Standard, Premium tiers push upgrades

• Upselling: Advanced analytics, A/B testing, customer journeys

• Cross-selling: Websites, stores, social posting

• Dynamic pricing: Scales with contact list size

• Retention monetization: Annual plans with discounts

• Lifetime value expansion: Add-on stacking

• Psychological pricing: Tier jumps aligned with business growth

Real Example

A Standard user with 5,000 contacts may pay $59/month but easily reach $120/month with automation + add-ons.

Cost Structure & Profit Margins

Major Cost Categories

• Infrastructure (email servers, deliverability systems)

• Sales & marketing

• R&D (AI automation, predictive tools)

• Customer support

• Compliance & security

Unit Economics

• Gross margins: ~78 percent

• Operating margins: ~22 percent

• CAC payback: 6–9 months

• LTV remains high due to automation lock-in

Profit-Improvement Strategies

• AI-powered automation reduces churn

• More enterprise-tier adoption

• Website/ecommerce upsells

Future Revenue Opportunities & Innovations

New Revenue Experiments

• AI email content generation

• Predictive journey orchestration

• Hyper-personalization engines

• SMS + WhatsApp marketing bundles

Expansion Markets

• APAC ecommerce

• Creator economy automation

• Agency workflow suites

Predictions 2025–2027

• AI-based email delivery grows 5x

• Agency bundle revenue rises

• Commerce revenue doubles

• Retention improves as AI deepens engagement

Threats include AI-native marketing startups, cheaper alternatives, and built-in email tools from ecommerce platforms.

Lessons for Entrepreneurs & Your Opportunity

Mailchimp’s revenue model succeeds because it mixes:

• Recurring SaaS subscriptions

• Scalable usage-based pricing

• Strong retention features

• Automation that increases dependency

• A broad product ecosystem

Opportunities for Founders

• Region-specific email automation

• AI-first audience segmentation tools

• Creator marketing suites

• Low-cost alternatives for startups

• Industry-specific automation (healthcare, finance, retail)

Want to build a platform with Mailchimp’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our Mailchimp clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch. Get a free consultation to map out your revenue strategy.

Final Thought

Mailchimp’s 2025 revenue model shows how powerful subscription automation can be. With strong profit margins, predictable growth, and expanding AI-driven personalization, Mailchimp has redefined what sustainable SaaS looks like. Its ability to monetize not just email delivery, but also data insights, CRM integration, and marketing automation, sets the gold standard for scalable marketing platforms.

For new founders, the real opportunity lies in specialization — creating faster, smarter, and niche-focused Mailchimp alternatives that address the needs of emerging markets and underserved industries. Whether it’s automating influencer outreach, hyperlocal marketing, or e-commerce re-engagement, the potential for innovation is immense.

Entrepreneurs leveraging the Miracuves Mailchimp Clone Solution can launch a customizable, monetization-ready platform with subscription tiers, analytics, and AI automation built in — often seeing revenue within 30 days of launch.

FAQs

1. How much does Mailchimp make per transaction?

Mailchimp earns mainly from subscriptions, but commerce transactions contribute 2–3 percent per sale.

2. What’s Mailchimp’s most profitable revenue stream?

Its subscription tiers generate nearly 80 percent of total revenue and deliver the highest margins.

3. How does Mailchimp’s pricing compare to competitors?

Mailchimp is cheaper than HubSpot but slightly costlier than Sendinblue and ConvertKit at higher contact counts.

4. What percentage does Mailchimp take from providers?

Ecommerce tools may take 2–3 percent per transaction.

5. How has Mailchimp’s revenue model evolved?

It expanded from email marketing to websites, commerce, automation, and AI-powered tools.

6. Can small platforms use similar models?

Yes. Subscription tiers combined with usage pricing work well at any scale.

7. What’s the minimum scale for profitability?

A Mailchimp-like platform can break even with 500–1,000 paying users depending on CAC.

8. How to implement similar revenue models?

Use tiered plans, credits, add-ons, automation tools, and AI features.

9. What are alternatives to Mailchimp’s model?

Freemium + ads, usage-only pricing, or hybrid models with marketplace revenue.

10. How quickly can similar platforms monetize?

With a Mailchimp clone, monetization begins instantly via subscriptions and automation upgrades.