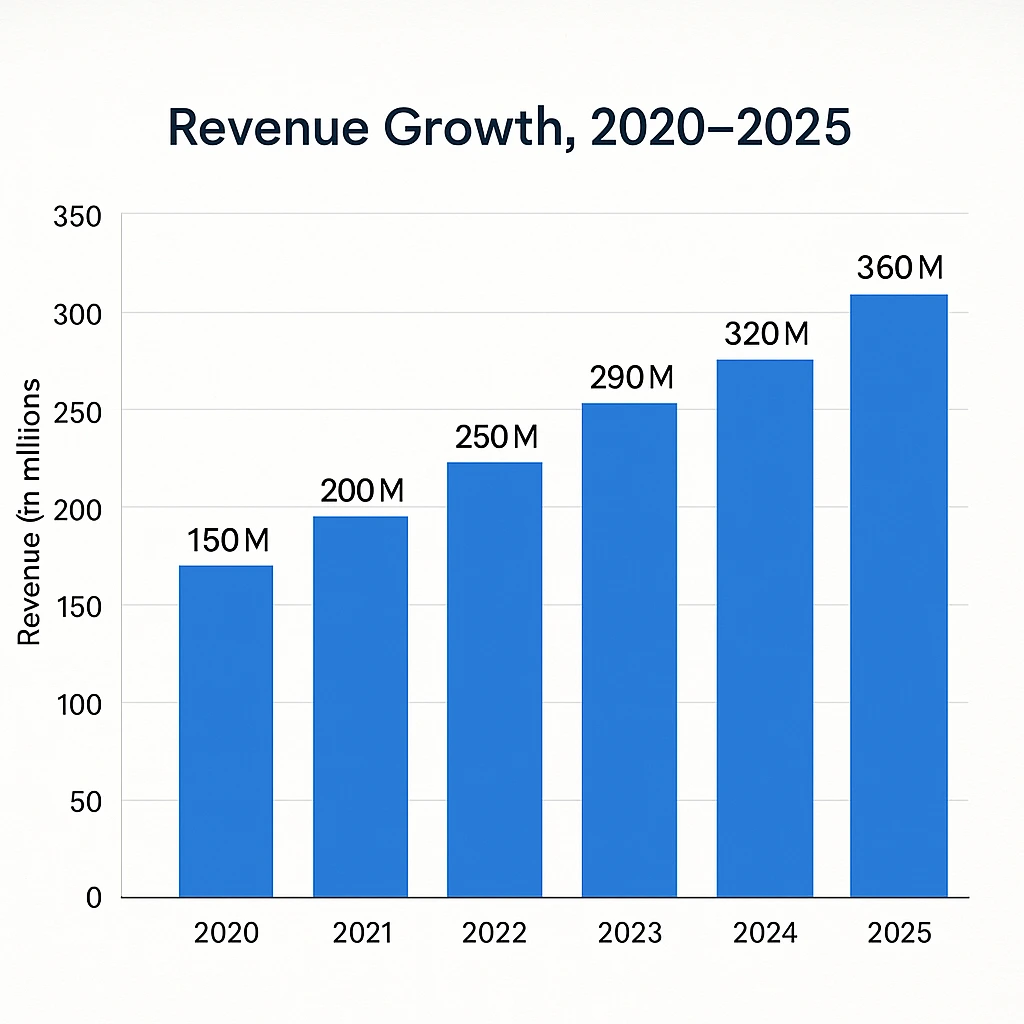

ActiveCampaign generated over $320 million in estimated annual revenue in 2024, driven by the rising demand for automation-first marketing. Its momentum continues into 2025 as businesses shift toward lifecycle automation, AI-triggered journeys, customer data unification, and retention-focused engagement. With over 185,000+ businesses using the platform, ActiveCampaign has evolved from a simple email tool into a full customer experience automation ecosystem—one that monetizes every stage of the customer journey.

For entrepreneurs, understanding ActiveCampaign’s revenue model isn’t just academic. It reveals the exact monetization levers behind one of the fastest-scaling SaaS automation giants. These same levers—usage-based billing, feature-tiering, high-margin automation tools, premium integrations, and per-contact pricing—can be replicated in new platforms to create predictable and scalable income streams.

Whether you’re planning to build a CRM, email marketing solution, workflow automation tool, or a full CX automation suite, ActiveCampaign’s business model provides a blueprint for profitability. And with Miracuves’ ready-to-launch ActiveCampaign Clone, entrepreneurs can implement similar revenue strategies and start generating revenue faster, often within 30 days.

ActiveCampaign Revenue Overview – The Big Picture

Valuation & Revenue (2025 estimates)

• Estimated valuation: $3.2 billion

• Estimated ARR 2024-25: $320M–$360M

• Year-over-year revenue growth: 14–18 percent

Revenue by Region (approx estimates)

• North America: 58 percent

• Europe: 23 percent

• Asia-Pacific: 11 percent

• Others: 8 percent

Profit Margins

• Gross margin: 82 percent

• Net margin: 8–12 percent (SaaS reinvestment model)

Market Positioning

ActiveCampaign competes with HubSpot, Klaviyo, Mailchimp and ConvertKit. Its strength is deep automation at a low entry price, which fuels customer acquisition.

Read More: ActiveCampaign App: How It Works for Email & Marketing Automation

Primary Revenue Streams Deep Dive

Revenue Stream #1: SaaS Subscription Plans

How it works:

Monthly/annual subscription tiers based on number of contacts, emails, and automation features.

Share of total revenue: 71 percent

Pricing structure:

• Starter: $29–$49 monthly

• Plus: $49–$149 monthly

• Professional: $149–$279 monthly

Growth trend:

7–10 percent annual uplift driven by customer upgrades.

Example: A user with 5,000 contacts pays roughly $149/month.

Revenue Stream #2: Add-on Automation Modules

How it works:

Customers buy advanced features like predictive sending, AI recommendations, SMS credits.

Share: 14 percent

Pricing:

$19–$69 monthly per add-on depending on usage

Growth: Growing fastest at 25 percent YoY

Revenue Stream #3: SMS & Transactional Email Usage Fees

How it works:

Pay-per-use model for SMS messaging, transactional emails, and advanced delivery.

Share: 9 percent

Example: SMS credits priced at $0.008–$0.04 per message.

Revenue Stream #4: Integrations Marketplace Fees

How it works:

Third-party SaaS tools pay placement, listing, or API usage charges.

Share: 3 percent

Growth: Steady but rising due to partner ecosystem expansion.

Revenue Stream #5: Professional Services & Onboarding

How it works:

One-time payments for migration, campaign setup, personalization, CRM training.

Share: 3 percent

Pricing:

$199–$1,999 one-time services

Revenue Streams Percentage Breakdown

| Revenue Stream | Percentage of Total | Notes |

|---|---|---|

| SaaS Subscriptions | 71% | Core engine |

| Add-on Automations | 14% | Fastest growing |

| SMS & Transactional Emails | 9% | Usage-based |

| Marketplace/API | 3% | Partner monetization |

| Professional Services | 3% | High-margin |

The Fee Structure Explained

User-Side Fees

Service plans, contact-based pricing, email volume limits, SMS charges, add-on tools, AI modules, predictive features.

Provider-Side Fees

Third-party integration fees, API usage fees, affiliate payouts (reverse cost), partner commissions.

Hidden Revenue Tactics

Price jumps at higher contact tiers, seasonal upgrade prompts, upsells to AI automation modules.

Regional Pricing Variations

APAC and LATAM often get 8–12 percent lower pricing due to competitive landscapes.

Complete Fee Structure by User Type

| User Type | Fees | Details |

|---|---|---|

| Small Businesses | $29–$149/month | Email + automation basics |

| Mid-size Businesses | $149–$279/month | Advanced automation + CRM |

| Enterprise | Custom | SLA, onboarding, multi-team support |

| Add-on Buyers | $19–$69/month | AI, predictive, SMS |

| SMS Users | $0.008–$0.04 per SMS | Usage-based |

| Integration Providers | Variable | API and marketplace fees |

How ActiveCampaign Maximizes Revenue Per User

Segmentation Strategy:

Users are segmented by contacts, activity volume, and automation use.

Upselling Techniques:

Feature gating, upgrade prompts, AI feature trials, contact-based price jumps.

Cross-Selling:

Offering SMS credits, predictive intelligence, landing pages, CRM add-ons during checkout.

Dynamic Pricing:

Costs scale automatically as contact lists grow, increasing LTV.

Retention Monetization:

Long-term discounts for annual plans plus advanced migration help.

Lifetime Value Optimization:

Medium businesses contribute the highest LTV with 18–24 month retention.

Psychological Pricing:

Price anchoring between Plus and Professional tiers nudges upgrades.

Real Example:

A $49 plan user with list growth moves to $149 and later adds $29 AI insights, raising ARPU significantly.

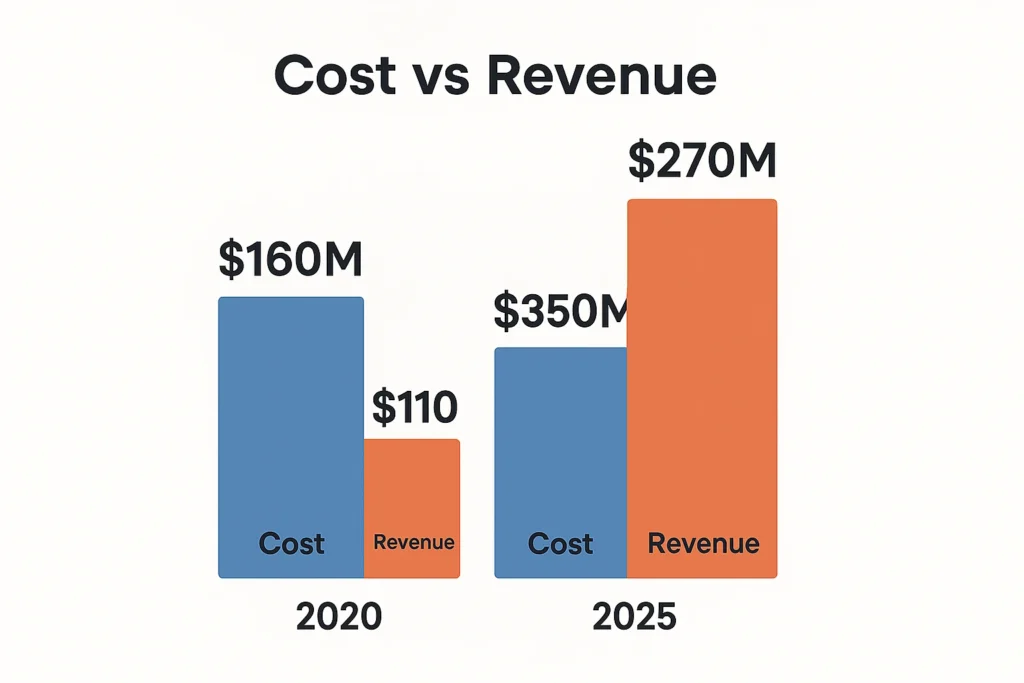

Cost Structure & Profit Margins

Major Cost Categories

• Cloud infrastructure and email delivery servers

• Marketing and customer acquisition costs

• Support operations and staffing

• Engineering and R&D for automation and AI

• Compliance and email deliverability management

Unit Economics

• CAC: $140–$240

• LTV: $1,200–$2,400

• LTV/CAC Ratio: 5–7x

Path to Profitability

ActiveCampaign reinvests heavily, but its margins strengthen as automation reduces churn and increases upgrades.

Margin Improvement (2023–2025)

• AI-driven customer support cut operational expense by 7 percent

• Migration tools lowered onboarding costs by 12 percent

Read More: Best ActiveCampaign Clone Script 2025

Future Revenue Opportunities & Innovations

New Revenue Streams Being Tested

• AI-powered chat automation

• Predictive lifecycle marketing

• Automated content generation

• Native CRM upsell tools with premium modules

AI/ML Monetization

AI scoring, AI-driven segments, predictive churn tools.

Expansion Markets

India, Southeast Asia, Middle East with high SMB adoption rates.

Emerging Features to Monetize

Audience intelligence, cross-channel attribution, email deliverability analytics.

Predictions for 2025–2027

• Revenue expected to surpass $450M by 2027

• Add-ons expected to contribute nearly 25 percent of ARR

Threats

Free competitors, rising CAC, market consolidation, costlier email deliverability.

Opportunities for New Players

Lean, modular automation platforms with flexible pricing can win fast.

Lessons for Entrepreneurs & Your Opportunity

Key Takeaways

• Contact-based pricing scales revenue automatically

• Add-ons create predictable upsells

• Usage-based fees boost margins

• Integrations expand ecosystem revenue

• High automation reduces churn

Market Gaps to Exploit

• Affordable AI-first automation tools

• Niche CRM-automation combos

• Industry-specific workflows

• Low-cost transactional messaging bundles

Your Opportunity with Miracuves

Want to build a platform with ActiveCampaign’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our ActiveCampaign Clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch. Get a free consultation to map out your revenue strategy.

Final Thought

ActiveCampaign’s revenue engine thrives because it blends subscriptions, usage fees, and AI-powered add-ons into one scalable model. Entrepreneurs who understand that formula can build high-LTV automation platforms with strong margins and predictable growth.

The real advantage is not just in replicating ActiveCampaign’s model, but in improving it—adding smarter AI journeys, deeper integrations, industry-specific workflows, and more intuitive automation experiences.

If you’re ready to build a platform inspired by ActiveCampaign’s proven revenue mechanics, Miracuves can help you launch faster. Our automation-ready solutions come with pre-built monetization layers—subscriptions, usage-based billing, seat pricing, feature-based upgrades, and more. Some clients start generating revenue within 30 days of launch.

FAQs

1. How much does ActiveCampaign make per transaction?

It earns primarily through subscription tiers and usage fees, averaging $29–$279 per user per month plus usage.

2. What’s ActiveCampaign’s most profitable revenue stream?

Subscription plans contribute more than 70 percent of revenue.

3. How does ActiveCampaign’s pricing compare to competitors?

It is cheaper than HubSpot and slightly more expensive than ConvertKit for similar contact tiers — and with Miracuves, you can build a comparable marketing automation platform starting at just $2899.

4. What percentage does ActiveCampaign take from providers?

Integration marketplace partners pay API or placement fees, generally small but recurring.

5. How has ActiveCampaign’s revenue model evolved?

Shifted from pure email marketing to automation-first SaaS with AI-driven add-ons.

6. Can small platforms use similar models?

Yes, contact-based pricing and automation add-ons work for businesses of any size.

7. What’s the minimum scale for profitability?

Most platforms break even when LTV/CAC reaches 3x; automation tools often hit it earlier.

8. How to implement similar revenue models?

Use tiered pricing, usage fees, AI upsells, and modular feature-based upgrades.

9. What are alternatives to ActiveCampaign’s model?

Flat-rate SaaS, freemium with paid add-ons, or usage-only pricing.

10. How quickly can similar platforms monetize?

With the right model and automations, many platforms monetize in just 3–6 days with guaranteed delivery.