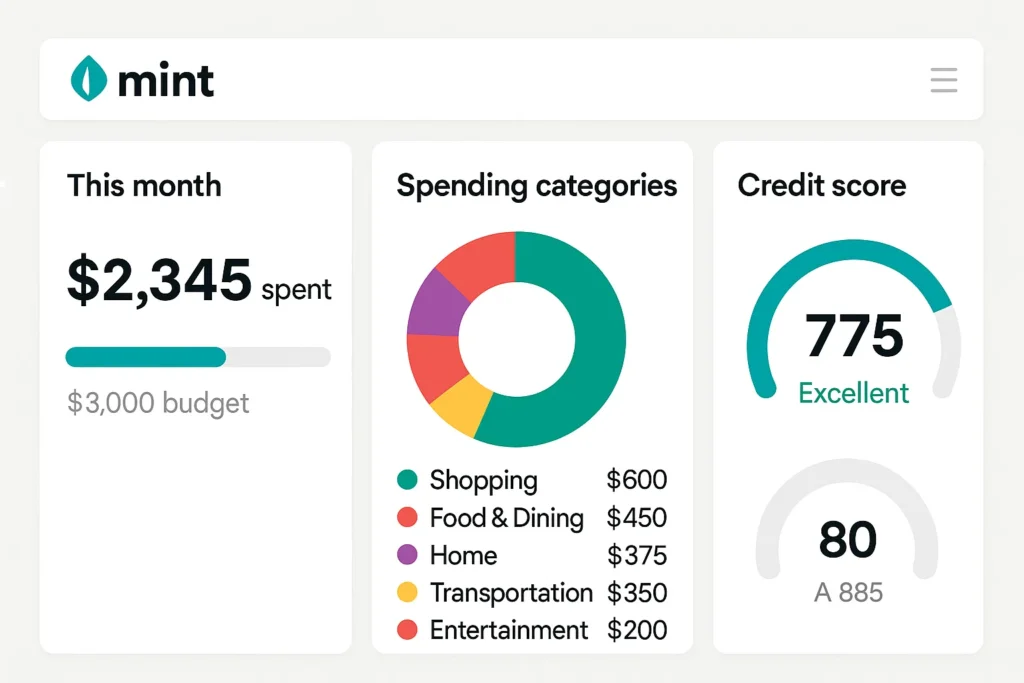

Imagine being able to see your bank accounts, credit cards, bills, budgets, and spending habits all in one clean dashboard—updated automatically without spreadsheets or manual calculations. That’s the convenience Mint brought to millions of users as one of the most trusted personal finance apps in the U.S.

Mint was created to help people take control of their money with simple tools: automatic budget tracking, bill reminders, credit score updates, and smart financial insights. It made personal finance feel less overwhelming by turning numbers into easy-to-understand visuals and actionable advice.

By the end of this guide, you’ll understand exactly what Mint is, how it works, its business model, feature set, and the technology behind it—plus how entrepreneurs can build similar personal finance apps with Miracuves.

What Is Mint? The Simple Explanation

Mint is a personal finance management app that helps users track their spending, manage budgets, monitor bills, and view all financial accounts in one place. By connecting bank accounts, credit cards, loans, and investments, Mint automatically categorizes transactions and provides insights into where money is going.

The Core Problem Mint Solves

Most people struggle to keep track of finances across multiple accounts. Mint simplifies this by giving users a single dashboard that updates automatically, eliminating guesswork and manual budgeting.

Target Users and Use Cases

Mint is used by:

• Individuals who want a simple, visual way to track spending

• People who struggle with budgeting or overspending

• Users managing multiple bank accounts or credit cards

• Anyone wanting automatic categorization and reminders

• Beginners learning personal finance

Current Market Position

Mint has been one of the most recognizable finance apps in the U.S., known for making budgeting easy and accessible. Even after discontinuation of new feature updates, it remains widely referenced as a gold standard for personal finance tools.

Why It Became Successful

Mint won users because it offered:

- A free, easy-to-use money management tool

- Automatic transaction syncing

- Smart budgeting recommendations

- Clean visual insights

- Real-time alerts and notifications

It made financial awareness simple for everyday people.

How Mint Works — Step-by-Step Breakdown

For Users (Everyday Money Managers)

Account Creation

Users sign up with an email and secure password. Once inside, they connect their financial accounts—bank accounts, credit cards, loans, investments, and even bills.

Automatic Account Syncing

Mint securely pulls transaction data from connected institutions. This allows:

- Real-time balance updates

- Automatic categorization (e.g., groceries, rent, shopping)

- Spending insights without manual input

Budget Creation

Mint creates suggested budgets based on past spending patterns. Users can:

- Adjust limits

- Set monthly goals

- Track progress visually

- Receive alerts when nearing or exceeding budgets

Bill Tracking & Alerts

Mint notifies users about:

- Upcoming bills

- Low balance alerts

- Due dates

- Unusual spending

- Potential late fees

It acts like a financial assistant that stays on top of all bills.

Credit Score Monitoring

Users get free credit score updates and suggestions on how to improve their credit health.

Example User Journey

A user connects their accounts → Mint categorizes all past transactions → creates smart budgets automatically → sends alerts about bills and overspending → provides spending trends to help improve money management.

For Financial Service Providers (Indirect Role)

Mint is not a marketplace but does feature:

- Personalized product recommendations: credit cards, loans, savings accounts

- Insight-based suggestions: reduce fees, save on bills, optimize financial choices

Providers benefit by being recommended to users based on their financial patterns.

Technical Overview (Simplified)

Mint operates using:

- APIs and secure integrations with financial institutions

- Data aggregation technology to pull transactions in real time

- AI-based categorization models to classify spending

- Personalized insight engines that track trends and detect abnormalities

- Encrypted cloud storage for sensitive financial data

All financial syncing is automated, meaning users rarely need to manually update anything.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Mint’s Business Model Explained

How Mint Makes Money

Mint is free for users, so its revenue comes from indirect monetization channels:

- Affiliate commissions: Mint recommends credit cards, loans, savings accounts, and financial products. When a user signs up, Mint earns a commission.

- Advertising: Financial institutions pay Mint to feature their products within the app.

- Financial product partnerships: Banks and lenders sponsor personalized recommendations.

This model allows Mint to stay free while offering valuable financial tools.

Pricing Structure

Mint does not charge users.

There are:

- No subscription fees

- No premium tier for core features

- No costs for tracking accounts or budgets

Its revenue relies entirely on partnerships and advertising rather than user payments.

Commission / Fee Breakdown

Mint earns revenue when users engage with recommended products such as:

- Credit cards

- Personal loans

- High-yield savings accounts

- Investment accounts

- Insurance options

Partners pay Mint per sign-up or based on performance metrics like clicks and conversions.

Market Size and Growth

Personal finance management apps serve millions of U.S. users. As banking becomes more digital, demand for budgeting, spending analysis, and bill reminders continues to increase. Even with new competition, Mint remains one of the most recognized names in personal finance tools.

Profit Margin Insights

Mint’s cost structure is low because:

- The app operates digitally with automated workflows

- It relies on affiliate and ad revenue

- There is no underwriting, inventory, or risk exposure

This makes the model highly scalable and low-maintenance.

Revenue Model Breakdown

| Revenue Stream | Description | Who Pays | Nature |

|---|---|---|---|

| Affiliate Commissions | Earned when users sign up for recommended products | Banks, lenders, financial companies | Performance-based |

| Sponsored Listings | Financial products promoted inside the app | Partner institutions | Advertising |

| Data Insights (Aggregated) | Market-level insights—not personal data | Partners | Optional/non-personal |

Key Features That Make Mint Successful

Unified Financial Dashboard

Mint brings together bank accounts, credit cards, loans, investments, and bills in one place. This single-view dashboard eliminates the need to check multiple apps or statements.

Automatic Transaction Categorization

Every purchase is sorted into categories like groceries, dining, utilities, entertainment, and more. Users get clear insights without doing any manual tracking.

Smart Budgeting Tools

Mint suggests budgets based on spending habits. Users can:

- Set spending limits

- Track budget progress visually

- Get alerts when nearing or exceeding budgets

This makes budgeting easier and more intuitive.

Bill Reminders & Alerts

Mint sends timely notifications for:

- Upcoming bills

- Low balance

- Large or unusual transactions

- Bank fee alerts

These alerts help users avoid late payments and unexpected overdrafts.

Credit Score Tracking

Users receive free credit score updates along with personalized recommendations to improve credit health.

Goal Setting & Financial Planning

Users can set goals such as:

- Paying off debt

- Saving for emergencies

- Building an investment fund

Mint tracks progress and offers helpful suggestions.

Insightful Spending Reports

Mint visualizes spending trends using charts and timelines, helping users understand where their money actually goes each month.

Security & Privacy

All financial data is encrypted and secured using banking-level protection. Mint does not store login credentials directly—it uses tokenized connections through financial aggregators.

Modern, Intuitive UI

Mint succeeded because it made personal finance feel friendly and easy. Its visual approach, clarity, and automation helped millions adopt budgeting habits without financial complexity.

Recent Enhancements & Updates

Modern budgeting tools, better alerts, improved categorization accuracy, and cleaner UI flows have kept Mint relevant even as competitors grow.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

The Technology Behind Mint

Tech Stack Overview (Simplified)

Mint operates on a secure, cloud-based architecture designed for large-scale financial data processing. Core components include:

- Backend services that sync data from banks and financial institutions

- Frontend web and mobile apps built for fast, visual budgeting

- Data analytics engines that process spending patterns and categorize transactions

- A centralized insights system that generates alerts, reminders, and suggestions

The entire experience is built around automation—updating itself without requiring manual input from users.

Real-Time Data Syncing

Mint connects with banks and credit unions through secure aggregator APIs. These APIs allow Mint to:

- Fetch transactions

- Update account balances

- Detect new bills

- Monitor unusual activity

Everything refreshes automatically, giving users a live financial snapshot.

Data Handling & Privacy

Mint uses bank-level security protocols:

- End-to-end encryption

- Tokenized access rather than storing credentials

- Enforced secure connections for all data transfers

- Multi-factor authentication

- Regular security audits

User financial data remains private and is not sold to third parties.

Scalability

Mint’s cloud infrastructure allows it to handle millions of users without performance issues. Its microservices architecture ensures:

- Faster data syncing

- Independent scaling of budgeting, alerts, and reporting services

- Quick updates without downtime

Mobile App vs Web

- Mobile App: Best for quick checks—budgets, alerts, daily spending, credit score.

- Web Platform: Best for detailed financial reports, long-term planning, and deep-dive spending analysis.

Both platforms sync seamlessly and show the same real-time data.

API Integrations

Mint integrates with:

- Banks

- Credit unions

- Investment platforms

- Loan providers

- Credit bureaus

These integrations let Mint pull accurate data and deliver personalized insights without requiring users to track anything manually.

Why This Tech Matters

Mint’s innovation comes from its ability to simplify financial management with zero manual effort. Its tech:

- Removes friction

- Automates budgeting

- Offers personalized financial insights

- Builds user trust through security and transparency

For entrepreneurs, it proves that a well-designed financial aggregator can change how millions manage money.

Mint’s Impact & Market Opportunity

Industry Disruption

Mint changed how Americans think about budgeting. Before Mint, most people relied on spreadsheets, pen-and-paper tracking, or checking balances manually. Mint automated everything—syncing accounts, categorizing transactions, and creating budgets instantly.

This shift popularized personal finance apps, inspiring nearly every modern budgeting tool that came afterward.

Market Statistics & Growth

The personal finance management (PFM) market continues to grow due to:

- Increase in digital banking

- Rise of mobile-first financial behavior

- Consumer demand for spending clarity

- Growing dependence on automated budgeting tools

Mint helped establish this market, and despite competition, it remains a reference point for what PFM apps should offer.

User Demographics & Behavior

Mint primarily attracts:

- Young professionals managing multiple accounts

- Families wanting to control spending

- Students learning budgeting basics

- Individuals needing bill reminders

- Credit-conscious users who prefer proactive financial tracking

Users typically log in multiple times per week, seeking clarity on spending, budgets, and upcoming bills.

Geographic Presence

Mint is primarily used in the United States, where banking API access and financial aggregators support seamless data integration.

Future Projections

The demand for automated financial tools is rising. Users want:

- Intelligent alerts

- Investment tracking

- AI-driven financial recommendations

- Automated savings tools

- Bill negotiation and fee detection

This creates massive opportunity for next-generation Mint-like apps with more personalization and automation.

Opportunities for Entrepreneurs

There is strong market demand for niche personal finance apps such as:

- AI-driven budgeting platforms

- Student financial planning tools

- Family budgeting and shared wallets

- Cashflow apps for freelancers

- Debt payoff automation tools

- Credit score coaching platforms

This massive success is why many entrepreneurs want to create Mint-like platforms with enhanced analytics, automation, and modern UI/UX.

Building Your Own Mint-Like Platform

Why Businesses Want Mint-Style Platforms

Mint proved that people want a simple, automated, and visual approach to managing their money. A Mint-like platform delivers high value by offering:

- Effortless budgeting

- Automatic expense categorization

- Unified financial overview

- Alerts that prevent overspending and missed bills

- Insightful financial coaching

For businesses, the model is attractive because it:

- Requires no underwriting risk

- Scales easily with data and automation

- Generates recurring engagement

- Supports strong monetization through partnerships

Key Considerations Before You Start Development

Before building a Mint-style app, define:

- User focus: beginners, families, freelancers, credit builders, or high-net-worth users

- Connected financial institutions: which banks, wallets, or credit unions you’ll support

- Core features: budgeting, credit monitoring, goals, bill tracking, or all-in-one

- Security requirements: encryption, MFA, tokenized bank connections

- Monetization model: ads, affiliate, premium tier, or hybrid

- Regulatory compliance: financial data handling, consumer privacy, aggregator standards

These decisions guide the architecture, development cost, and user journey.

Cost Factors & Pricing Breakdown

Mint-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Budgeting & Expense Tracker MVP | Core mobile/web app for linking a few bank accounts via aggregator APIs, user registration & login, basic balance and transaction view, manual categorisation, simple budgets, basic spending charts, alerts for low balance or upcoming bills, standard admin panel | $60,000 |

| Mid-Level Personal Finance Management Platform | Multi-bank and card connectivity, automatic categorisation, custom budget rules, recurring bill tracking, goal-based savings views, improved analytics dashboards, notifications & insights, export options, polished mobile-first UX with web and apps | $130,000 |

| Advanced Mint-Level Money Management Ecosystem | Wide financial institution coverage, advanced enrichment and insights, cash flow forecasting, credit score integration, offers/recommendations engine, multi-currency support (where applicable), deep analytics, A/B testing tools, cloud-native, highly scalable architecture | $220,000+ |

Mint-Style Personal Finance App Development

The prices above reflect the global market cost of developing a Mint-like personal finance and budgeting app — typically ranging from $60,000 to over $220,000, with a delivery timeline of around several months for a full, from-scratch build. This usually includes secure bank connections through aggregators, data categorisation and enrichment, budgeting and goals features, analytics dashboards, and production-grade mobile apps.

Miracuves Pricing for a Mint-Like Custom Platform

Miracuves Price: Starts at $13,999

This is positioned for a feature-rich, JS-based Mint-style personal finance platform that covers secure account linking (via your chosen data providers), balance and transaction views, automatic and manual categorisation, budgets and savings goals, core analytics, notifications, and a modern web dashboard plus mobile apps. From this foundation, the solution can be extended into deeper insights, credit score or offers integration, and more advanced recommendation engines as your user base and product strategy evolve.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational personal finance ecosystem ready for launch and future expansion.

Delivery Timeline for a Mint-Like Platform with Miracuves

For a Mint-style, JS-based custom build, the typical delivery timeline with Miracuves is about 30–90 days, depending on:

- Depth of budgeting, goals, and insights features

- Number and complexity of bank/aggregator, credit score, and offer-partner integrations

- Complexity of analytics dashboards, segmentation, and notification logic

- Scope of web portal, mobile apps, branding requirements, and long-term scalability plans

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features to Include

A strong Mint-style app should have:

- Bank account and credit card syncing

- Auto-categorized transactions

- Visual budgets

- Bill tracking and alerts

- Credit score monitoring

- Spending insights and monthly summaries

- Goal tracking (savings, debt, investment)

- Secure document vault

- Mobile + web access

- Strong encryption and security

Advanced features you can add:

- AI spending predictions

- Smart budgeting automation

- Shared budgets for families or couples

- Cashflow tracking for freelancers

- Fee alerts and bill negotiation suggestions

- Personalized financial coaching

Read More :- Read the complete guide on fintech app development costs

Conclusion

Mint changed personal finance by proving that budgeting doesn’t need to be complicated or intimidating. By automating data syncing, simplifying budgets, and giving users a clear financial snapshot, Mint made money management accessible to millions.

For entrepreneurs, it serves as a blueprint: when you solve a universal problem with clarity, automation, and great design, your platform can become a household name.

FAQs :-

How does Mint make money?

Mint earns revenue through affiliate commissions and advertisements. When users sign up for financial products like credit cards, loans, or savings accounts recommended in the app, Mint receives a referral fee from partner institutions.

Is Mint available outside the USA?

Mint is primarily built for the U.S. market and supports financial institutions based in the United States. It is not widely supported in other countries due to banking integration limitations.

How much does Mint cost to use?

Mint is completely free. Users can access budgeting tools, credit score updates, and financial tracking without paying a subscription fee.

Does Mint charge service providers or banks?

Financial partners pay Mint for referrals, sponsored product placements, and performance-based conversions. Users do not pay any charges to Mint.

How does Mint ensure safety and privacy?

Mint uses bank-level encryption, secure data transmission, tokenized authentication, and multi-factor authentication to protect user information. It does not store login credentials directly.

Can I build something similar to Mint?

Yes. A Mint-like platform is highly feasible with the right technology stack and secure financial integrations. Many entrepreneurs now build niche budgeting and finance-management apps for specific audiences.

What makes Mint different from competitors?

Mint stands out for its simplicity, strong bank integrations, automatic categorization, and clear visual budgeting tools. Its free model and long-standing brand presence also make it popular.

How many users does Mint have?

Mint has served millions of users across the U.S. and has long been considered one of the most popular personal finance apps, even as new competitors enter the space.

What technology does Mint use?

Mint uses secure financial APIs, cloud infrastructure, AI-powered categorization, encrypted data storage, and automated analytics engines to deliver real-time financial insights.

How can I create an app like Mint?

You can build a Mint-like app from scratch or use a pre-built personal finance management (PFM) framework. Miracuves helps entrepreneurs launch apps like Mint in 30-90 days, complete with bank integrations, budgeting tools, analytics, and UI customization.