Gorillas shocked the global commerce industry by scaling to over $1 billion in annualized revenue within just a few years, powered by its bold 10-minute grocery delivery promise. At a time when traditional grocery delivery struggled with thin margins and slow fulfillment, Gorillas redefined customer expectations around speed and convenience.

Unlike marketplace grocery apps that act as intermediaries between retailers and customers, Gorillas built a vertically integrated model. By owning inventory, operating hyperlocal dark stores, and managing last-mile logistics in-house, the company gained tighter control over pricing, margins, and delivery performance. This structure allowed Gorillas to optimize unit economics at the neighborhood level rather than relying on third-party commissions.

Speed was not just a marketing hook—it was a behavioral strategy. Ultra-fast delivery increased order frequency, encouraged impulse purchases, and positioned Gorillas as a daily-use platform rather than an occasional grocery service. High-density operations further amplified efficiency, lowering cost per order as volume grew.

Gorillas Revenue Overview – The Big Picture

Gorillas operated as a quick commerce (q-commerce) platform, delivering groceries and daily essentials from hyperlocal dark stores within minutes.

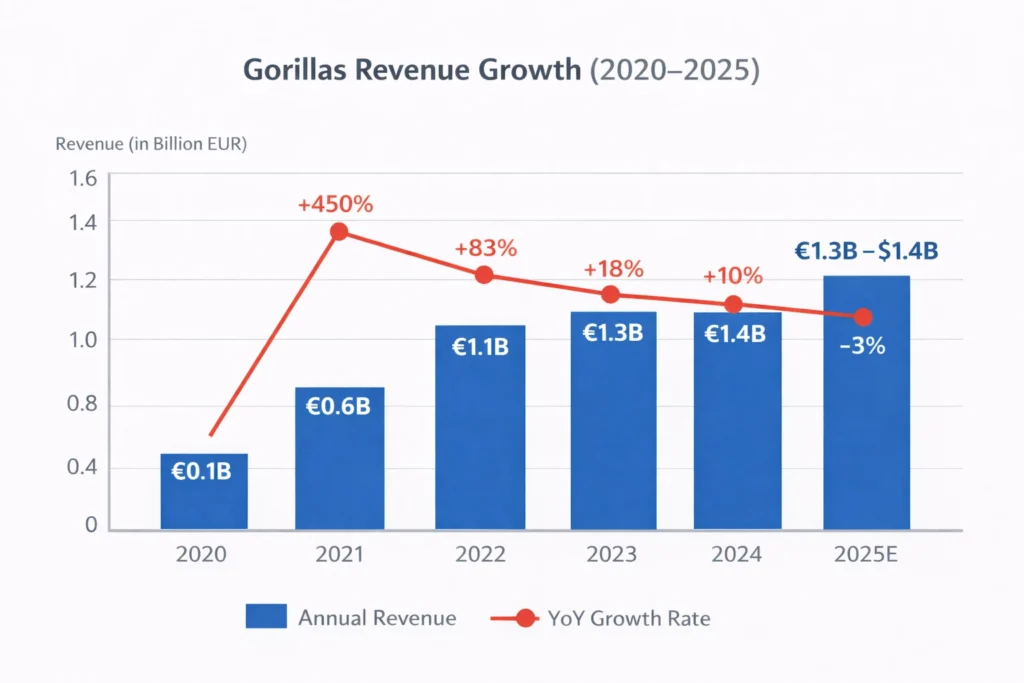

- Peak Annualized Revenue (2024–2025): ~$1.3–1.4 billion

- Valuation (at peak): ~$3 billion

- YoY Growth (peak years): 60–80%

- Primary Markets: Germany, UK, France, Netherlands

- Gross Margins: 25–35%

- Core Competitors: Getir, GoPuff, Flink, DoorDash Mart

Although Gorillas later consolidated via acquisition, its revenue model remains one of the most studied blueprints in instant commerce.

Read More: What is Gorillas and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Inventory Sales & Retail Margins

Gorillas purchased groceries wholesale and sold them directly to customers.

This allowed Gorillas to earn retail margins similar to convenience stores, rather than relying on commissions.

- Revenue Share: ~60%

- Average Markup: 25–40%

- High-margin items: Snacks, beverages, private-label goods

Revenue Stream #2: Delivery Fees

Customers paid a delivery fee per order, usually kept low to encourage frequent purchases.

- Revenue Share: ~12–15%

- Average Fee: €1.80–€3.00

- Strategy: Low fee + high frequency

Revenue Stream #3: Minimum Order Values

Gorillas enforced minimum basket sizes to protect unit economics.

- Typical Minimum: €10–€15

- Impact: Higher AOV, reduced loss per delivery

Revenue Stream #4: Private-Label Products

Gorillas launched its own branded grocery items.

- Revenue Share: ~8–10%

- Margin Advantage: 2–3x higher than branded goods

Revenue Stream #5: Brand Promotions & Supplier Incentives

FMCG brands paid for visibility and promotions inside the app.

- Revenue Share: ~5–7%

- High-margin income: Near-zero fulfillment cost

[Table: Revenue streams percentage breakdown]

The Fee Structure Explained

User-Side Fees

Customers paid delivery fees, small service charges, and sometimes surge fees during peak demand.

Provider-Side Fees

There were no third-party merchant commissions since Gorillas owned the inventory.

Hidden Revenue Layers

Supplier rebates, co-marketing deals, and private-label margin uplift were major hidden profit drivers.

Regional Pricing Variation

Dense cities like Berlin and London had lower delivery fees but higher order frequency, while suburban areas relied on higher basket sizes.

[Table: Complete fee structure by user type]

How Gorillas Maximizes Revenue Per User

Gorillas focused heavily on habit formation and speed psychology.

Customers were segmented by usage patterns such as late-night shoppers, families, and daily essentials buyers. Upselling was driven by bundles, while cross-selling surfaced impulse items at checkout.

Dynamic pricing adjusted delivery fees and promotions in real time. Retention was fueled by lightning-fast fulfillment, which created emotional loyalty rather than price loyalty.

Private-label pricing undercut supermarkets while maintaining strong margins. Frequent users placed 3–4 orders per week, driving high lifetime value.

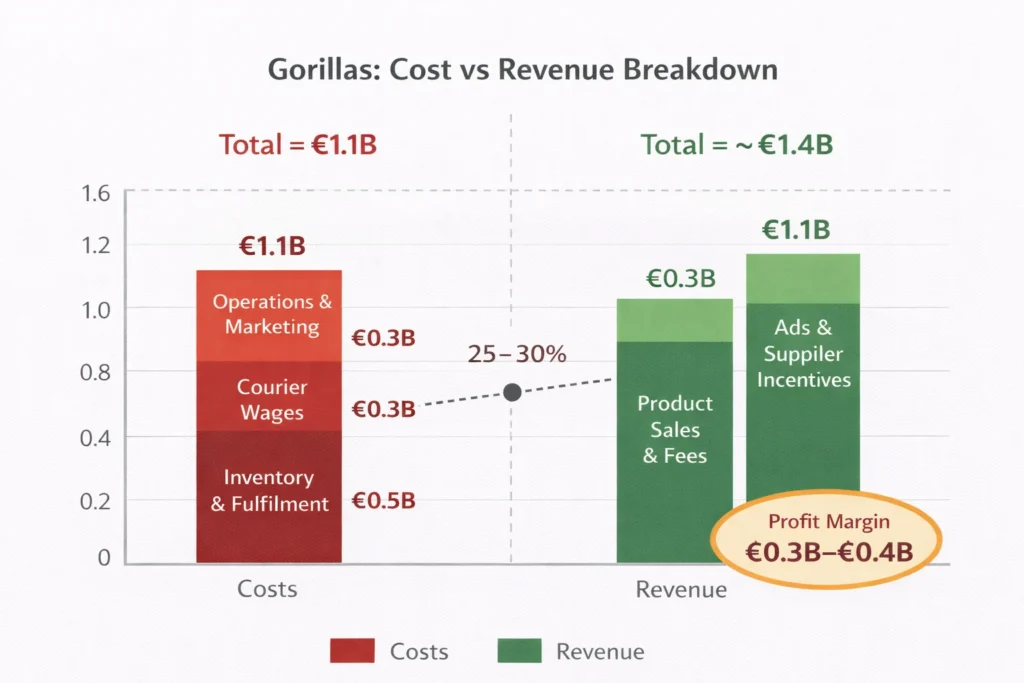

Cost Structure & Profit Margins

Gorillas’ model was capital-intensive but scalable in dense markets.

Major costs included dark-store rent, inventory holding, courier wages, spoilage, and technology infrastructure. Marketing costs were initially high but declined as brand recognition grew.

At scale, Gorillas achieved positive contribution margins per order, especially in dense urban zones. Profitability depended heavily on order density, store throughput, and private-label penetration.

Read More: Best Gorillas Clone Scripts 2025 – Launch a Grocery App Fast

Future Revenue Opportunities & Innovations

Gorillas’ model opened doors to new monetization paths.

Private-label expansion, retail media advertising, and AI-driven demand forecasting were key future levers. B2B grocery delivery, office supplies, and health essentials represented adjacent opportunities.

Between 2025 and 2027, the industry trend favors fewer dark stores with higher throughput, automation, and stronger unit economics.

Risks include labor regulation, inventory waste, and competitive pricing pressure—but opportunities remain strong for focused local players.

Lessons for Entrepreneurs & Your Opportunity

What works:

- Inventory ownership drives margin control

- Speed increases frequency more than discounts

- Dense coverage beats wide expansion

What to replicate:

- Dark-store fulfillment

- High-frequency SKUs

- Private-label strategy

Market gaps exist in Tier-2 cities, campus zones, and specialized vertical quick commerce.

Want to build a platform with Gorillas’ proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Gorillas-style clone solutions come with flexible revenue models you can customize. Some clients see revenue within 30 days of launch if you want it, we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Gorillas proved that speed and inventory ownership can fundamentally redefine grocery economics. By collapsing delivery times and controlling the entire fulfillment stack, it shifted consumer behavior from planned shopping to impulse-driven, high-frequency ordering.

Even as the original company evolved through consolidation, the revenue model itself remains highly influential. Dark stores, inventory-led margins, private labels, and localized density are now standard playbooks across global quick-commerce platforms.

The key insight is not just speed, but operational focus. Gorillas showed that profitability in quick commerce depends on neighborhood-level efficiency, disciplined SKU selection, and repeat usage rather than wide but shallow expansion.

FAQs

1. How much does Gorillas make per order?

Roughly €6–10 in gross margin at scale.

2. What’s Gorillas’ most profitable revenue stream?

Inventory margins combined with private-label products.

3. How does Gorillas’ pricing compare to supermarkets?

Slightly higher, justified by instant delivery.

4. Does Gorillas take commissions from sellers?

No, it owns and sells inventory directly.

5. How has Gorillas’ revenue model evolved?

From growth-first to margin-focused optimization.

6. Can startups replicate this model?

Yes, in dense local markets.

7. What’s the minimum scale for profitability?

High order density per dark store.

8. How can founders implement this model?

Combine dark stores, private labels, and fast delivery.

9. What are alternatives to Gorillas’ model?

Marketplace grocery delivery or hybrid models.

10. How quickly can similar platforms monetize?

Many begin generating revenue within weeks of launch.