Plaid began as a small fintech API startup that solved one of the industry’s biggest challenges — connecting apps with users’ bank accounts securely and instantly. Today, Plaid powers thousands of global fintech apps, from digital wallets to neobanks to investment platforms. With financial data sharing becoming essential, Plaid now processes billions of API calls across 12,000+ financial institutions.

In 2026, open banking and financial data aggregation are projected to exceed $60B in market value, giving founders massive opportunity to build data-driven fintech solutions. Whether it’s personal finance apps, digital lending platforms, wealth management dashboards, or UPI-enabled tools — Plaid’s model is now a backbone for the modern financial ecosystem.

A Plaid Clone Script empowers entrepreneurs to launch an open banking connectivity layer with secure APIs, bank integrations, real-time transaction insights, identity verification, and financial analytics. With Miracuves Clone Solutions, founders get a compliant, scalable, and high-security infrastructure built for global fintech operations.

What Makes a Great Plaid Clone?

A world-class Plaid Clone in 2026 must deliver secure financial data connectivity, bank-level compliance, and real-time API performance. Plaid succeeded because it solved a fundamental pain point: giving fintech apps instant access to user bank accounts without compromising security or user trust.

To match this reliability, your Plaid Clone must integrate strong encryption, multi-bank compatibility, high uptime, and an API architecture capable of handling large volumes of sensitive financial data. The system must be fast, accurate, and compliant with global data standards such as PSD2, GDPR, and RBI norms.

Core Elements of a Great Plaid Clone in 2026

- API-first architecture enabling plug-and-play bank connectivity

- <300ms response time for real-time financial data calls

- 99.9% uptime to support uninterrupted app operations

- Bank-grade security including AES 256 encryption and tokenization

- Strong identity verification (KYC, KYB, PAN/Aadhaar verification)

- Secure OAuth flows for consent-driven data sharing

- Multibank integration compatibility

- Accurate transaction categorization & analytics

- Robust sandbox mode for developers

Modern Features Every Plaid Clone Must Include

- Instant account authentication

- Balance checks and verification

- Transaction history sync

- Income verification APIs

- Recurring payment insights

- Fraud detection and anomaly alerts

- AI-based transaction categorization

- Webhook event notifications

- Global open banking support

Comparison Table: Traditional Bank APIs vs Modern Plaid Clone (2026)

| Feature | Traditional Bank APIs | Modern Plaid Clone (2026) |

|---|---|---|

| Integration | Slow, inconsistent | Unified plug-and-play APIs |

| Response Time | 1–3 seconds | <300ms |

| Authentication | Basic | OAuth, tokenization |

| Data Accuracy | Limited | AI-based categorization |

| Uptime | 90–95% | 99.9% |

| Developer Tools | Minimal | SDKs, sandbox, docs |

| Compliance | Basic | PSD2, GDPR, RBI-ready |

Essential Features Every Plaid Clone Script Must Have

A Plaid Clone is not just an API layer — it is the backbone of modern fintech applications. Whether powering digital wallets, lending apps, wealth tech platforms, or personal finance tools, your system must provide instant, secure, and accurate financial data connectivity.

Founders building a Plaid-style solution must ensure that every component — from account authentication to transaction categorization — is engineered for speed, accuracy, and compliance. Below is the complete feature architecture required for a 2026-ready Plaid Clone.

User-Side Features

Users expect fast, secure, and transparent bank connection workflows.

- Seamless bank login via secure OAuth

- Biometric consent approval

- Clear data permission screens

- Instant authentication without failures

- Secure session handling

Developer & App Integration Capabilities

A Plaid Clone must be developer-friendly to encourage integration across fintech platforms.

- SDKs for Android, iOS, Web, and backend languages

- Sandbox environment for test integrations

- Clear API documentation

- Webhooks for real-time notifications

- Tokenized access for secure operations

Admin Panel (Platform Intelligence Layer)

The admin panel powers compliance, monitoring, and performance.

- Bank integration management

- API health monitoring

- Transaction logs & audit trails

- Suspicious activity alerts

- Developer onboarding tools

- API key management

- Compliance configuration (KYC/KYB rules)

Data Intelligence Features

These features turn raw bank data into high-value insights.

- Transaction categorization with AI/ML

- Recurring payment detection

- Cash flow analysis

- Income verification & affordability scoring

- Expense segmentation dashboards

Advanced 2026 Features

- AI-driven anomaly detection for fraud

- Predictive analytics for lending & wealth management apps

- Cross-border open banking connectivity

- Blockchain-based audit logs for immutable compliance

- Smart webhook triggers for real-time financial events

Technical Architecture Requirements

To match Plaid’s performance standard, your platform must be built on modern, high-speed architecture.

- Microservices-based backend

- Auto-scaling cloud infrastructure

- AES-256 encryption + tokenization

- Secure OAuth 2.0 authorization

- <300ms API response average

- Redundant failover systems

- Global CDN distribution for API speed

Feature Comparison: Basic vs Professional vs Enterprise

| Version | API Features | Intelligence | Compliance | Best For |

|---|---|---|---|---|

| Basic | Account auth, balance check | Limited | Standard | MVP startups |

| Professional | Transactions, income API, categorization | Analytics | Strong | Fintech scale-ups |

| Enterprise | Global open banking, AI scoring, fraud detection | Predictive insights | Bank-grade | Large fintechs & banks |

How Miracuves Implements These Features

Miracuves builds enterprise-grade Plaid Clones optimized for:

- Bank-level security and encrypted communication

- Instant authentication and real-time data sync

- API-first microservices architecture

- Developer-friendly SDKs and tools

- AI-layered financial intelligence

- Regulatory compliance across regions

- Scalable foundation for global fintech apps

Cost Factors & Pricing Breakdown

Plaid-Like Financial Data & Banking API Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Financial Data API MVP | Bank account linking, transaction data access, basic authentication flows, webhook support, and a simple admin panel. | $80,000 |

| 2. Mid-Level Banking Data Platform | Multi-bank connectivity, real-time balance & transaction sync, enrichment logic, developer dashboards, and analytics. | $180,000 |

| 3. Advanced Plaid-Level Platform | Global bank integrations, identity verification, income & asset verification APIs, risk signals, compliance automation, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a secure, API-first financial data platform similar to Plaid, trusted by fintech apps for bank connectivity and user-permissioned data access.

Miracuves Pricing for a Plaid-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete financial data infrastructure with secure bank-linking flows, transaction and balance APIs, webhook-based sync, permissioned data access, compliance-ready architecture, and a centralized admin dashboard — built for scalable fintech integrations.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, developer dashboard integration, and deployment assistance — allowing you to launch a fully branded Plaid-style data platform under your own ownership.

Launch Your Plaid-Style Financial Data Platform — Contact Us Today

Delivery Timeline for a Plaid-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Number of supported banks and regions

- Data types (transactions, identity, income, assets)

- Real-time sync and webhook complexity

- Compliance, consent, and security requirements

- Developer tooling and documentation depth

- Branding and UI/UX customization

Tech Stack

Built using a JS-based architecture, ideal for financial data and API platforms that require secure connectivity, scalable microservices, real-time synchronization, developer-first tooling, and enterprise-level reliability.

Customization & White-Label Option

Building a Plaid-style financial data connectivity and API infrastructure isn’t just about linking bank accounts — it’s about creating a secure, compliant, developer-friendly ecosystem that allows apps to access financial data, verify accounts, initiate payments, and build intelligent financial products. A platform inspired by Plaid must excel in data accuracy, API reliability, bank integrations, authentication flows, and strong security protocols while remaining simple for both developers and end users.

Miracuves delivers a fully white-label Plaid-style solution that can be customized for fintech startups, neobanks, lending platforms, budgeting apps, wealth-tech systems, accounting tools, and enterprise financial applications. You gain complete control over data permissions, bank integrations, API structure, UX flows, and compliance requirements.

Why Customization Matters

Open banking and financial APIs differ significantly across:

- Regions (Open Banking U.K., PSD2 Europe, India Account Aggregator, U.S. aggregator-based model)

- Bank connectivity methods (APIs vs. screen scraping in some markets)

- Data access levels (balances, transactions, statements, accounts)

- Compliance frameworks (GDPR, SOC2, PCI, RBI-AA, etc.)

- Use cases (lending, KYC, verification, analytics, payments)

Customization ensures your platform fits your region, your ecosystem, and your developer needs, not a rigid API setup.

What You Can Customize

1. Bank Integrations & Connectivity

- Direct API integrations with banks

- Aggregator-based fallback methods

- Multi-country connectivity

- Tiered access (basic info, balances, transactions, statements)

- Custom polling frequency or webhook updates

2. Authentication & Consent Flows

- OAuth-based secure login

- One-tap session re-authentication

- User-permissioned access screens

- Custom branding for all consent windows

- Region-specific consent templates

3. Financial Data Models

- Account details (savings, checking, loan, credit card)

- Transaction categorization & enrichment

- Income detection

- Cash-flow analytics

- Bank statement parsing

- AI-assisted data cleaning and anomaly detection

4. Verification & Risk Modules

- Bank account ownership verification

- Micro-deposit verification

- Real-time account balance checks

- Risk scoring for lenders

- Identity linking (KYC + bank data)

5. Payment Initiation (Region-Dependent)

- Instant account-to-account transfers

- UPI/ACH/SEPA payment initiation

- Smart retry logic

- Mandate management

- Refunds & reversal handling

6. Developer Tools & Documentation

- REST API layer with detailed endpoints

- Sandbox testing environments

- Webhooks for event notifications

- SDKs for iOS, Android, Web

- API analytics dashboard

- Custom usage limits and pricing tiers

7. Security & Compliance

- End-to-end encryption

- OAuth 2.0 tokenization

- Zero-knowledge data design (optional)

- Data residency for regulated markets

- Audit logs and breach-prevention systems

- SOC2/GDPR/PCI preparations (region-dependent)

8. Dashboards & Internal Tools

- Admin dashboard for managing partners

- Developer account control panel

- User consent logs

- App performance tracking (API latency, uptime, errors)

- Billing & usage analytics

9. Monetization & Partner Programs

- Tiered API pricing

- Pay-per-call or subscription-based models

- Revenue-sharing for partner apps

- Enterprise licensing

How Miracuves Handles Customization

- Requirement Mapping

Define your region, compliance model, fintech use-cases, and integration targets. - Architecture Planning

Modular framework covering: connectivity → data models → verification → payments → dashboards → webhooks. - Design & Development

UX branding, API structuring, consent flows, developer tools, data pipelines, and custom integrations. - Testing & QA

Latency testing, data-accuracy validation, load testing, security audits, and regulatory readiness checks. - Deployment

A fully white-labeled financial data-connectivity platform is deployed with your domain, branding, and partner onboarding.

Real Examples from the Miracuves Portfolio

Miracuves has delivered 600+ fintech and data-driven systems, including:

- Bank-account verification APIs

- Financial data aggregation engines

- Lending & risk-scoring platforms

- Payment-initiation modules

- Developer-focused fintech APIs

- White-label financial data and analytics ecosystems

These implementations demonstrate how a Plaid-style platform can be transformed into a secure, compliant, and developer-ready financial infrastructure under your brand.

Launch Strategy & Market Entry

Launching a Plaid-style financial connectivity platform demands a highly structured approach, because your system becomes the underlying infrastructure for hundreds of fintech applications. A successful launch focuses on compliance approvals, robust API performance, developer onboarding, bank integrations, and early partnerships with fintech startups that rely on secure financial data access.

Pre-Launch Checklist

Before going live, ensure your entire connectivity ecosystem is validated end-to-end:

- API performance tests under high load

- Bank integration stability checks

- KYC/KYB verification flows

- Secure OAuth & consent screens

- Sandbox environment setup for developers

- Full security audit and penetration testing

- Documentation + SDK preparation

- Developer onboarding workflow setup

- App Store & Play Store publishing (if mobile components exist)

Market Entry Strategy by Region

India

- Focus on UPI, net banking, and Aadhaar-based verification

- Target neobanks, personal finance apps, and credit-line startups

- Partner with lending apps for income & transaction insights

United States

- Emphasize ACH connectivity, identity verification, and bank login APIs

- Target wealth-tech, budgeting apps, payroll apps, and lending platforms

Europe

- Comply with PSD2 SCA, GDPR, and open banking directives

- Connect with multi-country banks and micro-transaction fintechs

Middle East

- Integrate mobile wallets and bank APIs

- Provide KYB support for fintech merchants and SME platforms

User & Developer Acquisition Frameworks

A Plaid Clone grows fastest when developers adopt it early.

- Offer a free-tier developer plan

- Launch API documentation pages and tutorials

- Create partnerships with early-stage fintechs

- Provide integration assistance for the first 100 developers

- Publish case studies and sample apps demonstrating usage

- Use LinkedIn + Product Hunt campaigns to attract startups

Monetization Models Proven in 2026

- Per-API call usage billing

- Monthly developer subscription tiers

- Income verification API charges

- Bank account linking fees

- Insights as a service (analyzed financial data)

- White-label custom integrations for banks & enterprises

Miracuves’ End-to-End Launch Support

Miracuves provides complete launch assistance, ensuring your open banking platform enters the market securely and at full scale:

- Complete server and cloud deployment

- Bank API integrations with monitoring

- Documentation + SDK creation

- Developer sandbox setup

- Real-time performance monitoring for 90 days

- Compliance alignment for your region

- Scalability planning for 10K → 1M+ API requests per day

With this foundation, founders launch with confidence, ensuring their Plaid Clone is reliable, fast, compliant, and trusted by fintech developers from day one.

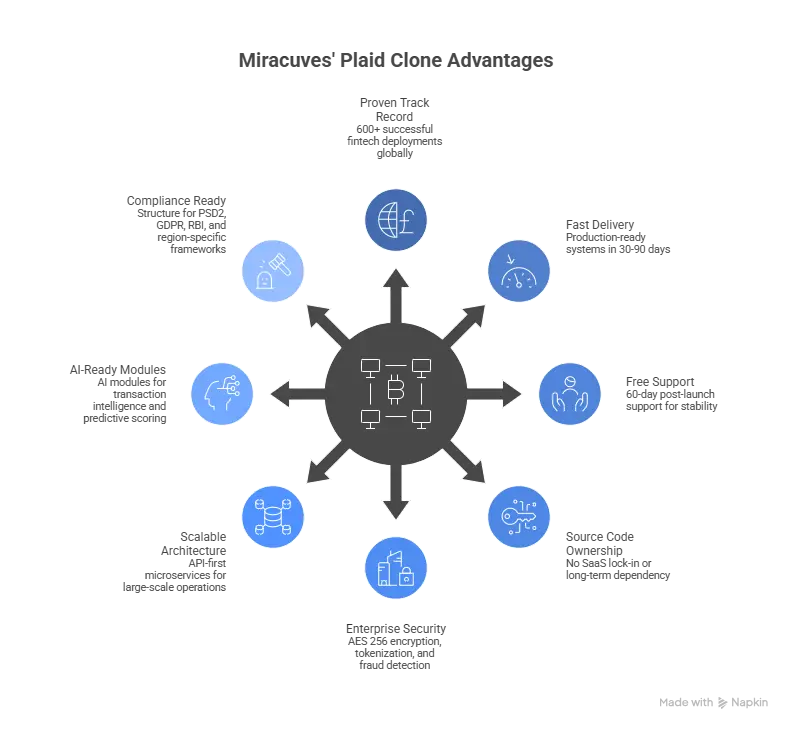

Why Choose Miracuves for Your Plaid Clone

Building a Plaid-style financial connectivity platform requires deep technical expertise, regulatory understanding, and mastery over secure API ecosystems. Most development teams can build apps — but very few can build infrastructure that other fintech apps depend on. This is exactly where Miracuves stands apart.

Miracuves specializes in high-performance, API-first fintech systems engineered for scale, security, and compliance. With a proven track record across banking, lending, payments, wealth management, and digital wallets, Miracuves delivers a Plaid Clone that’s not experimental — it’s production-ready from day one.

Miracuves’ Core Strengths

- 600+ successful fintech deployments across global markets

- 30–90 days delivery timeline for full, production-grade Plaid Clone systems

- Free 60-day post-launch support for optimization and stability

- Full source-code ownership, ensuring no SaaS lock-in or long-term dependency

- Enterprise-grade security including AES 256 encryption, tokenization, secure OAuth, and fraud detection

- API-first microservices architecture for large-scale fintech operations

- AI-ready modules for transaction intelligence, cash flow analysis, and predictive scoring

- Compliance-ready structure for PSD2, GDPR, RBI, and region-specific frameworks

Success Stories

- A digital lending platform integrated Miracuves’ Plaid Clone to approve 70% faster loan applications through real-time bank data sync.

- A budgeting app processed over 5 million monthly transactions with zero downtime using Miracuves’ high-availability architecture.

- A neobank expanded across three regions using Miracuves’ open banking engine, scaling to 200K+ users in months.

Miracuves combines speed, reliability, and enterprise-level engineering to help founders build open-banking infrastructure that developers trust and users rely on.

Final Thought

A Plaid-style platform is more than an API service — it’s the foundation that powers the next generation of fintech apps. When entrepreneurs understand Plaid’s open banking model and combine it with Miracuves’ engineering depth, they gain the ability to launch a secure, compliant, and high-performance financial connectivity layer in record time.

In the 2026 fintech landscape, the most successful platforms will be those that provide seamless bank integrations, real-time financial intelligence, and developer-friendly APIs. Miracuves ensures your Plaid Clone is built for long-term scale, enterprise security, and fast adoption, enabling your business to become an essential part of the global open banking ecosystem.

Ready to launch your Plaid Clone? Get a free consultation and a complete project roadmap from Miracuves — trusted by 200+ global fintech founders.

FAQs

How quickly can Miracuves deploy my Plaid Clone?

Miracuves can deliver a fully production-ready Plaid Clone within 30–90 days, depending on the API modules, compliance setups, and level of customization required.

What’s included in the Miracuves Plaid Clone package?

You receive a complete open-banking connectivity system with account authentication, balance checks, transactions API, income verification, admin dashboard, developer portal, SDKs, sandbox environment, and full API documentation.

Do I get full source-code ownership?

Yes, Miracuves provides complete source-code ownership so you have long-term control of the platform without any SaaS subscriptions or vendor lock-ins.

How does Miracuves ensure security for a Plaid-style platform?

Security is ensured through AES-256 encryption, tokenization, secure OAuth flows, multi-layer authentication, real-time monitoring, and compliance-aligned data handling.

Can Miracuves integrate region-specific banking APIs?

Yes, Miracuves supports Indian net banking, UPI layers, PSD2-compliant EU APIs, US ACH connectivity, Middle-East fintech APIs, and custom regional integrations.

Does Miracuves assist with developer onboarding tools?

Yes, you get a fully branded developer portal, sandbox testing environment, API keys management system, and integration guides to help fintech developers onboard quickly.

Is post-launch maintenance included?

Miracuves includes 60 days of free post-launch support covering performance tuning, issue resolution, monitoring, and compliance adjustments.

Can the data categorization and intelligence engine be customized?

Yes, AI-based transaction categorization, cash-flow analytics, recurring payment detection, and predictive insights can be tailored to your use case.

What is the upgrade and scaling policy?

You can add new APIs, global bank connections, AI modules, fraud detection layers, or developer features anytime, with scalable microservices supporting millions of API requests.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wealthfront Clone Scripts 2025: Launch Your Automated Investing Platform Faster

- Best Afterpay Clone Scripts 2026: Launch a Powerful BNPL App for Your Fintech Startup

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Groww Clone Scripts 2026: Launch a Powerful Investment & Trading Platform Fast

- Best Acorns Clone Scripts 2025 – Launch Your Micro-Investing App Fast