In 2025, Flippa stands as one of the world’s largest marketplaces for buying and selling online businesses, websites, apps, domains, and digital assets, supported by a global buyer network, data-driven valuation tools, and transaction infrastructure that enables deals to close across borders, currencies, and business models at scale.

With the rise of micro-SaaS, content sites, eCommerce stores, and AI-driven digital products, Flippa has positioned itself at the center of the digital asset economy by offering curated listings, built-in due diligence, escrow protection, and performance analytics that reduce risk and increase deal velocity for both buyers and sellers.

For founders, Flippa’s model offers powerful lessons in marketplace monetization, trust-layer engineering, and scalable fee design. The real advantage lies in tiered pricing, success-based commissions, verification systems, and lifecycle monetization strategies that turn one-time transactions into long-term platform relationships.

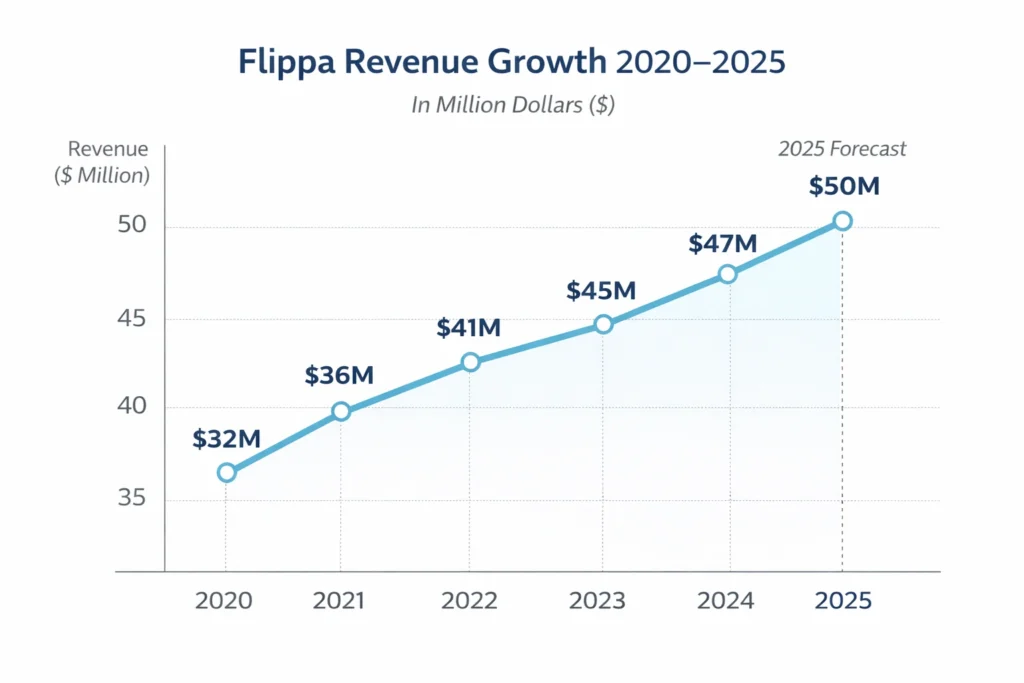

Flippa Revenue Overview – The Big Picture

- 2025 Revenue: ~$45–50 million (estimated from filings, investor reports, and marketplace volume)

- Valuation: ~$200–250 million (private market estimates)

- YoY Growth: ~18–22%

- Revenue by Region:

- North America: ~45%

- Europe: ~30%

- Asia-Pacific & others: ~25%

- Average Gross Margin: ~70%

- Net Profit Margin: ~18–22%

- Competition Benchmark:

- Empire Flippers: Higher ticket size, curated listings

- MicroAcquire: Lower fees, founder-focused SaaS exits

Read More: What Is Flippa App? How It Works for Buying & Selling Online Assets

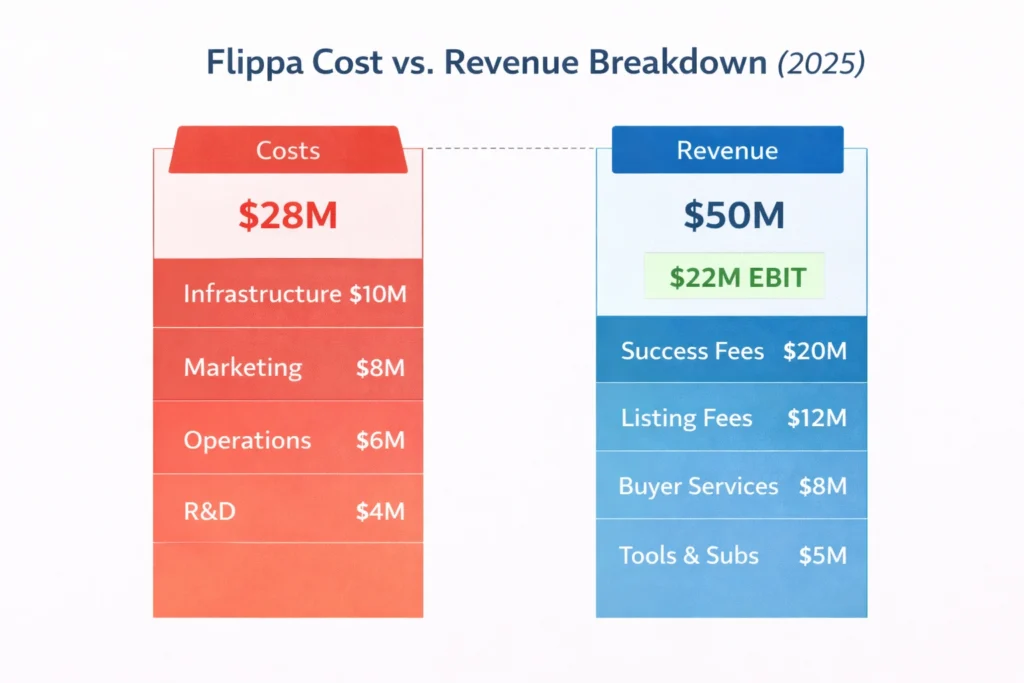

Primary Revenue Streams Deep Dive

Revenue Stream #1: Seller Listing Fees (≈25%)

Sellers pay upfront fees to list assets on the platform.

- How it works: Tiered listing packages

- Pricing (2025): $49–$499 per listing

- Value: Immediate cash flow regardless of sale outcome

Revenue Stream #2: Success Fees / Commission (≈40%)

Flippa takes a percentage when a deal closes.

- Commission range: 5%–15% depending on deal size

- Highest contributor to total revenue

Revenue Stream #3: Buyer Premium Services (≈15%)

Optional tools for buyers.

- Due diligence reports

- Deal sourcing & advisory

- Legal & escrow facilitation

Revenue Stream #4: Featured Listings & Promotions (≈10%)

Sellers pay for higher visibility.

- Homepage placement

- Email promotions

- Category boosts

Revenue Stream #5: Data, Valuation & SaaS Tools (≈10%)

Subscriptions for valuation tools, analytics, and deal insights.

Revenue Streams Percentage Breakdown

| Revenue Source | % Share |

|---|---|

| Success Fees | 40% |

| Listing Fees | 25% |

| Buyer Services | 15% |

| Featured Listings | 10% |

| Tools & Subscriptions | 10% |

The Fee Structure Explained

User-Side Fees

- Listing fees (sellers)

- Success commissions

- Optional premium services

Provider-Side Fees

- Third-party escrow

- Legal & verification partners

Hidden Revenue Layers

- Payment processing margins

- Upsell conversion funnels

- Data-driven pricing tiers

Regional Pricing Variation

- USD-based pricing globally

- Higher-value markets see higher average commissions

Complete Fee Structure by User Type

| User Type | Fees Paid |

|---|---|

| Seller | Listing + success fee |

| Buyer | Optional advisory & tools |

| Enterprise seller | Custom commission |

How Flippa Maximizes Revenue Per User

- Segmentation: Hobby founders, SaaS builders, agencies, investors

- Upselling: Featured listings, verification badges

- Cross-selling: Due diligence + escrow bundles

- Dynamic pricing: Higher fees for larger exits

- Retention monetization: Repeat sellers & buyers

- LTV optimization: Seller lifecycle monetization

- Psychological pricing: Low entry listing → high success fee

Example: A $100 listing often converts into $2,500–$10,000 in success fees.

Cost Structure & Profit Margins

- Infrastructure: Marketplace platform, analytics, hosting

- CAC & Marketing: Paid acquisition, partnerships, SEO

- Operations: Trust & safety, deal support teams

- R&D: Valuation algorithms, fraud detection

- Unit economics: Extremely low marginal cost per listing

- Margin optimization: Automation & data leverage

- Profitability path: Scale volume, not headcount

Read More: Best Flippa Clone Scripts– Build Your Digital Asset Marketplace

Future Revenue Opportunities & Innovations

- AI-powered business valuation engines

- SaaS-only curated exits

- Subscription-based buyer access

- Embedded financing for acquisitions

- Secondary market for revenue shares

Risks & Threats

- Fraud & misrepresentation

- Regulatory scrutiny

- Competition from niche marketplaces

Opportunities for New Founders

- Vertical-specific asset marketplaces

- Regional digital business exchanges

- Faster escrow & compliance layers

Lessons for Entrepreneurs & Your Opportunity

What works

- Trust-first marketplace design

- High-margin success fees

- Data-backed pricing

What to replicate

- Tiered monetization

- Seller-first onboarding

- Strong verification layers

Market gaps

- Faster deal closure

- Transparent valuation models

- Industry-specific exits

Want to build a platform with Flippa’s proven revenue model?

Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Flippa-style marketplace clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 3–9 days.

if you want it we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Flippa proves that digital assets are a repeatable, scalable market when supported by standardized listing frameworks, transparent valuation benchmarks, and global distribution of buyers and capital. By turning unique businesses into comparable, tradable assets, the platform creates liquidity and predictability in an otherwise fragmented market.

Its strength lies in combining trust, data, and transactional leverage. Through verification systems, escrow-backed payments, performance analytics, and algorithm-driven deal matching, Flippa reduces friction, increases close rates, and maximizes revenue per transaction for both the platform and its users.

For founders, the opportunity is clear: niche marketplaces can outperform general ones when they offer deeper industry insights, faster deal cycles, specialized buyer pools, and tailored monetization models—creating defensible platforms that command higher fees and stronger long-term loyalty.

FAQs

1. How much does Flippa make per transaction?

Anywhere from a few hundred dollars to over $100,000 on large exits.

2. What’s Flippa’s most profitable revenue stream?

Success-based commissions.

3. How does Flippa’s pricing compare to competitors?

Higher than DIY platforms, lower than fully brokered exits.

4. What percentage does Flippa take from sellers?

Typically 5%–15% depending on deal size.

5. How has Flippa’s revenue model evolved?

From listings-only to data, tools, and advisory services.

6. Can small platforms use similar models?

Yes, especially in niche verticals.

7. What’s the minimum scale for profitability?

A few hundred successful transactions annually.

8. How to implement similar revenue models?

Start with listing fees, then layer success fees.

9. What are alternatives to Flippa’s model?

Broker-led exits or subscription-only marketplaces.

10. How quickly can similar platforms monetize?

Often within the first 30–60 days after launch.