IKEA didn’t become a global furniture giant just by selling affordable sofas. It scaled by building a smart system that combines cost efficiency, self-service shopping, and lifestyle-driven branding. In 2026, the business model of IKEA is still one of the strongest examples of how operational design can create mass-market loyalty.

At its core, IKEA delivers value through flat-pack innovation, modular product design, and a high-volume retail engine that keeps prices accessible without compromising on style. Customers get functional, modern home solutions, while IKEA benefits from predictable demand, streamlined logistics, and strong control over product margins.

What makes IKEA’s model powerful today is how it adapts to changing consumer behavior. With more people prioritizing compact living, sustainability, and fast delivery, IKEA is evolving beyond big-box stores into omnichannel experiences—blending showrooms, ecommerce, and last-mile fulfillment to stay competitive and scalable worldwide.

How the IKEA Business Model Works

The IKEA business model works like a highly engineered ecosystem where design, pricing, logistics, and customer behavior are connected into one repeatable system. IKEA doesn’t just sell furniture—it sells affordable lifestyle solutions at massive scale by controlling everything from product design to distribution.

Type of Business Model

IKEA runs a hybrid retail model, combining:

- Direct-to-consumer (D2C) retail (stores + online)

- Self-service + self-assembly model

- Omnichannel commerce (click & collect, delivery, city stores)

Value Proposition (Who Gets What?)

IKEA creates value for multiple segments:

1) Customers (Home buyers, renters, families)

- Affordable, stylish, functional furniture

- Modular products for small spaces

- Easy availability across categories (furniture, décor, kitchen, storage)

2) Suppliers & Manufacturers

- Long-term bulk purchase contracts

- Stable demand forecasting

- Process optimization through standard designs

3) Logistics & Delivery Partners

- High-volume fulfillment opportunities

- Efficient packaging and predictable shipments

Key Stakeholders in the IKEA Ecosystem

- Customers (buyers + repeat shoppers)

- Product designers & category teams

- Global suppliers and factories

- Warehousing and distribution hubs

- Store operations teams

- Delivery + installation service partners

How the Model Evolved Over Time

IKEA’s model evolved in major stages:

- Phase 1: Large warehouse-style stores + flat-pack dominance

- Phase 2: Expansion into home accessories + impulse categories

- Phase 3 : Omnichannel growth through:

- smaller city stores

- faster delivery models

- app-based shopping journeys

- sustainability-led product innovation

- smaller city stores

Why It Works in 2026

In 2026, IKEA wins because:

- Consumers want value + design, not luxury pricing

- Small homes need space-saving modular furniture

- Flat-pack keeps shipping and storage costs low

- Omnichannel makes IKEA reachable without needing a big store visit

- Sustainability focus strengthens brand trust and long-term retention

Target Market & Customer Segmentation Strategy

IKEA’s growth isn’t only about low pricing—it’s about understanding why people buy furniture at different life stages. The IKEA strategy is built around serving customers who want a better-looking home without paying premium designer prices. In 2026, this focus is even stronger because buyers expect affordability, fast delivery, and modern aesthetics together.

Primary Customer Segments

1) Urban renters & young professionals

- Need compact, modular, easy-to-move furniture

- Prefer minimal, modern design

- High repeat purchases (storage, décor, upgrades)

2) Middle-income families

- Buy in bulk (beds, sofas, dining, kids furniture)

- Value durability + budget control

- Strong seasonal buying behavior (festivals, home upgrades)

3) First-time home buyers

- Want complete home setup in one place

- Prefer bundles, room sets, and guided inspiration

- High order value during “new home” stage

Secondary Customer Segments

- Students and shared-living customers

- Small offices and startups

- Interior designers looking for affordable basics

Customer Journey (Discovery → Conversion → Retention)

- Discovery: Social media inspiration, search, store visits, catalogs

- Conversion: Room displays, price transparency, easy checkout

- Retention: Repeat décor buys, seasonal refresh cycles, loyalty programs

Acquisition Channels & LTV Optimization

- SEO + Google Shopping + product searches

- In-store experience + impulse add-ons

- App + email offers + personalized recommendations

- Cross-selling through “complete the room” bundles

Market Positioning & Competitive Edge

IKEA positions itself as “design for everyone”—affordable, reliable, and trend-aware. Its biggest advantage is the combination of global scale + efficient operations + brand trust, which makes it hard for local furniture brands to match both price and consistency.

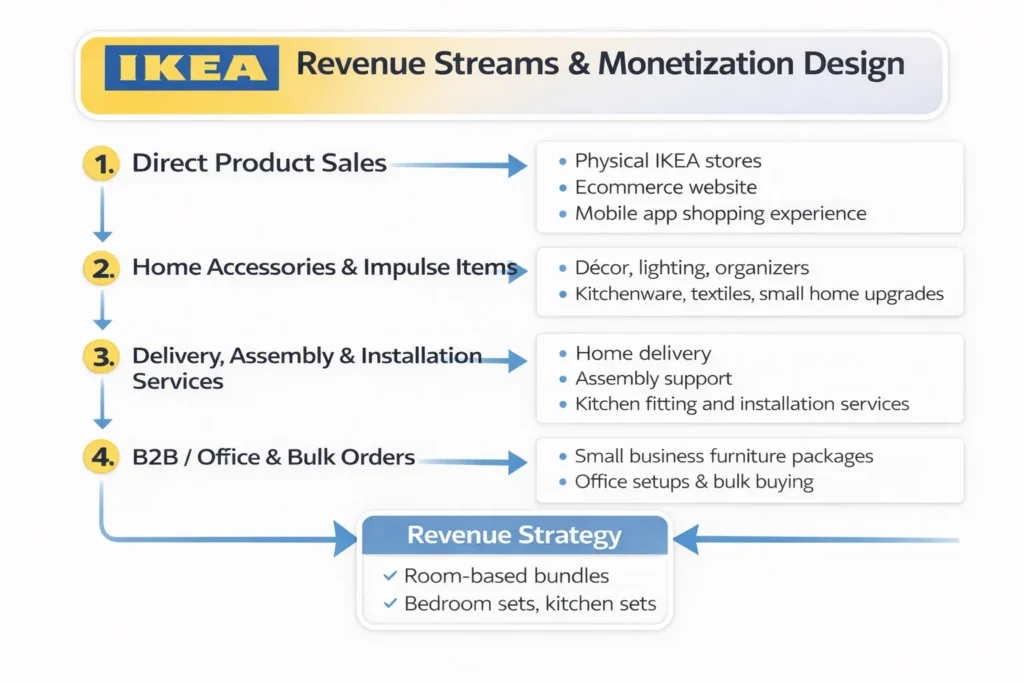

Revenue Streams and Monetization Design

Once you understand who IKEA serves, the next question becomes clear: how does IKEA actually make money—and why is its revenue model so stable?

The IKEA revenue model is built on high-volume product sales, smart margin control, and repeat-purchase categories that keep customers coming back. Instead of relying on one income source, IKEA earns across furniture, home essentials, services, and add-on purchases.

Primary Revenue Stream 1: Direct Product Sales (Core Engine)

Mechanism

IKEA earns most of its revenue by selling products directly through:

- physical IKEA stores

- ecommerce website

- mobile app shopping experience

Pricing Model (2026)

- affordable-to-mid pricing for mass market

- room-based bundles (bedroom sets, kitchen sets, storage combos)

- seasonal offers without heavy discount dependency

Revenue Contribution

- largest revenue driver

- strong profit stability due to private-label and exclusive designs

Growth Trajectory

- higher focus on modular furniture for urban living

- more “complete room” bundles to increase average order value

- improved online discovery to boost conversions

Secondary Revenue Stream 2: Home Accessories & Impulse Categories

Mechanism

Customers add high-margin items like:

- décor, lighting, organizers

- kitchenware, textiles, small home upgrades

Why it matters

- increases cart value

- improves repeat purchase frequency

Secondary Revenue Stream 3: Delivery, Assembly & Installation Services

Mechanism

IKEA monetizes convenience through:

- home delivery

- assembly support

- kitchen fitting and installation services

Why it matters (2026)

As more customers shop online, service revenue grows alongside product sales.

Secondary Revenue Stream 4: B2B / Office & Bulk Orders

Mechanism

IKEA also earns from:

- small business furniture packages

- office setups and bulk buying

Overall Monetization Strategy (How It All Connects)

IKEA’s monetization works because each stream supports the other:

- furniture drives the big purchase

- accessories raise margins

- services reduce friction and increase conversions

- bundles and room sets increase customer lifetime value

This layered structure makes IKEA resilient, scalable, and profitable even during price-sensitive market cycles.

Operational Model & Key Activities

IKEA’s success isn’t only about design—it’s about running one of the most efficient retail machines in the world. The IKEA operational model is built to reduce costs at every step, from product development to delivery. In 2026, this matters even more because customers expect affordable pricing, fast fulfillment, and consistent quality across regions.

Core Operations (What IKEA Runs Daily)

IKEA’s key activities include:

- Product design & standardization (modular, flat-pack friendly)

- Supplier coordination & bulk manufacturing

- Inventory planning & warehouse management

- Store operations (self-service layout + experience zones)

- Ecommerce operations (online catalog, checkout, support)

- Quality control & returns handling

- Customer support + service scheduling (delivery/assembly)

Platform + Retail Execution

IKEA blends physical + digital operations through:

- real-time stock visibility

- click-and-collect systems

- delivery slot planning

- customer journey optimization across app and store

Resource Allocation (How IKEA Invests)

In 2026, IKEA typically prioritizes:

- Tech & digital upgrades: improving online experience and fulfillment tracking

- Logistics expansion: faster delivery hubs and regional distribution

- Store formats: large stores + smaller city outlets

- Sustainability R&D: recyclable materials and energy-efficient production

- Customer experience: room displays, guided shopping, service improvements

Why This Operational Model Wins

IKEA stays competitive because it controls:

- cost per unit through scale

- shipping efficiency through flat-pack design

- customer conversion through store experience + room inspiration

- repeat buying through high-utility categories and accessories

Strategic Partnerships & Ecosystem Development

IKEA doesn’t scale globally by working alone. Its ecosystem is built on long-term partnerships that strengthen supply stability, reduce operational risk, and improve customer experience. In 2026, the IKEA partnership strategy is focused on speed, sustainability, and omnichannel convenience—because modern customers want affordable furniture and reliable delivery.

Collaboration Philosophy

IKEA partners with organizations that help it:

- lower costs without lowering quality

- expand into new markets faster

- improve delivery and installation efficiency

- innovate in sustainable materials and production

Key Partnership Types

1) Technology & API Partners

- ecommerce infrastructure support

- inventory and warehouse automation

- customer experience tools (recommendations, personalization)

2) Payment & Financing Alliances

- card networks and payment gateways

- buy-now-pay-later and EMI providers

- in-store + online financing integrations

3) Logistics & Last-Mile Delivery Partners

- regional courier and freight partners

- installation and assembly service networks

- reverse logistics for returns and replacements

4) Manufacturing & Supplier Partnerships

- long-term contracts with global factories

- raw material suppliers (wood, textiles, packaging)

- production partners aligned with IKEA’s cost and sustainability goals

5) Regulatory & Expansion Alliances

- local compliance consultants

- real estate and retail infrastructure partners

- sustainability and certification organizations

Ecosystem Strategy (Why It Creates a Moat)

IKEA’s ecosystem builds a strong competitive edge because:

- partners help strengthen network efficiency, not just reach

- supply chain partnerships create cost advantages that are hard to copy

- logistics tie-ups improve delivery speed, increasing conversion

- sustainability alliances build long-term trust and brand preference

Growth Strategy & Scaling Mechanisms

IKEA’s growth is not powered by hype—it’s powered by repeatable systems. The IKEA growth strategy is designed to scale across countries, customer lifestyles, and housing trends without losing its core promise: good design at affordable prices. In 2026, IKEA grows by expanding its omnichannel reach, improving speed-to-home delivery, and increasing customer lifetime value through smart category expansion.

Growth Engines (What Drives Expansion)

1) Organic Brand Pull + Lifestyle Positioning

IKEA benefits from strong word-of-mouth because customers don’t just buy products—they buy an “IKEA home” identity:

- modern, minimalist aesthetics

- affordable upgrades

- functional living solutions

2) Store Experience as a Conversion Engine

Its physical stores act like a live showroom where customers:

- explore room setups

- discover bundles

- make high-ticket decisions confidently

3) Omnichannel Scaling

In 2026, IKEA is scaling faster through:

- ecommerce-first buying journeys

- click-and-collect models

- smaller city stores for accessibility

- faster last-mile delivery expansion

4) Category Expansion for Higher LTV

IKEA increases lifetime value by adding:

- home accessories and essentials

- kitchen solutions and storage systems

- work-from-home furniture

- seasonal collections that trigger repeat buys

Scaling Challenges & How IKEA Solves Them

Challenge 1: Supply chain pressure + global disruptions

Solution: diversified suppliers, better forecasting, regional distribution hubs

Challenge 2: Last-mile delivery complexity

Solution: delivery partnerships + optimized flat-pack packaging + scheduled assembly services

Challenge 3: Competing with online-first furniture brands

Solution: stronger ecommerce experience + faster delivery + improved product discovery

Challenge 4: Sustainability expectations in 2026

Solution: recyclable packaging, responsible sourcing, long-term eco design strategy

Competitive Strategy & Market Defense (2026)

The furniture and home-living market is crowded in 2026—local brands compete on price, premium brands compete on design, and online-first players compete on speed. IKEA stays ahead because it doesn’t win on just one factor. It wins through a rare combination of scale, cost control, brand trust, and repeatable execution.

Key Competitive Advantages

1) Scale + Cost Efficiency

IKEA’s biggest advantage is its global operating scale:

- bulk manufacturing lowers per-unit costs

- standardized designs reduce production complexity

- flat-pack packaging reduces storage and shipping costs

2) Strong Brand Equity + Trust

Customers trust IKEA for:

- predictable quality at a fair price

- modern design that fits most lifestyles

- a consistent experience across regions

3) Switching Barriers Through System Buying

IKEA products often connect into a larger setup:

- modular wardrobes

- kitchen systems

- storage ecosystems

This creates repeat purchases because customers prefer matching expansions.

4) Innovation in Retail Experience

IKEA uses:

- room-based storytelling

- guided customer journeys

- “complete the room” merchandising

to improve conversion and basket size.

5) Data-Driven Omnichannel Strategy

In 2026, IKEA strengthens its defense by improving:

- online product discovery

- inventory visibility

- delivery scheduling and service reliability

Market Defense Tactics (How IKEA Protects Share)

- Pricing discipline: staying affordable without damaging margins

- Fast adaptation: introducing compact living solutions and trending collections

- Store format innovation: large stores + city outlets + pickup points

- Service upgrades: delivery, assembly, and installation to reduce friction

- Supply chain resilience: multi-region sourcing and distribution planning

This is how IKEA stays strong even when competitors try to copy its product styles—because the real advantage is the system behind the products.

Read more : Best IKEA Clone Scripts 2025: Build a Scalable Furniture & Home Decor Marketplace

Lessons for Entrepreneurs & Implementation

If you study IKEA closely, you realize its success isn’t based on furniture alone—it’s based on designing a business system that scales profitably. IKEA proves that in 2026, the strongest brands don’t just sell products or services. They build repeatable ecosystems where cost control, customer experience, and operational efficiency work together.

Key Factors Behind IKEA’s Success

- Design-to-cost thinking: products are designed to be affordable from day one

- Operational simplicity: standardized parts, repeatable manufacturing, predictable supply chain

- High-volume + high-retention categories: furniture brings customers, accessories keep them returning

- Customer participation model: self-service + self-assembly lowers costs without lowering value

- Brand consistency: IKEA delivers the same lifestyle promise globally

Replicable Principles for Startups

Founders can copy IKEA’s core playbook by focusing on:

- building a clear value proposition (affordable + functional + modern)

- creating bundles and add-ons to increase average order value

- designing for logistics efficiency (delivery, packaging, cost control)

- using experience-driven conversion (UI/UX for apps, showroom effect for platforms)

Common Mistakes to Avoid

- competing only on low pricing without operational control

- ignoring retention and relying only on new customer acquisition

- scaling too fast without stable supply chain and support systems

- offering too many options without standardization

Implementation Timeline & Investment Priorities

A practical build plan in 2026 looks like:

- Phase 1: validate demand + build core catalog/service

- Phase 2: optimize operations + improve repeat purchase loops

- Phase 3: scale with partnerships + expand into new regions/categories

Ready to implement IKEA’s proven business model for your market? Miracuves builds scalable platforms with tested business models and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable apps. Get your free business model consultation today.

Conclusion :

IKEA’s business model proves one powerful lesson: real scale doesn’t come from selling more products—it comes from building a system that makes growth easier every year. From flat-pack innovation to standardized design and efficient logistics, IKEA has mastered the balance between affordability and consistency, which is why it continues to win in global markets.

In 2026 and beyond, platform-style thinking is shaping every industry, including retail. The brands that succeed won’t be the ones with the most options—they’ll be the ones with the smartest execution engine, strongest customer trust, and most scalable operations. IKEA shows that when innovation meets discipline, even everyday products can become a billion-dollar ecosystem.

FAQs:

What type of business model does IKEA use?

IKEA uses a hybrid retail business model combining direct-to-consumer sales, large-format stores, ecommerce, and a self-service/self-assembly approach to reduce costs and scale globally.

How does IKEA’s model create value?

IKEA creates value by offering affordable, modern, functional home solutions through smart design, flat-pack packaging, and efficient supply chains that keep pricing accessible.

What are IKEA’s key success factors?

Its biggest success factors are cost-efficient operations, standardized product design, strong brand trust, high-volume sales, and repeat-purchase categories like home accessories.

How scalable is IKEA’s business model?

Very scalable. IKEA can expand into new regions using repeatable store formats, supplier networks, and standardized product systems, supported by omnichannel fulfillment in 2026.

What are the biggest challenges in IKEA’s model?

Key challenges include supply chain disruptions, last-mile delivery complexity, inventory planning, and competition from online-first furniture brands.

How can entrepreneurs adapt IKEA’s model to their region?

Entrepreneurs can adapt it by focusing on local sourcing, compact product designs, bundles, affordable pricing, and strong delivery/installation partnerships.

What are alternatives to this model?

Alternatives include a marketplace furniture model where multiple sellers list products, a subscription/rental commerce model for flexible monthly furniture access, and a D2C single-brand model focused on one category like sofas or mattresses. Another strong option is an on-demand hyperlocal delivery model for faster same-day home essentials.

Related Article :