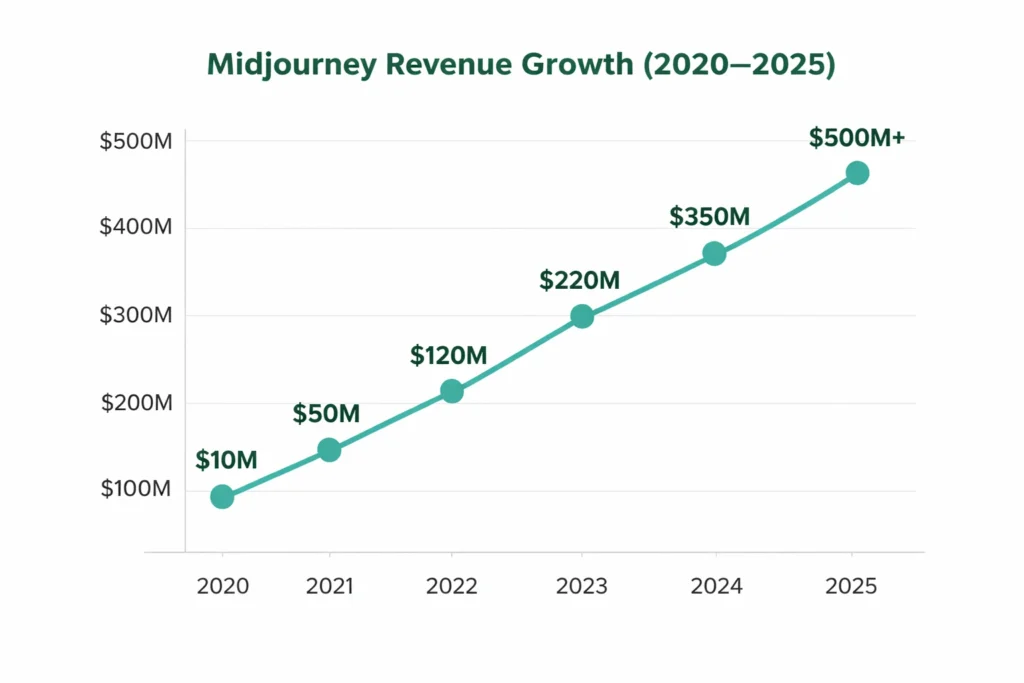

In 2025, Midjourney crossed an estimated $500+ million in annual revenue, proving that generative AI can scale into a high-margin digital business without ads or marketplaces. Its success is driven by a compute-efficient subscription model that converts GPU access and creative tooling into recurring revenue, while premium tiers capture professional and enterprise demand. This structure allows Midjourney to balance rapid user growth with margin optimization, turning infrastructure costs into a competitive advantage rather than a constraint.

What started as a Discord-based art experiment has evolved into one of the most powerful subscription-driven AI platforms in the world, serving creators, agencies, and businesses at global scale. The platform’s tight feedback loop between community, product development, and model upgrades accelerates innovation and keeps engagement high. By embedding collaboration and visibility into its workflow, Midjourney has transformed user activity into organic marketing and continuous product validation.

For founders, Midjourney offers a blueprint for building AI SaaS monetization, premium digital services, and community-powered growth loops that reduce customer acquisition costs. Its model demonstrates how low-friction entry pricing can seed mass adoption, while advanced features, privacy controls, and enterprise access create natural upsell paths. The deeper lesson lies in designing platforms where users don’t just consume value—they actively help shape and scale the product ecosystem.

Midjourney Revenue Overview – The Big Picture

2025 Revenue: ~$500–550 million (estimated from subscriber base, pricing tiers, and usage metrics)

Valuation: ~$5–7 billion (private market estimates based on ARR multiples)

YoY Growth: ~35–45%

Revenue by Region:

- North America: ~38%

- Europe: ~27%

- Asia-Pacific: ~25%

- Rest of World: ~10%

Profit Margins:

- Gross margin: ~70–80% (digital-first, subscription-led model)

- Net margin: Strong but reinvested into compute infrastructure and model R&D

Competition Benchmark:

- DALL·E (OpenAI): Bundled via API & enterprise licensing

- Stability AI: Open-source + enterprise services

- Adobe Firefly: Creative Cloud integration model

Primary Revenue Streams Deep Dive

Revenue Stream #1: Subscription Plans (Core Revenue – ~85%)

Midjourney operates on a monthly and annual subscription model that unlocks fast generation speeds, private mode, higher-quality renders, and commercial usage rights.

Pricing (2025):

- Basic: $10/month

- Standard: $30/month

- Pro: $60/month

- Mega/Enterprise: Custom pricing

How it works:

Users pay recurring fees for GPU access, generation limits, and licensing privileges.

2025 Data:

- Estimated paying users: ~6–7 million

- Average annual revenue per user (ARPU): ~$85–95

- Estimated contribution: ~$430M+

Revenue Stream #2: Enterprise & API Licensing (~7%)

Brands and platforms license Midjourney’s image generation engine for internal tools, marketing automation, and product design workflows.

How it works:

Custom contracts based on usage volume, model access, and SLA guarantees.

2025 Contribution: ~$35–40M

Revenue Stream #3: Commercial Usage Rights & Private Mode (~4%)

Professional creators and agencies pay extra for private generation and legal usage rights.

How it works:

Premium plans include IP protection and exclusive rendering environments.

2025 Contribution: ~$20M+

Revenue Stream #4: Compute Credits & High-Volume Rendering (~3%)

Heavy users buy GPU credit packs for large-scale batch generation.

2025 Contribution: ~$15M

Revenue Stream #5: Community & Creator Programs (~1%)

Revenue from branded competitions, featured artist programs, and educational partnerships.

2025 Contribution: ~$5M

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share | Estimated Revenue |

|---|---|---|

| Subscriptions | 85% | $430M |

| Enterprise/API | 7% | $38M |

| Commercial Rights | 4% | $22M |

| Compute Credits | 3% | $15M |

| Community Programs | 1% | $5M |

The Fee Structure Explained

User-Side Fees

- Monthly subscriptions: $10–$60+

- GPU credit top-ups

- Private generation add-ons

Provider-Side Fees

- Enterprise licensing contracts

- API access fees

Hidden Revenue Layers

- Annual billing discounts that lock in long-term ARR

- Premium licensing for commercial usage

Regional Pricing Variation

- Lower pricing tiers in Asia and LATAM

- Enterprise pricing standardized globally

Complete Fee Structure by User Type

| User Type | Fees Paid | Revenue Source |

|---|---|---|

| Hobby Creator | $10–$30/month | Subscription |

| Professional Artist | $60/month | Subscription + Rights |

| Enterprise Team | Custom | Licensing |

| Power User | Credit Packs | Compute Sales |

| Educator/Partner | Custom | Partnerships |

How Midjourney Maximizes Revenue Per User

Segmentation:

Hobbyists → Professionals → Agencies → Enterprises.

Upselling:

Basic users are nudged toward Pro plans for speed and privacy.

Cross-Selling:

Compute credits and commercial rights.

Dynamic Pricing:

Usage-based enterprise contracts.

Retention Monetization:

Continuous model upgrades lock in creators.

LTV Optimization:

Average lifetime value estimated at $180–250 per user.

Psychological Pricing:

Low entry cost ($10/month) reduces friction, while premium tiers capture professionals.

Real Data Example:

An agency using Pro + API access can generate 10x the revenue of a casual user annually.

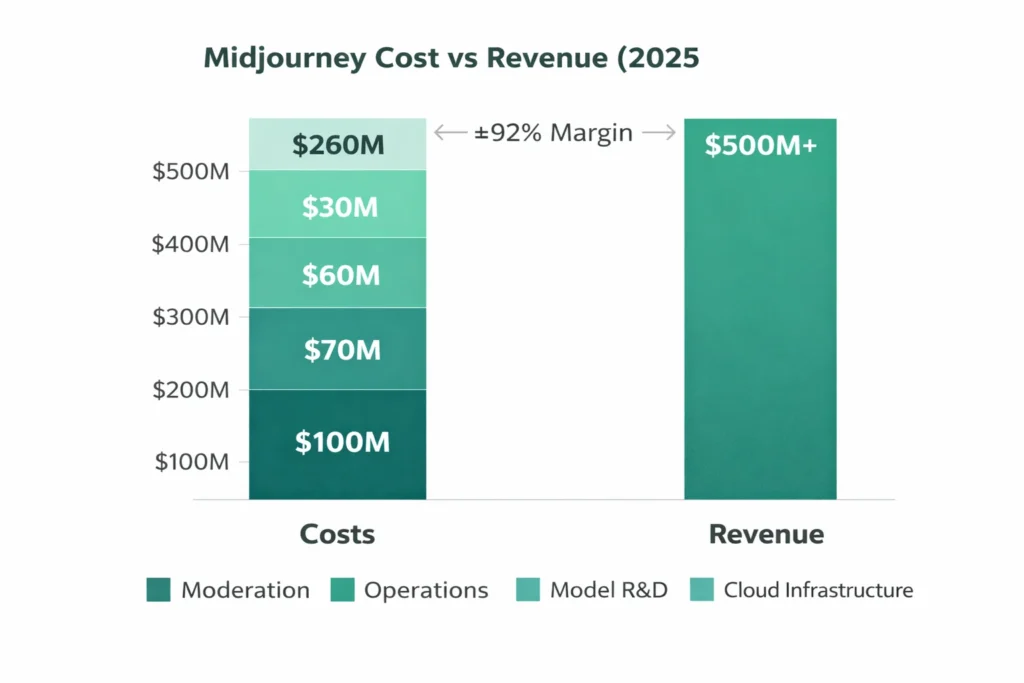

Cost Structure & Profit Margins

Infrastructure Costs:

GPU clusters, cloud compute, storage, inference pipelines.

CAC & Marketing:

Low paid marketing, heavy organic growth via social media and community.

Operations:

Moderation, legal compliance, customer support.

R&D:

Model training, dataset expansion, AI optimization.

Unit Economics:

- Estimated CAC: <$10 per user

- Monthly gross margin per Pro user: ~$35–40

Margin Optimization:

Annual plans, optimized GPU utilization, regional compute routing.

Profitability Path:

Scale-driven compute efficiency and enterprise licensing growth.

Future Revenue Opportunities & Innovations

New Streams:

- AI video generation subscriptions

- Brand asset automation platforms

- 3D and game asset generation tools

AI/ML-Based Monetization:

Personalized model tuning for enterprises.

Market Expansion:

Asia-Pacific creative industries and SaaS platforms.

Predicted Trends 2025–2027:

- AI-powered design workflows

- Embedded generative tools in SaaS products

- Subscription bundling with creative suites

Risks & Threats:

Compute costs, copyright regulations, open-source competition.

Opportunities for New Founders:

Vertical-specific AI tools for real estate, fashion, and eCommerce.

Lessons for Entrepreneurs & Your Opportunity

What Works:

- Subscription-first AI SaaS model

- Community-led product growth

- Premium licensing layers

What to Replicate:

- Low-friction entry pricing

- Tiered monetization paths

Market Gaps:

- Industry-specific AI image platforms

- Localized AI tools for regional markets

Improvements Founders Can Use:

- White-label AI generation systems

- Embedded AI APIs for platforms

Want to build a platform with Midjourney’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Midjourney clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Midjourney proves that AI creativity is a premium digital service, not a free commodity, by positioning advanced generation quality, speed, and commercial rights behind paid tiers. This approach reframes AI output as a business-critical tool rather than a novelty, enabling professionals and enterprises to justify recurring spend. The result is a pricing model that aligns perceived value with real productivity gains, reinforcing willingness to pay across creative and commercial use cases.

Its success lies in combining community, technology, and tiered monetization into a scalable global platform that grows through both product excellence and network effects. The community acts as a real-time innovation engine, surfacing use cases, testing new features, and driving organic adoption. At the same time, tiered plans allow the platform to monetize casual creators, professionals, and enterprises differently, maximizing revenue per user without fragmenting the experience.

For founders, the future belongs to AI ecosystems that solve specific industry problems, not just generate content. The biggest opportunities lie in verticalized platforms for sectors like real estate, fashion, healthcare, and eCommerce, where AI can automate workflows, reduce costs, and improve decision-making. Building these focused ecosystems creates defensibility, higher switching costs, and long-term revenue stability beyond generic AI tools.

FAQs

1. How much does Midjourney make per transaction?

Primarily through monthly subscriptions and enterprise licensing rather than per-image fees.

2. How does Midjourney’s pricing compare to competitors?

It’s cheaper than enterprise design tools and more premium than open-source AI platforms.

3. What percentage does Midjourney take from providers?

It doesn’t operate a marketplace, so revenue is direct from users and enterprises.

4. How has Midjourney’s revenue model evolved?

From community-based access to a structured AI SaaS subscription platform.

5. Can small platforms use similar models?

Yes, tiered AI subscriptions work well for niche markets.

6. What’s the minimum scale for profitability?

Around 50,000–100,000 paying users, depending on compute efficiency.

7. How to implement similar revenue models?

Offer freemium access, tiered subscriptions, and enterprise licensing.

8. What are alternatives to Midjourney’s model?

API-based pricing, usage-based billing, or bundled SaaS monetization.

9. How quickly can similar platforms monetize?

Many AI platforms begin generating revenue within 30–60 days of launch.

10. What’s Midjourney’s most profitable revenue stream?

Professional and enterprise subscription tiers.