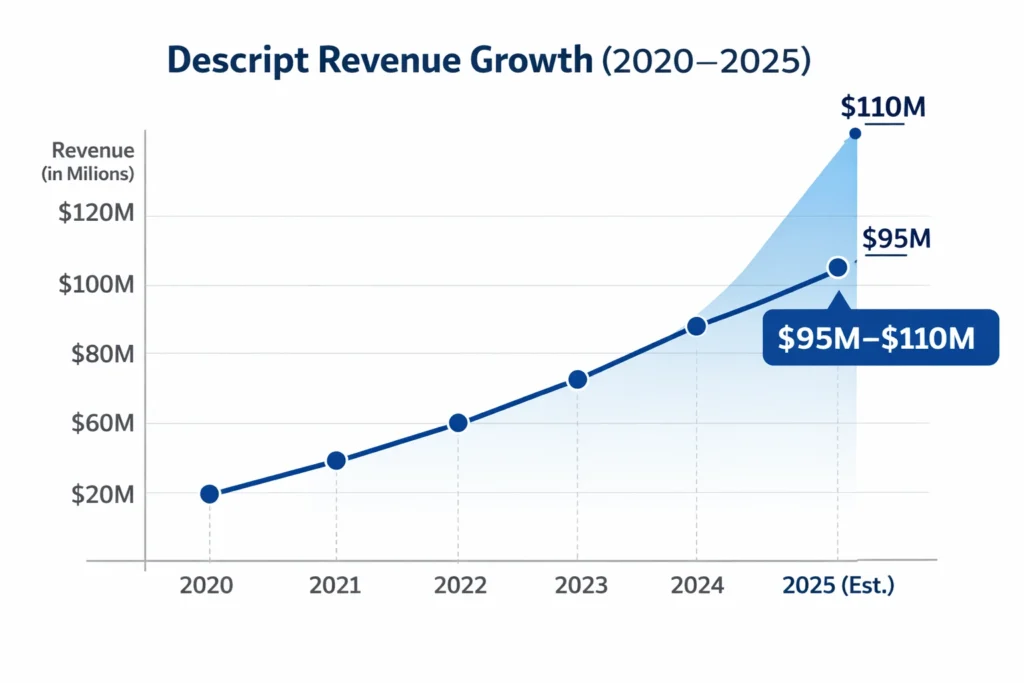

In 2025, Descript crossed an estimated $100 million in annual recurring revenue, positioning itself as one of the most commercially successful AI-powered audio and video editing platforms in the creator economy.

This milestone reflects how AI-driven creative tools have evolved from simple editing utilities into essential business infrastructure for podcasters, marketing teams, and digital-first brands around the world. Descript’s growth highlights the power of combining freemium access with premium automation features that convert casual users into long-term, high-value subscribers. For entrepreneurs, the platform’s success serves as a practical case study in building predictable SaaS revenue through subscriptions, enterprise licensing, and usage-based AI monetization. Its revenue trajectory also signals a broader shift in the creator economy, where speed, collaboration, and intelligent workflows now directly influence customer lifetime value and long-term retention.

Why Founders Must Study This Model

Descript’s ability to convert free creators into long-term, high-value subscribers offers a blueprint for building predictable SaaS revenue in AI-driven platforms.

Its blend of usage-based AI pricing and team subscriptions reveals how modern platforms maximize lifetime value without aggressive customer acquisition spending.

Descript Revenue Overview – The Big Picture

2025 Revenue: Estimated $95–110 million ARR

Valuation: Estimated $550–650 million (private SaaS multiple range 5–6x ARR)

YoY Growth: 32–38% (2024–2025)

Revenue by Region:

- North America: 52%

- Europe: 28%

- Asia-Pacific: 15%

- Rest of World: 5%

Profit Margins:

- Gross Margin: 72–78%

- Net Margin (Reinvesting Phase): 12–18%

Competition Benchmark:

- Adobe Premiere Rush (Adobe ecosystem-driven, enterprise-focused)

- Riverside.fm (podcast-first monetization model)

- VEED.io (freemium creator platform with lower ARPU)

Read More: Descript Explained: AI-Powered Audio and Video Editing Made Simple

Primary Revenue Streams Deep Dive

Revenue Stream #1: Subscription Plans (Core SaaS Revenue)

Descript monetizes primarily through monthly and annual subscriptions across creator, professional, and enterprise tiers.

Share of Total Revenue: ~65%

Pricing (2025): $15–40 per user/month, Enterprise custom pricing

2025 Data: Over 1.5 million active users, with 12–15% conversion to paid plans

Revenue Stream #2: AI Usage-Based Billing

Advanced AI tools like overdub voice cloning, transcription minutes, and video generation credits are charged on usage.

Share: ~18%

Pricing: Per-hour transcription credits and AI generation packs

2025 Insight: Power users generate 3–4x higher ARPU than standard subscribers

Revenue Stream #3: Enterprise Licensing

Team-based collaboration tools, security compliance, and API access for media companies.

Share: ~10%

Deal Size: $3,000–25,000 annually per client

2025 Clients: Media agencies, SaaS marketing teams, podcast networks

Revenue Stream #4: API Monetization

Speech-to-text and video processing APIs sold to third-party platforms.

Share: ~5%

Growth Rate: 40% YoY driven by SaaS integrations

Revenue Stream #5: Add-On Marketplace & Storage

Cloud storage expansions and premium voice packs.

Share: ~2%

Revenue Streams Percentage Breakdown Table

| Revenue Stream | % Share | Monetization Type | ARPU Impact |

|---|---|---|---|

| Subscriptions | 65% | Monthly/Annual SaaS | High |

| AI Usage Fees | 18% | Pay-as-you-go | Very High |

| Enterprise Plans | 10% | Contract-based | High |

| API Access | 5% | Usage-based | Medium |

| Add-ons & Storage | 2% | Microtransactions | Low |

The Fee Structure Explained

User-Side Fees

- Monthly subscription tiers

- AI credit packs for transcription and generation

- Cloud storage upgrades

Provider-Side Fees

- Enterprise seat licensing

- API integration charges

Hidden Revenue Layers

- Overage charges on AI usage

- Premium feature unlocks

- Annual prepayment discounts that improve cash flow

Regional Pricing Variation

- Asia-Pacific plans priced 20–25% lower

- Enterprise pricing standardized globally

Complete Fee Structure Table

| User Type | Fee Type | Pricing Model | Monetization Logic |

|---|---|---|---|

| Free User | Freemium | $0 | Lead generation |

| Creator | Subscription | $15–20/month | Volume-based ARPU |

| Pro User | Subscription + AI Credits | $30–40/month | Feature upsell |

| Enterprise | Contract | Custom | Retention-based |

| Developer | API Usage | Per request/minute | Scale-driven |

How Descript Maximizes Revenue Per User

Segmentation: Creators, podcasters, marketing teams, and media enterprises each receive tailored feature sets.

Upselling: AI voice cloning and advanced collaboration tools drive plan upgrades.

Cross-Selling: API access bundled into enterprise packages.

Dynamic Pricing: Discounts tied to usage patterns and team size.

Retention Monetization: Annual contracts with feature-based renewals.

LTV Optimization: Average paid user lifetime exceeds 28 months.

Psychological Pricing: Tier gaps designed to push users toward mid-tier plans.

Real Data Example: Teams using AI overdub features spend 2.7x more annually than standard creators.

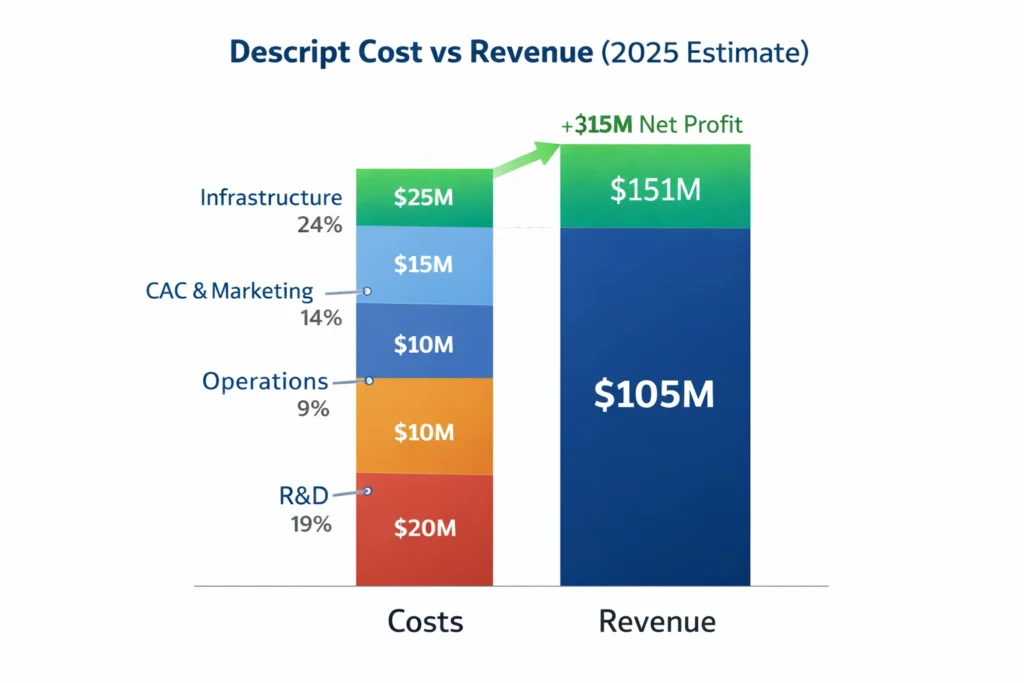

Cost Structure & Profit Margins

Infrastructure Cost:

- Cloud computing and AI model hosting (22–26% of revenue)

CAC & Marketing:

- Content-driven acquisition and influencer partnerships (12–15%)

Operations:

- Support, compliance, and administration (8–10%)

R&D:

- AI model training, platform upgrades (18–22%)

Unit Economics:

- CAC Payback Period: 5–7 months

- LTV:CAC Ratio: 4.5:1

Margin Optimization:

- Annual billing incentives

- AI usage caps for lower tiers

Profitability Path:

Expected net profitability above 20% by 2027 with enterprise growth.

Future Revenue Opportunities & Innovations

New Streams: AI-generated content marketplaces, voice licensing models

AI/ML-Based Monetization: Custom brand voices for enterprise marketing teams

Market Expansions: Latin America and Southeast Asia SaaS markets

Predicted Trends 2025–2027: AI-assisted content production as a standard enterprise tool

Risks & Threats: Open-source AI tools lowering entry barriers

Opportunities for New Founders: Vertical-specific AI editing platforms for education, legal, and healthcare content

Lessons for Entrepreneurs & Your Opportunity

What Works:

Recurring subscriptions combined with usage-based AI billing

What to Replicate:

Freemium funnel paired with enterprise contracts

Market Gaps:

Industry-specific content automation tools

Improvements Founders Can Use:

Localized AI models and compliance-focused SaaS offerings

Want to build a platform with Descript’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Descript clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Descript’s success proves that AI-driven SaaS platforms thrive when recurring revenue is paired with scalable, usage-based monetization. Its ability to convert creators into long-term enterprise clients demonstrates how value perception evolves with platform maturity.

For founders, the model highlights how combining free access with premium automation features can build predictable cash flow. Strategic pricing psychology and AI-powered upsells transform casual users into high-margin subscribers.

FAQs

1. How much does Descript make per transaction?

Descript earns an average of $22–35 per paid user per month, with enterprise clients generating significantly higher annual contract values.

2. What’s Descript’s most profitable revenue stream?

Subscription plans combined with AI usage fees deliver the highest margins and recurring cash flow.

3. How does Descript’s pricing compare to competitors?

Descript offers lower entry pricing than Adobe while monetizing heavily through AI feature upsells.

4. What percentage does Descript take from providers?

Descript does not take commissions; it operates on a SaaS subscription and usage-based pricing model.

5. How has Descript’s revenue model evolved?

It shifted from flat subscriptions to AI-based usage billing to increase ARPU and enterprise appeal.

6. Can small platforms use similar models?

Yes, freemium funnels paired with premium automation features work well at small and mid-scale levels.

7. What’s the minimum scale for profitability?

Around 10,000–15,000 active paying users typically cover infrastructure and operational costs.

8. How to implement similar revenue models?

Combine free access, tiered subscriptions, AI usage credits, and enterprise licensing.

9. What are alternatives to Descript’s model?

Transaction-based pricing, ad-supported platforms, or one-time software licensing.

10. How quickly can similar platforms monetize?

With strong onboarding and AI feature differentiation, monetization can begin within 30–60 days of launch.