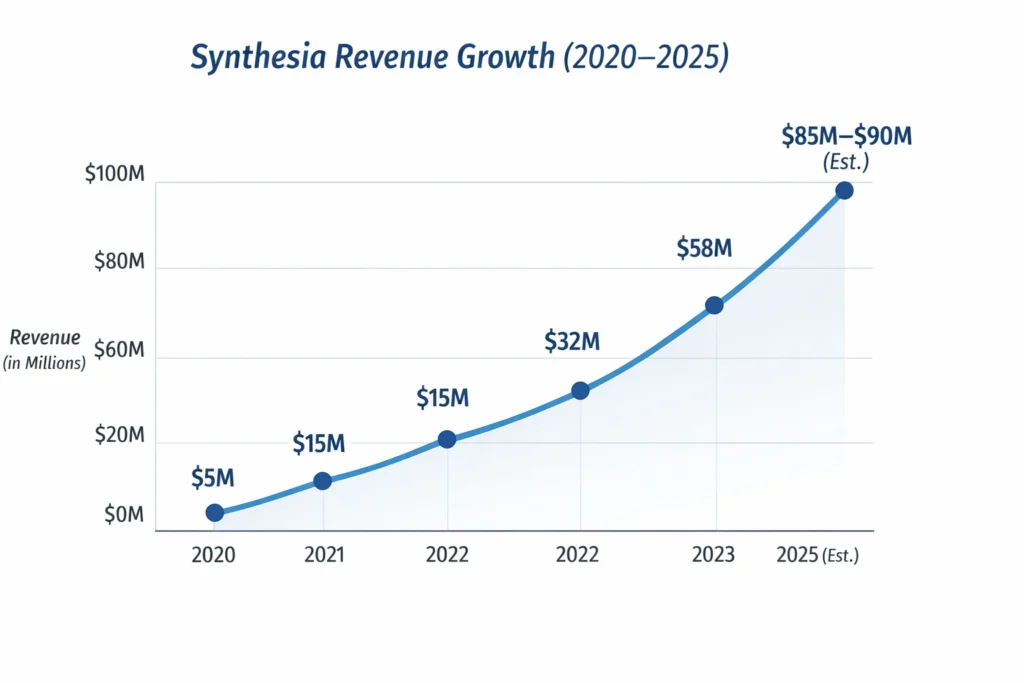

Synthesia crossed an estimated $85–90 million in annual revenue in 2025, making it one of the most commercially successful AI video platforms globally. What started as an AI experiment is now a serious SaaS business reshaping how enterprises create video content. Its growth demonstrates that AI-powered content tools are not just novel products—they can scale into multi-million-dollar businesses by solving real pain points like video production cost, time, and accessibility. The platform’s adoption across marketing, corporate training, and internal communications highlights the diverse verticals that AI video can penetrate.

For founders, Synthesia’s growth is not about hype—it’s about predictable recurring revenue, strong enterprise contracts, and exceptionally high margins driven by AI automation. The company leverages subscription-based pricing to create steady cash flow, while enterprise deals lock in long-term revenue with minimal churn. By automating video creation with AI avatars and voice synthesis, Synthesia keeps marginal costs near zero while scaling globally. This combination of efficiency, predictability, and scale is a textbook example of how modern SaaS and AI converge to create sustainable profitability.

Studying this model helps entrepreneurs understand how AI products convert innovation into cash flow, especially in B2B SaaS markets where willingness to pay is high. Founders can learn how to segment users effectively, upsell additional features, and structure enterprise agreements to maximize lifetime value. It also showcases the importance of continuous AI improvement, intellectual property, and customer trust in retaining clients and staying ahead of competitors. For startups, understanding these principles provides actionable insights into building a platform that not only attracts users but monetizes efficiently and scales globally.

Synthesia Revenue Overview – The Big Picture

- 2025 Estimated Revenue: $85–90 million

- Valuation: ~$1.2 billion

- YoY Growth (2024–2025): ~38%

- Primary Markets: North America (45%), Europe (35%), Asia-Pacific (15%), Others (5%)

- Gross Profit Margin: ~78–82%

- Net Margin (estimated): 22–25%

- Core Competitors: HeyGen, D-ID, Colossyan, Pictory

Synthesia operates as a high-margin AI SaaS platform, benefiting from subscription predictability and enterprise-scale deployments.

Read More: What Is Synthesia? How AI Avatars Turn Text Into Studio-Style Videos

Primary Revenue Streams Deep Dive

Revenue Stream #1: Subscription Plans (Core SaaS Revenue)

This is Synthesia’s main engine. Users pay monthly or annually to create AI avatar videos.

- Share of Revenue: ~55%

- Pricing: $30–$90 per seat/month (global average)

- 2025 Contribution: ~$48 million

Revenue Stream #2: Enterprise Licensing

Large organizations license Synthesia for internal training, HR, and communications.

- Share of Revenue: ~25%

- Pricing: $10,000–$200,000+ per year

- 2025 Contribution: ~$22 million

Revenue Stream #3: Custom Avatars & Voice Models

Brands pay extra for private avatars and voices.

- Share of Revenue: ~10%

- Pricing: $1,000–$5,000 per avatar

- 2025 Contribution: ~$8.5 million

Revenue Stream #4: API & Integrations

Used by platforms embedding AI video into LMS or CRM tools.

- Share of Revenue: ~6%

- Pricing: Usage-based

- 2025 Contribution: ~$5 million

Revenue Stream #5: Add-ons & Usage Overages

Extra video minutes, languages, or storage.

- Share of Revenue: ~4%

- 2025 Contribution: ~$3.5 million

[Table: Revenue Streams Percentage Breakdown]

| Revenue Stream | % Share | 2025 Revenue Est. |

|---|---|---|

| Subscriptions | 55% | $48M |

| Enterprise Licensing | 25% | $22M |

| Custom Avatars | 10% | $8.5M |

| API & Integrations | 6% | $5M |

| Add-ons & Overages | 4% | $3.5M |

The Fee Structure Explained

User-Side Fees

- Monthly/annual subscription fees

- Usage-based charges for video minutes

- Premium avatar and voice fees

Provider-Side Fees

- None (Synthesia controls the platform and IP)

Hidden Revenue Layers

- Annual contract discounts lock in long-term cash

- Seat expansion inside enterprises

- Internal department upselling

Regional Pricing Variation

- Higher pricing in US & EU

- Discounted plans in emerging markets

[Table: Complete Fee Structure by User Type]

| User Type | Fees Paid | Monetization Logic |

|---|---|---|

| Individual Creator | Subscription + overages | High LTV via upgrades |

| SMB | Team plans | Seat expansion |

| Enterprise | Annual license | Long-term contracts |

| Developers | API usage fees | Volume-based growth |

How Synthesia Maximizes Revenue Per User

Synthesia segments users by role and intent—marketers, trainers, HR teams, and educators all see different upsells.

Upselling occurs through higher video limits, better avatars, and enterprise-grade compliance. Cross-selling includes API access and custom avatars.

Dynamic pricing adjusts based on usage patterns, while retention is driven by workflow lock-in—once companies build training libraries, churn drops significantly.

Psychological pricing plays a role: annual plans appear cheaper monthly, pushing upfront cash flow. In enterprise accounts, LTV often exceeds $60,000 per client, compared to CAC under $4,000.

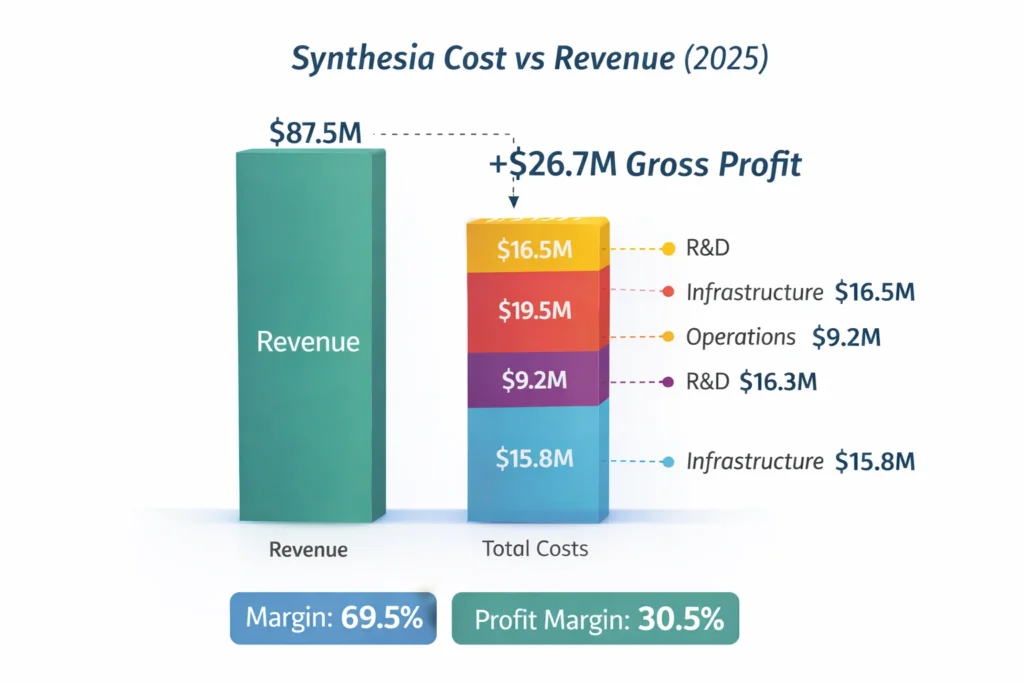

Cost Structure & Profit Margins

Major Cost Centers

- Infrastructure & Compute: ~18%

- Sales & Marketing (CAC): ~22%

- Operations & Support: ~12%

- R&D & AI Training: ~18%

Unit Economics

- Average SMB customer LTV: ~$3,200

- Gross margin per video: ~85%

Synthesia achieves profitability by reusing AI models at scale, reducing marginal cost close to zero after deployment.

Future Revenue Opportunities & Innovations

New monetization avenues include real-time AI presenters, localized avatars for regional markets, and AI-powered personalization.

AI/ML monetization will shift toward performance-based pricing, where companies pay per engagement rather than per minute.

Between 2025–2027, expansion into Asia and Latin America is expected to accelerate growth. Risks include deepfake regulations and rising competition, but opportunities remain massive for niche-focused platforms.

Lessons for Entrepreneurs & Your Opportunity

What works is clear: subscriptions first, enterprise contracts second, and add-ons everywhere.

Founders can replicate this by focusing on one vertical—education, real estate, healthcare—and offering tailored AI avatars.

Market gaps exist in regional language content, offline deployment, and industry-specific compliance.

Want to build a platform with Synthesia’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Synthesia clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Synthesia proves that AI businesses win not by novelty, but by monetization discipline. It’s not enough to have a cutting-edge AI product—success comes from structuring revenue streams that scale predictably. Synthesia demonstrates the power of combining subscription plans, enterprise contracts, and usage-based pricing to capture value from every user segment. Its disciplined monetization strategy highlights that even highly innovative tech must be paired with strong business fundamentals to achieve sustainable growth.

Its success shows how automation, subscriptions, and enterprise trust combine into a scalable machine. By automating video creation with AI, Synthesia reduces marginal costs dramatically while maintaining high-quality output. Enterprise clients are willing to pay a premium because of reliability, compliance, and integration capabilities. Founders can take note that scaling an AI business isn’t just about technology—it’s also about building trust, simplifying adoption, and embedding your solution into workflows that clients can’t easily replace.

For founders, the opportunity lies not in copying features—but in applying the same revenue logic to underserved niches. There are countless industries—education, real estate, healthcare, and internal corporate communication—where AI-driven content creation is still nascent. By focusing on niche-specific AI solutions, designing clear monetization paths, and optimizing LTV per user, startups can replicate Synthesia’s success on a smaller, more focused scale. The key takeaway is to marry innovative tech with a revenue-first mindset—the combination of both is what creates a truly scalable, profitable AI platform.

FAQs

1. How much does Synthesia make per transaction?

From $30 per month for individuals to over $100,000 annually for enterprises.

2. What’s Synthesia’s most profitable revenue stream?

Enterprise licensing due to long contracts and low churn.

3. How does Synthesia’s pricing compare to competitors?

It’s premium-priced but justified by quality and enterprise trust.

4. What percentage does Synthesia take from providers?

Not applicable—it owns the platform and technology.

5. How has Synthesia’s revenue model evolved?

It shifted from individual creators to enterprise-first monetization.

6. Can small platforms use similar models?

Yes, especially with niche-focused SaaS subscriptions.

7. What’s the minimum scale for profitability?

Around 1,500–2,000 paying SMB users.

8. How to implement similar revenue models?

Start with subscriptions, add usage limits, then enterprise plans.

9. What are alternatives to Synthesia’s model?

Pay-per-video, freemium, or performance-based pricing.

10. How quickly can similar platforms monetize?

With the right niche, monetization can begin within 30–60 days.