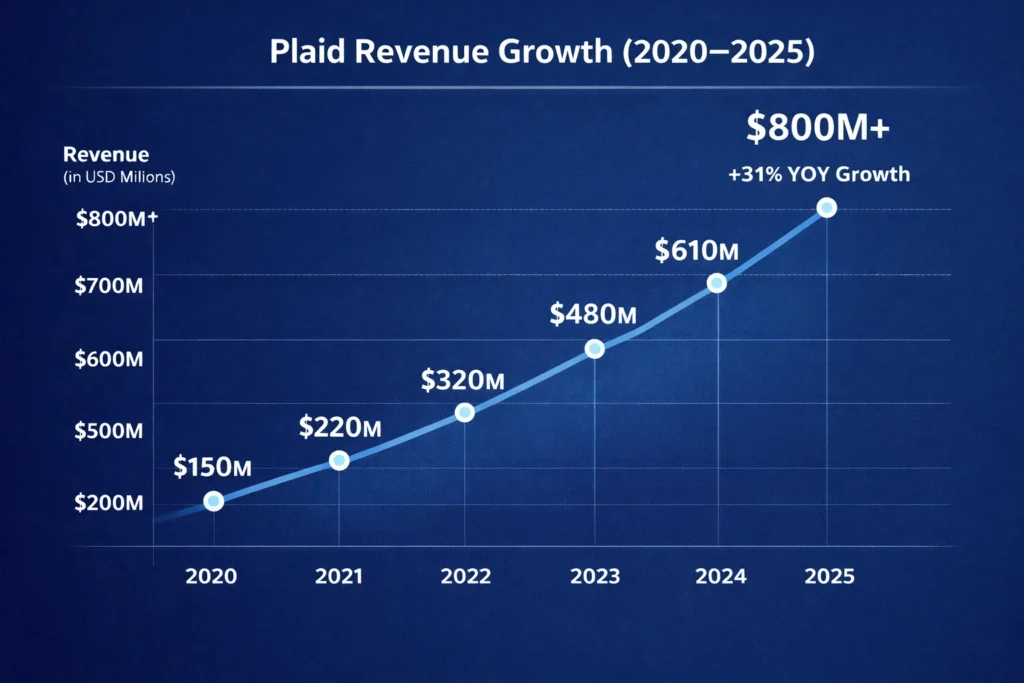

In 2025, Plaid crossed an estimated $800 million in annual revenue, becoming one of the most critical data infrastructure layers powering the global fintech ecosystem. This growth has been driven by rapid adoption across digital banks, lending platforms, and embedded finance tools that rely on real-time account data and identity verification. Expansion into regulated markets and partnerships with major financial institutions have further strengthened Plaid’s position as a trusted intermediary in open banking and secure data sharing.

For founders, Plaid isn’t just an API company — it’s a financial data backbone connecting banks, apps, and institutions into a single programmable network for payments, identity, and compliance. Its value lies in simplifying complex integrations, standardizing data formats across thousands of banks, and offering compliance-ready services that reduce regulatory burden for fintech builders. This infrastructure-first approach creates strong network effects, where each new integration increases the platform’s value for all participants.

This revenue model shows how infrastructure platforms monetize data access, developer dependency, and regulatory trust — not end users — turning fintech plumbing into high-margin, recurring SaaS revenue. By layering usage-based pricing with premium compliance tools, enterprise support, and multi-product bundles, Plaid builds predictable income streams that grow as its customers scale. For new founders, it highlights the opportunity to target regulated, high-friction industries where reliability, security, and long-term partnerships command premium pricing.

Plaid Revenue Overview – The Big Picture

2025 Revenue: ~$800M

Valuation: ~$13.4B (private market estimates)

YoY Growth: ~31%

Revenue by Region:

- North America: 68%

- Europe: 19%

- Asia-Pacific: 9%

- LATAM: 4%

Profit Margins: Estimated 30–36% EBITDA (API SaaS + enterprise contracts)

Competition Benchmark:

- Yodlee

- MX

- Finicity (Mastercard)

- Tink (Visa)

- TrueLayer

Plaid operates as a data infrastructure utility — every fintech app, bank, or platform that integrates its APIs becomes part of a long-term revenue network.

Read More: How Plaid Works Behind the Scenes — The Fintech Backbone for Banks & Apps

Primary Revenue Streams Deep Dive

Revenue Stream #1: API Usage Fees (Core Connectivity)

How it works: Apps pay per connection, per API call, or per active user to access bank data, balances, and transactions.

% Share: ~48%

Pricing: $0.30–$1.50 per user/month (usage-based tiers)

2025 Data: Powering 12,000+ fintech apps and platforms

Revenue Stream #2: Identity & Compliance Services

How it works: Revenue from KYC, AML, and identity verification APIs for fintech onboarding.

% Share: ~18%

Pricing: $0.50–$2.00 per verification

2025 Data: 500M+ identity checks annually

Revenue Stream #3: Payments & Money Movement APIs

How it works: Transaction fees for ACH, RTP, and open banking-based payments.

% Share: ~15%

Pricing: 0.3%–0.8% per transaction

2025 Data: $20B+ in annual payment volume routed

Revenue Stream #4: Enterprise Data Solutions

How it works: Custom data platforms for banks, lenders, and large financial institutions.

% Share: ~11%

Pricing: $50K–$500K per year

2025 Data: 200+ enterprise clients

Revenue Stream #5: Developer Platform & Premium Tools

How it works: Revenue from dashboards, analytics, and sandbox environments for scaling fintech teams.

% Share: ~8%

Pricing: Subscription tiers

2025 Data: 100,000+ developers

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share | Annual Revenue Contribution (2025) |

|---|---|---|

| Core API Usage | 48% | ~$384M |

| Identity & Compliance | 18% | ~$144M |

| Payments APIs | 15% | ~$120M |

| Enterprise Data Platforms | 11% | ~$88M |

| Developer Tools | 8% | ~$64M |

The Fee Structure Explained

User-Side Fees

- End users: Free (cost absorbed by fintech apps)

- Business apps: Pay per API call or per connected account

Provider-Side Fees

- Fintechs: Usage-based billing (monthly invoices)

- Banks: Revenue-sharing agreements

Hidden Revenue Layers

- Data enrichment services

- Risk scoring APIs

- Premium uptime SLAs

- Regulatory compliance packages

Regional Pricing Variation

- US: Usage-based pricing dominance

- Europe: Open banking compliance bundles

- Asia: Enterprise-first contracts

Complete Fee Structure by User Type

| User Type | Fee Type | Price Range |

|---|---|---|

| Startups | API usage | $0.30–$1.50/user/month |

| Scaleups | Tiered usage | $5K–$50K/month |

| Enterprises | Custom contracts | $50K–$500K/year |

| Banks | Revenue share | Volume-based |

| Developers | Platform tools | Free → $10K+/month |

How Plaid Maximizes Revenue Per User

Plaid grows by expanding developer dependency.

Segmentation: Startups, fintech unicorns, banks, enterprises

Upselling: Identity, payments, compliance APIs

Cross-selling: Analytics + risk + data enrichment

Dynamic Pricing: Volume-based API tiers

Retention Monetization: Infrastructure lock-in

LTV Optimization: Multi-product adoption strategy

Psychological Pricing: “Utility pricing” vs SaaS pricing

Real Data Example: Average enterprise LTV exceeds $250,000+

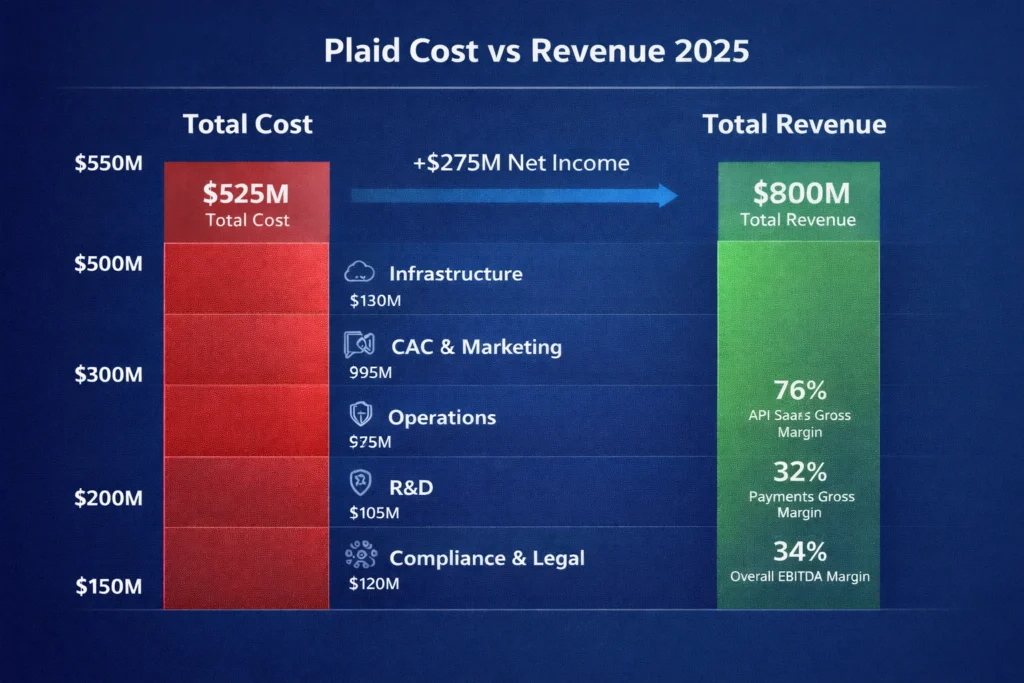

Cost Structure & Profit Margins

Infrastructure Cost: Bank integrations, cloud, data security (~25%)

CAC & Marketing: Developer relations, partnerships (~12%)

Operations: Compliance, legal, data privacy (~15%)

R&D: API reliability, new endpoints, AI fraud tools (~22%)

Unit Economics:

- API gross margin: 65%+

- Enterprise contract margin: 70%+

Margin Optimization:

- AI-powered routing

- Caching & data compression

- Automated compliance audits

Profitability Path: Plaid improves margins by bundling multiple APIs into enterprise contracts.

Read More: Best Plaid Clone Script 2026 – A Secure Open Banking API Platform

Future Revenue Opportunities & Innovations

New Streams:

- AI-driven financial intelligence APIs

- Credit scoring and underwriting platforms

- Real-time fraud detection services

AI/ML-Based Monetization:

- Predictive risk models

- Automated income verification

- Smart compliance scoring

Market Expansions:

- LATAM open banking

- Government digital ID platforms

- Embedded finance for SaaS tools

Predicted Trends 2025–2027:

- Open banking becomes regulated globally

- Fintech stacks consolidate around fewer APIs

- AI-powered compliance becomes standard

Risks & Threats:

- Bank-owned data platforms

- Regulatory data localization laws

- Vertical fintech APIs

Opportunities for New Founders:

- Regional data infrastructure

- Industry-specific fintech APIs

- SME-focused open banking tools

Lessons for Entrepreneurs & Your Opportunity

What Works:

- Usage-based monetization

- Developer-first platform strategy

- Compliance as a revenue layer

What to Replicate:

- API bundling

- Infrastructure lock-in

- Enterprise pricing tiers

Market Gaps:

- Localized open banking platforms

- SME-friendly data APIs

- AI-driven compliance fintech

Founder Improvements:

- No-code API builders

- Vertical-specific financial data tools

- Regional compliance automation

Want to build a platform with Plaid’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Plaid clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, andif you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Plaid proves that the most valuable fintech companies don’t own the customer — they own the infrastructure that every customer-facing app depends on.

By turning financial data access into a programmable utility, Plaid transforms compliance, connectivity, and trust into predictable, compounding revenue streams.

For founders, the opportunity lies in building regional and vertical-specific data rails that power entire industries rather than individual applications.

FAQs

1. How much does Plaid make per transaction?

Plaid typically charges per connected account or per API call, averaging $0.30–$1.50 per user/month.

2. What’s Plaid’s most profitable revenue stream?

Core API usage and enterprise data contracts.

3. How does Plaid’s pricing compare to competitors?

More developer-focused than Tink and more flexible than bank-owned platforms.

4. What percentage does Plaid take from providers?

Plaid usually uses usage-based billing rather than percentage cuts.

5. How has Plaid’s revenue model evolved?

It expanded from bank connectivity to identity, payments, and compliance platforms.

6. Can small platforms use similar models?

Yes, at regional or industry-specific scales.

7. What’s the minimum scale for profitability?

Roughly $1M–$3M in monthly API usage revenue.

8. How to implement similar revenue models?

Build API-first platforms with tiered usage pricing and enterprise contracts.

9. What are alternatives to Plaid’s model?

Tink, MX, Yodlee, Finicity, and TrueLayer.

10. How quickly can similar platforms monetize?

Some fintech APIs generate revenue within 30–60 days after onboarding clients.