Razorpay is one of India’s most influential fintech success stories—built for a market where businesses needed faster, simpler, and more reliable ways to accept and manage payments. What started as a developer-friendly payment gateway quickly evolved into a full-stack financial platform for startups, SMEs, and fast-growing digital brands. Today, Razorpay is not just “payments”—it is an operating layer that helps businesses collect money, automate payouts, manage subscriptions, and improve cash flow.

A key reason the business model of Razorpay matters in 2026 is because the company didn’t stop at transaction fees. It expanded into high-value products like RazorpayX (banking + business finance), payroll, vendor payouts, and recurring billing—creating multiple revenue streams from the same customer base.

For entrepreneurs studying how modern fintech platforms scale, Razorpay is a perfect blueprint of ecosystem-driven growth.And for founders building payment-led platforms today, Miracuves can help you apply similar architecture—creating scalable, secure, and monetization-ready systems that grow from a single product into a complete business ecosystem.

How the Razorpay Business Model Works

Razorpay operates as a full-stack fintech infrastructure platform that helps businesses accept, process, and manage money digitally. At its core, Razorpay connects merchants (businesses) with payment networks (cards, UPI, net banking, wallets), banks, and compliance systems—so transactions happen smoothly and securely. Over time, it evolved from a simple payment gateway into a financial operating system for Indian businesses, covering collections, payouts, subscriptions, and embedded banking.

1) Type of Business Model

Razorpay follows a Hybrid B2B fintech platform model, combining:

- Transaction-based model (charges per successful payment)

- SaaS-style recurring revenue (subscriptions, premium tools)

- Value-added services model (payout automation, fraud tools, payroll, capital support)

- Platform ecosystem model (integrations + partner-led distribution)

2) Value Proposition (Who Gets What Value)

Razorpay creates value for multiple segments in the ecosystem:

For Businesses / Merchants

- Accept payments via UPI, cards, net banking, wallets

- Faster onboarding and smooth checkout experience

- Smart dashboards for tracking settlements, refunds, failures

- Automation for payouts, payroll, subscriptions, invoices

For Developers / Product Teams

- Simple APIs + plugins for fast integration

- Payment orchestration tools (routing, retries, tokenization support)

- Easy scaling across regions and business models

For Enterprises

- Higher success rates via optimized payment flows

- Advanced reconciliation + compliance controls

- Custom workflows for marketplaces and high-volume platforms

For Partners (Platforms, Resellers, SaaS tools)

- Revenue through integrations and merchant referrals

- Strong product compatibility with ecommerce + SaaS ecosystems

3) Key Stakeholders in the Razorpay Ecosystem

Razorpay works like a bridge between stakeholders:

- Merchants → accept money + run operations

- Customers → make payments through preferred methods

- Banks → settlements, accounts, compliance rails

- Card Networks (Visa/Mastercard/RuPay) → authorization + processing

- UPI ecosystem → instant bank-to-bank payments

- Regulators → rules on data, KYC, payments, and security

- Technology partners → ecommerce, POS, accounting, CRM platforms

4) Evolution of the Razorpay Model

Razorpay scaled by expanding its product stack step-by-step:

- Phase 1: Payment Gateway (simple online collections)

- Phase 2: Merchant tools (invoices, payment links, dashboards)

- Phase 3: Payouts + subscriptions (RazorpayX, recurring billing)

- Phase 4: Full fintech suite (payroll, vendor payments, automation)

- Phase 5 : Embedded finance + platform-level orchestration

- deeper integrations into SaaS, ecommerce, marketplaces

- smarter fraud prevention + compliance-first growth

- deeper integrations into SaaS, ecommerce, marketplaces

Read more : What is Razorpay and How Does It Work?

Target Market & Customer Segmentation Strategy

Razorpay’s growth comes from a sharp focus on business customers who need fast, reliable, and scalable payment infrastructure. Instead of targeting consumers directly, it builds products for the companies that serve consumers—ecommerce brands, SaaS startups, marketplaces, education platforms, and large enterprises. This B2B focus helps Razorpay scale efficiently because once a merchant integrates Razorpay, the platform becomes part of daily operations, driving long-term retention and repeat usage.

1) Primary Customer Segments (Core Users)

1. Startups & Digital-First SMBs

- Online stores, D2C brands, service marketplaces

- Need quick onboarding, simple dashboards, and stable payment success rates

- High growth potential, strong product adoption

2. Mid-Market Businesses

- Growing ecommerce and SaaS companies with higher transaction volumes

- Need automation: refunds, settlements, reconciliation, payout scheduling

- More likely to buy add-on products like subscriptions and payouts

3. Large Enterprises

- High-volume platforms, aggregators, and regulated businesses

- Need custom workflows, compliance controls, and optimized routing

- Value reliability, security, and dedicated support

2) Secondary Customer Segments (Expansion Users)

1. Marketplaces & Platforms

- Require split payments, vendor payouts, and settlement logic

- Use Razorpay for payout automation + compliance

2. Subscription-Based Businesses

- SaaS, edtech, membership platforms

- Need recurring billing, dunning, renewals, and invoicing tools

3. Offline-to-Online Businesses

- Retailers, clinics, local service brands moving digital

- Use payment links, invoices, and UPI-first checkout flows

3) Customer Journey: Discovery → Conversion → Retention

Discovery

- Search intent (payment gateway, UPI integration, subscription billing)

- Partner platforms (Shopify-like stores, ecommerce builders)

- Developer communities and product referrals

Conversion

- Fast KYC + onboarding

- Easy integration via APIs/plugins

- Transparent pricing and quick go-live experience

Retention

- Daily dependency: settlements, refunds, dashboards

- Add-on adoption: payouts, subscriptions, payroll

- High switching cost once workflows are automated

4) Acquisition Channels Razorpay Uses (and Why They Work)

- SEO + high-intent landing pages (payment gateway, UPI payments, subscriptions)

- Developer-first distribution (docs, APIs, integrations)

- Ecommerce + SaaS partnerships (platform integrations drive bulk adoption)

- Inside sales + enterprise deals (high-value accounts, long-term contracts)

- Product-led growth (free onboarding + upsell via add-ons)

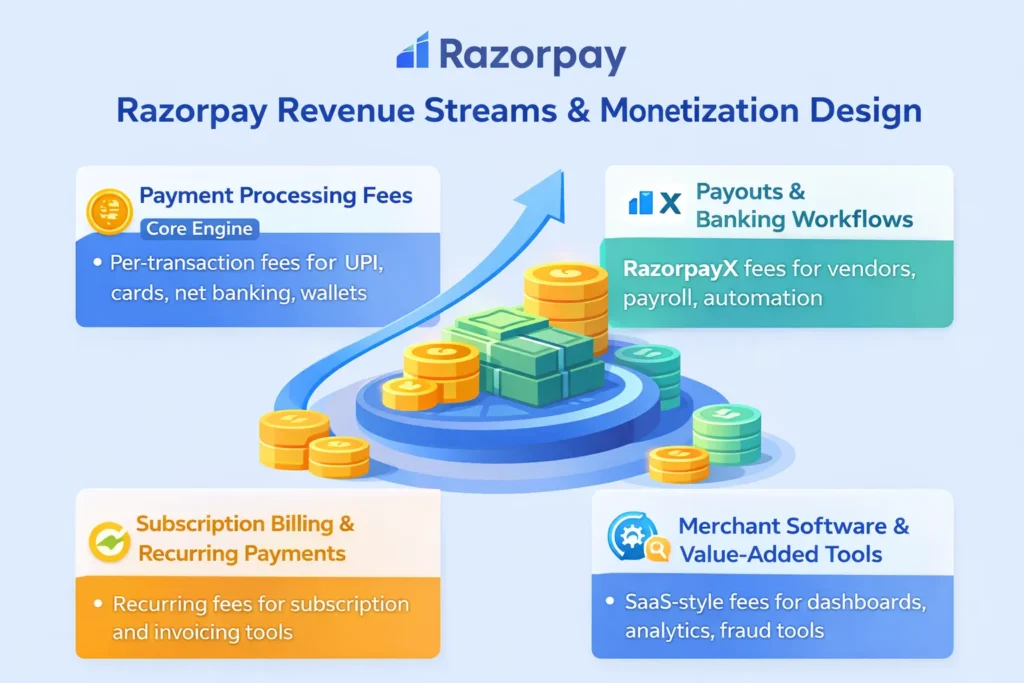

Revenue Streams and Monetization Design

Once Razorpay locks in merchants through smooth payment infrastructure, the real strength of the Razorpay revenue model comes from expanding revenue per customer. It starts with transaction fees, but grows through value-added fintech products like payouts, subscriptions, payroll, and banking workflows. This layered monetization makes Razorpay scalable because revenue increases naturally as merchants scale their own business.

Primary Revenue Stream 1: Payment Processing Fees (Core Engine)

Mechanism

Razorpay earns a fee every time a merchant successfully processes a payment through its gateway—UPI, cards, net banking, wallets, and other methods.

Pricing Model

- Per-transaction fee structure (fixed + % based)

- Higher pricing potential for:

- credit/debit card payments

- international cards

- currency conversion

- premium routing/optimization features

- credit/debit card payments

Revenue Contribution

- Largest and most consistent revenue driver

- Directly scales with merchant GMV (payment volume)

Growth Trajectory (2026)

- More UPI + digital commerce adoption in India

- Higher payment volumes from D2C, SaaS, and marketplaces

- Demand for higher payment success rates and faster settlements

Secondary Revenue Stream 2: RazorpayX (Payouts + Banking Workflows)

Mechanism

Razorpay monetizes business banking operations by helping companies:

- send vendor payouts

- process refunds at scale

- manage payroll disbursements

- automate settlement workflows

Monetization

- Fees on payouts and transfers

- Premium automation tools and enterprise workflows

- Value increases with business complexity

Secondary Revenue Stream 3: Subscription Billing & Recurring Payments

Mechanism

Razorpay enables subscription businesses to manage:

- recurring billing cycles

- renewals and upgrades

- failed payment recovery (dunning)

- invoicing and plan management

Monetization

- Subscription billing fees

- Add-on tools for retention and automation

- Higher lifetime value from recurring revenue clients

Secondary Revenue Stream 4: Merchant Software + Value-Added Tools

Mechanism

Beyond payments, Razorpay provides operational tools that merchants pay for because they reduce manual work and improve efficiency.

Examples include:

- smart dashboards + reconciliation tools

- payment links and invoice products

- analytics and reporting layers

- fraud/risk controls (depending on package level)

Monetization

- SaaS-style monthly/annual pricing

Bundled plans for mid-market and enterprise customers

Operational Model & Key Activities

Razorpay’s success isn’t only about what it sells—it’s about how efficiently it runs the machine behind payments. In fintech, the product experience must feel simple, but the operations underneath are complex: compliance, security, uptime, fraud control, settlement accuracy, and support. Razorpay wins by building a high-trust platform where merchants can depend on smooth money movement every day.

1) Core Operations (How Razorpay Runs Daily)

Platform & Infrastructure Management

- High-availability payment processing systems (low downtime tolerance)

- Load handling for peak sale events and high-traffic spikes

- Continuous monitoring of payment success rates and failures

Risk, Fraud & Compliance

- KYC onboarding workflows for merchants

- Fraud detection and transaction risk scoring

- Regulatory compliance and audit readiness (critical in 2026)

Merchant Support & Dispute Handling

- Refund processing, chargeback management, settlement issues

- Dedicated support for enterprise merchants

- Faster resolution improves trust and retention

Product Growth & Merchant Adoption

- Product-led onboarding flows (easy setup, quick activation)

- Merchant education through documentation and integration guides

- Continuous UX improvements for checkout and dashboard usage

Marketing + Distribution Execution

- High-intent SEO acquisition (payment gateway, UPI, subscriptions)

- Partnership-led growth through ecommerce and SaaS platforms

- Enterprise sales cycles for large accounts

2) Key Activities That Drive Performance

Razorpay’s most important activities are tightly connected to reliability and scale:

- Payment routing optimization to improve success rates

- Settlement and reconciliation accuracy (daily financial correctness)

- API performance and developer experience upgrades

- Expansion of product suite (payouts, payroll, subscriptions)

- Data analytics for merchant insights and operational efficiency

3) Resource Allocation Strategy (2026 Lens)

While exact numbers vary by quarter, Razorpay’s operational focus typically leans heavily toward:

Tech & Infrastructure

- Major investment in uptime, scalability, security, and monitoring

- Continuous upgrades for speed and payment success rates

Compliance + Risk

- Strong internal compliance teams

- Security-first engineering practices

- Regulatory readiness as a competitive advantage

Growth + Distribution

- SEO and integration-led acquisition for SMBs

- Enterprise sales teams for high-volume merchants

- Partner teams to expand reach through platforms

R&D + New Product Lines

- Embedded finance expansion (business banking workflows)

- Automation tools for CFO/finance teams

- Deeper subscription + payout product innovation

Strategic Partnerships & Ecosystem Development

Razorpay didn’t scale only by building products—it scaled by building an ecosystem. In fintech, partnerships are not optional; they are the backbone of distribution, compliance, and reliability. Razorpay’s partnership strategy is designed to create a win-win network where merchants get smoother money movement, partners get added value for their users, and Razorpay expands adoption without relying only on paid marketing.

Razorpay’s Collaboration Philosophy

Razorpay partners with platforms that already have strong business traffic—ecommerce builders, SaaS tools, banks, and enterprise networks—then integrates deeply so merchants can activate payments instantly. This creates “embedded distribution,” where Razorpay becomes part of the workflow rather than a separate product decision.

1) Technology & API Partners

These partnerships help Razorpay reach merchants faster through integrations.

- Ecommerce platforms and store builders

- CRM and business management tools

- Accounting and invoicing software

- Developer tools and automation platforms

Why it matters:

When Razorpay is pre-integrated, merchant onboarding becomes frictionless, improving adoption and retention.

2) Payment Network & Banking Alliances

Razorpay depends on strong financial rails to ensure settlement speed and transaction success.

- Banking partners for settlements and accounts

- UPI ecosystem connections

- Card networks and processing partners

- Compliance and verification support systems

Why it matters:

Better banking relationships improve payment success rates, reduce settlement delays, and strengthen trust.

3) Marketplace, Logistics & Payout Partnerships

For marketplaces and platforms, payouts are as important as collections.

- Vendor payout automation partners

- Marketplace settlement logic collaborations

- Cross-platform payout tools for gig and seller ecosystems

Why it matters:

This strengthens Razorpay’s role in two-way money flow: collecting from customers and distributing to partners/vendors.

4) Marketing & Distribution Partnerships

Razorpay expands reach by collaborating with channels that already influence business buyers.

- Startup ecosystems and accelerators

- SaaS marketplaces and referral partners

- Agency and solution partners

- Enterprise ecosystem networks

Why it matters:

These partners drive high-quality merchant acquisition with stronger conversion rates than cold outreach.

5) Regulatory & Expansion Alliances

In 2026, compliance is a growth lever, not a limitation.

- Regulatory alignment initiatives

- Industry bodies and fintech networks

- Expansion-ready compliance collaborations

Why it matters:

Strong compliance partnerships reduce risk, speed up approvals, and help Razorpay operate smoothly at scale.

Read more : Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

Growth Strategy & Scaling Mechanisms

Razorpay’s growth is a result of building a strong core product first, then scaling through expansion layers—new merchant segments, new products, and deeper ecosystem integration. Instead of chasing growth through discounts or one-time campaigns, Razorpay focuses on long-term compounding: more merchants → more transactions → better optimization → more trust → more adoption.

Growth Engines (What Drives Razorpay’s Scale)

1) Product-Led Growth (PLG)

Razorpay’s onboarding is designed to feel fast and simple, especially for startups and SMBs.

- Quick signup + guided setup

- Easy integration through plugins and APIs

- Dashboard-first experience for tracking payments, refunds, and settlements

- Smooth activation that turns new merchants into active users quickly

Why it works:

The faster a merchant goes live, the faster Razorpay earns transaction revenue.

2) Developer-First Distribution

Razorpay built strong adoption by making developers a key growth channel.

- Strong API documentation and integration support

- SDKs and ready-made integrations for common platforms

- Reliable sandbox environments and testing flows

Why it works:

Developers influence payment decisions early, and integrations create long-term stickiness.

3) SEO + High-Intent Demand Capture

Razorpay benefits from intent-driven search behavior in India’s growing digital economy.

- Ranking for keywords like payment gateway, UPI payments, subscription billing

- Conversion-focused landing pages for each use case

- Strong educational content for merchants exploring payments and compliance

Why it works:

These users are already ready to buy, so conversion rates are naturally higher.

4) Partnerships + Embedded Distribution

Razorpay scales through integrations that bring merchants directly into its ecosystem.

- Ecommerce platforms and SaaS tools

- Business software ecosystems

- Startup networks and referral channels

Why it works:

Merchants adopt Razorpay inside tools they already use, reducing friction and acquisition cost.

Competitive Strategy & Market Defense

Razorpay operates in one of the most competitive fintech spaces in India, where players fight on pricing, onboarding speed, payment success rates, and trust. What makes Razorpay stand out is that it doesn’t compete like a “payment gateway company.” It competes like a platform business—building strong switching barriers, deeper product adoption, and ecosystem value that is difficult for competitors to copy quickly.

Competitive Advantages (Why Razorpay Stays Ahead)

1) Strong Switching Barriers Through Deep Integration

Once Razorpay is integrated into a business’s payment flows, payouts, refunds, and reconciliation systems, replacing it becomes operationally expensive.

- Payment gateway integration

- Settlement workflows

- Refund and dispute processes

- Dashboard reporting and finance operations

Result: high retention and long-term merchant stickiness.

2) Ecosystem Depth Beyond Payments

Razorpay’s product suite acts as a moat because merchants can use multiple tools under one account.

- Collections + payouts

- Subscription billing

- Payroll and vendor payments

- Banking workflows (RazorpayX)

Result: more revenue per customer and reduced churn risk.

3) Trust, Compliance & Reliability as a Brand Asset

In 2026, businesses care more about reliability than just pricing.

- Compliance-first onboarding

- Security-driven product design

- High uptime expectations

- Faster support and issue resolution for key accounts

Result: Razorpay becomes a “safe choice” for serious businesses.

4) Data-Driven Optimization

Razorpay improves performance using real-time transaction insights.

- Payment success rate monitoring

- Failure pattern detection

- Checkout improvements and routing logic

- Risk scoring and fraud reduction

Result: better payment outcomes for merchants → stronger loyalty.

5) Distribution Advantage Through Integrations & Partnerships

Razorpay expands through embedded distribution, not only ads.

- Ecommerce platforms

- SaaS tools and marketplaces

- Startup ecosystems and referrals

- Enterprise partnerships

Result: scalable acquisition with lower long-term CAC.

Lessons for Entrepreneurs & Implementation

If you’re building a fintech, marketplace, SaaS, or on-demand platform in 2026, Razorpay is a strong reminder that the biggest businesses don’t win by offering “one feature.” They win by becoming a system—a product that businesses depend on daily. The Razorpay story shows how a company can start with a simple payment use case, then expand into a complete ecosystem that increases revenue per customer while reducing churn.

Key Factors Behind Razorpay’s Success

Razorpay scaled because it focused on the right fundamentals:

- Solved a high-frequency problem: businesses need payments every day

- Built trust through reliability: uptime, settlements, and support created confidence

- Designed for developers: easy APIs and integrations drove fast adoption

- Expanded into a product suite: payouts, subscriptions, payroll, and banking workflows

- Created strong switching costs: once integrated, replacing Razorpay becomes difficult

Replicable Principles for Startups (What You Can Copy)

Founders can apply Razorpay-style thinking even outside fintech:

- Start with one core use case that has daily/weekly repeat usage

- Build a platform that becomes part of operations, not just a tool

- Use product-led onboarding to reduce adoption friction

- Expand monetization through add-ons and premium workflows

- Invest early in trust factors: security, compliance, and performance

Common Mistakes to Avoid

Many startups fail because they copy the surface-level idea, not the strategy.

Avoid these mistakes:

- Competing only on low pricing (it kills margins and loyalty)

- Building too many features before the core product is stable

- Ignoring compliance and security until scale (too late in fintech)

- Weak onboarding that delays activation and increases drop-offs

- No upsell path beyond the primary revenue stream

How to Adapt Razorpay’s Model for Local or Niche Markets

Razorpay’s model can be adapted into different industries by focusing on the “money flow layer” of any ecosystem.

Examples:

- Local marketplaces: collections + vendor payouts + settlement automation

- Subscription platforms: billing + renewals + payment failure recovery

- B2B SaaS tools: embedded payments + invoicing + finance dashboards

- Service platforms: booking + payments + refund automation

The key is to build a platform that handles the full operational loop, not just one step.

Implementation & Investment Priorities

Here’s a realistic Razorpay-inspired build approach:

Phase 1 : Core MVP

- Payment/transaction engine (or core marketplace flow)

- Merchant onboarding + dashboard

- Basic reporting and settlement visibility

Phase 2 : Stability + Trust

- Risk controls and fraud prevention

- Better support workflows

- Performance improvements + reliability upgrades

Phase 3 : Monetization Expansion

- Payouts or subscription billing modules

- Automation features that reduce manual work

- Tiered plans and upsell bundles

Phase 4 : Ecosystem Scale

- Partnerships and integrations

- Enterprise features and custom workflows

- Compliance-ready scaling architecture

Ready to implement Razorpay’s proven business model for your market? Miracuves builds scalable platforms with tested business models and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable apps. Get your free business model consultation today.

Conclusion

Razorpay’s journey proves that the most powerful platforms in 2026 are not just built on innovation—they are built on execution, trust, and ecosystem depth. What makes the Razorpay business model so effective is how it turns a simple need (accepting payments) into a long-term operational dependency for businesses. By expanding from collections into payouts, subscriptions, and finance automation, Razorpay created a compounding system where growth naturally follows merchant success.

The bigger lesson for founders is clear: the future belongs to platforms that don’t just “offer a service,” but become the backbone of how businesses operate. In the platform economy of 2026 and beyond, companies that win will be the ones that build reliable infrastructure, remove friction at scale, and create multiple monetization layers without breaking user trust.

FAQs

1) What type of business model does Razorpay use?

Razorpay uses a B2B fintech platform model. It combines transaction-based payment processing with SaaS-style tools like payouts, subscriptions, and business automation.

2) How does Razorpay’s model create value?

It helps businesses collect payments smoothly, reduce failures, and automate settlements. Merchants save time, improve cash flow, and manage money operations from one dashboard.

3) What are Razorpay’s key success factors?

Strong reliability, fast onboarding, and developer-friendly APIs are major strengths. Its product expansion beyond payments also increases retention and lifetime value.

4) How scalable is Razorpay’s business model?

It scales naturally because revenue grows with merchant transaction volume. As merchants grow, Razorpay earns more and can upsell add-on products for higher margins.

5) What are the biggest challenges in Razorpay’s model?

The biggest challenges are compliance, fraud risk, and maintaining high payment success rates. It also requires strong infrastructure to handle peak traffic and settlement accuracy.

6) How can entrepreneurs adapt it to their region?

Start with a core payment or transaction product, then add local features like payouts, invoicing, and compliance workflows. Focus on trust, reliability, and partnerships in your market.

7) What are alternatives to this model?

Alternatives include subscription-only SaaS, marketplace commission models, and bank-led payment systems. Some businesses also use embedded finance models with bundled services.

8) How has Razorpay evolved over time?

Razorpay started as a payment gateway and expanded into a full fintech stack. It added payouts, subscription billing, and business banking tools to deepen merchant dependency.

Related Article :