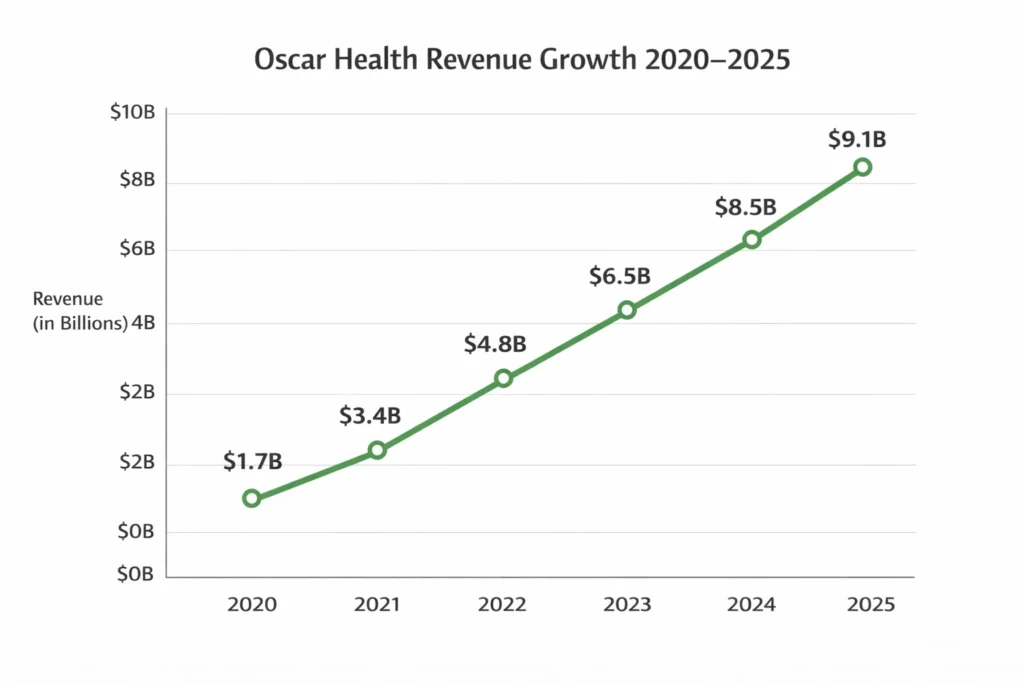

Oscar Health generated an estimated $9.1 billion in revenue in 2025, positioning itself as one of the largest technology-driven health insurance platforms in the United States. What started as a digital-first insurer has evolved into a full-stack healthcare ecosystem that blends insurance, telemedicine, data intelligence, and member engagement into a single monetization engine.

For entrepreneurs, Oscar Health represents a powerful shift in how healthcare businesses can scale. Instead of relying only on traditional policy sales, the company builds recurring revenue through integrated care experiences, platform-based services, and data-enabled efficiency that lower costs while increasing lifetime value.

What makes Oscar Health especially relevant for founders is how it turns complex healthcare systems into consumer-friendly digital platforms. From mobile apps that guide patients through care journeys to backend analytics that optimize provider networks, every layer of the business is designed to monetize trust, accessibility, and automation.

Studying this model gives founders a blueprint for building regulated, high-retention SaaS platforms in industries where customer loyalty, compliance, and operational efficiency determine long-term profitability.

Oscar Health Revenue Overview – The Big Picture

2025 Revenue: ~$9.1 billion

Valuation: ~$3.5 billion (public market capitalization estimate)

YoY Growth: ~12% (driven by Medicare Advantage expansion and platform services growth)

Revenue by Region:

- United States: ~100%

- State Coverage: 20+ states with ACA and Medicare Advantage plans

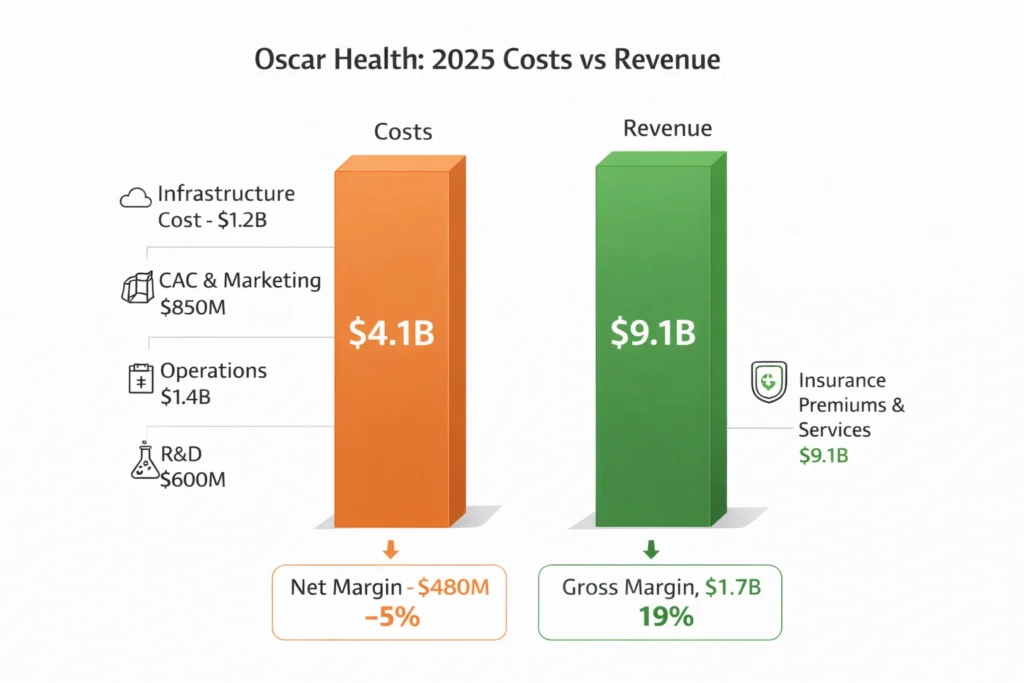

Profit Margins:

- Gross Margin: ~18%

- Net Margin: -5% (narrowing losses through medical cost optimization and tech efficiency)

Competition Benchmark:

- UnitedHealth Group: ~$371B revenue

- Elevance Health (Anthem): ~$179B revenue

- Humana: ~$118B revenue

- Oscar Health: ~$9.1B revenue

Oscar Health competes by positioning itself as a technology-first insurer that reduces medical costs through care navigation, telehealth integration, and data-driven provider matching rather than pure scale alone.

Primary Revenue Streams Deep Dive

Revenue Stream #1: Insurance Premiums (78%)

This is Oscar Health’s core revenue engine. Members pay monthly premiums for ACA marketplace plans, employer-sponsored plans, and Medicare Advantage coverage. Pricing varies by age, location, and plan tier.

2025 Data:

- Average Monthly Premium Per Member: $620

- Estimated Members: ~1.2 million

- Annual Revenue Contribution: ~$7.1 billion

Revenue Stream #2: Government Programs & Risk Adjustment (9%)

Oscar participates in federal risk-adjustment programs and receives reimbursements tied to member health complexity and care outcomes.

2025 Data:

- Revenue Contribution: ~$820 million

Revenue Stream #3: Platform Services (Cigna + Health Systems) (7%)

Oscar’s technology platform is licensed to other insurers and healthcare organizations to manage claims, care navigation, and member engagement.

2025 Data:

- Average Platform Contract: $4–8 million annually

- Revenue Contribution: ~$640 million

Revenue Stream #4: Telehealth & Care Services (4%)

Oscar monetizes virtual care visits, care coordination programs, and clinical support services bundled into plans.

2025 Data:

- Revenue Contribution: ~$360 million

Revenue Stream #5: Data & Analytics Services (2%)

Aggregated health system performance data is used by enterprise healthcare partners and payers for network optimization and compliance reporting.

2025 Data:

- Revenue Contribution: ~$180 million

Revenue streams percentage breakdown

| Revenue Stream | % Share | Annual Revenue (2025) |

|---|---|---|

| Insurance Premiums | 78% | $7.1B |

| Government Programs | 9% | $820M |

| Platform Services | 7% | $640M |

| Telehealth Services | 4% | $360M |

| Data & Analytics | 2% | $180M |

The Fee Structure Explained

User-Side Fees:

- Monthly Insurance Premiums

- Copays ($10–$75 per visit)

- Deductibles (up to $9,450 annually, plan-based)

- Out-of-network charges

Provider-Side Fees:

- Claims processing platform fees

- Network participation fees

- Performance-based incentive adjustments

Hidden Revenue Layers:

- Risk adjustment reimbursements

- Care management bonuses from federal programs

- Enterprise platform licensing fees

Regional Pricing Variation:

- Urban Markets: 10–25% higher premiums

- Rural Markets: Lower premiums, higher care navigation costs

Complete fee structure by user type

| User Type | Fees Paid | Revenue Impact |

|---|---|---|

| Members | Premiums, copays, deductibles | High |

| Providers | Platform & network fees | Medium |

| Enterprise Clients | SaaS licensing | Medium |

| Government | Risk reimbursements | High |

How Oscar Health Maximizes Revenue Per User

Segmentation:

Members are segmented by care needs, risk level, and plan tier.

Upselling:

Bronze and Silver plan members are guided toward Gold plans with lower deductibles.

Cross-Selling:

Virtual care packages and wellness programs bundled into employer plans.

Dynamic Pricing:

Premiums and benefit designs adjust annually based on claims and regional healthcare costs.

Retention Monetization:

Dedicated care teams reduce churn by improving healthcare outcomes.

LTV Optimization:

- Average Member Lifetime: 5.1 years

- Estimated LTV Per Member: ~$38,000

Psychological Pricing:

Clear cost dashboards inside the app help members perceive higher value and fairness in pricing.

Real Data Example:

Members using virtual care tools show 27% lower annual medical costs, increasing platform profitability.

Cost Structure & Profit Margins

Infrastructure Cost:

- Cloud platforms, claims engines, data pipelines

- ~$1.2 billion annually

CAC & Marketing:

- Marketplace ads, broker commissions, employer sales teams

- ~$850 million annually

Operations:

- Care teams, compliance, customer support, provider relations

- ~$1.4 billion annually

R&D:

- AI care navigation, platform development, cybersecurity

- ~$600 million annually

Unit Economics:

- Average CAC Per Member: ~$710

- Annual Revenue Per Member: ~$7,440

Margin Optimization:

Improved provider matching and preventive care reduce high-cost hospitalizations.

Profitability Path:

Oscar targets sustainable profitability by expanding enterprise SaaS revenue and Medicare Advantage scale through 2027.

Read More: Best Oscar Health Clone Script 2026 | Health Insurance Platform

Future Revenue Opportunities & Innovations

New Streams:

- Employer health platforms for SMBs

- Chronic care management subscriptions

AI/ML-Based Monetization:

- Predictive health risk APIs for insurers and hospital systems

Market Expansions:

- Medicare Advantage in new states

- Enterprise SaaS for international health systems

Predicted Trends 2025–2027:

- Embedded health insurance inside HR platforms

- AI-driven claims adjudication

- Personalized care plans tied to dynamic pricing

Risks & Threats:

- Regulatory shifts in ACA marketplaces

- Rising medical inflation

Opportunities for New Founders:

Niche platforms for remote workers, gig economy healthcare, and preventive care subscriptions.

Lessons for Entrepreneurs & Your Opportunity

What Works:

- Digital-first member experience

- Platform-based monetization

- Data-driven healthcare optimization

What to Replicate:

- SaaS + insurance hybrid model

- Recurring enterprise contracts

- AI-powered care navigation

Market Gaps:

- Affordable healthcare platforms for startups

- Cross-border digital insurance

Improvements Founders Can Use:

- Real-time claims approval

- Blockchain-based patient data management

Want to build a platform with Oscar Health’s proven revenue model?Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Oscar Health clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Oscar Health demonstrates how healthcare businesses can move beyond policy sales and become digital health platforms that monetize services, software, and data alongside traditional insurance. The company’s success lies in simplifying healthcare for users while building powerful backend systems that optimize costs and care outcomes.

For founders, the real lesson is that regulated industries can still scale like SaaS companies when technology becomes the core product. By embedding automation, analytics, and user experience into every layer, platforms can generate predictable, high-retention revenue.

As AI and digital health tools continue to reshape global healthcare, business models inspired by Oscar Health’s hybrid approach will lead the next wave of healthtech and insurtech innovation.

FAQs

1. How much does Oscar Health make per transaction?

On average, Oscar generates about $620 per member per month in premium revenue.

2. What’s Oscar Health’s most profitable revenue stream?

Insurance premiums remain the largest and highest-margin stream at scale.

3. How does Oscar Health’s pricing compare to competitors?

It is often 5–15% lower in ACA marketplaces due to digital care optimization.

4. What percentage does Oscar Health take from providers?

Oscar retains roughly 70–80% of premiums after medical and network costs.

5. How has Oscar Health’s revenue model evolved?

It expanded from insurance-only into enterprise SaaS and care services.

6. Can small platforms use similar models?

Yes, especially in niche healthcare and subscription-based care platforms.

7. What’s the minimum scale for profitability?

Around 150,000–200,000 active members based on current unit economics.

8. How to implement similar revenue models?

Combine subscription billing, care services, and platform licensing.

9. What are alternatives to Oscar Health’s model?

Broker-led insurance platforms and flat-fee healthcare memberships.

10. How quickly can similar platforms monetize?

With partnerships and automation, revenue can begin within 30–90 days of launch.