The Business Model of Wealthfront isn’t just about robo-advising — it’s a modern, productized financial ecosystem built on automation, trust, and long-term customer lifetime value. Wealthfront proved that wealth management can scale like software, not like a traditional advisory firm dependent on human labor and high overhead.

In 2026, this model matters more than ever. Passive investing continues to rise, consumers increasingly distrust high-fee intermediaries, and AI-driven personalization has become an expectation rather than a luxury. At the same time, Millennials and Gen Z strongly prefer self-service financial tools that feel transparent, calm, and easy to use.

For entrepreneurs and product leaders, Wealthfront offers powerful lessons in how low-touch, high-trust platforms scale profitably. It shows why simplicity beats feature overload in regulated industries, and how pricing psychology, automation, and retention loops can create compounding growth for years. At Miracuves, we see this as a blueprint for building capital-efficient platforms that scale responsibly.

How the Wealthfront Business Model Works

Wealthfront’s business model is built around a simple but powerful structure:

Automate wealth-building for individuals using software — then scale through trust, low fees, and long-term retention.

Unlike traditional investment firms that rely on human advisors (expensive, slow, and hard to scale), Wealthfront operates like a fintech SaaS platform — where the “advisor” is the product.

1) Type of Business Model (Core Framework)

Wealthfront runs a hybrid fintech model, combining:

- Robo-advisory (AUM-based model)

- Banking-like cash management

- Subscription-style premium financial tooling

- Embedded financial ecosystem strategy

2) Wealthfront’s Value Proposition (By User Segment)

Wealthfront succeeds because it offers clear value to multiple user types, but without building a messy multi-sided marketplace.

For Investors (Primary Users)

They gain:

- Automated investing (ETF-based portfolios)

- Passive long-term growth without “stock picking”

- Tax-loss harvesting and optimization

- Low fees compared to human advisors

- Easy onboarding and clean UX

For High-Earning Professionals

They gain:

- Advanced tax strategies

- Portfolio rebalancing

- Automated planning tools (“set it and forget it”)

For Beginners

They gain:

- Confidence through automation

- Simple financial language

- Low minimums compared to legacy wealth managers

For Wealthfront (The Company)

Wealthfront gains:

- Long-term AUM growth

- Extremely high retention (money rarely moves once invested)

- Scalable revenue without scaling headcount

3) Stakeholders in the Wealthfront Ecosystem

Even though Wealthfront looks like a direct-to-consumer app, it relies on a quiet ecosystem of financial infrastructure partners.

Key stakeholders include:

- Users / investors – deposit cash, invest assets, stay long-term

- Custodians & broker-dealers – hold the assets securely

- ETF providers – supply the investment products Wealthfront allocates into

- Banking partners – power cash accounts and FDIC sweep programs

- Regulators – SEC, FINRA, banking compliance bodies

- Data & security vendors – identity verification, fraud detection

This is important because Wealthfront’s “platform” is actually a layer above financial plumbing.

4) Evolution of Wealthfront’s Model Over Time

Wealthfront didn’t start as a full ecosystem — it evolved strategically.

Phase 1: Robo-advisor core

- Portfolio automation

- Passive investing narrative

- Competing with Betterment and traditional advisors

Phase 2: Differentiation through automation

- Tax-loss harvesting

- Direct indexing features

- Smart rebalancing

Phase 3: Expansion into financial operating system

- High-yield cash accounts

- Financial planning tools

- “One dashboard for wealth” positioning

5) Why the Wealthfront Model Works in 2026

In 2026, Wealthfront’s model still works because it aligns with modern consumer behavior:

- People prefer self-serve finance over sales-driven advisors

- Millennials and Gen Z value transparency and low fees

- AI expectations make “automated financial help” feel normal

- Investors want tax efficiency, not just returns

- Wealth-building has become “app-based,” like fitness and productivity

Read more : What is Wealthfront and How Does It Work?

Target Market & Customer Segmentation Strategy

Wealthfront’s growth isn’t powered by mass-market appeal in the way Cash App or Robinhood scale.

Instead, it scales through something more strategic:

A sharply defined target customer with high income potential, long-term wealth accumulation, and low churn behavior.

This is one of the most underrated reasons Wealthfront’s business model works so well.

1) Primary Customer Segments (Who Wealthfront Is Really Built For)

Wealthfront’s “ideal user” is not a day trader.

It’s typically:

Primary Segment: High-earning young professionals

- Age: 25–45

- Income: mid-to-high

- Often in tech, healthcare, consulting, finance

- Comfortable with digital products

- Wants investing handled automatically

- Values optimization (tax, time, simplicity)

This segment is extremely attractive because:

- They invest consistently

- Their income rises over time

- Their portfolio grows naturally

- They rarely churn once onboarded

2) Secondary Customer Segments

Wealthfront also captures adjacent segments that fit its “automation + trust” DNA:

Secondary Segment A: First-time investors

- Want to start investing but fear mistakes

- Overwhelmed by stock-picking

- Need simplicity and guidance

Secondary Segment B: Passive investors switching from banks

- Keep too much money in low-interest accounts

- Want cash + investing in one place

- Prefer a single “money home base”

Secondary Segment C: HNW-lite (emerging affluent)

- Not ultra-rich, but $250K–$2M investable assets

- Want tax optimization without hiring a human advisor

- Especially drawn to direct indexing and advanced portfolio tooling

3) Why Users Stay: Retention Psychology

Wealthfront’s retention is driven by a mix of product design and behavioral finance.

People stay because:

- Investing becomes automated (habit forms)

- Switching feels risky (loss aversion)

- Taxes create friction (moving assets triggers complexity)

- The platform becomes their financial “home screen”

4) Customer Journey: Discovery → Conversion → Retention

Wealthfront’s customer journey is extremely intentional.

Stage 1: Discovery

Common entry points:

- “Best robo-advisor” comparisons

- YouTube + personal finance creators

- Google search for investing basics

- Word-of-mouth among tech workers

- Employer-driven interest (stock compensation, RSUs, etc.)

Stage 2: Conversion

Conversion triggers:

- Low fees compared to advisors

- Trust signals (regulated, transparent)

- Smooth onboarding UX

- Clear explanation of portfolios

- Strong “set it and forget it” messaging

Stage 3: Retention

Retention mechanisms:

- Auto-deposits

- Portfolio growth visualization

- Tax optimization features

- Cash + investing consolidation

- Financial planning dashboards

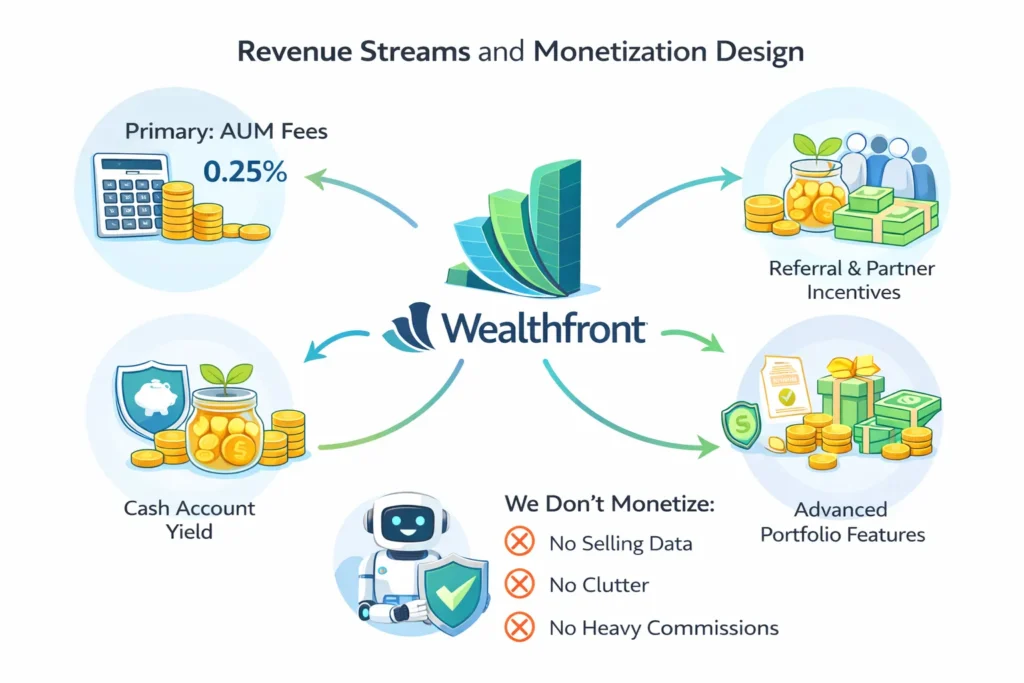

Revenue Streams and Monetization Design

Now we move from who Wealthfront serves to the heart of the business model:

How money flows through the platform — quietly, predictably, and at scale.

Wealthfront’s monetization strategy is a masterclass in low-friction, long-term revenue design, especially in regulated industries where aggressive upselling kills trust.

1) Primary Revenue Stream: Assets Under Management (AUM) Fee

This is Wealthfront’s core engine.

How it works

- Wealthfront charges a flat annual management fee (~0.25%)

- Applied to the total assets managed on behalf of users

- Automatically deducted — no invoices, no renewals

Why this is powerful

- Revenue grows as customer wealth grows

- Market appreciation boosts revenue without new acquisition

- Predictable cash flow

- Deep alignment with customer outcomes

Approximate impact

- AUM fees account for ~85–90% of total revenue

- Margins improve as automation reduces marginal costs

This makes Wealthfront structurally similar to:

- SaaS with expansion revenue

- Subscription businesses with compounding ARPU

2) Secondary Revenue Streams (Supporting Layers)

While AUM fees dominate, Wealthfront has built supporting monetization layers that increase platform value without harming trust.

Secondary Stream 1: Cash Account Yield Spread

- Wealthfront earns a spread via partner banks

- Users get high-yield cash accounts

- Wealthfront earns on deposits through interest-sharing arrangements

This turns idle cash into:

- A retention mechanism

- A monetization channel

- A top-of-funnel product for new users

Secondary Stream 2: Advanced Portfolio Features

- Direct indexing for larger portfolios

- Enhanced tax-loss harvesting

- More sophisticated asset allocation

These features:

- Increase AUM stickiness

- Attract higher-net-worth users

- Raise effective revenue per customer indirectly

Secondary Stream 3: Referral & Partner Incentives

- Referral bonuses structured as:

- Free management periods

- Cash incentives

- Free management periods

- Low CAC compared to paid ads

- Increases trust via peer validation

Secondary Stream 4: Financial Ecosystem Cross-Utilization

While not overtly “sold,” Wealthfront benefits when users:

- Move more cash into the platform

- Consolidate accounts

- Make Wealthfront their primary financial hub

This increases:

- Assets retained

- Lifetime revenue

- Platform defensibility

3) What Wealthfront Doesn’t Monetize (By Design)

This is a strategic choice that builds trust.

Wealthfront does not:

- Sell user data

- Push commission-heavy products

- Encourage high-frequency trading

- Promote risky financial instruments

This restraint is critical in fintech.

4) Overall Monetization Architecture

Wealthfront’s revenue design works because:

- One core revenue stream (AUM) stays simple

- Secondary streams support, not distract

- Pricing psychology emphasizes fairness, not extraction

- Revenue scales with customer success

Operational Model & Key Activities

If Wealthfront’s business model is the idea, its operations are the machine that quietly compounds value every day.

What makes Wealthfront special operationally is this:

It runs a multi-billion-dollar financial operation with a team size far smaller than traditional wealth managers — because software does the work.

1) Core Operations (What Wealthfront Does Daily)

Wealthfront’s day-to-day operations are highly automated, but extremely disciplined.

Platform & Technology Management

- Portfolio algorithms and rebalancing engines

- Automated tax-loss harvesting logic

- Risk profiling and asset allocation models

- Continuous platform reliability and uptime

This is the core “advisor brain” — written in code.

Financial Infrastructure & Compliance

- Broker-dealer and custodian integrations

- Regulatory reporting (SEC, FINRA)

- Trade execution and reconciliation

- Audit readiness and compliance monitoring

This layer ensures:

- Trust

- Legal defensibility

- Long-term survival in a regulated market

Customer Support (Low Volume, High Quality)

- Fewer tickets due to automation

- Support focuses on:

- onboarding help

- edge cases

- education, not selling

- onboarding help

Support quality reinforces trust rather than acting as a sales channel.

Growth & Marketing Operations

- Content marketing and SEO

- Comparison-page optimization

- Referral program management

- Thought leadership in passive investing

Marketing emphasizes:

- Education over hype

- Long-term wealth narratives

- Credibility over virality

2) Resource Allocation Strategy

Wealthfront’s budget allocation reflects its belief that technology is the product.

Approximate focus areas:

- Technology & Engineering: ~45–50%

- Core platform

- Security

- AI-driven optimization

- Core platform

- Compliance & Risk: ~15–20%

- Regulatory operations

- Legal and audits

- Regulatory operations

- Marketing & Growth: ~15–20%

- SEO, content, partnerships

- SEO, content, partnerships

- Customer Experience & Support: ~10%

- R&D & New Products: ~10%

- Planning tools

- Cash features

- Ecosystem expansion

- Planning tools

This allocation is very different from:

- Traditional advisory firms (sales-heavy)

- Banks (branch-heavy)

3) Automation as an Operational Advantage

Automation allows Wealthfront to:

- Scale without proportional headcount growth

- Maintain consistent decision-making

- Reduce human bias in investing

- Offer predictable user experiences

In operational terms:

- One codebase replaces thousands of advisors

- Marginal cost per user trends toward zero

- Reliability improves with scale, not complexity

4) Regional & Expansion Operations

Wealthfront expands cautiously:

- Focuses on regulatory clarity

- Prioritizes infrastructure readiness

- Avoids overextension into incompatible markets

This conservative approach supports:

- Brand trust

- Compliance excellence

Long-term resilience

Strategic Partnerships & Ecosystem Development

Wealthfront may feel like a clean, self-contained app — but behind the scenes, it’s built on a quiet network of strategic partnerships.

And this is one of the most important lessons for entrepreneurs:

Fintech platforms don’t scale alone. They scale by orchestrating infrastructure partners — while keeping the user experience unified.

Wealthfront’s partnership strategy is not flashy. It’s structural.

1) Wealthfront’s Collaboration Philosophy

Wealthfront doesn’t try to own every layer of finance.

Instead, it focuses on:

- Owning the customer relationship

- Owning the product experience

- Owning the automation logic

- Partnering for regulated infrastructure

This is the same playbook used by modern platform companies:

- Shopify (merchants + ecosystem)

- Stripe (payments infrastructure)

- Apple (hardware + partner services)

- Uber (demand orchestration)

2) Key Partnership Types in Wealthfront’s Ecosystem

A) Technology and API Partners

Wealthfront relies on technology partners for:

- Identity verification (KYC)

- Fraud detection

- Banking APIs and connectivity

- Security monitoring and compliance tooling

These partners help Wealthfront:

- Move faster

- Reduce risk

- Maintain enterprise-grade reliability

B) Custodian & Brokerage Infrastructure Partners

This is one of the most critical layers.

Wealthfront partners with:

- Custodians who hold customer assets

- Brokerage infrastructure that executes trades

This enables:

- legal custody separation (trust)

- scalable trade execution

- audit-ready transaction records

C) Payment and Banking Alliances

Wealthfront’s cash account strategy depends on banking partners that provide:

- FDIC sweep programs

- account routing and settlement

- ACH transfers and deposit infrastructure

These alliances make Wealthfront feel like a bank — without becoming one.

This is a key strategic move:

Wealthfront becomes the interface; banks become the backend.

D) Marketing and Distribution Partnerships

Wealthfront’s distribution strategy includes:

- Affiliate networks

- finance comparison sites

- personal finance newsletters

- creator-driven education ecosystems

This is extremely effective because:

- finance is trust-based

- peer recommendations convert better than ads

- the audience is already in “money decision mode”

E) Regulatory and Expansion Alliances

Fintech growth requires regulatory alignment.

Wealthfront maintains:

- legal partnerships

- compliance consultants

- regulatory monitoring services

These partnerships reduce:

- expansion risk

- product launch friction

- compliance failure probability

3) Ecosystem Strategy: How Partnerships Create a Moat

Wealthfront’s ecosystem creates defensibility in three ways:

1. Network Effects (Soft, Not Viral)

Not a social network effect — but a financial one:

- More users → more deposits → more stability

- More AUM → better ability to invest in tooling

- Better tooling → stronger retention → more AUM

It’s a compounding loop.

2. Partner Value Creation

Partners benefit because:

- Wealthfront brings them deposits and transactions

- Wealthfront customers are high-quality and low-risk

- The platform generates long-term recurring activity

So partners want Wealthfront to grow.

3. Monetization Inside the Ecosystem

Partnerships also enable monetization:

- interest spread on cash accounts

- cost-efficient trade execution

- operational leverage at scale

Even when customers don’t “see” monetization, the ecosystem makes the economics work.

Growth Strategy & Scaling Mechanisms

Wealthfront’s growth story is not the typical “move fast and break things” Silicon Valley play.

In 2026, this style of growth is increasingly respected — because fintech winners aren’t the loudest apps. They’re the ones people trust with real money.

1) Wealthfront’s Core Growth Engines

A) Organic Growth via Trust + SEO

Wealthfront is one of the best examples of high-intent SEO-driven growth in fintech.

It benefits from search behavior like:

- “Best robo-advisor”

- “Wealthfront vs Betterment”

- “How to invest automatically”

- “Tax-loss harvesting explained”

This is powerful because:

- These users already want the product

- Conversion rates are naturally high

- Customer acquisition costs stay sustainable

B) Referral Loops (Low CAC, High Quality Users)

Wealthfront’s referral programs work well because:

- People talk about investing with peers

- Referrals feel safer than ads

- The product is simple to recommend

Typical referral mechanics:

- Free management for a period

- Cash bonuses

- Incentives tied to deposits

This creates:

- A low-cost growth flywheel

- High-quality users who resemble existing ones

C) Product-Led Growth Through Financial “Gravity”

Wealthfront builds growth through product gravity — meaning the product naturally pulls in more of a user’s money over time.

Once a user joins, they often:

- move cash in

- set recurring deposits

- consolidate external accounts

- invest larger balances

This is subtle, but it’s the most powerful growth mechanism Wealthfront has.

D) New Product Lines as Growth Expansion

Wealthfront expands not by launching unrelated features, but by expanding deeper into the same customer need:

“Help me manage my money intelligently with minimal effort.”

Expansion examples include:

- cash accounts

- automated financial planning

- tax optimization features

- direct indexing tools

- portfolio personalization

Each new feature:

- increases retention

- increases AUM

- increases long-term revenue

E) Geographic Scaling Model

Wealthfront’s geographic growth is naturally constrained (mainly U.S.-focused) due to:

- regulatory differences

- banking infrastructure

- tax law complexity

So rather than international expansion, Wealthfront scales by:

- increasing AUM per user

- capturing more cash deposits

- moving upmarket into higher-asset users

This is a key strategic decision.

2) Scaling Challenges & How Wealthfront Overcame Them

Challenge 1: Trust Barrier

In finance, the biggest obstacle is:

“Will you mess up my money?”

Wealthfront overcame this by:

- extreme transparency

- simple pricing

- clean UX

- strong compliance posture

- calm brand voice

Challenge 2: Product Complexity vs Simplicity

As Wealthfront added more advanced tools, it risked becoming too complex.

Its solution:

- keep the UI minimal

- hide complexity behind automation

- explain advanced features in plain language

This is an elite product strategy move.

Challenge 3: Market Volatility

During downturns, users panic.

Wealthfront reduced churn by:

- emphasizing long-term investing

- educating users

- reinforcing passive investing principles

- avoiding gamified trading behavior

Challenge 4: Competition (Betterment, Vanguard, Schwab, etc.)

Wealthfront competed by:

- going deeper on automation

- leaning into tax optimization

- maintaining a modern “tech product” feel

- positioning against traditional advisory friction

Challenge 5: Regulatory + Operational Complexity

Scaling fintech isn’t just adding servers.

Wealthfront scaled by:

- investing heavily in compliance automation

- partnering for regulated infrastructure

- building internal risk discipline early

Competitive Strategy & Market Defense

Wealthfront competes in a brutally crowded space.

It’s not just fighting robo-advisors like Betterment — it’s competing with:

- legacy giants (Vanguard, Fidelity, Schwab)

- banking apps (SoFi, Marcus, Capital One)

- trading-first platforms (Robinhood)

- human financial advisors

So the big question becomes:

How does Wealthfront defend its market position when competitors have more money, bigger brands, and larger distribution?

The answer: Wealthfront doesn’t try to win by being everything. It wins by being the best at one job.

1) Wealthfront’s Competitive Advantages

A) Automation Depth (A Real Product Moat)

Many competitors offer “automated investing.”

Wealthfront offers:

- deep portfolio automation

- tax-loss harvesting as a standard expectation

- advanced allocation strategies

- direct indexing for higher-balance users

- intelligent rebalancing logic

This creates a real moat because:

- it’s hard to replicate without years of iteration

- the value becomes noticeable as portfolios grow

B) Switching Barriers & Financial Stickiness

Wealthfront benefits from one of the strongest retention dynamics in business:

Money doesn’t move easily.

Once assets are invested:

- users hesitate to transfer

- taxes complicate decisions

- moving feels risky

- the effort doesn’t feel worth it

So Wealthfront’s churn is naturally low — not through lock-in, but through behavioral friction.

C) Brand Equity Built on Calm Trust

In fintech, most apps try to be:

- exciting

- flashy

- “fun”

Wealthfront deliberately chooses the opposite.

Its brand is:

- calm

- rational

- minimalist

- anti-hype

- long-term oriented

This matters because:

- trust is the currency of wealth platforms

- the brand signals maturity and safety

- the product feels like a “serious tool”

D) Data-Driven Personalization

Wealthfront uses data to:

- recommend portfolios

- tailor risk profiles

- optimize tax strategies

- improve onboarding conversion

And importantly, it does this without:

- creepy surveillance vibes

- aggressive upselling

- manipulative nudges

In 2026, where privacy expectations are higher, that balance is a competitive advantage.

E) Compliance Strength as a Competitive Weapon

This is a hidden moat.

Many startups die because they treat compliance like a checkbox.

Wealthfront treats compliance as:

- a product requirement

- an operational discipline

- a trust engine

In regulated markets, compliance maturity becomes a barrier to entry.

2) Wealthfront’s Market Defense Tactics

A) Defending Against New Entrants

When new robo-advisors appear, Wealthfront’s defense is:

- stronger brand credibility

- better automation

- proven reliability

- trust-based switching barriers

New entrants can copy features — but they can’t copy time.

B) Handling Pricing Wars

Wealthfront avoids price wars by:

- keeping fees already low

- focusing on value (tax savings, automation)

- not racing competitors to zero

This is smart because:

- price wars kill fintech margins

- trust erodes when pricing becomes chaotic

- low price alone isn’t enough in finance

Read more : Best Wealthfront Clone Scripts 2025: Launch Your Automated Investing Platform Faster

Lessons for Entrepreneurs & Implementation

This is where Wealthfront’s story turns from analysis into a playbook.

If you’re a founder building a fintech app, SaaS platform, marketplace, or subscription product, Wealthfront offers some of the clearest lessons on how to scale responsibly — without burning trust or capital.

Think of this section as mentorship, not theory.

1) Key Factors Behind Wealthfront’s Success

A) Productized Expertise Beats Human Labor

Wealthfront replaced:

- thousands of human advisors

with: - one scalable software system

B) Trust Is a Growth Strategy

Trust wasn’t a byproduct — it was designed.

Wealthfront built trust through:

- transparent pricing

- calm branding

- conservative product decisions

- regulatory discipline

C) Simple Pricing Wins Long-Term

A single, clear fee outperformed:

- commissions

- bundles

- upsells

D) Retention Beats Virality

Wealthfront doesn’t need to go viral.

Why?

- customers stay for years

- assets grow over time

- LTV keeps increasing

E) Automation Creates Margins

As Wealthfront’s AUM grows:

- costs don’t scale linearly

- margins expand

- profitability improves

Implementation Timeline & Investment Priorities

A realistic execution roadmap looks like:

Phase 1 : Foundation

- market research

- regulatory planning

- MVP automation logic

- trust-first UX

Phase 2 : Validation

- early adopters

- retention optimization

- infrastructure partnerships

- pricing validation

Phase 3 : Scaling

- automation expansion

- AUM or usage growth

- ecosystem features

- operational leverage

Ready to implement Wealthfront’s proven business model for your market?

Miracuves builds scalable platforms with tested business models and growth mechanisms.

We’ve helped 200+ entrepreneurs launch profitable apps across fintech, SaaS, and marketplaces. Get your free business model consultation today.

Conclusion

Wealthfront’s business model proves something that many founders underestimate in 2026:

The biggest companies aren’t always the loudest — they’re the ones that quietly earn trust and compound value over time.

By turning wealth management into software, Wealthfront didn’t just reduce fees — it redefined the entire category. It showed that automation can replace human-heavy operations, and that long-term retention can outperform short-term hype.

Innovation gets attention. Execution earns longevity.And as platform economies mature beyond 2026, the winners will be the companies that build ecosystems people depend on — not just apps people try.The future belongs to platforms that combine trust, automation, and compounding customer value.

FAQs

1) What type of business model does Wealthfront use?

Wealthfront uses a hybrid robo-advisory business model. It combines automated investing (AUM-based fees) with cash management and financial planning tools.

2) How does Wealthfront’s model create value?

It creates value by automating portfolio management, reducing investing fees, and optimizing taxes. Users get long-term wealth-building without needing a human advisor.

3) What are Wealthfront’s key success factors?

Its biggest success factors are automation, low-fee simplicity, and trust-first branding. Strong retention and tax optimization features also drive long-term growth.

4) How scalable is Wealthfront’s business model?

It’s highly scalable because software handles investing, rebalancing, and optimization automatically. Revenue grows as user assets grow, without matching increases in staffing costs.

5) What are the biggest challenges for Wealthfront?

The biggest challenges include building trust, managing regulations, and competing with financial giants. Market volatility also tests customer confidence and retention.

6) How can entrepreneurs adapt Wealthfront’s model to their region?

Start with a niche segment and partner with local banking and compliance providers. Keep the product simple, trust-driven, and expand features only after retention is proven.

7) What are alternatives to this business model?

Alternatives include subscription-based financial planning, commission-based brokerage, advisor marketplaces, and embedded finance models. Each works depending on trust level, regulation, and customer behavior.

8) How has Wealthfront evolved over time?

Wealthfront evolved from a robo-advisor into a full wealth platform. It expanded into cash accounts, tax optimization, and automated financial planning to increase retention and AU

Related Article :